The USDX Is Still King: Don’t Jump The Gun Like Euro Bulls

The USD Index has declined in recent days, but it doesn’t mean it lost its crown. With the EUR/USD rallying hard, the USDX suffered in the process – but in reality, the ECB hasn’t really done anything to support the euro.

Wall Street woke up to excessive pessimism on Feb. 3, with the Nasdaq Composite sinking by 3.74%. Moreover, with gold and silver also declining by 0.34% and 1.46% respectively, the volatility was unkind to the PMs.

More importantly, though, the GDXJ ETF declined by 2.43% and was easily the worst performer of the bunch. Actually, when you consider what I warned about previously, the price action was far from a surprise:

Once one realizes that the GDXJ is more correlated with the general stock market than the GDX is, the GDXJ should be showing strength here. If stocks don’t decline, the GDXJ is likely to underperform by just a bit, but when (not if) stocks slide, the GDXJ is likely to plunge visibly more than the GDX.

To that point, with the GDX ETF only declining by 1.24%, it’s another example of why shorting the GDXJ ETF offers the best risk-reward ratio. Moreover, while the USD Index remains under short-term pressure, a greenback comeback should add to the PMs’ troubles over the medium term.

Having said that, let's take a look at the situation from a fundamental point of view.

Hear What They Want to Hear: Part 2

With another ECB monetary policy meeting resulting in another bullish reaction from the EUR/USD, investors followed the same misguided script that I outlined on Oct. 29. To explain, I wrote:

With the EUR/USD rallying sharply on Oct. 28, the ECB must have accelerated the hawkish rhetoric, right? Well, in reality, the ECB maintained its dovish stance and the fundamental outlook for the EUR/USD remains unchanged.

However, because investors ‘hear what they want to hear,’ and speculators do what speculators do, the EUR/USD rallied on the news. I mean, why not speculate on a euro that’s been one of the worst-performing developed market currencies versus the U.S. dollar YTD? Couldn’t it catch fire and revert to the mean?

Well, with the same merry-go-round spinning for months, I warned on May 4 that euro celebrations often end in disappointment. I wrote:

With the EUR/USD rising on hope and falling on reality, history has shown that the latter is likely to reign supreme over the medium term.

To that point, with the medium-term extremely unkind to the EUR/USD, short-term bursts of optimism faded when reality re-emerged. As a result, is this time really different?

To explain, the green line above tracks the EUR/USD. If you analyze the misguided optimism present on May 4 and Oct. 28, you can see that we’ve been down this road before. Moreover, with the EUR/USD rallying six times following the last eight ECB monetary policy meetings, the price action is par for the course. However, the short-term surges haven’t stopped the EUR/USD from making lower lows in the following months.

To that point, what happened that got euro bulls so fired up? Well, as we witnessed throughout 2021, nothing. In reality, the ECB maintained its dovish stance, and monetary policy was left unchanged. The committee’s statement read:

“Monthly net purchases under the APP will amount to €40 billion in the second quarter of 2022 and €30 billion in the third quarter. From October onwards, the Governing Council will maintain net asset purchases under the APP at a monthly pace of €20 billion for as long as necessary to reinforce the accommodative impact of its policy rates. The Governing Council expects net purchases to end shortly before it starts raising the key ECB interest rates.”

As a result, while the Fed will end its bond-buying program and should raise interest rates at its March monetary policy meeting, the ECB still plans to continue QE from "October [2022] onwards." Thus, while currency traders attempt to time the bottom again, the fundamentals that led to a weaker euro in 2021 remain unchanged.

Moreover, during ECB President Christine Lagarde's press conference on Feb. 3, she said the following about inflation:

“Inflation increased to 5.1 percent in January, from 5.0 percent in December 2021. It is likely to remain high in the near term. Energy prices continue to be the main reason for the elevated rate of inflation. Their direct impact accounted for over half of headline inflation in January and energy costs are also pushing up prices across many sectors.”

