Long-time readers will know we’ve spilled a fair bit of digital ink on things like oil, coal, heck… even Bitcoin.

But there’s one asset we have been suspiciously mum on so far. Gold.

We did a deep dive on the “barbaric metal” in a recent Insider Newsletter issue and figured we’d also share some of our thoughts with you.

After just sitting there silently for the last couple of years (at least when measured in USD), we expect gold to shine again this year.

The way we see things, gold as a monetary instrument best moves on a loss of faith in the prevailing currency system.

And in today’s increasingly fracturing world, this is precisely what we’re seeing.

The “freezing” of Russia’s foreign currency reserves by the West last year sent a message to the rest of the world: your assets are no longer safe in our hands. Rule of law be damned!

This prompted countries from sea to shining sea to adjust accordingly. How?

Not by buying Bitcoin (as sympathetic as we are to the idea behind it). Instead, the pointy shoes have been stuffing their… ahem, vaults with that useless lump of rock — gold.

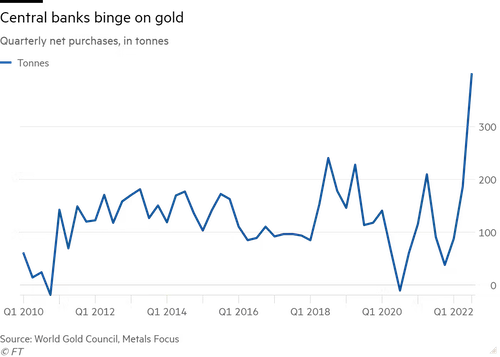

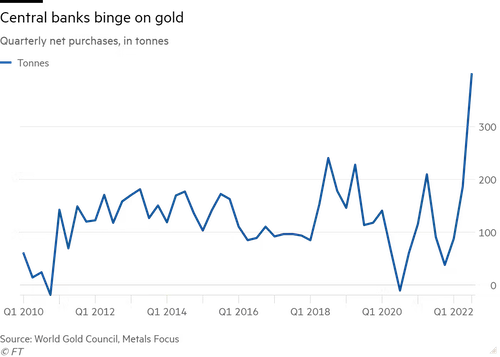

As per the Financial Times:

Central banks are scooping up gold at the fastest pace since 1967, with analysts pinning China and Russia as big buyers in an indication that some nations are keen to diversify their reserves away from the dollar.

You have to ask yourself, with everything taking place around us, why would that trend not continue — or even accelerate — in 2023?

Now, you might say…

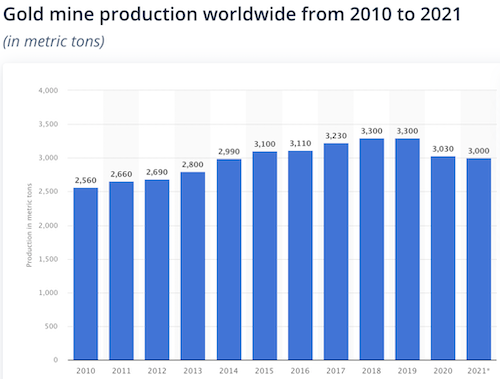

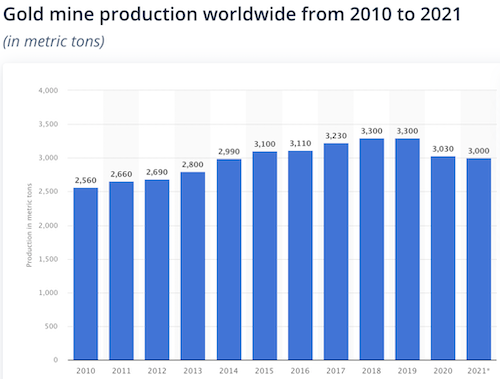

“Surely, gold miners must’ve been ramping up production.”

Except that hasn’t been the case. In fact — much like the energy space (or any commodity, really) — production of gold has been slowly shrinking.

With all the tailwinds, we think you could do worse than gold.

It’s why we own precious metals stocks in our portfolio as well as physical gold, stored safely at our best equivalent of Gringotts.

Have a great weekend!

More By This Author:

Predictable

Our World This Week: Gilty As Charged

Our World This Week: Getting Spanked

Disclaimer: This is not intended to render investment advice. None of the principles of Capex Administrative Ltd or Chris MacIntosh are licensed as financial professionals, brokers, bankers or even ...

more

Disclaimer: This is not intended to render investment advice. None of the principles of Capex Administrative Ltd or Chris MacIntosh are licensed as financial professionals, brokers, bankers or even candlestick makers in any jurisdiction, anywhere on this big ball of dirt.We do NOT know your individual situation, and you should always consult with your attorneys, accountants, financial planners, and those that are sanctioned to provide you with advice. DO YOUR OWN DUE DILIGENCE.

But seriously, all investments carry risk. Some of what I discuss arguably carries great risk. Investments which can lead to you losing 100% of your capital and maybe more if you are stupid and use margin.If you invest more than you can afford to lose, or borrow money from Joey down at the tavern, Master Card or Visa to make your investments, then you need to go and read a different website.

But really seriously…

Capex Administrative LTD – parent company of CapitalistExploits.at is not a a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Neither CapitalistExploits.at, Capex Administrative LTD purport to tell or suggest which investment securities members or readers should buy or sell for themselves. Readers, subscribers, site users and anyone reading material published by the above mentioned entities should always conduct their own research and due diligence and obtain professional advice before making any investment decision. Capex Administrative LTD, it’s principles and employees cannot and will not be liable for any loss or damage caused by a reader’s reliance on information obtained in any of our posts, newsletters, special reports, email correspondence, memberships or on this website. Like us, our readers are solely responsible for their own investment decisions.

The information contained herein does not constitute a representation by Capex Administrative LTD or CapitalistExploits.at or a solicitation for the purchase or sale of securities. Our opinions and analyses are based on sources believed to be reliable and are written in good faith, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. All information contained in our newsletters or on our website should be independently verified with the companies and individuals mentioned. The editor and publisher are not responsible for errors or omissions.

Capex Administrative LTD may receive compensation from time to time from the companies or individuals that may be mentioned in our newsletters, special reports or on our web site. If compensation is received we will indicate that compensation in the post or the content, or on this website within this “disclaimer.” You should assume a conflict of interest when compensation is received and proceed accordingly.

Any opinions expressed are subject to change without notice. Owners, employees and writers may hold positions in the securities that are discussed in our newsletters, reports or on our website.Owners, employees and writers reserve the right to buy and sell securities mentioned on this website without providing notice of such purchases and sales. You should assume that if a company is discussed on this website, in a special report or in a newsletter or alert, that the principals of Capex Administrative LTD have purchased shares, or will make an investment in the future in said company.

If you have a question as to what we own and when, we are happy to fully-disclose any and all interests to our readers.

less

How did you like this article? Let us know so we can better customize your reading experience.