The Risk-On Trade Is Fading, That’s Bad News For Stocks Short-Term

The risk-on trade may be in serious jeopardy, and that may be bad for the entire market. When digging deeper into ETF trends, it seems that many that have led the market higher are now beginning to roll over.

The best performing sectors have all been risk-on in sentiment, while anything tied to global growth or risk-off has underperformed. Biotech, Technology, and Semis have all been far and away, the best performing sectors. If these sectors begin to retreat, it likely means the big market rally will turn lower too. (Premium content – How Low Can Markets Go If The Uptrends Break)

(Mott Capital – Reading The Markets Content)

Biotech

The XBI has been the winner this year, rising by 18%. They’re now two bearish signals that have been presented. First, the relative strength has flatlined since April, despite the ETF rising to record highs, a bearish divergence. Now for the first time, we are seeing the RSI sink, and that would suggest that all that bullish momentum is leaving the ETF and sector.

Additionally, the ETF has now broken a significant uptrend, a drop below $110 likely triggers a deeper move to $105 or less.

Technology

The technology ETF XLK has risen by almost 15% this year. It, too, has a bearish divergence in the RSI, which has now fallen to the lowest level in some time. Additionally, like the XBI, the XLK has broken an enormous uptrend that has been in place since mid-April. Based on the current set up, it appears the ETF could fall to around $99.

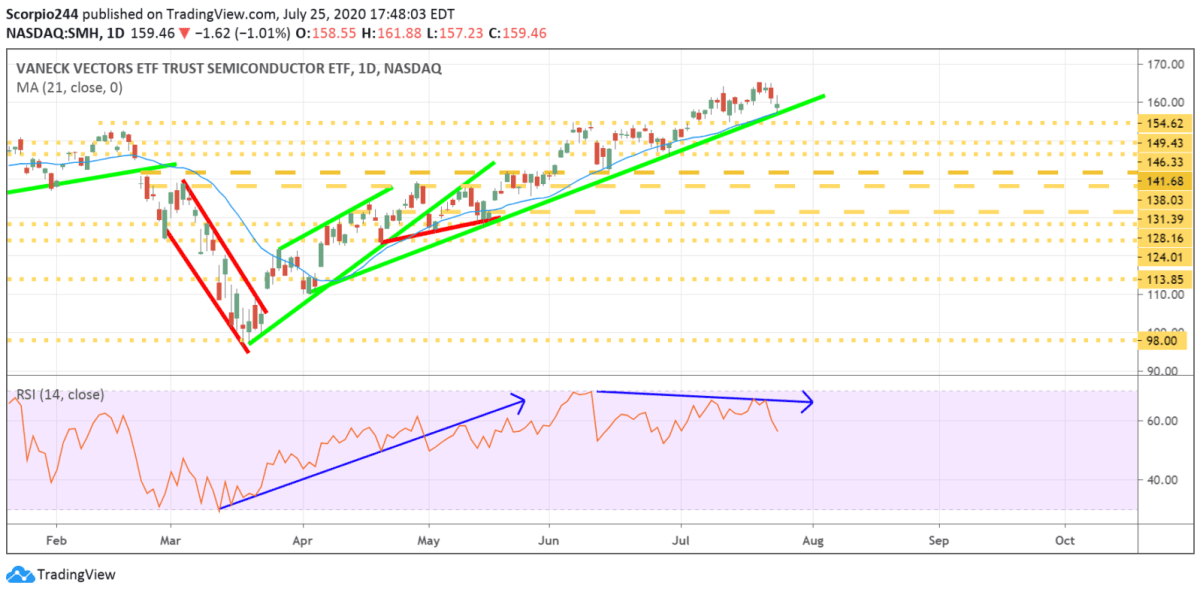

Semis

The SMH ETF is also flashing the same bearish divergence on the RSI, but it is yet to break the uptrend.It has the potential to drop to around $149

Copper

Meanwhile, copper prices have been weakening and showing many of the same characteristics as the sector listed above, with a chance for the metal to fall to around $2.65.

10-Year Yields

We have seen a big move lower in yields, with the 10-Year testing support around 55 bps. A break below that support sends yields to around 35 bps.

Finally, the high yield ETF HYG could be on its way back to $80.50.

Just keep an eye on these, they will tell you the direction of the markets next move.

I had not considered risk/non-risk as the two stock categories previously, but the separation does make sense. But with always being cautioned that "past performance is no promise of future performance" I have always considered stocks to have some risk factor.

Some organizations do seem to have much more skill available for making choices, while some others seem to be rather random in their directions. Looking into organization management prior to investing, and observing past performance, do seem to be wise moves, and certainly better than running on emotions.

I think that I am making sense here. Possibly not, though.