The Problem Is Fiat

Photo by Dmitry Demidko on Unsplash

There’s a growing global dissatisfaction with all government fiat and bank analysts are racing to announce fresh $5000 targets for gold.

How high can the metals go? What about the miners that have become cash cows… can they keep rising even if the metals pause?

These are key questions, and to help answer them, please see below.

(Click on image to enlarge)

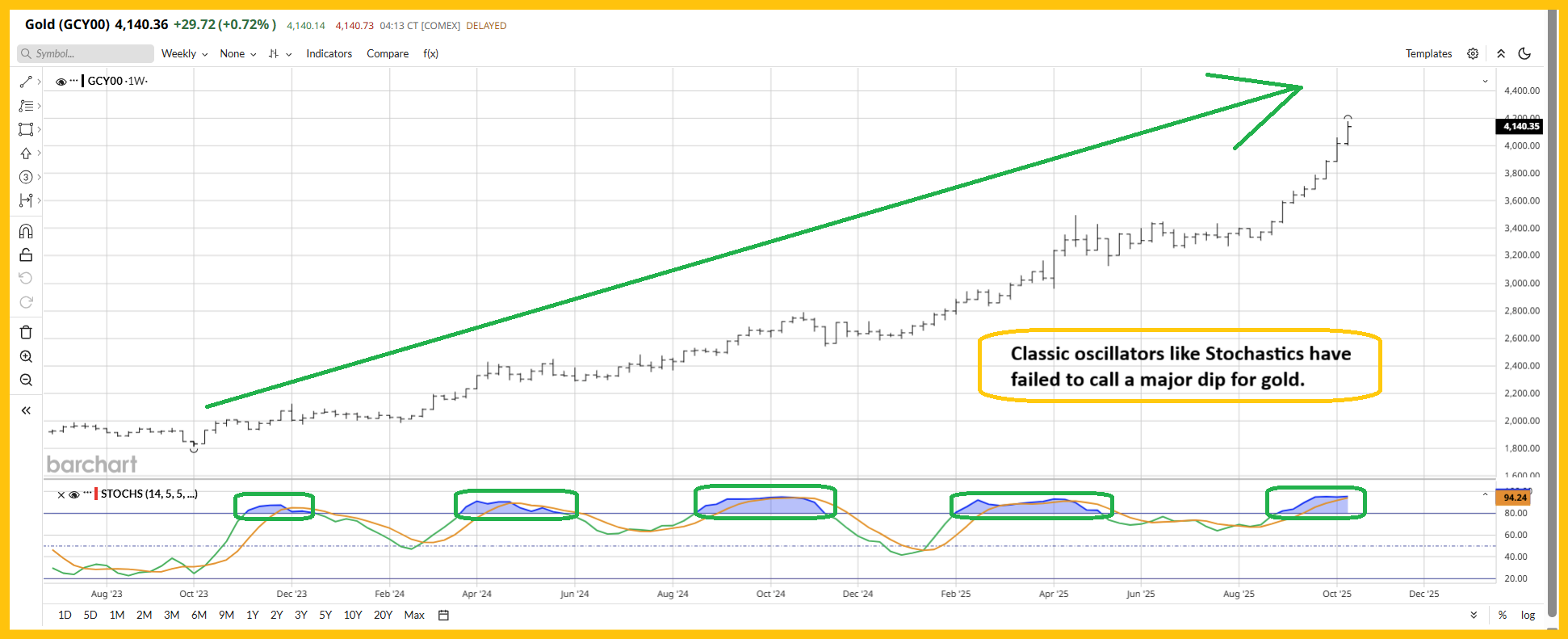

Since arriving at my buy zone of $1810 in October 2023, gold has moved relentlessly higher.Classic oscillators like RSI and Stochastics have become overbought many times… while defiant gold continues to surge.

Incredibly, some of the tiny price dips ended when oscillator rollovers suggested a big tumble was just beginning!

