The Weekender: The Dip That Refuses To Burn

Image Source: Pixabay

Buy The Dip

The tape ended the week like a freight train that refuses to slow, even when the tracks look slick. A quarter-point trim from the Fed, whispers of more easing, and suddenly every stumble feels like a buyable dip rather than a genuine crack. Traders may not love the Fed’s compass—half the time it looks like it’s spinning—but liquidity is back in the bloodstream, and that alone is enough to keep the market’s pulse thumping.

Friday’s session added a theatrical flourish with Trump and Xi on the phone, a conversation that stretched for hours and felt more like backstage diplomacy than front-page drama. The absence of fresh landmines was itself a tailwind—markets don’t need fireworks when silence feels like safety. By the closing bell, the major benchmarks were not just afloat but pressing into record-high territory, as if the tide itself had conspired to lift every hull in the harbour.

US equities saw the largest net buying in 12 weeks, driven by long buys in Single Stocks and to a lesser extent short covers in Macro Products. 9 of 11 sectors were net bought, led by Info Tech/Financials/Consumer Disc/Health Care." - GS Prime

The S&P and Nasdaq extended their streak like runners hitting new personal bests, while the Dow moved with the steady cadence of an old freight train still finding new tracks to roll. Tech once again played the star quarterback, sprinting downfield with AI optimism tucked under its arm. Utilities provided the blocking—steady, unspectacular, but clearing space. Energy, on the other hand, slipped on its own cleats, falling back as crude price jitters undercut the sector.

Small-caps told a different story—one of nerves and rate sensitivity. The Russell had briefly punched an intraday record only to slip by the close, reminding us that these players live and die by interest-rate expectations. For them, lower borrowing costs are oxygen, but any hesitation from Powell’s crew cuts into the air supply.

Meanwhile, the political theatre had its own subplot. Trump hinted at progress on trade, fentanyl, Ukraine, and a TikTok deal stitched together with names like Oracle and Silver Lake. Xi’s script, as usual, was cleaner: rules, stability, and no fresh barriers. For markets, the nuance didn’t matter—it was the headline optics that mattered. No new grenades thrown into the ring meant traders could exhale and go back to their playbook: buy the dip, ride the rate cut wave.

Even September—the month traders often compare to a haunted house for equities—hasn’t lived up to its sinister billing. Instead of knives falling from the ceiling, Wall Street has found itself surfing a wave of liquidity, policy repricing, and AI capital flows. Nvidia’s splashy investment in Intel was just another spark on the wire, feeding the narrative that the future is still being built at warp speed.

The bigger story is that the market has learned to thrive in ambiguity. Rate cuts that might once have been read as a warning flare are now treated like high-octane fuel thanks to a still buoyant economy. A phone call between rivals that could have been a landmine is now a relief rally. It’s not rational, but it’s familiar. Traders don’t need certainties—they need enough plausible stories to keep capital moving forward.

And so, the week closes with markets at record highs, yet still balancing on a jobs market tightrope. Liquidity is the net below, but every step is taken with the knowledge that the wire runs over a valuation canyon. Traders will keep walking as long as the crowd cheers and the music plays, but the truth remains: this is a rally fed less by fundamentals than by the refusal of risk to combust.

The dip, once again, has refused to burn, so no one is singing the September Blues just yet.

Gold: Overbought, Overvalued, Overcrowded—Yet Unstoppable

Every seasoned trader knows the drill: when an asset is described as overbought, overvalued, and overcrowded, that’s usually the cue for a pullback. Yet gold, the oldest asset in humanity’s financial arsenal, continues to defy that script. Even the “quanty” French bank with its neat fair-value models is flashing warning lights, showing bullion stretched well beyond what its spreadsheets can justify. But models don’t clear trades; flows do. And here we are, knocking on the $3,700 door as if valuation gravity has been permanently switched off.

This is not the froth of hot money chasing a fad. Something deeper is coursing through the market—structural, agnostic, almost primal. Rate cuts may be the convenient narrative, but that only really sticks when the dollar weakens. Into week’s end, the dollar has held firm. So why does gold refuse to bend? Because the bid is not tactical. It’s structural.

Think of the market as a crowded theater where everyone is waiting for the exit sign to flicker. Political uncertainty, tariff shadows, geopolitical fractures—traders sprint to gold not because it promises yield, but because it promises refuge. But this time, it’s not just traders. It’s the world’s central banks quietly shifting their ballast.

Since 2022, emerging-market central banks have been buying gold like sailors stocking fresh water before a long voyage. Russia’s frozen reserves were the wake-up call—paper claims can be seized, but no one can “freeze” a bar of bullion in your vault. Their purchases have increased fivefold since then. That’s not a tactical hedge; that’s a strategic regime shift.