To that point, I noted on Feb. 1 that while energy remains an issue, the majority of goods and services in the Eurozone are far from the danger zone. I wrote:

While I’ve highlighted the discrepancy on several occasions, the pricing pressures confronting Europe are mainly a function of oil & gas irregularities. Outside of that, most goods and services are within the ECB’s expected inflation range.

Think about it: why would the ECB raise interest rates when core inflation is at 2.7% YoY and wage inflation is at 2.3% YoY? In stark contrast, U.S. core inflation increased by 5.5% YoY on Jan. 12, and U.S. average hourly earnings increased by 4.7% YoY on Jan. 7. As such, while I’ve stated it on numerous occasions, the Fed and the ECB are worlds apart.

Furthermore, Eurostat – the statistical office of the European Union – released its latest inflation report on Feb. 2. And while headline inflation increased by 0.30% month-over-month (MoM), core inflation decreased by 0.5% MoM.

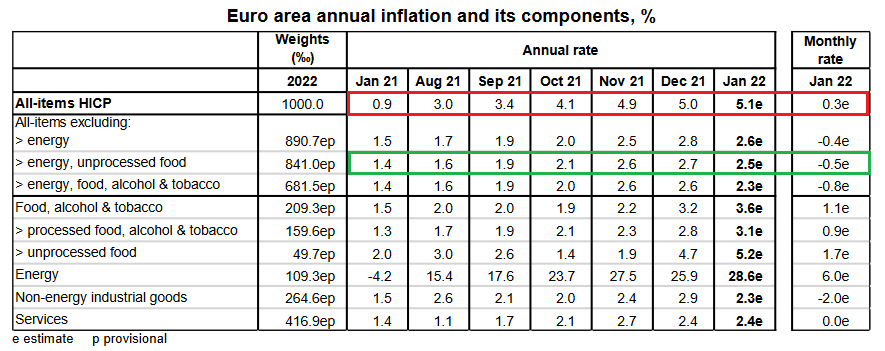

Please see below:

Source: Eurostat

To explain, follow the trajectory of the red rectangle above. As you can see, headline inflation (which includes food and energy) went from a 0.9% year-over-year (YoY) increase in January 2021 to a 5.1% YoY increase in January 2022. Pretty troublesome, huh?

However, if you focus your attention on the green rectangle, you can see that Eurozone core inflation (which excludes food and energy) declined from 2.7% YoY in December 2021 to 2.5% YoY in January 2022. As a result, while investors assume that abnormally high headline inflation will elicit a hawkish response from the ECB, the reality is that oil & gas remain the region’s only problem.

Conversely, with core inflation falling MoM and moving closer to the ECB’s 2% annual target, the data support the central bank’s dovish stance. Moreover, Lagarde made my point during her press conference.

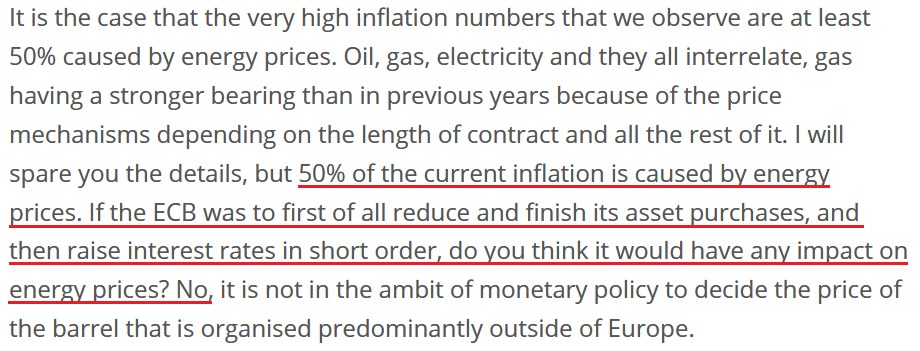

Please see below:

Source: ECB

On top of that, when asked about potential interest rate hikes, Lagarde responded:

“How do you hike interest rates? By hiking interest rates. And clearly, we will have a very sophisticated determined approach and analysis to doing that. We will only do that in the sequence that we have fixed for ourselves, and which has been agreed, which is that we will look at net asset purchases first, gradually, on a data-dependent basis. Then we will look at interest rates.”

