Trends, Dynamics, And Forecasts In Gold And Silver Markets In February 2024

Image Source: Pixabay

As we enter February 2024, the precious metals market appears to offer a mix of opportunities for long-term oriented investors. While the gold charts have been showing a positive trend that has not been fully accepted by investors, anomalies in the silver market have been showing a completely different scenario, one characterized by supply shortages against a backdrop of stable prices.

This post will take a look at the latest updates and data from both markets, providing insights into the current situations and what they could mean for precious metals investors.

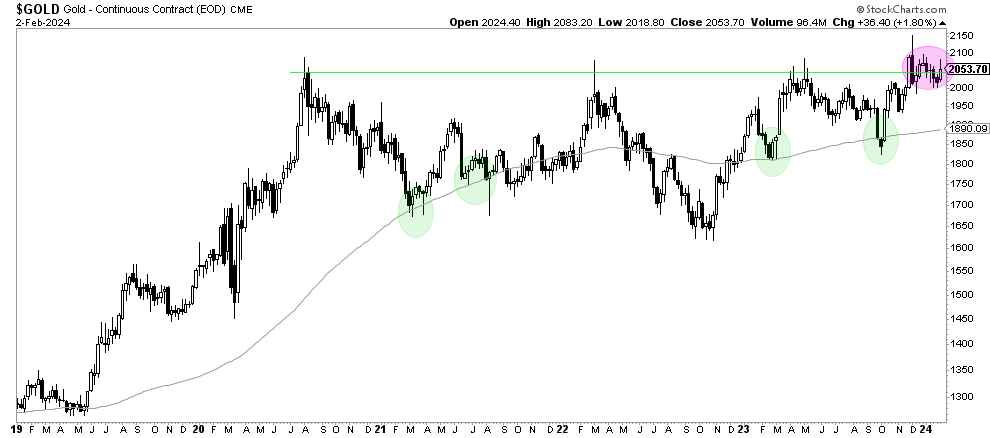

Gold Market Overview

The gold market has recently shown strength, according to its weekly chart analysis. Recent prices have been significantly above the long-term average, and the series of high weekly closings seem to signal a strong outlook, though investor sentiment has remained cautious.

This contrast highlights a market filled with potential, waiting for wider recognition of its positive trends.

(Click on image to enlarge)

Image Source: InvestingHaven

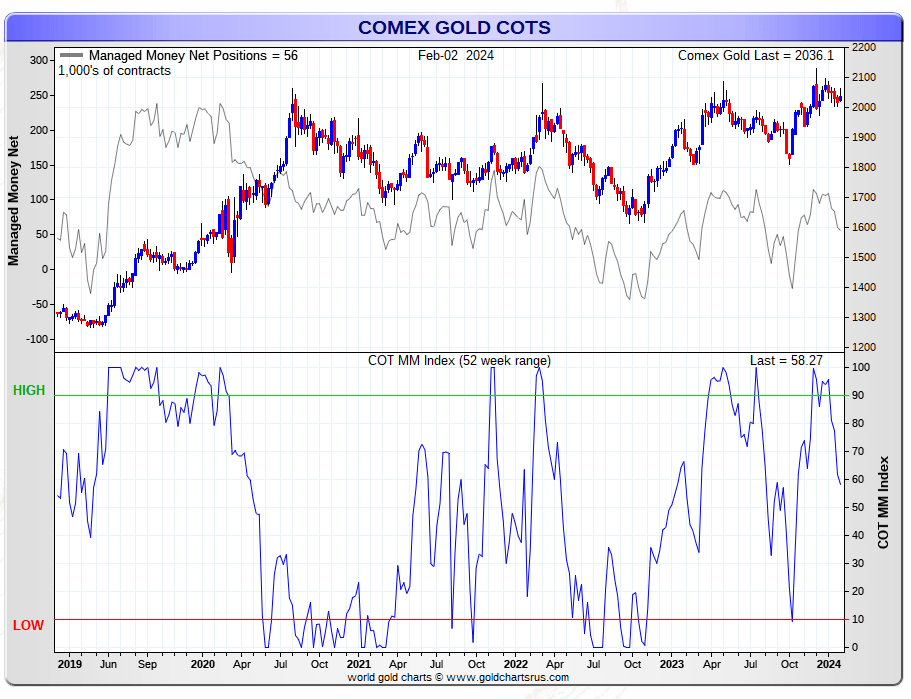

The move away from speculators in gold futures and the expected Federal Reserve policy changes only further strengthen the case for gold. These elements, along with a technical breakout, suggest gold prices are likely to rise, despite current market doubts.