The imbalance is glaring. Developed markets like the U.S., Germany, and France sit on vaults where 70% of reserves are already gold. But China? Less than 10%. Across emerging markets, the average sits closer to 5–15%. The global medium-term target looks more like 20%. Do the math on that rebalancing, and you begin to understand why every dip gets swallowed.

Layer on ETFs, and the equation only tightens. Central banks are competing for the same physical bars as retail and institutional flows. Normally, ETF inflows wax and wane with interest-rate cycles. But when recession fears flare, they overshoot. But even with recession odds dialled way back, the structural bid from sovereign hands keeps ETFs chasing, like two rivers feeding into the same reservoir.

What does this all mean? The forecasts talk $3,800 by end-2025, maybe higher if a downturn materializes. But the number isn’t the story. The story is the change in DNA. Gold is no longer just the speculative sidecar on Fed policy or the hedge against dollar weakness. It has morphed into a geopolitical reserve asset for a multipolar world.

Overbought, overvalued, overcrowded? Sure. But in this tape, those words have lost their bite. Gold is no longer just a trade—it’s becoming the reserve insurance policy of nations. And that’s a bid you don’t fade lightly.

Nothing ever climbs in a straight line—not markets, not fortunes, not even gold. Every chart, no matter how bullish, carries its own jagged edges. The line rises, it hesitates, it stumbles, it retraces. That’s not failure, it’s rhythm. Even the strongest bull has to stop for breath.

Gold is no exception. It has surged, dazzled, and broken through barriers that once felt like ceilings. But it won’t march unbroken forever. There will be pauses, pullbacks, corrections dressed up as reversals. That’s the market’s way of shaking the tree to see who holds on.

The real lesson? Don’t mistake the stumble for the end of the dance. Traders who panic at the first retrace are the ones who get shaken out right before the music resumes. The dip is never just a fall; it’s often an invitation.

So when the next pullback comes—and it will—remember what to do. This market doesn’t reward the ones who chase after the last headline. It rewards those who know the script, who can keep their nerve when the tape flickers red.

Because in the end, opportunity doesn’t knock politely. It disguises itself as doubt, as weakness, as a chart pulling back just when everyone thought it was invincible. That’s the moment to lean forward, not back.

Gold will breathe, it will slip, it will retrace. But for those who know the playbook, every stumble is just the market whispering: you’ll get another chance—be ready to buy the dip. ( Me September 2023)

Forex Market and Its Political Kabuki

The FX stage this week has been lit not by economic fundamentals alone, but by the flickering lanterns of political theatre. Think Kabuki: elaborate costumes, stylized gestures, an audience that knows the script yet still waits for the subtle twist. The dollar, the yen, the euro—each character steps forward, bows, and reveals its mask.

The greenback found an unlikely understudy in the latest jobs data. A sharp dip in jobless claims gave the dollar a rare gust of support, a breeze strong enough to push back against oversold conditions, especially in EUR/USD. The euro, already tripping over its own shoelaces thanks to soft continental numbers, stumbled further.

But this dollar reprieve feels more like a temporary encore than a headlining act. The script still points toward the Fed easing path, but short dollar bets will certainly start fretting about the embedded weak job market narrative if weekly claims continue to hold up into next month’s NFP report.

But the real end-of-week performance came from Tokyo. I misjudged the Bank of Japan, which taught me the hard lesson of trading during political theatre: I booked a golf round when I should have been glued to the tape. A rate hold was the base case, but the dissenting votes blindsided those who had not pencilled in October for the first hike. Two board members stood up and effectively shouted “Raise!”—a rare scene on a BoJ stage that has long played the same easy-money script. Suddenly, the market sees hawkish actors emerging from the wings. The message is unmistakable: inflation has danced long enough above target that even the traditionally dovish chorus can’t ignore the music.

USD/JPY now feels less like a one-way train to 150 amid the Takaichi-san political Kabuki. The BoJ’s dissenters, coupled with firm wage growth and sticky core inflation north of 3%, provide ballast. Governor Ueda, of course, plays the balancing act—confident in growth, cautious on tariffs, data-dependent in tone. His mask is calm, but the subtext is shifting. With the Fed expected to cut again, the BoJ finally has cover to march toward policy normalization, perhaps as soon as October. Even after a 25bp lift, the rate remains far below neutral. Conditions will still be accommodative—just less absurdly so.

