This Is A Recipe For Hot Inflation In 2021

Get ready for a tsunami of liquidity to hit the financial system.

President Trump has already signed a COVID-19 stimulus bill that will give $600 to most Americans. The House of Representatives has since passed a bill to increase the amount to $2,000.

So that’s a massive wave of money flowing into the economy.

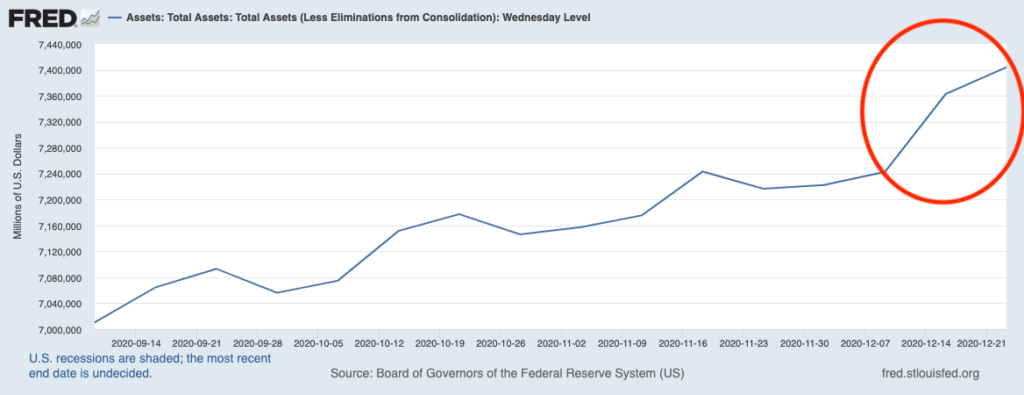

On top of this, the Fed has just pumped $162 BILLION into the financial system in the last two weeks.

To provide some perspective here.

During the apex of its monetary policy response to the Great Financial Crisis of 2008, the Fed was printing $80 billion in new money per month.

It just printed $162 billion in 14 days

Again, a tsunami of liquidity is going to hit the financial system in 2021. And unlike in 2008, this time it’s going to unleash hot inflation.

One of the most baffling aspects of policymakers’ response to the Great Financial Crisis of 2008 was the total lack of inflation appearing in the broader economy.

After all, in 2008 central banks embarked on the most aggressive monetary easing in history (up until that point). Between 2008 and 2016, central banks:

- Cut interest rates over 650 times.

- Printed over $12 TRILLION in new money.

- And pushed over $10 trillion bond yields into NEGATIVE territory.

And yet, for the most part, inflation was nowhere to be found. Yes, the cost of the living for most Americans continued to rise, but it didn’t rise any faster than it had in the preceding 30 years. Indeed, on a year over year basis, inflation never managed to stay above 2% for very long.

So where was the inflation?

It was in stocks, housing prices, and other assets. All of the money central banks printed never got into the real economy. It went to the banks. And the banks either used it to speculate in the stock market (investment banks) or they sat on it.

This time around, in 2020, things are VERY different: between stimulus payments and central bank lending facilities directly to small businesses/ Main Street, much of the stimulus money is actually going straight into the economy.

In the U.S., we’ve already seen TWO stimulus programs of over $4.2 trillion of which at least $2 trillion will go directly into the U.S. economy. And on top of this, the Fed has put over $1.6 TRILLION in actual real money into the U.S. economy in the form of credit facilities.

Add that up are you’re talking about $3.6+ trillion in new money entering the economy this year. The U.S.’s GDP is about $22 trillion, so we’re talking about an amount of money equal to 17% of GDP.

THAT’s how you get hot inflation. And the markets know it.

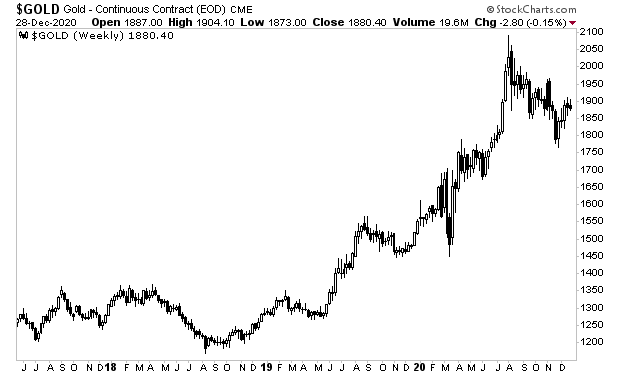

Take a look at what gold has been doing.

Again, BIG inflation will be the BIG theme for 2021.

Investors who are well-positioned to profit from it could see literal fortunes.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.