Two Signs That Confirm A Bearish Outlook

Two important factors that I have written about earlier only confirm the obvious for the precious metals: a bearish short-term outlook.

Today’s technical part of the analysis is going to be very brief, because of two reasons. First, very little happened during yesterday’s (Mar. 24) session. Second, what occurred simply confirmed what I had written earlier. There are two important things that happened yesterday, which can be considered signs. They both confirm the bearish outlook for the short term and they both indicate that our profitable short positions are likely to become much more profitable in the near future.

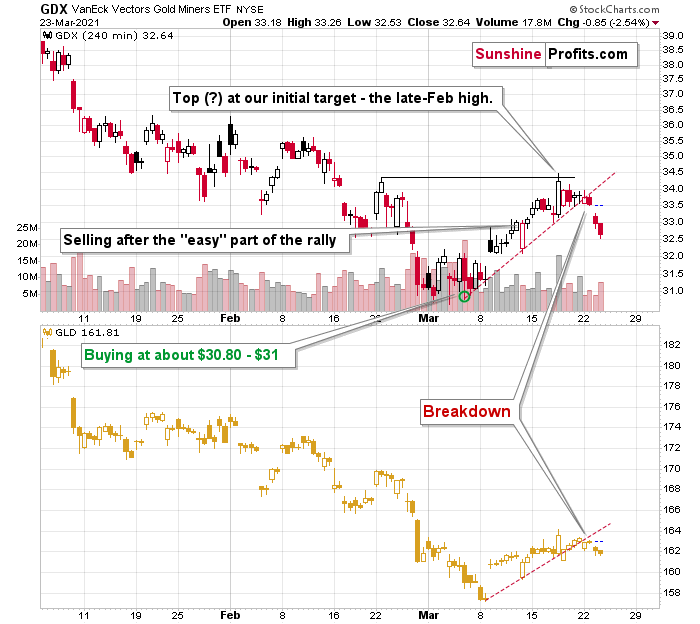

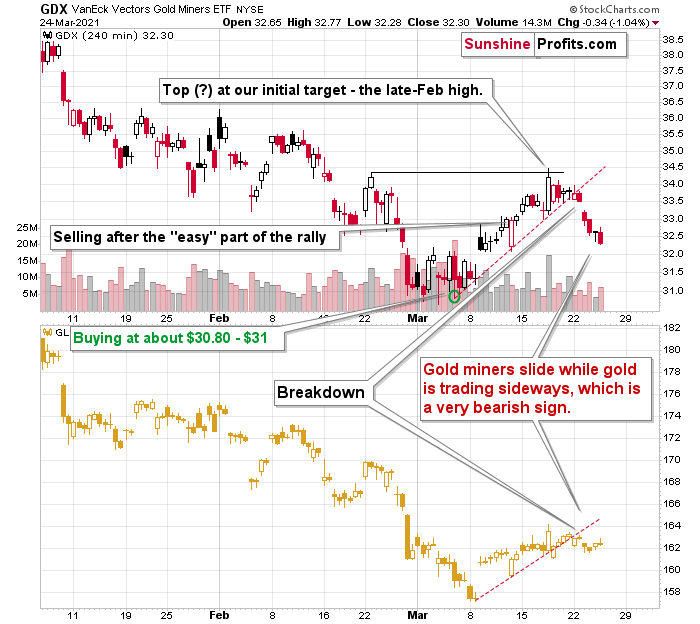

The first sign – just like yesterday – came from the mining stocks. Let’s start with a quote from yesterday’s comments on the 4-hour GDX ETF chart:

If you’ve been waiting for a high-quality sign that the next big move in the precious metals sector is underway – you just got it.

There are days on the markets when nothing happens, there are days when what happens is visible only to some (like Monday’s session), and there are days when the market’s signals are crystal-clear – as if the charts were practically screaming at the person examining them. Yesterday, was one of the latter kind of days.

Without further ado, let’s take a look at the key development that we just saw in the precious metals’ world – the big decline in the GDX ETF – proxy for mining stocks.

[NOTE: THE CHART BELOW IS JUST LIKE YOU SAW IT YESTERDAY]

After the tiny breakdown that I described yesterday (Mar. 24), the GDX ETF declined significantly, and it even opened the session with a price gap. If you look at the left side of the chart, you’ll see that this is the way in which the big January decline started. In the next 2 months, the value of the GDX ETF declined by over $8.

The reason that I left the chart without yesterday’s price changes is that I want you to be able to easily compare both of them and the changes that took place.

Gold (here: GLD) ended the session higher (precisely: $0.56 or 0.35% higher) while the GDX ended the day lower ($0.34 or 1.04% lower).

In other words, miners want to decline so badly that they ignored the move higher in gold and declined anyway! Seeing this after a bearish price gap and a breakdown is practically as bearish as this chart could get in the short run.

