Two Bearish Confirmations For Junior Miners

The markets are closed in the U.S., and we’re normally not posting anything on the non-market days, but I thought that I’ll make an exception to provide you with a quick heads-up before tomorrow’s session.

Having said that, let’s take a look at two bearish confirmations that we just got, starting with the gold-USD link.

The USD Index declined somewhat on Friday and in today’s trading (on the futures market).

(Click on image to enlarge)

It also moved very close to its 23.6% Fibonacci retracement level, which is one of the lesser-known retracements, but at times it’s worth paying attention to it – especially during the most powerful uptrends, where even correcting 38.2% of the rally is too much. And based on the fundamental factors (rising real interest rates), the rally in the USD is likely to be a powerful one.

So, the USD Index could bottom any day or hour now. And… That’s not the most important thing from the precious metals investors’ and traders’ point of view. Gold’s relative weakness is.

(Click on image to enlarge)

The most important detail is that while the USDX moved to new short-term lows, gold didn’t. Despite intraday attempts, it refuses to rally.

This gold-USD dynamic is bearish for the following weeks. This is especially the case given that gold already corrected 38.2% of the previous decline, so “technically” the correction might already be over. And the relative weakness vs. the USDX suggests that it is indeed over.

And you know what else should be making new highs?

Junior miners.

Are they making new highs?

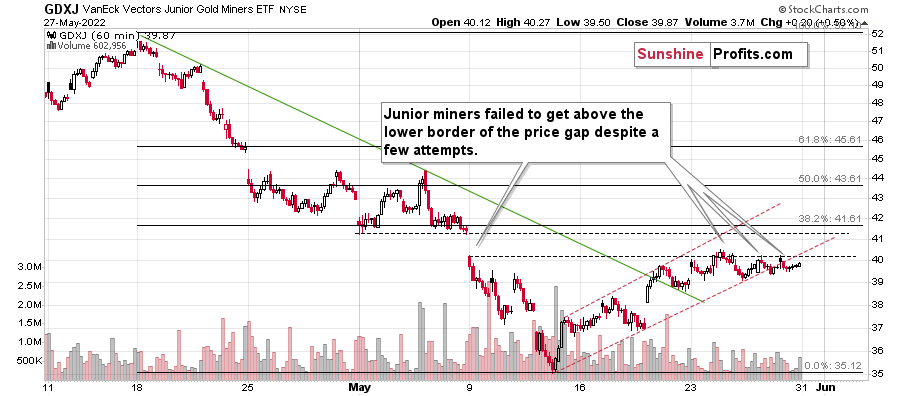

(Click on image to enlarge)

No.

In fact, on the above chart, we can see that juniors failed to close the week at the previous week above the lower border of the previous price gap. The resistance held.

Instead, the GDXJ closed the week below the very short-term trading channel, which means that we just saw a breakdown.

Now, the above performance could have been viewed as “normal” and not “weak” if the general stock market was weak on Friday.

However, exactly the opposite was true!

