The Week Ahead: Tesla’s Robotaxi Reveal & Fed Rate Decision In Focus

↵

Image Source: Pexels

Financial markets prepare for a consequential week as the Federal Reserve delivers its latest monetary policy decision and Tesla approaches a potential breakthrough in autonomous driving technology. Economic data releases and ongoing geopolitical tensions add further complexity to the trading environment.

The Federal Reserve wraps up its two-day policy meeting Wednesday with widespread expectations for unchanged interest rates. Market participants anticipate the central bank will maintain its current target range of 4.25% to 4.5%.

(Click on image to enlarge)

Attention centers on the updated Summary of Economic Projections and accompanying dot plot showing official rate forecasts. Federal Reserve Chair Jerome Powell’s post-meeting press conference at 2:30 p.m. ET will provide crucial guidance on policy direction.

Central Bank Faces Growing Rate Cut Pressure

Recent economic indicators present a mixed picture for policymakers. May inflation data showed prices rising 2.4% year-over-year, continuing a downward trend from earlier peaks.

This cooling inflation backdrop has intensified calls for monetary easing. Market pricing currently reflects expectations for two rate reductions during 2025, aligning with the Fed’s previous projections.

President Trump has publicly advocated for a full percentage point rate cut. Fed officials remain focused on monitoring price pressures potentially linked to trade policy changes before adjusting their stance.

𝗝𝗨𝗦𝗧 𝗜𝗡: 🇺🇸 President Trump calls for the Fed to cut interest rates by one full point. pic.twitter.com/gw6Vm8udF4

— Lark Davis (@TheCryptoLark) June 11, 2025

Consumer spending data arrives Tuesday with the May retail sales report. Economists forecast a 0.6% monthly decline in overall sales, though core measures excluding volatile categories may show continued growth.

Retail sales minus autos and gasoline are projected to increase 0.4% for the month. The control group calculation used in GDP estimates could rise 0.5%, suggesting underlying consumer resilience.

Tesla Advances Robotaxi Technology Timeline

Tesla CEO Elon Musk indicated the company might launch its robotaxi service in Austin, Texas, beginning Sunday, June 22. The executive emphasized safety considerations could alter the timeline.

BREAKING:

— Dalton Brewer (@daltybrewer) June 10, 2025

THE FIRST EVER TESLA ROBOTAXI WITH NO ONE IN THE DRIVER SEAT WAS JUST SPOTTED IN AUSTIN

Robotaxi is printed on the side of the car 😎$TSLApic.twitter.com/TK39Tojhzq

This potential deployment marks a critical juncture for Tesla’s autonomous vehicle ambitions. The company has positioned self-driving technology as central to its long-term business strategy beyond traditional vehicle manufacturing.

Investment analysts view Tesla as well-positioned in the autonomous vehicle race. The company’s data collection capabilities and manufacturing scale provide competitive advantages in developing and deploying the technology.

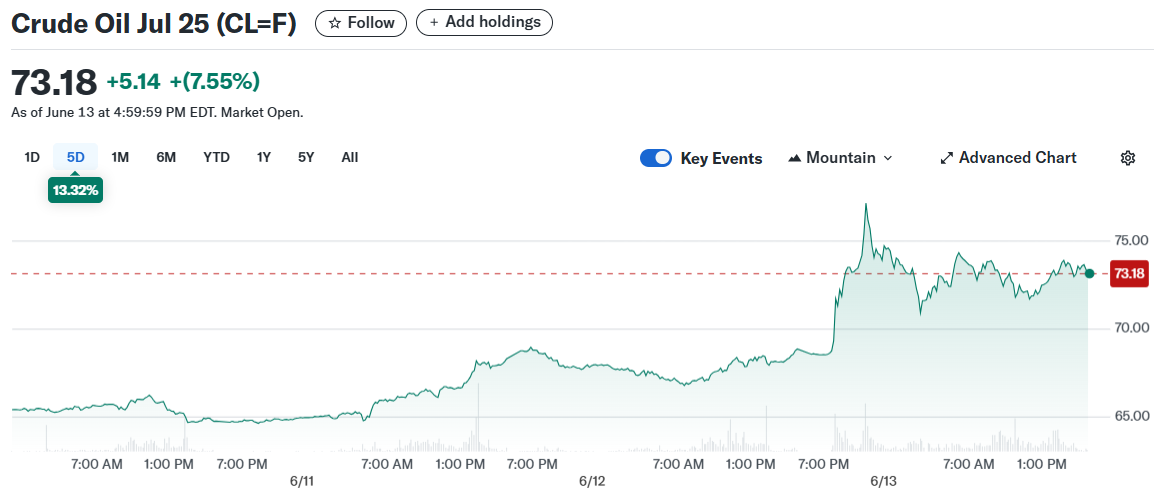

Energy markets remain volatile following escalating Middle East tensions. Brent crude oil futures approached $74 per barrel while West Texas Intermediate crude reached nearly $73.

(Click on image to enlarge)

Commodity strategists warn that further conflict escalation could drive oil prices toward $120 per barrel. Such increases would likely pressure consumer price inflation back toward problematic levels.

Market strategists suggest equity investors may maintain optimism if energy price spikes prove temporary. Sustained oil price increases could complicate Federal Reserve policy calculations and economic growth prospects.

Housing market indicators receive attention amid ongoing affordability challenges. The National Association of Home Builders confidence index arrives Tuesday, followed by construction permits and housing starts data Wednesday.

Construction activity remains constrained by high borrowing costs and material expenses. New data will reveal whether builders are responding to persistent housing supply shortages.

Financial markets observe the Juneteenth federal holiday Thursday with trading suspended. Corporate earnings reports remain sparse but include several companies facing operational headwinds.

Source: Earnings Whispers

Homebuilder Lennar reports Monday following previous warnings about market conditions. Technology services firm Accenture and automotive retailer CarMax announce results Friday after recent profit disappointments.

The confluence of monetary policy decisions, technological developments, and geopolitical events creates an unusually complex trading environment. Investors must navigate multiple competing factors while assessing their portfolio implications.

More By This Author:

Bitcoin Treasuries Boom: 60 Firms Make Bold Moves In Just 5 Days

BlackRock Inc. Targets $35 Billion Revenue Amid Strong Private Markets Push

Tesla Inc. Stock: Rises On Eased U.S. Rules For Self-Driving Cybercabs