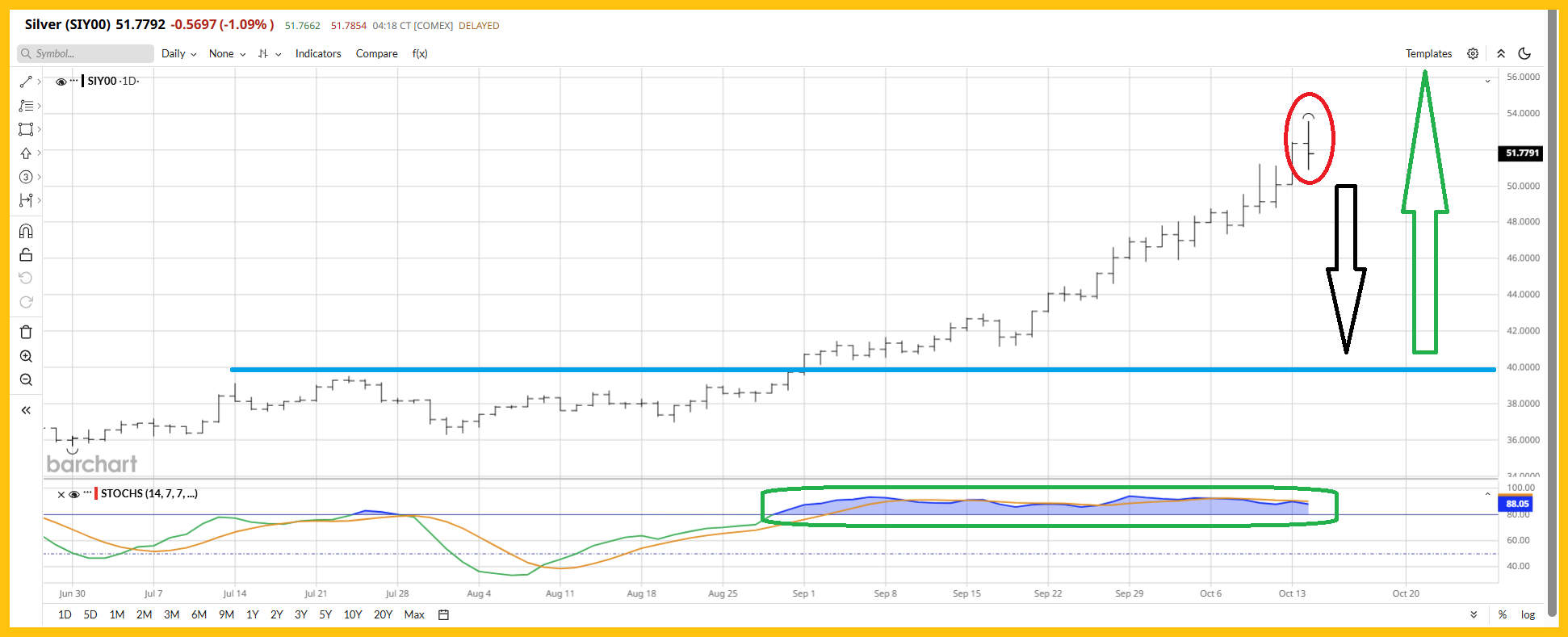

Silver? Well, most analysts thought silver would pause at $50 and instead it has burst through that zone like a rocket enroute to the moon.

(Click on image to enlarge)

Unfortunately, while a moonshot to $100 likely does lie ahead, the price has hit my $54 target this morning, and a significant dip could start very soon.

Amateur investors like to sell at fiat price tops, while professionals like to sell into strength that they anticipate will continue.

If an investor only sells to call a top, what they are doing is trying to get out of the market… barely alive.If the market falls hard before they sell, they can get badly hurt.

I’ve labelled $4000 gold and $50 silver a zone to sell swing positions, but not those that are core.Both metals are showing increased volatility, and whether they make a short-term peak here or continue higher really doesn’t matter because profit booking is about getting richer, not about calling tops.

How much should be sold? That depends on the individual investor.I like the idea of selling “up to 30%” of positions, with the exact number left to the individual.

What to sell?Well, I don’t have much interest in selling gold at any price because of its superiority to fiat as money.As an example of that superiority, gold shot higher on Friday when the stock market crashed and new prospective tariffs on China were announced.It then moved strongly higher when the stock market soared when the government promised “everything will be fine”.

The mightiness of this monetary metal is clear.

Silver could regain the respect as money that it had in the past if central banks begin purchasing it like gold… but it doesn’t have that respect yet, so selling some here could be viewed as wise.

The miners?Well, they are hot and set to get a lot hotter!If a miner can produce gold incredibly profitably at $3500, $3000, and $2500, should investors care if there’s a dip in the gold price from $4500 to $4000?Of course not.

The loss of money manager confidence in all government fiat is a monumental event. It’s not going to end simply because there’s a healthy price correction in the gold market.

(Click on image to enlarge)

“flagship” CDNX weekly chart

The massive base pattern suggests that regardless of whether there’s a pause in the gold and silver upside action or not, the miners (both juniors and seniors) have years and perhaps decades of great performance ahead.

(Click on image to enlarge)

exciting GDXJ chart

A lot of the component stocks are intermediate producers.In the long term, the price of this magnificent ETF could reach $1000.

