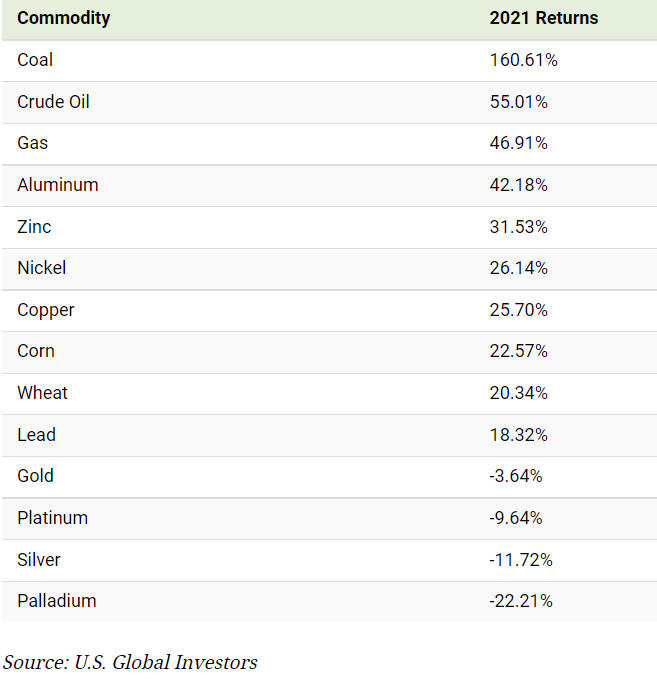

The Periodic Table Of Commodity Returns (2012-2021)

(Click on image to enlarge)

For investors, 2021 was a year in which nearly every asset class finished in the green, with commodities providing some of the best returns.

The S&P Goldman Sachs Commodity Index (GSCI) was the third best-performing asset class in 2021, returning 37.1% and beating out real estate and all major equity indices.