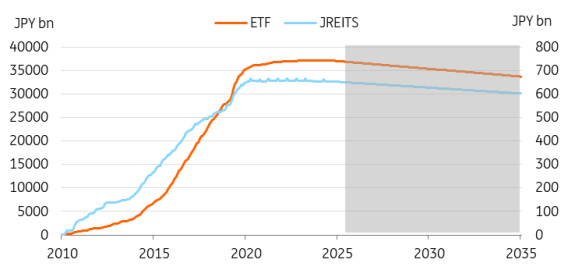

Then came the side act: ETF and J-REIT sales. The announcement didn’t ignite fireworks—0.05% of trading value is hardly a flood—but it was sooner than most had scripted. Think of it as a kabuki interlude: a symbolic gesture, slow and deliberate, telegraphing that the props of the old easing play are being dismantled. The pace is glacial, but the symbolism is strong.

Goldman: "BOJ TO SELL ABOUT 330B YEN OF ETFS PER YEAR - this pace is smaller than the ones our economists had projected: ¥600 billion per year (book value; about ¥1.1 trillion at market value)"

ETF/J-REIT sells at a snail’s pace

Overlay all this with politics, and the Kabuki metaphor becomes more than just imagery. The upcoming LDP leadership vote could twist the plot. Enter Sanae Takaichi, draped in the robes of Abeconomics, signalling fiscal largesse and opposition to rate hikes. If she claims the stage, monetary tightening could be delayed under the guise of fiscal generosity. Raise the tax-free income threshold, scrap gasoline levies, spend more—that’s her script. The BoJ, wary of a too-fast yen surge, might welcome the cover to wait. After all, the stronger the Fed cuts, the more the yen risks sprinting higher, jeopardizing Japan’s export recovery.

So, traders watch this Kabuki play unfold. The dollar holds a borrowed mask, supported by fleeting labour data. The yen dons new makeup, suddenly less docile and more hawkish in tone. The euro stumbles like a background dancer, its cues uncertain. Politics lurks backstage, ready to improvise a fresh twist in the act.

For now, the curtain hasn’t dropped. But the FX pit knows: every bow, every drumbeat, every stylized move in this Kabuki carries market consequences. The trick is recognizing which gestures are scripted theatre—and which hint at an unscripted, genuine shift in the plot.

The Curve’s Heavy Cargo

The Fed’s quarter-point trim was meant to lighten the ship, but instead the vessel feels heavier in the water. Market rates are running higher, curves are re-steepening, and if this were a bond bull market it’s hiding its horns well. The tape doesn’t lie: jobless claims and a firmer Philly Fed added ballast to the U.S. growth story, and rather than sailing lower, yields rose with the tide.

The 10-year flirted with 4.1% twice — once in the U.S. night, once when New York came back on deck. Asia and Europe tried to tug it back down, but when the U.S. data hit, the line snapped and the yield drifted higher. Still, the 4% mooring has broadly held for now, like a seawall against the waves.

Behind the scenes, capital flows tell their own story. July’s Treasury International Capital report was hardly a thunderclap but revealed the slow choreography of buyers and sellers. China and Japan offloaded a combined $51bn, Canada dumped $57bn like a trader hitting a stop, while the UK and European centers stepped in with size, alongside the UAE, Hong Kong, and Korea. Strip out China and Japan, and foreigners were still net buyers, even if the pace is a shadow of what it was when domestics were plowing in at twice the clip. Call it reluctant sponsorship — not flashy, but enough to keep the floor under Treasuries.

Yet, the pressure at the long end is becoming a global refrain. Germany loaded its funding cannon at the far maturities, skewing more than half of its incremental supply into the 15- and 30-year brackets. The UK followed suit: the BoE promised to slim its gilt book by £70bn, trimming its sails but still catching the wind with 20-year and longer maturities. Traders hoping for a reprieve at the ultra-long end didn’t find it here — issuance remains heavy, and QT is easing off the throttle but not slamming the brakes.

The problem is that steepening is no longer a simple one-way voyage. Macro dynamics in the U.S. now overlap with structural shifts in Europe. Dutch pension funds eye hedges into their transition, inflation indexation is generating fresh demand for receivers, and yet the street is already crowded with steepeners — too many traders piled into the same lifeboat. That means when the current reverses, the scramble to the other side could amplify volatility rather than dampen it.

This is the kind of market where you can’t just chart the path with yesterday’s compass. Long-end supply is still pressing, central banks aren’t offering the lifeline some had hoped for, and politics keeps tossing chop across the seas. Steepening pressure is real, but the trade is crowded — and crowded trades have a habit of flipping into whirlpools. The MOVE index hasn’t caught on yet, but if it does, the veneer of calm across asset classes could snap in an instant. Traders know how quickly still water can turn into a rip tide. Got Gold??

