Two Trades To Watch: EUR/USD, Oil - Monday, Feb. 20

Image Source: Unsplash

EUR/USD holds steady ahead of consumer confidence data. Oil rises after last week’s losses.

EUR/USD holds steady ahead of consumer confidence data

- EUR supported by hawkish ECB comments

- Strong US data & higher rate for longer support USD

- EZ consumer confidence forecast to rise to -19

EUR/USD is holding steady below 1.07 after booking mild gains across the previous week and as the US markets remain closed in observance of President’s Day.

While the US dollar received a boost from stronger-than-forecast U.S. data and hawkish Federal Reserve policymakers, the euro also benefited from hawkish ECB chatter.

ECB president Christine Lagarde as good as confirmed a 50-basis point rate hike in March. Even as inflation in the eurozone has started to fall, Christine Lagarde still considers it far too high.

Gas prices in Europe have also fallen considerably, helping the economic outlook. Gas prices have declined to the lowest level in 18 months thanks to a milder winter, ample storage, and sourcing from other countries.

Attention will now turn to eurozone consumer confidence, which is expected to rise to -19 up from -20.9. This would mark the fifth straight month that consumer confidence improves.

Moves in the USD could be muted as the US markets remain closed for Presidents’ Day.

Where next for EUR/USD?

After breaking out below the rising wedge at the start of February, EUR/USD has been consolidating, capped on the upper limit by 1.08, last week’s high and 1.0610 on the lower band, last week’s low.

The RSI below 50 favors further downside. Sellers could look for a fall below 1.0610 to expose the 100 sma at 1.0530 and the 2023 low of 1.0480.

On the flipside, buyers could be encouraged by the 50 sma crossing above the 200 sma in a bullish signal. Buyers could look for a rise above 1.08 to create a higher high and extend gains towards 1.0940 the rising trendline resistance and January high.

(Click on image to enlarge)

Oil rises after last week’s losses

- Fears of further fed hikes & rising inventories weighed last week

- China's optimism & improving risk sentiment lift prices

After falling 4.3% last week, oil is attempting to rebound on Monday. Oil fell sharply last week on concerns of higher interest rates in the US, after a series of stronger-than-forecast US data points. Higher rates for longer could dampen economic activity and weigh on oil demand.

Rising oil inventories also raised concerns of a supply glut, which comes as the Biden administration announced the release of a further 26 million barrels of crude oil.

Still, the risk on mood at the start of the week is helping risk assets, such as oil push high. Optimism surrounding the reopening in China is also keeping oil prices supported. The EIA and OPEC have highlighted Chinese demand as a critical driver of demand growth this year.

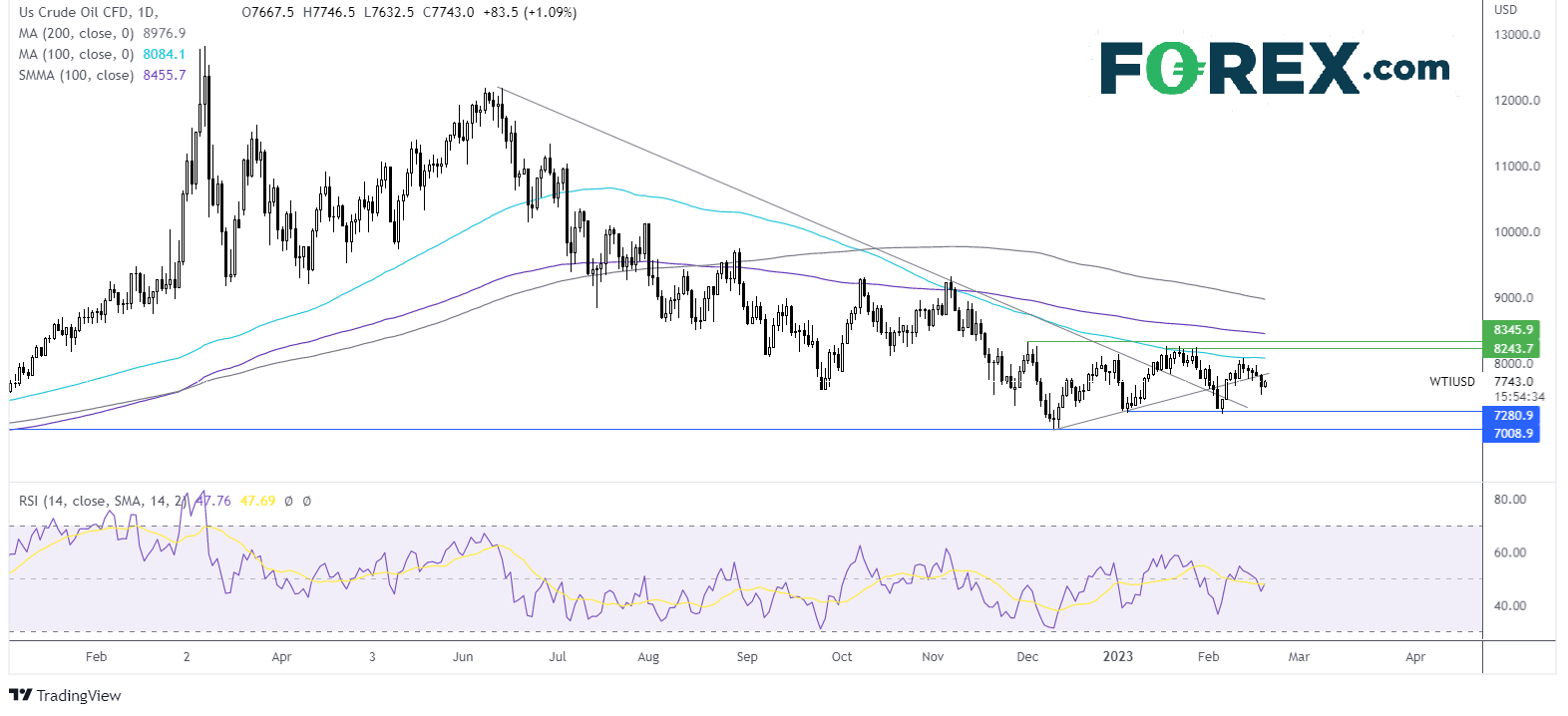

Where next for WTI oil?

Oil prices ran into resistance at 80.80 the 50 sma and rebounded lower, breaking below the multi-week rising trendline at 78.30, falling to a low of 75.40. Sellers will look for a break below here to extend the bearish trend towards 72.40 the February low and make a decline towards 70.00, the psychological level more likely.

On the flip side, the 50 sma at 80.85 poses a challenge on the upside with a rise above here needed to attack 83.40 the December high.

(Click on image to enlarge)

More By This Author:

US Open: Stocks Fall As Rate Hike Fears Rise

Two Trades To Watch: GBP/USD, DAX - Friday, Feb. 17

US Open: Strong Data Sinks Stocks

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more