Two Trades To Watch: FTSE, Gold - Thursday, Feb. 16

Image Source: Pixabay

FTSE rises above 8000 to fresh record highs. Gold struggles below 1840 ahead of PPI.

FTSE rises above 8000 to fresh record highs

The FTSE has opened higher, building on yesterday’s gains and pushing above 8000, the key psychological level to fresh record highs.

Cooler-than-expected UK inflation data yesterday takes the pressure off the BoE to keep raising interest rates aggressively, which is helping to calm recession fears. This combined with the weaker pound, which has lost 2% against the USD over the past 6 weeks, and the reopening of China’s economy, which supports resource stocks, has meant the FTSE has outperformed many of its global peers.

But can the rally continue? For now, these factors could continue to lift the FTSE. The pound could remain weak as the BoE takes its foot off the hiking gas, while the Fed may raise rates for longer after hotter-than-expected inflation. However, any sense of a dovish pivot from the Fed later in the year could see GBP/USD rally, potentially dragging on the UK index, which is mainly comprised of multinationals.

Part of the FTSE’s resilience in 2022, which saw the index rise 1%, while global peers slumped, is attributed to the lack of tech stocks on the index and its abundance of defensive stocks, those that often outperform in economic downturns.

As recession fears ease and the global economic outlook improves, particularly towards the end of this year, the FTSE could struggle to keep up.

Back to today, the FTSE will look to a speech by chief economist Huw Pill. Broader economic sentiment could also drive trading.

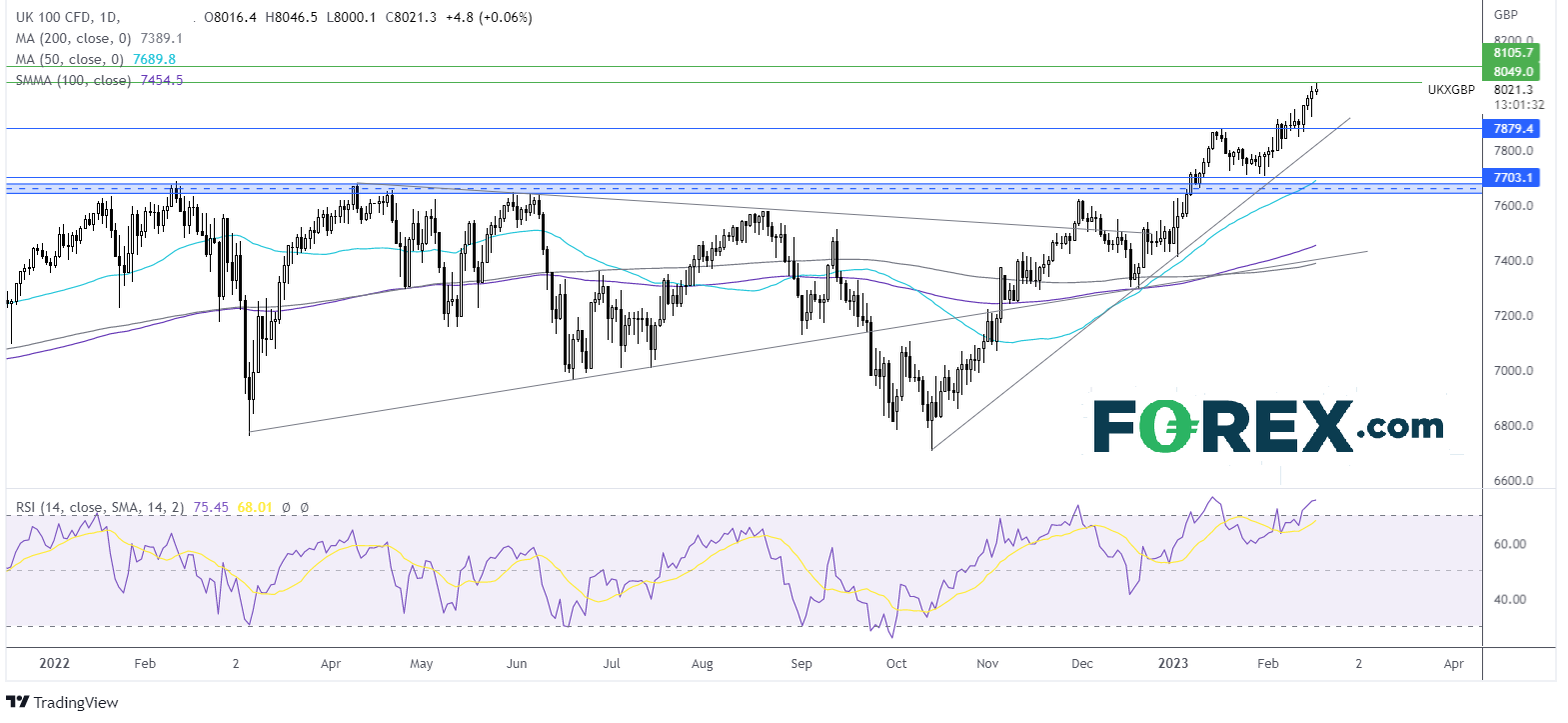

Where next for the FTSE?

The FTSE has extended gains, trading above its multi-month rising trendline. However, there are a few signs that the rally is looking overstretched, at least for now. The RSI is in overbought territory and today’s candle’s long upper wick suggests that there wasn’t much acceptance at the higher prices. As a result, buyers should proceed with caution.

On the downside, support can be seen at 7880 the January high, a break below here could negate the near-term uptrend. A break below 7700 creates a lower low and put the bears in control.

(Click on image to enlarge)

Gold struggles below 1840 ahead of PPI

Gold prices are struggling below 1840 after booking 1% losses in the previous session after stronger-than-expected retail sales fueled hawkish Fed bets.

Halfway through the month and gold is on track for its worst monthly performance since June last year as investors re-price Fed expectations. After a blowout jobs report, hotter-than-expected inflation, and surging retail sales, the US economy is showing few signs of a recession. The Fed may need to keep hiking rates to tame inflation.

Attention will now turn to PPI, which is expected to cool further to 5.4% YoY in January, down from 6.2%. Cooling PPI could raise hopes of cooling CPI and a less hawkish Fed, which could be beneficial for Gold.

US jobless claims will also be in focus and are expected to edge higher to 200k, up from 196k.

Where next for Gold prices?

After hitting resistance at 1959, Gol prices rebounded lower. The bearish engulfing candle and the break below the multi-month rising trendline support and the 50 sma, combined with the RSI below 50, keep sellers hopeful of further downside.

Sellers could look for a break below 1825, the 2023 low to expose the 100 sma at 1800 and the 200 sma at 1777.

Meanwhile, buyers could look for a rise over the 50 sma at 1860 to and 1870 the weekly high to extend gains towards 1900.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, EUR/GBP - Wednesday, Feb. 15Two Trades To Watch: GBP/USD, Gold - Tuesday, Feb. 14

US Open: Stocks Mixed In Cautious Trade Ahead Of Tomorrow's CPI

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more