I previously suggested investors could sell up to 30% of their holdings into the key round number $100, and that recommendation stands.

Note how GDXJ has pushed through that $100 zone without correcting significantly.Profit bookers should be happy to see this kind of action; they are calmly selling into strength simply to get richer, rather than trying to sell at an exact top to avoid a frightening crash.

(Click on image to enlarge)

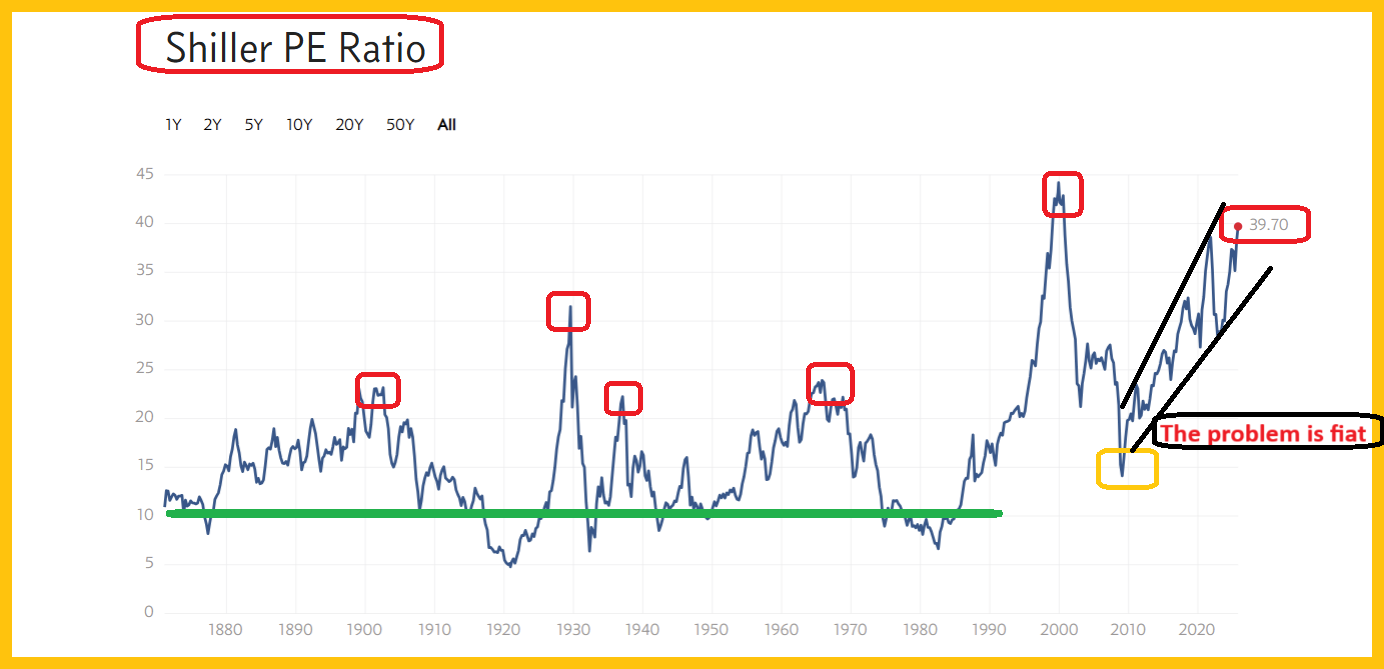

ominous CAPE/Shiller chart

The US stock market has been overvalued many times in the past, but the difference between those past events and the current one is the starting point.Horrifically, fiat printing has allowed the market to “reset” from a state of overvaluation rather than one of significant undervaluation.

That makes stocks vulnerable to both a crash like occurred in 1929 and to the kind of stagflationary gulag that followed the 1966 peak.

(Click on image to enlarge)

There have been many great buying opportunities since 2008, and I’ve urged investors to participate in them… but each of the big price sales has bottomed with the CAPE ratio still drastically overvalued.

The problem is fiat.It’s reached the end of its useful lifespan on this planet.Every day, more money managers are coming to this righteous conclusion… and acting on it.In a nutshell, gold can function as both the government and central bank for savvy citizens who are ready to embrace it fully.

(Click on image to enlarge)

spectacular GDX chart

For another great view of the action,

(Click on image to enlarge)

On the one hand, I’ve raised my long-term GDX target from $200 to $1000.On the other hand, modest profit booking into this phenomenal strength is my recommended play.The bottom gold stocks line: He and she who sells some to get richer today… lives to buy with a smile, on a future price sale day!

More By This Author:

Gold Stocks - The Best Is Yet To ComeGold Stock Freight Trains All Aboard

White Metals: The New Performance Haven