Top Takeaway From 2025 Gold & Silver Rally

Image Source: Pixabay

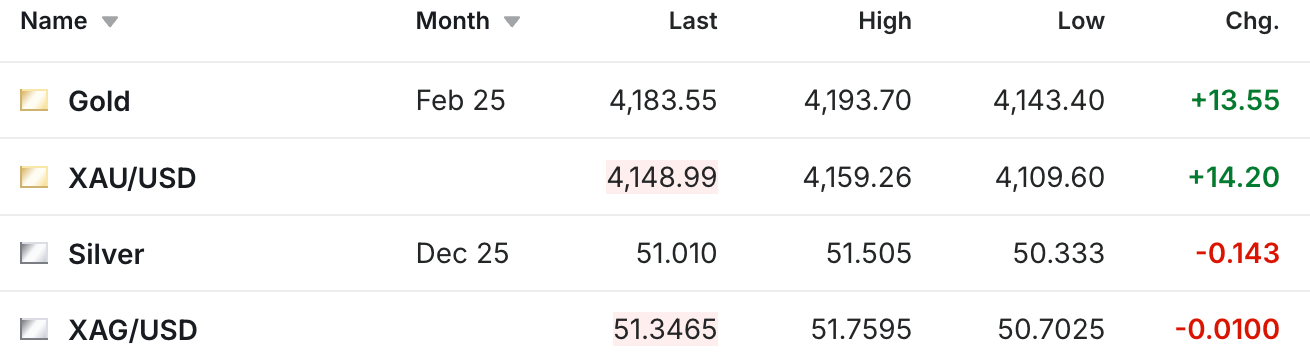

It’s been a somewhat quiet session in the gold and silver futures today after yesterday’s big day higher.

Gold is up $14 on the day, while silver is basically flat.

But as we head into the Thanksgiving holiday weekend, perhaps one of the single biggest takeaways from the stunning gold and silver rally that we’ve experienced this year is that this has all occurred before there’s been any sort of crisis.

Jerome Powell and the Federal Reserve have changed from last year’s ‘the economy is strong,’ to Powell now saying, ‘the economy may be on firmer footing, but job market weak.’ But we haven’t had a Lehman moment, or even a Signature Bank moment, and despite how you can see the footprints of the East continuing to move away from their former reliance on the dollar, we haven’t had any real break points there (perhaps with the sanctions on Russia being the last key one).

Yet given how the debt continues to pile up, while the Fed has ended quantitative tightening, and is highly expected at some point to resume quantitative easing, outside of some form of Fed gold certificate revaluation, or an outright gold revaluation, it seems like we’re headed for some sort of debt crisis at some point.

But it hasn’t happened yet, which is what makes the current rally all the more stunning. If you had had a crisis, and then the prices got to these levels, that would almost make more sense. But the fact that we’ve seen this rally even absent such a crisis makes you wonder what happens to the prices when that does occur.

It probably doesn’t help that Treasury Secretary Bessent is already warning about the next potential government shutdown.

Treasury Secretary Scott Bessent has said that he wants the Senate to end its filibuster rule, weeks after the longest government shutdown in history was ended, warning that a similar delay tactic may be used again in January to initiate a new shutdown.

At the same time, one of the larger refiners is seeing enough interest that they’re reviving their gold-backed token.

Swiss precious metals giant MKS PAMP SA is relaunching a gold token to capitalize on growing interest in digital bullion, six years after an initial attempt faltered.

MKS PAMP — which owns refineries, trading operations and retail platforms around the world — said a growing desire to trade gold, from newly rich crypto investors to institutional funds, encouraged the firm to revive the digital asset.

“If you’ve made your money in crypto, you’re very keen on, for example, having tokenized gold, because what you don’t want is simply this gold sitting in a safe,” Chief Executive Officer James Emmett said in an interview. “You actually want to be able to utilize it in one form or another, and want to be able to stake it or to leverage it,” he said.

So it sure seems like the monetary order is slowly, or some days even rapidly, changing before our eyes. And it’s fascinating to think what this will all look like in 10 or 20 years, in an increasingly electronic and automated world.

And that’s not even to touch on what would seemingly have to be an inevitable rush out of the bond market at some point, which we will touch on next week. Although this will be the last column of this week, as I will be taking a few days off for some rest, organization, and planning.

But I hope you’re getting set for a wonderful Thanksgiving with your family and loved ones, and remembering how even despite the government or the Federal Reserve, we all have a lot to be grateful for.

One last note is that there have been rumblings of a peace deal between Russia and Ukraine, and while it sounds like it’s far from finalized, just for the good of mankind, hopefully more peaceful times will be coming there soon.

So happy Thanksgiving to you, your family, and everyone who wakes up and just does their best each day.

More By This Author:

Why Silver Deficit Is Even Worse Than You ThoughtSolar Installations Surge, But Silver Thrifting Goes Into Overdrive

Gold & Silver Rally: Here’s What Everyone Is Missing…

Enjoy your time off, and Thank You.