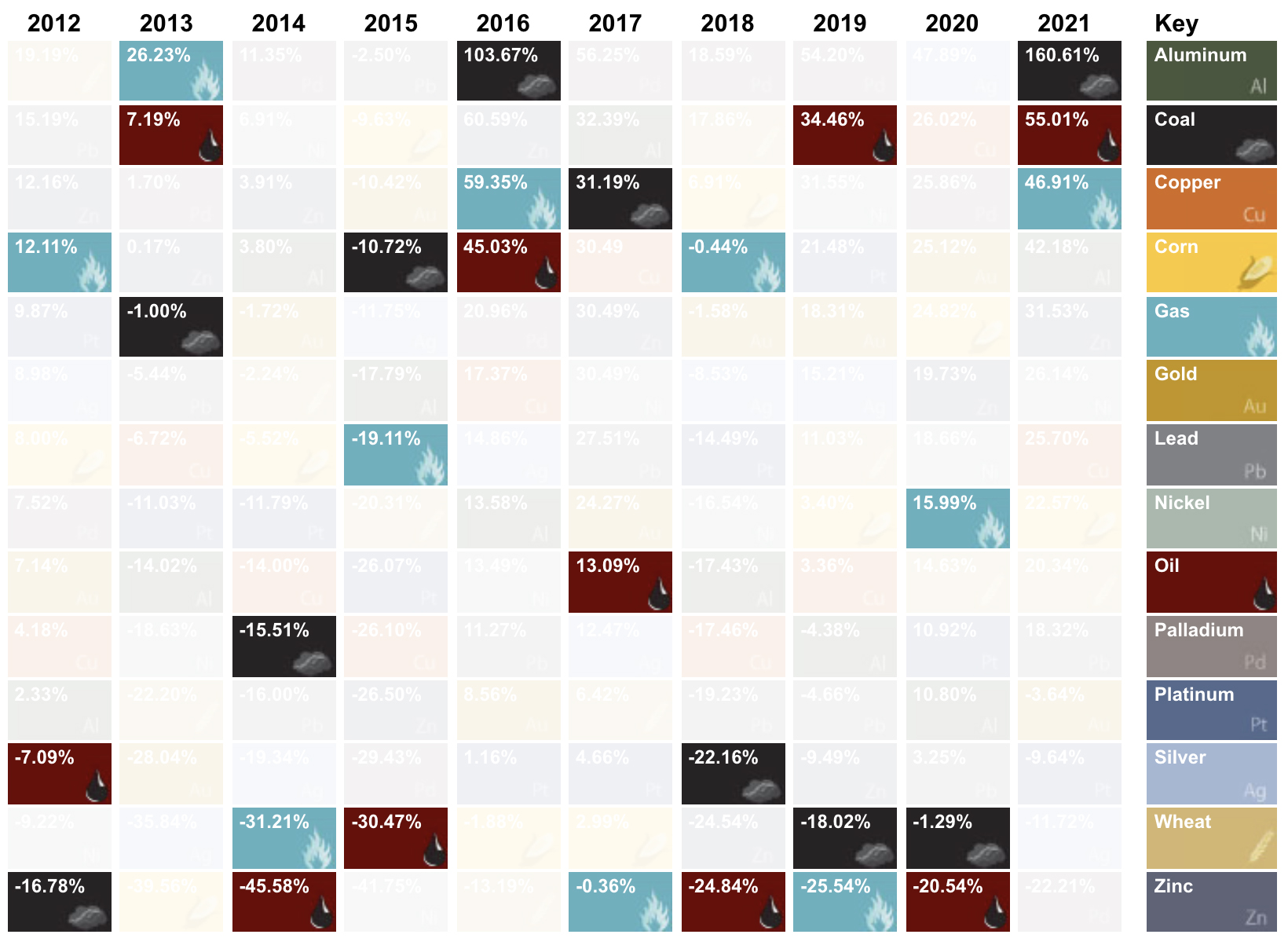

This graphic from U.S. Global Investors tracks individual commodity returns over the past decade, ranking them based on their individual performance each year.

Commodity Prices Surge in 2021

After a strong performance from commodities (metals especially) in the year prior, 2021 was all about energy commodities.

The top three performers for 2021 were energy fuels, with coal providing the single best annual return of any commodity over the past 10 years at 160.6%. According to U.S. Global Investors, coal was also the least volatile commodity of 2021, meaning investors had a smooth ride as the fossil fuel surged in price.

The only commodities in the red this year were precious metals, which failed to stay positive despite rising inflation across goods and asset prices. Gold and silver had returns of -3.6% and -11.7% respectively, with platinum returning -9.6% and palladium, the worst-performing commodity of 2021, at -22.2%.

Aside from the precious metals, every other commodity managed double-digit positive returns, with four commodities (crude oil, coal, aluminum, and wheat) having their best single-year performances of the past decade.

Energy Commodities Outperform as the World Reopens

The partial resumption of travel and the reopening of businesses in 2021 were both powerful catalysts that fueled the price rise of energy commodities.

After crude oil’s dip into negative prices in April 2020, black gold had a strong comeback in 2021 as it returned 55.01% while being the most volatile commodity of the year.

Natural gas prices also rose significantly (46.91%), with the UK and Europe’s natural gas prices rising even more as supply constraints came up against the winter demand surge.

(Click on image to enlarge)

Despite being the second-worst performer of 2020 with the clean energy transition on the horizon, coal was 2021’s best commodity.

High electricity demand saw coal return in style, especially in China which accounts for one-third of global coal consumption.

