Turkey: The Canary In The Coal Mine

Fundamentals

Chairman Powell has been re-nominated. The market seemed to see this as a bearish sentiment. It is similar to what happened in June when all Powell did was talk about tapering, with the idea that inflation is going to be transitory. He continues to believe that inflation will abate in the next few months.

We are entering a crucial time with the money supply exploding to record levels, debt running at 130% of GDP, and inflation globally is appearing everywhere. We see monetary inflation due to the stimulus that governments have been providing. The stimulus reduces the purchasing power of each unit of currency, so the dollar is worth less and less. Turkey this morning reached 20% inflation. The lira fell 9% Tuesday to as low as $0.08, or 13.45 to the U.S. dollar, pushing losses to more than 19% over the past week and 23% over the past month. Their central bank appears to have lost control of the monetary system. We are approaching hyperinflation in Turkey. If you are dealing with this level of debt and continue to reduce the strength of the US dollar, it aggravates the problem in the sense that it makes the dollar decline faster on top of the price inflation spiral. We also have a bottleneck of supplies.

“This inflation is going to continue for a few months longer than expected, particularly if consumers are willing to pay the higher prices,” Equity Management Academy CEO Patrick MontesDeOca said. “On top of that, we have wage price inflation as labor shortages lead to higher wages, even as the standard of living declines with the dollar worth less and prices rising.”

Gold and silver have been recently affected by the amount of short selling in the paper markets. They have artificially brought the price down in the physical market by selling short in the paper market.

“We expect a major reversion up from these levels,” MontesDeOca said. “Silver should reach $24.91 in the next week.”

Bitcoin is also due for a major move up as the US dollar’s value continues to erode. The government, in the face of such debt levels, cannot raise interest rates. They may talk about it. They may taper, but they cannot raise interest rates without risking a wave of defaults.

Source: Google

The market may dictate higher interest rates if there is a downgrading of US bonds. The government may also cap the long end of the market, the 30-year bond, and allow the short end of the market to invert. So short-term rates would move higher, while the government keeps long-term rates, where most of the debt is, stable to avoid a tsunami of defaults.

