Thoughts On Rick Rule Selling His Silver

.webp)

Photo by Zlaťáky.cz on Unsplash

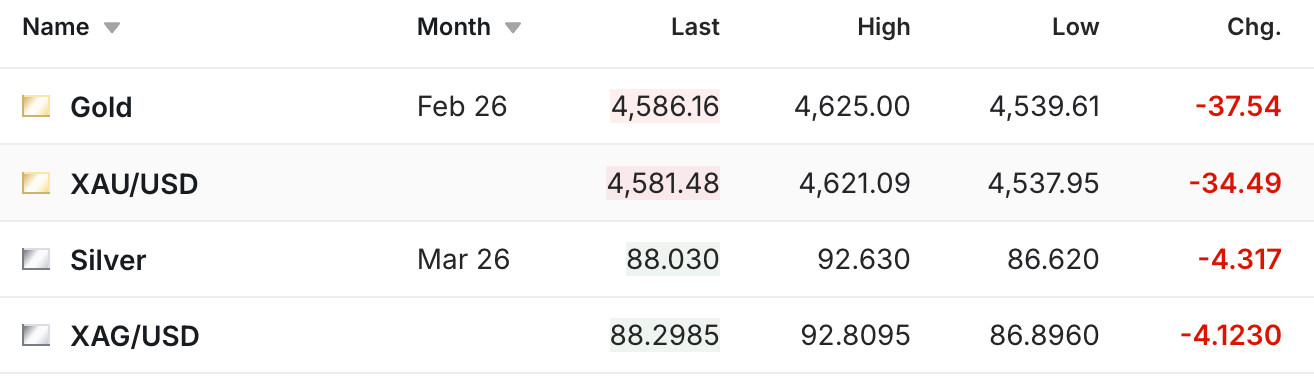

The gold and silver prices are down on Friday after another wild week in the precious metals markets.

The gold futures are down $37 to $4,586, and the silver futures are down $4.32 to $88.03.

The silver price is still about $2.50 higher on the week, $25 higher over the past month, and still trading at $97.44 in Shanghai.

I’m not seeing evidence to indicate that this is anything other than normal volatility when the price has been moving up $5-$7 at a time. And for a concise update of what I feel remains the most important issue in the silver market right now, watch this 4-minute video.

In terms of where we go from here, figure out the answer to how the issue in the video gets resolved, and you’ll have a good idea of what’s coming next. Unfortunately, it’s not a situation where there’s one single guaranteed outcome, but rather the next step forward or back is contingent upon the resolution of what’s currently happening in China.

There are scenarios in which we could see a substantially higher price, and there are scenarios where we could see the price go down quite a bit. Although, in terms of something that I think you might find helpful as you continue to update your plans and projections, in case you’re looking for a counterargument to the bullish theses in the silver market right now, Rick Rule was interviewed this week and he talked about why he’s getting ready to sell a large portion of his silver.

The whole interview is worth watching, although I queued this clip up to the 11:15 mark (his comment on this topic goes until 12:35) if you want to just hear the part where he talked about why he’s getting ready to sell his silver.

While you don’t necessarily have to agree with what he’s saying, I’ve found in my financial career that one of the most valuable things I’ve learned to do is to at least hear the counterarguments of the people I’m betting against, and then decide if there’s credence to what they’re saying, or if I can identify where I think they’ve missed something. So, even if you think someone is completely insane if they think the price is going down from here, I find it’s incredibly valuable to at least hear their thought process.

There are some things in there that he said that make a lot of sense, and some that I would see differently. But to be clear, you’ll notice in the beginning of his commentary that he mentions timelines, and distinguishes between a long-term horizon and a particular trade.

If you’re holding silver because you’re concerned about what’s still to come regarding the dollar and the debt, then that’s a different function than what he talks about in that clip. Although, given some of the price targets I see frequently thrown out on Twitter, where it feels almost as if a large portion of the market is expecting $200-300 silver without question in the next few months, I think Rick does raise some valid points.

One way to put it in perspective is to think back to 2023 or 2024 when silver was still below $30, and imagine how you would have felt if you knew that in less than two years it was going to be trading over $90. That’s not to say that you would have, or should have, planned to sell, but just to point out that we have already seen a large move, and I just feel like that is getting largely overlooked. Again, this is not to say that anyone should sell, or that I feel it’s my place to tell anyone what they should do, as obviously I’m writing to a large audience of people, and everyone’s situation is different.

Yet to the degree that I maintain a strong belief that someone will have a far better experience if they’re not the best trader, but they do practice prudent money management, as opposed to someone who’s a great market timer, yet sizes his bets too aggressively, if your current exposure leaves you feeling anxious or unable to sleep well at night, then regardless of what anybody else is doing, that might warrant further reflection.

Ultimately, it’s a good problem to have, and hopefully this just gives you a few ideas to consider as you make whatever decision feels right to you. But perhaps most importantly, make sure to get a break in there this weekend, and just appreciate all of the things that are going well in your life.

More By This Author:

Why Silver Just Rallied Past $91Silver Tightness Spreads To India

Gold & Silver Selloff, But Global Tension Starts To Boil