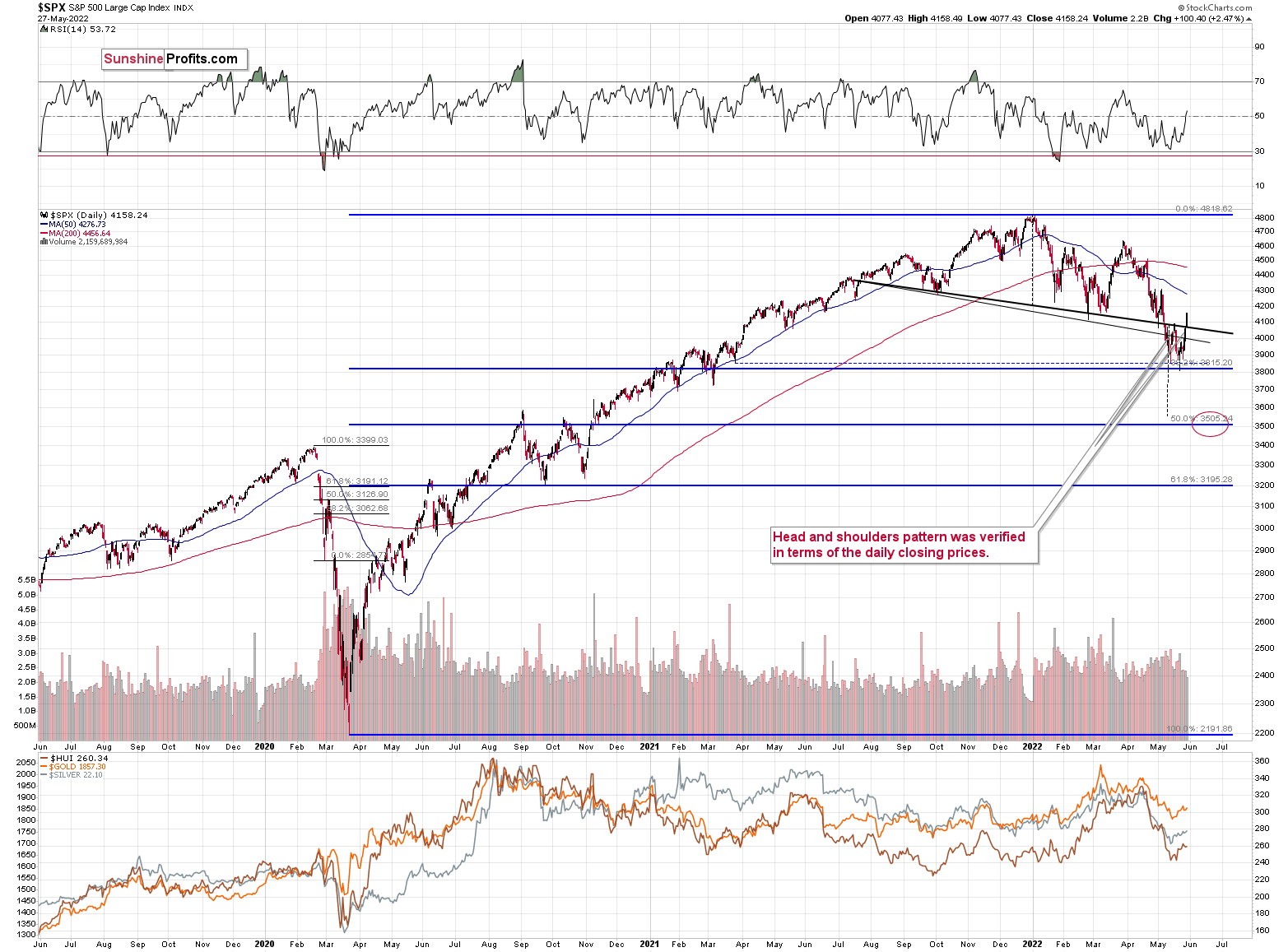

(Click on image to enlarge)

The S&P 500 moved about 2.5% higher on Friday, so – theoretically – junior miners should have shown some kind of strength. We didn’t see it. Instead, we saw junior miners move back and forth, which is a weak performance given the stock market’s rally.

So, gold is weak relative to the USD Index, and junior miners are weak relative to the general stock market. This is a profoundly bearish combination, and I’m very happy to be on the short side of the junior mining stocks trade once again. If I had any second thoughts about the recent profit-taking from the long position and entering into a short one, I would act (and make the switch to the short side) based on the above.

However, since we’ve already done that – my subscribers were warned in advance – we can simply view this as an additional confirmation that the market most likely agrees with us. And it appears likely that our streak of profits will grow bigger in the following weeks (it could be days too, but it’s a tough call to say if the decline will resume immediately).

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

Oh, just wait till it gets to it's 161.8 retracement!