This Is Who Sees A Cyclical Recovery

Labor Force Participation Rate Falls

Even though the unemployment rate fell 0.2% to 6.7%, this wasn’t a positive report because the labor force participation rate fell from 61.7% to 61.5%, which is a big decline. It’s down 1.9% from before the recession. It might never regain all its losses, but it should regain most of them if the recovery accelerates next spring. Demographics won’t be much different 18 months later.

On the other hand, industries have changed. The advent of technological advancement in the COVID-19 economy could keep some older folks out of the labor market. The prime age labor force participation rate fell 0.3% to 80.9%, which is 2.1% below where it was in February. The economy has 9.8 million fewer jobs because of the recession.

And, the 6.7% unemployment rate puts lipstick on a pig to a certain extent. The labor market has improved quickly, but it’s not back to normal.

Average hourly wage growth was 0.3% and yearly wage growth was 4.4%. The work week length stayed at 34.8 hours, and weekly earnings growth was 5.9%. Normally in recessions, wage growth increases because of composition effects. That means low wage workers lose their jobs, which pushes up the average pay rate.

This cycle is different because of the K-shaped recovery. Specifically, some industries can’t find enough workers and others are firing them left and right. Amazon (AMZN) is hiring everyone it can, but restaurants and movie theaters are struggling.

Shale Hasn’t Worked

Market narratives are usually true; they just go too far. For example, a company might be innovative, but once its stock rises over 1,000%, the optimism is over the top. The narrative on fracking is that it burns capital. That’s why energy has been in its worst downturn in 90 years.

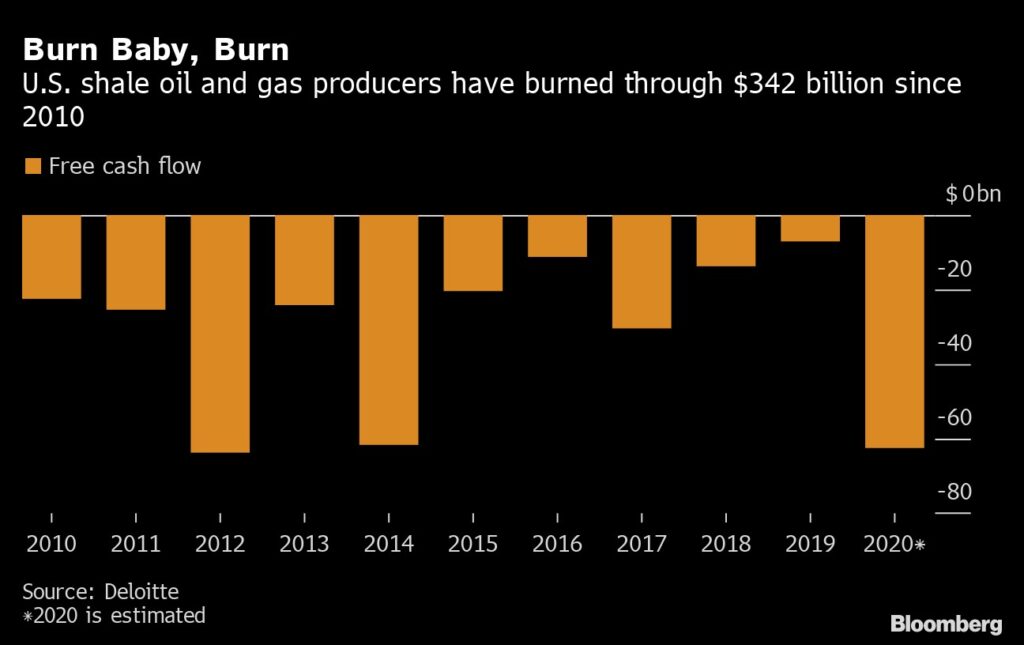

Fracking hurt all oil stocks because it increased supply, which hurt prices. Furthermore, it was bad for fracking companies specifically because of steep decline rates and faulty metrics. Firms invented the term EBITDAX, which excludes exploration expenses. As you can see from the chart below, shale oil and gas producers have burned through $342 billion since 2010.

Everyone has known about the negative energy thesis for a couple years. It has been priced in. The banks don’t want to lend to energy firms anymore. It won’t be easy to recover from this weak period. When oil prices recover next year, we can anticipate more free cash flow than in 2019.

Technology has improved, which lowers costs. Plenty of investors don’t believe this because they were sold lies a few years ago, but it’s true. If you were too stubborn to invest in energy stocks, you missed out on U.S. Silica (SLCA), which is up 573% from the March bottom.

Fewer Working From Home

Restaurants are in trouble. Over 110,000 restaurants have closed permanently or long-term as of late November. 87% of the 6,000 restaurants surveyed had a drop in revenue, with the average decline being 36%. 59% have higher labor costs, and 58% expect more layoff and furloughs in the next three months.

The BLS released new data through September. 19% of firms faced a government mandated closure, but 56% faced a drop in demand. 54% of businesses that weren’t required to close still had to cut hours or furlough workers.

The chart above shows the percentage of workers who are remote because of the pandemic. Interestingly, even as the software stocks exploded from May to late August, the percentage of people working from home fell due to the pandemic. There was a small increase in November because of the third wave.

It will likely rise in December and January, but fall for the rest of the year until it hits zero. Obviously, some people will still work from home, but this chart is measuring people who work from home because of the virus.

Investors See A Cyclical Upswing

In some ways, you can argue the cyclical upswing is mostly priced in. It depends on which asset you’re looking at. The 10-year yield and oil services stocks still have room to rise. However, you must wonder if copper has run too far after recently hitting its highest price since February 2013. As you can see from the chart below, the speculative net positioning as a percentage of open interest in copper is the highest since the mid-2000's and almost the highest ever. Pretty much everyone sees an upturn next year.

Services PMIs

The Markit PMIs were excellent in November. They certainly support the cyclical upswing narrative. The services PMI had the sharpest increase in activity since March 2015, as it rose from 56.9 to 58.4. Employment rose at the fastest pace in the survey’s history. The prices indexes were also at survey highs. The Chief Business Economist at Markit stated, “November saw US business activity surge higher at a rate not seen since early-2015 as companies enjoyed sharply rising demand for goods and services.”

The ISM PMI was weaker than Markit’s again, but it was still solid. The PMI fell from 56.6 to 55.9. Business activity fell from 61.2 to 58, and new orders fell 1.6 to 57.2. The employment index was up 1.4 to 51.5. It’s interesting how the employment indexes in both PMIs were stronger, yet the BLS report was weak.

It’s logical to expect the labor market to weaken given the shutdowns the pandemic is causing. California’s stay at home order affects 33 million people. An educational services firm was quoted in the ISM report as stating, “Recent spikes in the infection rates of COVID-19 have caused us to pause plans to further reopen our campus. Sourcing for the resumption and expanded use of onsite testing of students and staff along with concerns over possible personal protective equipment [PPE] shortages occupy most staff meetings.”

The quotes in the December ISM reading will probably indicate even more effects from the third wave.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more