Thus, with the ECB’s monetary policy statement reading that “from October onwards, the Governing Council will maintain net asset purchases under the APP at a monthly pace of €20 billion for as long as necessary to reinforce the accommodative impact of its policy rates,” how can the ECB raise interest rates if it still plans to purchase bonds past October 2022? Think about it: Lagarde said that “we will look at net asset purchases first.” And if ending QE is the first step in the process, then the ECB is nowhere near the second step.

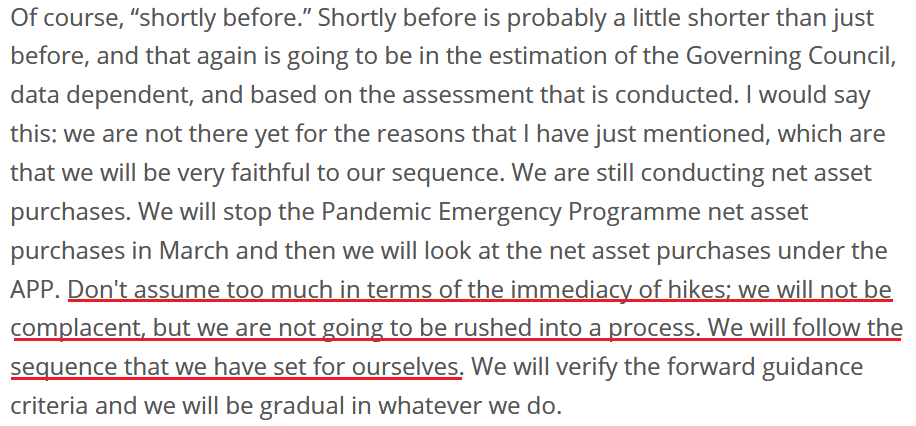

To that point, Lagarde reminded everyone:

Source: ECB

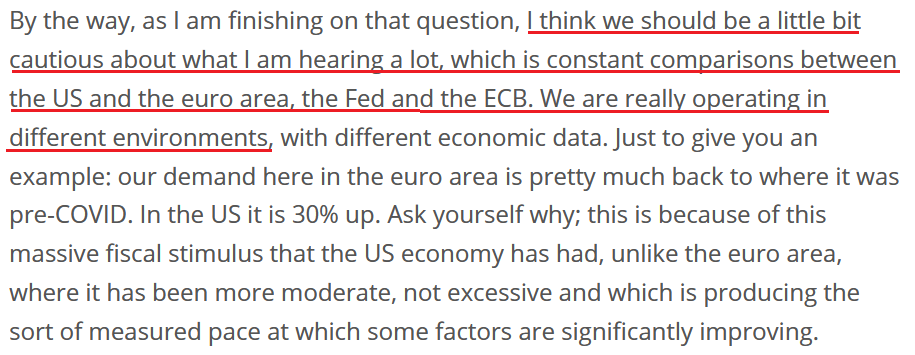

And finally:

Source: ECB

The bottom line? While it’s no surprise that investors ‘hear what they want to hear,’ the reality is that the ECB didn’t do anything hawkish on Feb. 3. And with the EUR/USD rallying hard, the USD Index suffered in the process. However, since the price action on Feb. 3 was likely another example of short-term hope an overpowering medium-term reality, the EUR/USD should resume its downtrend in the coming months. And with the Fed well ahead of the ECB, euro bulls should learn the same hard lessons they learned in 2021.

In conclusion, the PMs declined on Feb. 3, as Meta Platforms’ (Facebook’s) weak Q4 earnings print ignited another Nasdaq Composite sell-off. And with the GDXJ ETF falling hard, the junior miners continued their underperformance. Moreover, while the USD Index also declined, the dollar basket should recover those losses over the medium term. As a result, the fundamental outlook for the PMs remains profoundly bearish.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more