These Are The World's Largest Oil Producers

In 2022 oil prices peaked at more than $100 per barrel, hitting an eight-year high, after a full year of turmoil in the energy markets in the wake of the Russian invasion of Ukraine.

Oil companies doubled their profits and the economies of the biggest oil producers in the world got a major boost.

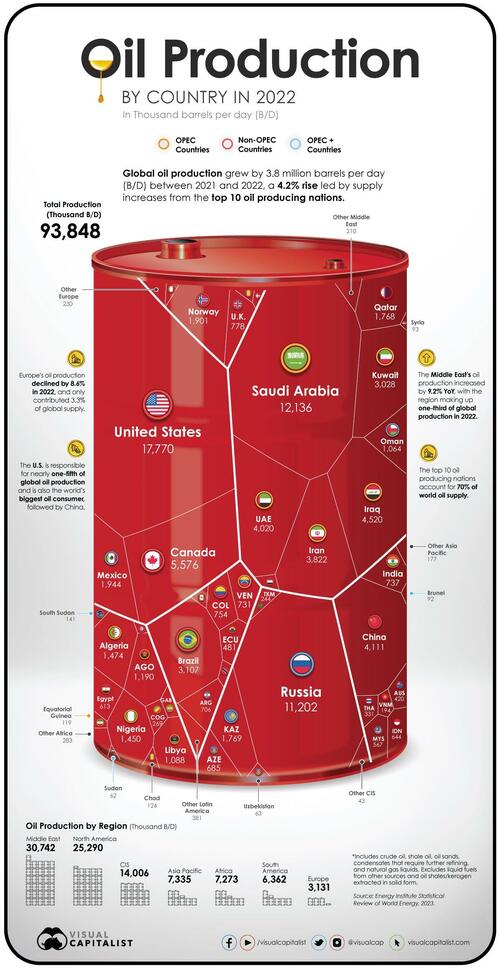

But which countries are responsible for most of the world’s oil supply? Using data from the Statistical Review of World Energy by the Energy Institute, Visual Capitalist's Pallavi Rao and Christina Kostandi visualized and ranked the world’s biggest oil producers.

Ranked: Oil Production By Country, in 2022

The U.S. has been the world’s biggest oil producer since 2018 and continued its dominance in 2022 by producing close to 18 million barrels per day (B/D). This accounted for nearly one-fifth of the world’s oil supply.

Almost three-fourths of the country’s oil production is centered around five states: Texas, New Mexico, North Dakota, Alaska, and Colorado.

We rank the other major oil producers in the world below.