Chart of the Week

This Stock Rally Is Different

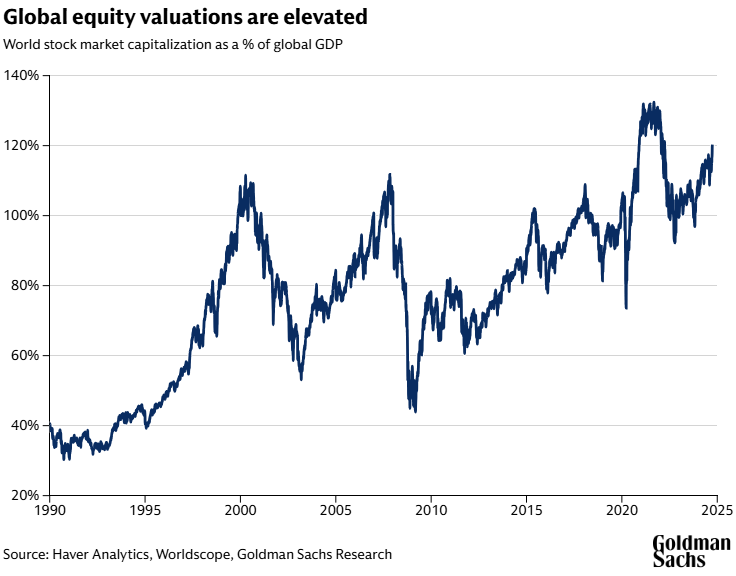

The market’s melody has changed. For the better part of a decade, investors could hum the same refrain: buy the leaders, let the tech megacaps pull the index higher, and ride benchmark beta like it was a risk-free rail. But Peter Oppenheimer at Goldman Sachs warns that tune won’t carry the next movement. This rally is different, and the backdrop is far less forgiving.

Valuations aren’t cheap, interest rates are still pinching, inflation remains sticky in places, and the tailwind of global trade expansion has slowed to a crawl.

Governments, meanwhile, are staring at ballooning spending obligations. Put those pieces together and the odds of another easy, broad-based structural bull market dim. Index returns will likely be more modest, and the story shifts from passive lift to active grind.

That doesn’t mean opportunity has vanished—it just means the compass points have multiplied. Oppenheimer frames it simply: the future belongs to diversification. Not just outside of the “Magnificent” cohort of US tech giants, but across sectors, styles, and geographies. Think specialization and dominance in niche export markets. Think services trade rather than goods. Think localization as fiscal policy tilts inward, and as tariffs and restrictions reshape supply chains. In Europe, that could mean strategic industries finding new pricing power. In the US, it could mean domestically focused champions with moats that deepen as capital redeploys at home.

The Fed has, perhaps unintentionally, sweetened the mix. By cutting rates into what still looks like a cyclical upswing, Powell and company have handed bulls a favorable wind. Tony Pasquariello of Goldman Sachs calls the setup “affirmation of the theme and the trend.” The history book is clear: when central banks ease without recession at the door, equity markets usually drift higher, sometimes sharply. Add stimulus atop expansion, and past cycles suggest the ball tends to bounce the bulls’ way.

So the chart of the week isn’t just a snapshot of index levels—it’s a reminder that the structure of this rally demands a new playbook. The age of narrow concentration may be over; the age of selective stock-picking may finally be back in session.

Running Update

Overall, it was a really good week, but you know the Saturday long run is going to be a grind when the heart rate spikes higher than normal by the 3K mark, no warning, no reason, just the body telling you it’s not going to be a free ride today. Coming off that hamstring pull hasn’t helped either—three weeks of halved mileage has left the tank thinner than I’d like, and pushing past 10K too aggressively now is just asking to tear the scab off again.

Today’s stumble was on me—I went out too fast, not respecting where I’m at in this training cycle. With only two weeks until Sam Ao run on October 5, the smart play is to reframe this one: a training run, not a race-day statement. That course, weaving through three bays, is too scenic to waste on gritted teeth and limping strides.

So the plan is simple: soak up the miles, enjoy the view, and treat the run as a long tempo run with friends. If the pace is there on the day, I’ll let it rip and kick it into gear. If not, I’ll still cross the line knowing I ran smart, not stubborn.

More By This Author:

The Propulsion Cut: From Intel Lifelines To Small-Cap Resurrection

The Fed’s Insurance Cut: A Soft Landing With Job-Risk Crosswinds

Asia Open: Dollar Holds The Line As Central Banks Crowd The Stage