(Click on image to enlarge)

Image Source: InvestingHaven

Silver Market Dynamics

The silver story, however, is significantly different.

The Silver Institute's latest data indicates a continuous physical silver supply shortage, which is now in its third consecutive year. This situation, against a background of steady prices, presents an anomaly—or an opportunity for alert investors.

The 2024 outlook for silver is influenced by several key factors:

- Anticipated demand to reach 1.2 billion ounces;

- Record industrial use;

- Growing jewelry demand;

- A slight drop in physical investment.

Despite an increase in supply, the market is expected to remain in a deficit, highlighting the disconnect between supply-demand basics and price action.

Silver Market Anomalies and Considerations

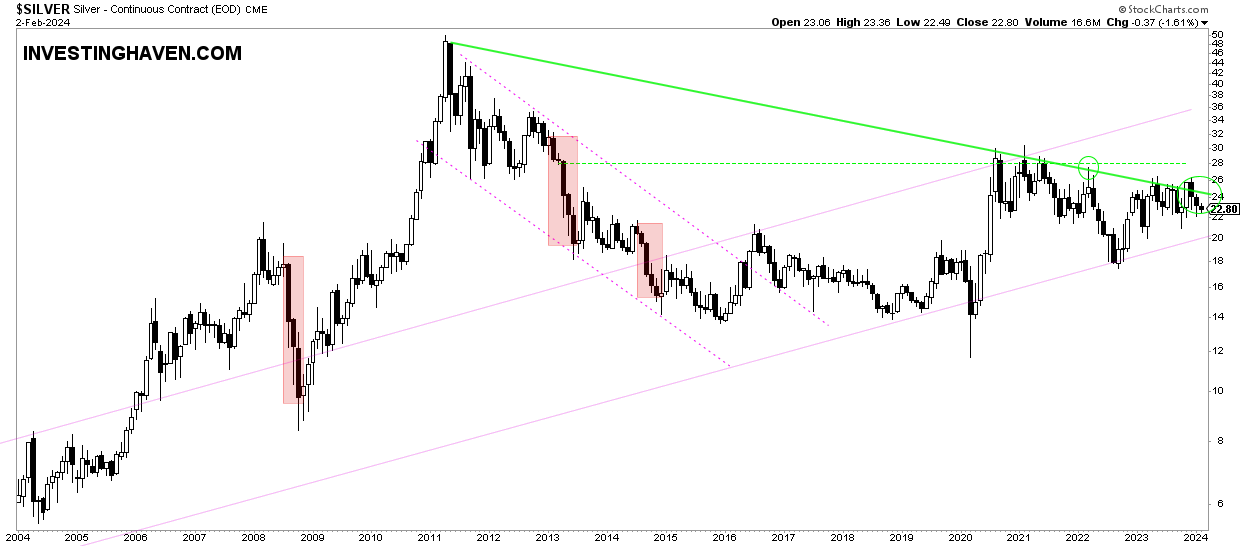

The ongoing supply deficit in silver, along with flat prices, may prompt questions about market dynamics and a possible undervaluation. The price of silver, often stable, now stands at a critical point, with long-term forecasts indicating significant upward potential.

This scenario, along with a high gold-to-silver price ratio and unique market forces in the COMEX silver futures market, highlights silver's undervalued status and the potential for a price increase.

(Click on image to enlarge)

Image Source: InvestingHaven

Comparative Analysis and Investor Implications

The different situations in the gold and silver markets in February 2024 illustrate a range of factors affecting precious metals for the remainder of 2024. Gold's positive charts and silver's supply-demand gap offer different paths for investors:

- For gold, the direction seems set for a gradual rise driven by economic policies and market dynamics.

- Conversely, silver's status suggests hidden potential for rapid growth, dependent on a reevaluation of market perceptions and investment flows.

The silver chart says it all - a secular breakout is in the making:

(Click on image to enlarge)

Image Source: InvestingHaven

Conclusion: A Combined Outlook for Precious Metals in 2024

As investors consider the conditions of the gold and silver markets, the key will be to recognize the underlying trends that define each metal's current state. The positive signs in gold, combined with the strong case for silver's undervaluation, may present opportunities for those willing to exhibit patience.

As 2024 progresses, the changing dynamics of these markets will undoubtedly reward their buy-and-hold investors. We certainly recommend against holding leveraged positions in precious metals.

More By This Author:

Beyond The Headlines: Ethereum's Trajectory In 2024 And 2025

A Strategic Look At The AI Boom Of 2024

What's Wrong With Silver?

Disclaimer: None.