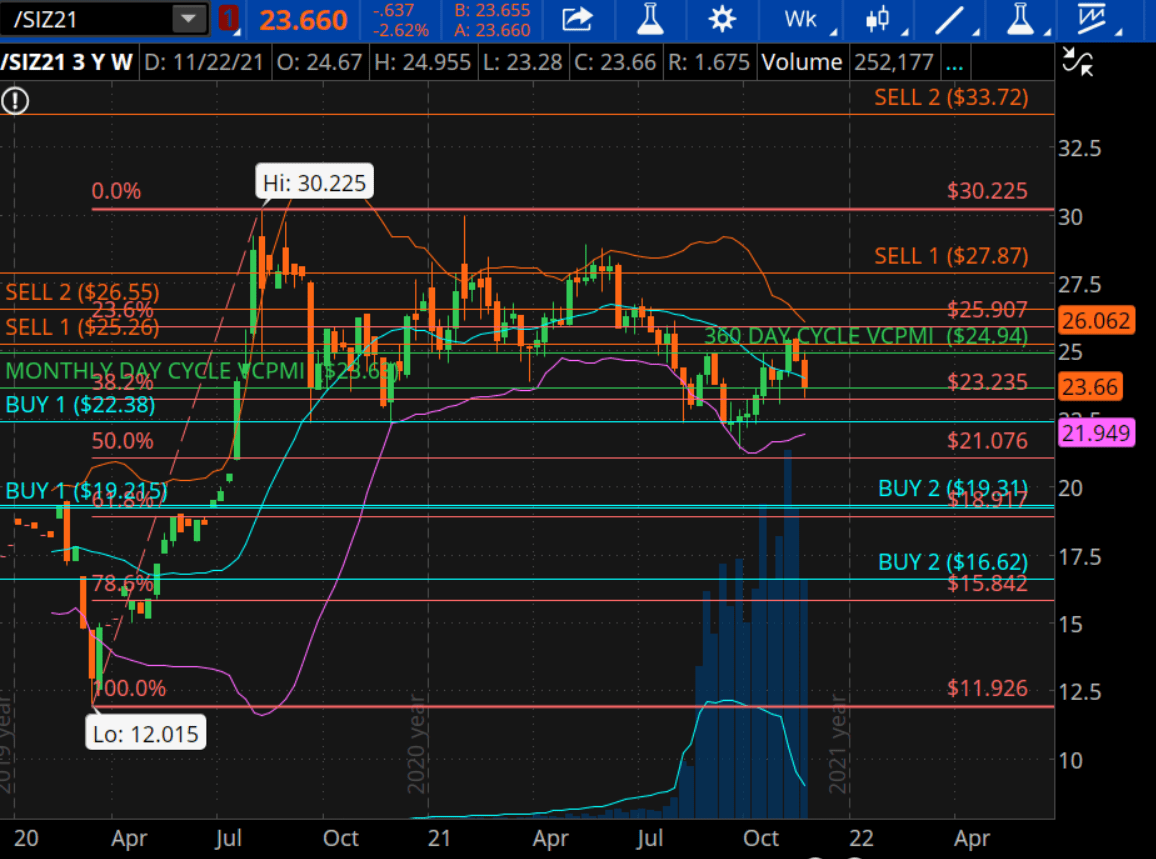

Precious Metals

For months, precious metals have been trading contrary to the fundamentals. Gold made a low on March 16, 2020, and then ran up. Silver reverted from the March 2020 lows to new highs of almost $30. Markets were discounting the tremendous stimulus coming into the market and wanted to see what damage the pandemic had done. Silver then moved down in choppy trading until the Reddit crowd came in and drove the price up to $30.33, catching a lot of shorts by surprise. Silver made a higher high and then went into another corrective pattern with a new low in September. Now we are in the third leg of the long-term bull market in silver.

Source: ema2trade.com

“This is not a bear market in silver,” MontesDeOca said. “It is a correction within a larger bull market.”

The third leg should equal the first leg, so we should have a move to almost a $30 move, which would mean roughly $50 silver after this third leg.

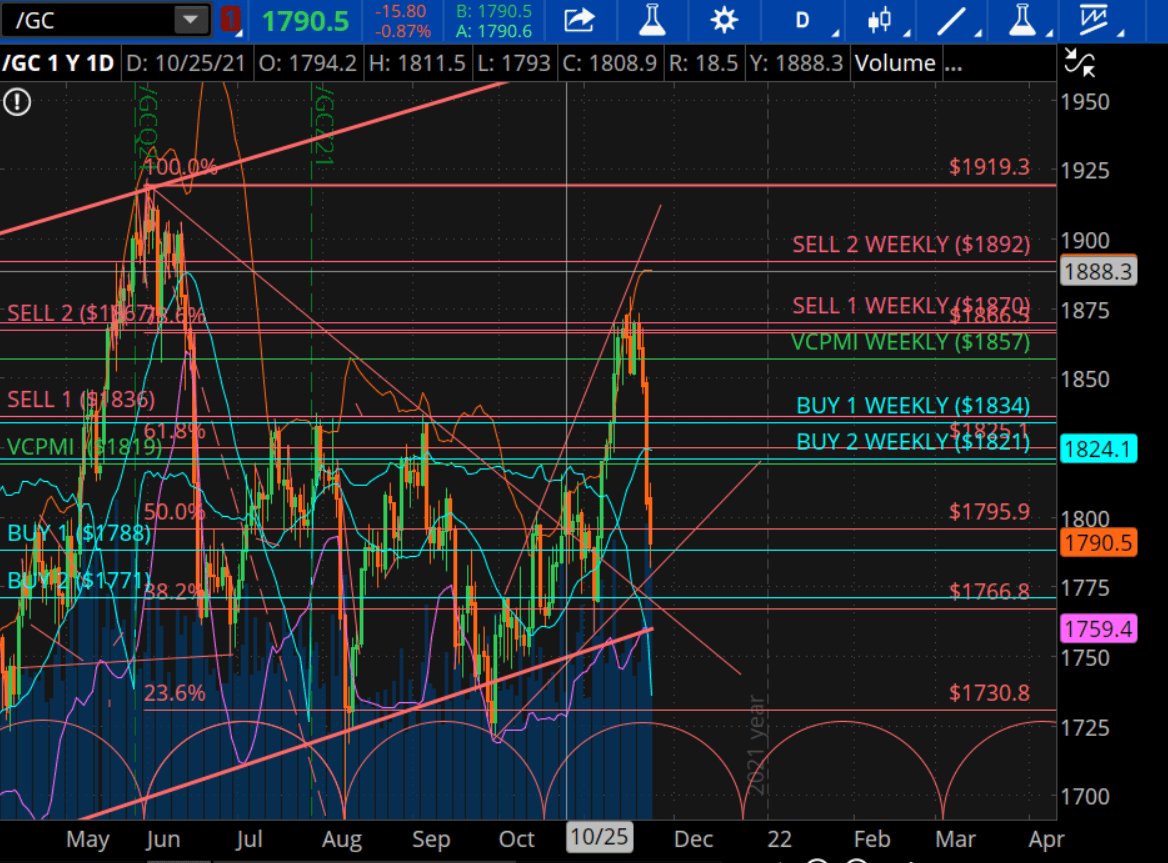

Gold

Source: ema2trade.com

Gold is down to $1790 and has activated a buy signal from the Buy 1 level of $1788 for the day. The target is $1819. We are trading below the weekly Buy 2 level of $1821. By closing below $1821, gold activated a bearish price momentum with a target of $1788, which was completed early on November 23. Now we have a buy trigger with a stop at $1788 or you can use a maximum dollar stop depending on your comfort level. If you are more aggressive, you can use a stop at $1771 as a protective level. Gold is approaching levels indicating accumulation of supply. It is activating buy triggers around the Buy 1 and 2 levels of $1788 and $1771, which are the best levels at which to add to your long positions.