| Rank | Country | 2022 Production (Thousand B/D) |

YoY Change | Share of World Supply |

|---|---|---|---|---|

| 1 | 🇺🇸 U.S. | 17,770 | +6.5% | 18.9% |

| 2 | 🇸🇦 Saudi Arabia | 12,136 | +10.8% | 12.9% |

| 3 | 🇷🇺 Russia | 11,202 | +1.8% | 11.9% |

| 4 | 🇨🇦 Canada | 5,576 | +3.0% | 5.9% |

| 5 | 🇮🇶 Iraq | 4,520 | +10.2% | 4.8% |

| 6 | 🇨🇳 China | 4,111 | +2.9% | 4.4% |

| 7 | 🇦🇪 UAE | 4,020 | +10.4% | 4.3% |

| 8 | 🇮🇷 Iran | 3,822 | +4.6% | 4.1% |

| 9 | 🇧🇷 Brazil | 3,107 | +3.9% | 3.3% |

| 10 | 🇰🇼 Kuwait | 3,028 | +12.0% | 3.2% |

| 11 | 🇲🇽 Mexico | 1,944 | +0.9% | 2.1% |

| 12 | 🇳🇴 Norway | 1,901 | -6.3% | 2.0% |

| 13 | 🇰🇿 Kazakhstan | 1,769 | -2.0% | 1.9% |

| 14 | 🇶🇦 Qatar | 1,768 | +1.8% | 1.9% |

| 15 | 🇩🇿 Algeria | 1,474 | +8.9% | 1.6% |

| 16 | 🇳🇬 Nigeria | 1,450 | -11.2% | 1.5% |

| 17 | 🇦🇴 Angola | 1,190 | +1.1% | 1.3% |

| 18 | 🇱🇾 Libya | 1,088 | -14.3% | 1.2% |

| 19 | 🇴🇲 Oman | 1,064 | +9.6% | 1.1% |

| 20 | 🇬🇧 UK | 778 | -11.0% | 0.8% |

| 21 | 🇨🇴 Colombia | 754 | +2.4% | 0.8% |

| 22 | 🇮🇳 India | 737 | -3.8% | 0.8% |

| 23 | 🇻🇪 Venezuela | 731 | +8.1% | 0.8% |

| 24 | 🇦🇷 Argentina | 706 | +12.4% | 0.8% |

| 25 | 🇦🇿 Azerbaijan | 685 | -5.6% | 0.7% |

| 26 | 🇮🇩 Indonesia | 644 | -6.9% | 0.7% |

| 27 | 🇪🇬 Egypt | 613 | +0.8% | 0.7% |

| 28 | 🇲🇾 Malaysia | 567 | -1.7% | 0.6% |

| 29 | 🇪🇨 Ecuador | 481 | +1.7% | 0.5% |

| 30 | 🇦🇺 Australia | 420 | -5.2% | 0.4% |

| 31 | 🇹🇭 Thailand | 331 | -17.5% | 0.4% |

| 32 | 🇨🇩 Congo | 269 | -1.7% | 0.3% |

| 33 | 🇹🇲 Turkmenistan | 244 | +1.0% | 0.3% |

| 34 | 🇻🇳 Vietnam | 194 | -1.2% | 0.2% |

| 35 | 🇬🇦 Gabon | 191 | +5.4% | 0.2% |

| 36 | 🇸🇸 South Sudan | 141 | -7.6% | 0.2% |

| 37 | 🇵🇪 Peru | 128 | +0.5% | 0.1% |

| 38 | 🇹🇩 Chad | 124 | +6.2% | 0.1% |

| 39 | 🇬🇶 Equatorial Guinea |

119 | -9.2% | 0.1% |

| 40 | 🇸🇾 Syria | 93 | -2.7% | 0.1% |

| 41 | 🇮🇹 Italy | 92 | -7.9% | 0.1% |

| 42 | 🇧🇳 Brunei | 92 | -13.8% | 0.1% |

| 43 | 🇾🇪 Yemen | 81 | -2.4% | 0.1% |

| 44 | 🇹🇹 Trinidad & Tobago |

74 | -3.6% | 0.1% |

| 45 | 🇷🇴 Romania | 65 | -6.2% | 0.1% |

| 46 | 🇩🇰 Denmark | 65 | -1.6% | 0.1% |

| 47 | 🇺🇿 Uzbekistan | 63 | -0.9% | 0.1% |

| 48 | 🇸🇩 Sudan | 62 | -3.3% | 0.1% |

| 49 | 🇹🇳 Tunisia | 40 | -12.9% | 0.0% |

| 50 | Other CIS | 43 | +4.4% | 0.0% |

| 51 | Other Middle East | 210 | +1.2% | 0.2% |

| 52 | Other Africa | 283 | -3.4% | 0.3% |

| 53 | Other Europe | 230 | -20.5% | 0.2% |

| 54 | Other Asia Pacific | 177 | -10.6% | 0.2% |

| 55 | Other S. & Cent. America |

381 | +68.5% | 0.4% |

| Total World | 93,848 | +4.2% | 100.0% |

Behind America’s considerable lead in oil production, Saudi Arabia (ranked 2nd) produced 12 million B/D, accounting for about 13% of global supply.

Russia came in third with 11 million B/D in 2022. Together, these top three oil producing behemoths, along with Canada (4th) and Iraq (5th), make up more than half of the entire world’s oil supply.

Meanwhile, the top 10 oil producers, including those ranked 6th to 10th—China, UAE, Iran, Brazil, and Kuwait—are responsible for more than 70% of the world’s oil production.

Notably, all top 10 oil giants increased their production between 2021–2022, and as a result, global output rose 4.2% year-on-year.

Major Oil Producing Regions in 2022

The Middle East accounts for one-third of global oil production and North America makes up almost another one-third of production. The Commonwealth of Independent States—an organization of post-Soviet Union countries—is another major regional producer of oil, with a 15% share of world production.

| Region | 2022 Production (Thousand B/D) |

YoY Change | Share of World Supply |

|---|---|---|---|

| Middle East | 30,743 | +9.2% | 32.8% |

| North America | 25,290 | +5.3% | 27.0% |

| CIS | 14,006 | +0.9% | 14.9% |

| Africa | 7,043 | -3.5% | 7.5% |

| Asia Pacific | 7,273 | -1.4% | 7.8% |

| South & Central America |

6,361 | 7.2% | 6.8% |

| Europe | 3,131 | -8.6% | 3.3% |

What’s starkly apparent in the data however is Europe’s declining share of oil production, now at 3% of the world’s supply. In the last 20 years the EU’s oil output has dropped by more than 50% due to a variety of factors, including stricter environmental regulations and a shift to natural gas.

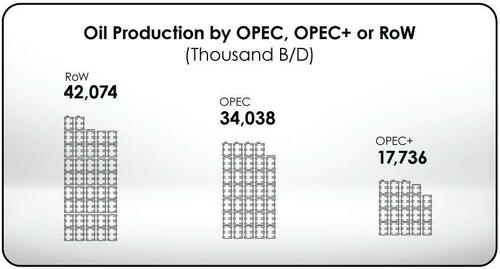

Another lens to look at regional production is through OPEC members, which control about 35% of the world’s oil output and about 70% of the world’s oil reserves.

When taking into account the group of 10 oil exporting countries OPEC has relationships with, known as OPEC+, the share of oil production increases to more than half of the world’s supply.

Oil’s Big Balancing Act

Since it’s the very lifeblood of the modern economy, the countries that control significant amounts of oil production also reap immense political and economic benefits. Entire regions have been catapulted into prosperity and wars have been fought over the control of the resource.

At the same time, the ongoing effort to pivot to renewable energy is pushing many major oil exporters to diversify their economies. A notable example is Saudi Arabia, whose sovereign wealth fund has invested in companies like Uber and WeWork.

However, the world still needs oil, as it supplies nearly one-third of global energy demand.

More By This Author:

Eurozone Inflation Tumbles To Two-Year Low

A Timeline Of US Government Shutdowns

"Fed's Last Hike" Triggers Q3 Carnage; Traders 'Sell All The Things' In September

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more