The Week Ahead – All Eyes On The Fed

(UKOIL) Brent crude takes a breather after bull run

(Click on image to enlarge)

(UKOIL) Brent crude remains elevated amid concerns of tight global crude supplies. The increased hope of a resolution surrounding Greenland would reduce trade tensions between America and Europe, supporting oil demand. At the same time, however, President Trump has not ruled out potential military involvement in Iran, which could support oil prices going into the first quarter of the year. 63.00 is a critical floor, and 67.00 is the target higher.

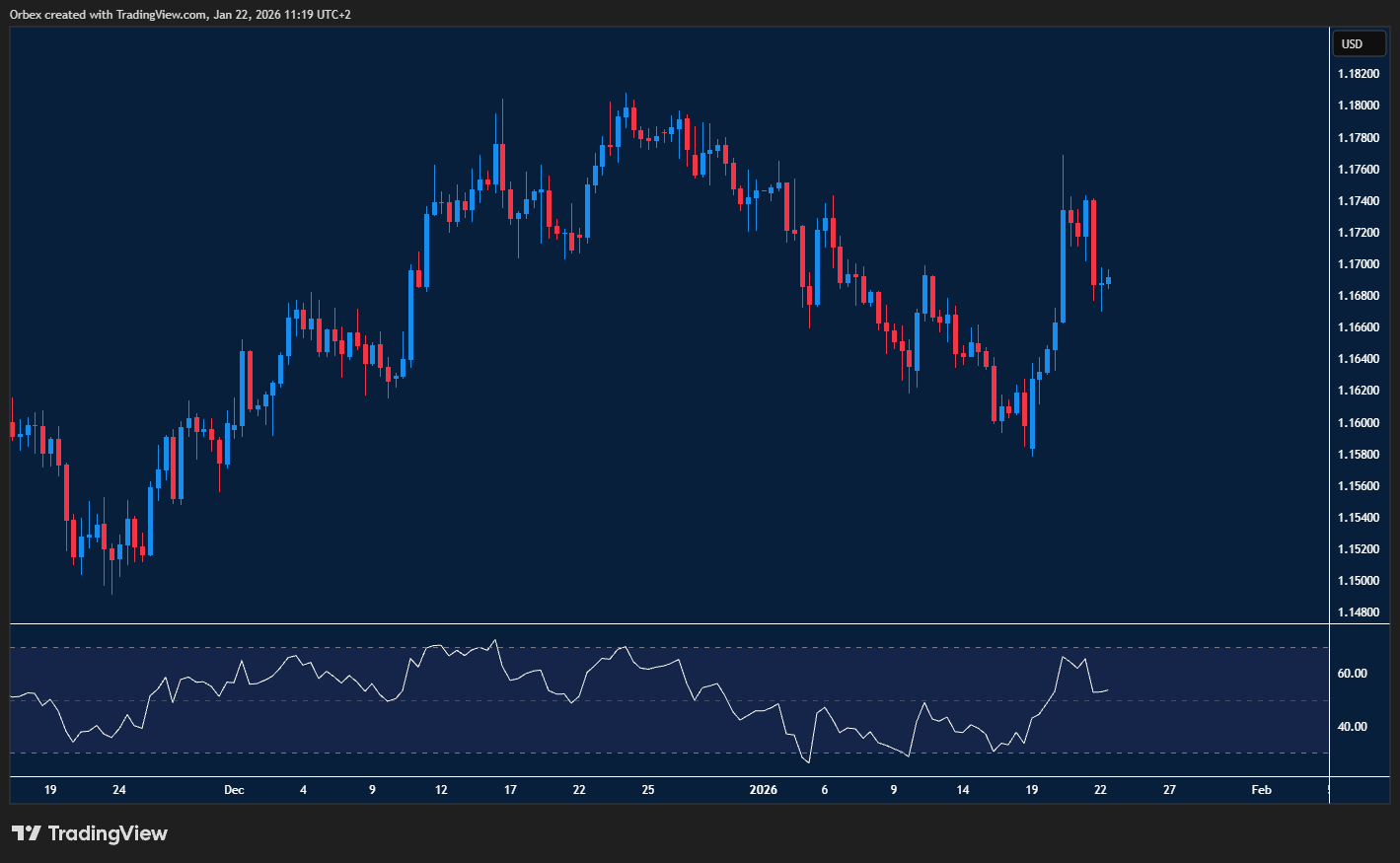

EURUSD reversing losses

(Click on image to enlarge)

It was quite a week for the pair, as Donald Trump controlled most of the market’s price action. First, the Dollar slumped amid fears of escalation over the Greenland debate. Then a deal with Nato was supposedly reached, snapping the Dollar back into life. Now it’s the turn of the Fed, with this week’s rate decision to see if any rate cuts are in line for the first quarter of the year. With inflation remaining well above the 2% target, will we see any surprises at the next meeting? 1.1750 is the next hurdle and 1.1580 a fresh support.

SPX 500 pushing for another record

(Click on image to enlarge)

Stocks returned to bullish mode after last week’s speech in Davos by Donald Trump. In addition, with the labor market looking supported, growing speculations are that the U.S. central bank would consider cutting rates more aggressively into 2026, which could give equities a solid boost. The index remains in a bullish channel, which could lead sentiment to shift prices even higher towards the next target of 7000. 6750 is the closest support if prices take a step back.

More By This Author:

When Will Gold Crack $5,000/oz?Intraday Analysis - Friday, Jan. 23

Trump’s Greenland Deal Propels The Dollar

Disclaimer: Orbex LIMITED is a fully licensed and Regulated Cyprus Investment Firm (CIF) governed and supervised by the Cyprus Securities and Exchange Commission (CySEC) (License Number ...

more