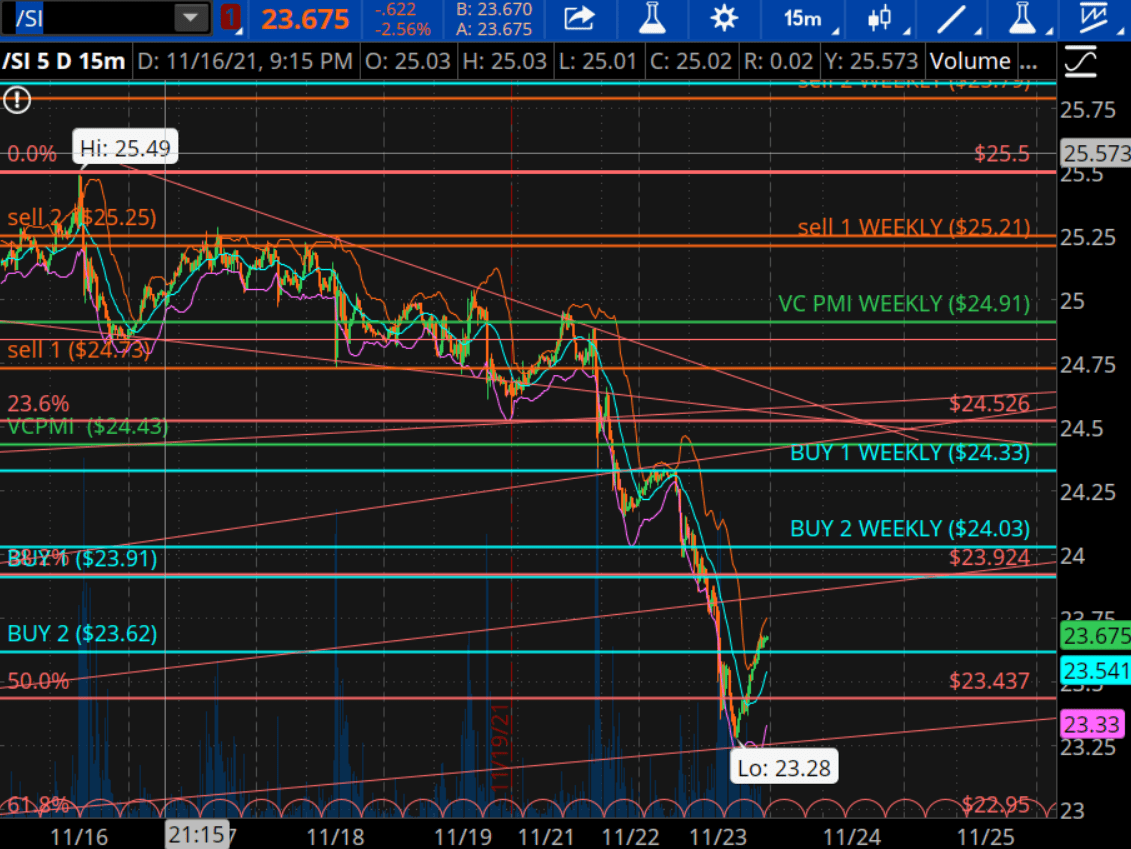

Silver Daily

Source: ema2trade.com

Silver is down 80 cents, following the same pattern as gold. It went neutral on a close below $24.03, which happened last night on November 22. The average daily price is $24.91 for the week. Silver is below that price, but near it, so we don’t trade around the average daily price. We wait to trade extremes of the market, which have the highest probability of a profitable trade. By closing above $24.91, we have a bullish weekly price momentum. The Sell 1 level is $24.91 for the weekly, which is the target. The daily signal target was $24.73. If the price moves up above that, the level becomes support and the next target is $25.25. If silver comes down, then the Buy levels below come into play at $23.91 and 23.62. The Buy levels are where you want to enter the market and go long or exit your short positions.

Disclosure: I/we have a beneficial long position in the shares of GDX, SILJ either through stock ownership, options, or other derivatives.

To learn more about how the VC PMI works and receive ...

more