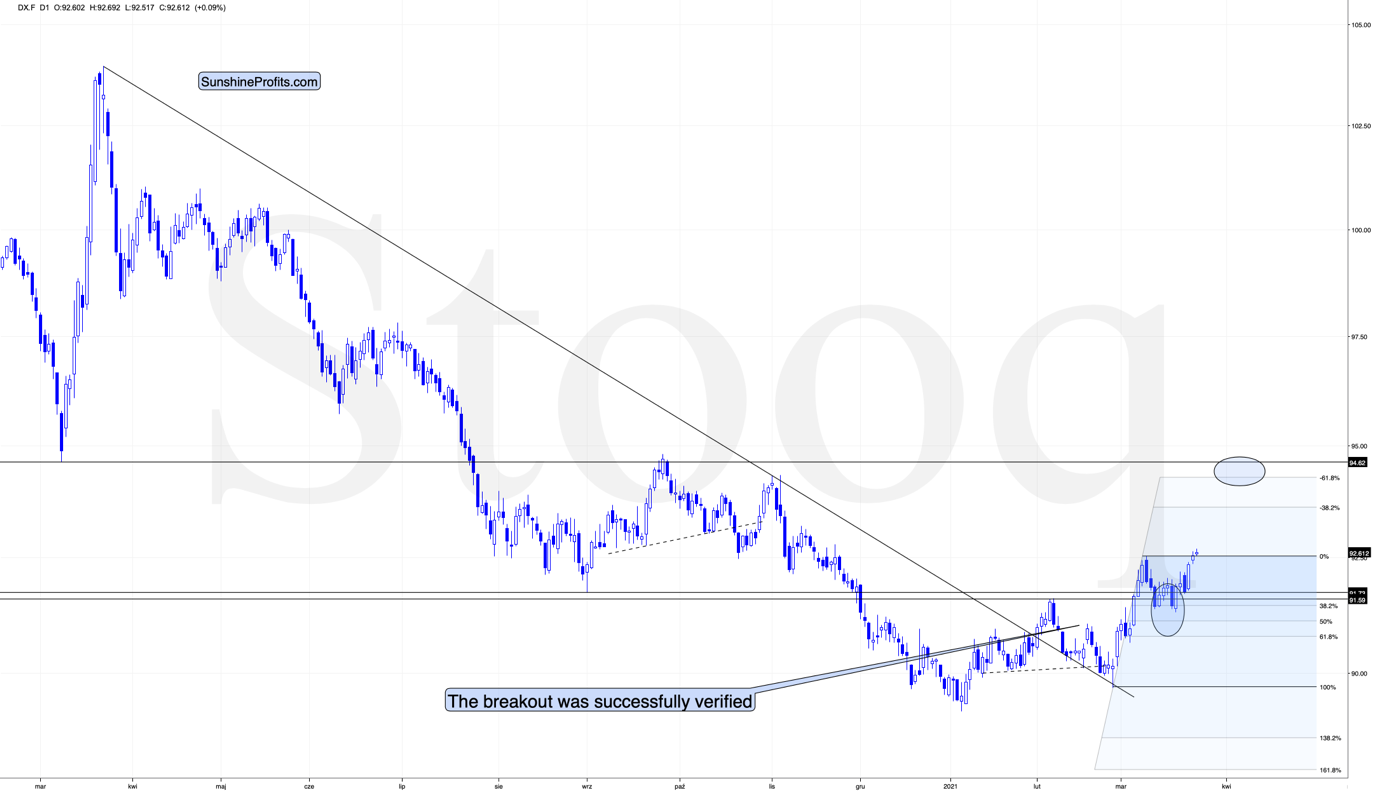

The second sign: At the moment of writing these words, the USD Index is breaking to new yearly highs.

In yesterday’s analysis, I commented on the USDX chart in the following way:

Right now, traders are likely taking the wait-and-see approach with regard to the USD Index. The latter just moved to its previous yearly highs. It’s already after verification of the breakout above the February highs, so it seems that it’s ready to break higher any day – or hour – now. When that happens, I expect the rally to take the USDX to at least 94, perhaps to 94.5 or 95. The September 2020 high is 94.8, so this level is the most likely upside target for the short term. I don’t think that the rally in the USD Index would end once it reaches the proximity of 95, but that’s when we might see another breather (perhaps after a breakout above this level and perhaps before the breakout, it’s too early to tell at this time).

The situation is developing as I outlined above. The breakout in the USD Index is not yet confirmed, but it seems quite likely that it will be confirmed shortly. I would not be surprised to see a weekly close near the previous yearly highs (the February highs) and then a powerful rally next week. This – if it happens in the above-mentioned way – would be likely to result in a major slide in the PMs next week.

Disclaimer: All essays, research, and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

Thank you Mr. Radomski, I think I finally joined the right precious metal newsletter! Yes, that was a great call on the USDX's breakout verification recently, expecting a major PM decline next week as well.

Thank you and welcome aboard!