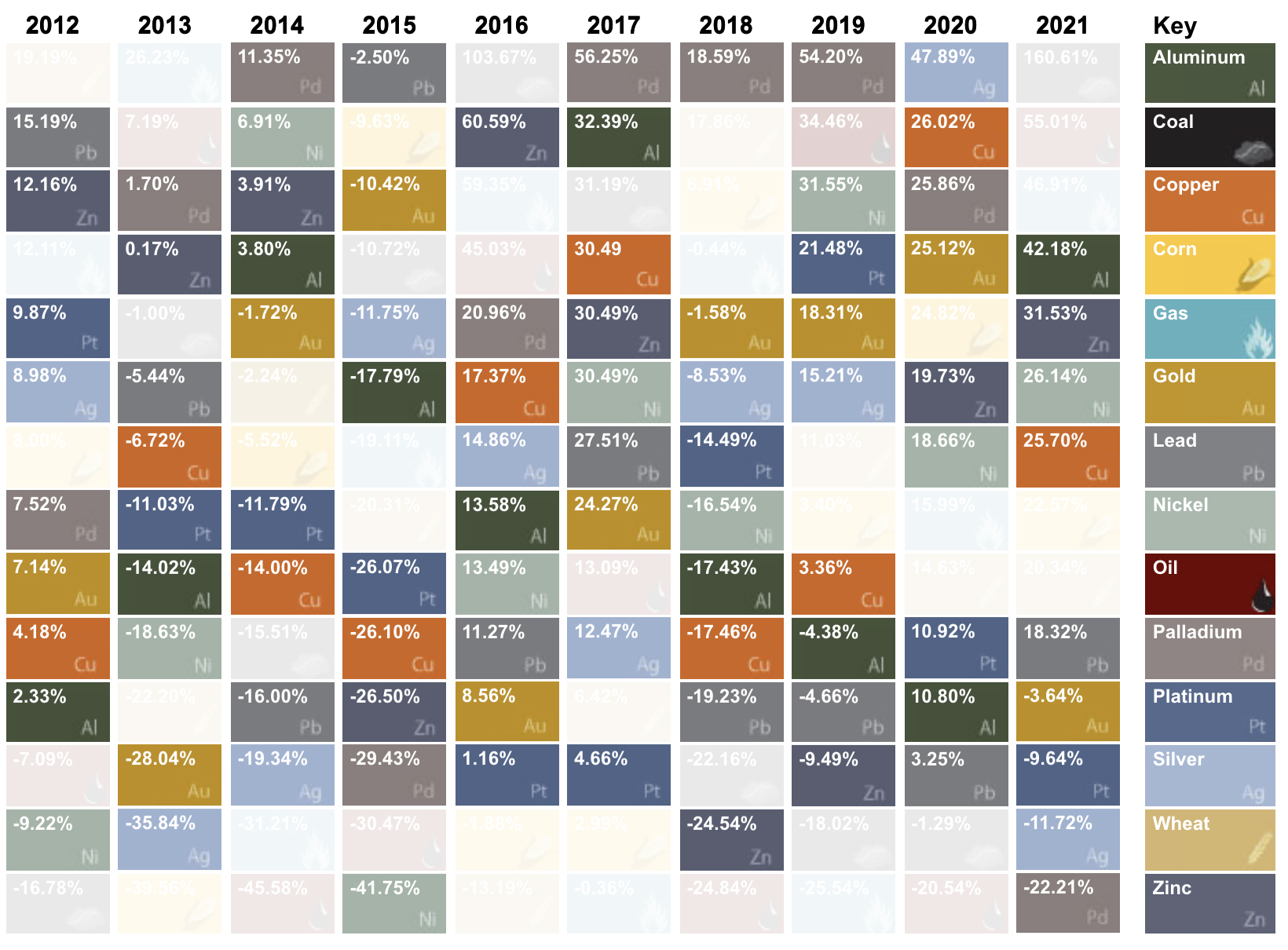

Base Metals Beat out Precious Metals

2021 was a tale of two metals, as precious metals and base metals had opposing returns.

Copper, nickel, zinc, aluminum, and lead, all essential for the clean energy transition, kept up last year’s positive returns as the EV batteries and renewable energy technologies caught investors’ attention.

Demand for these energy metals looks set to continue in 2022, with Tesla having already signed a $1.5 billion deal for 75,000 tonnes of nickel with Talon Metals.

(Click on image to enlarge)

On the other end of the spectrum, precious metals simply sunk like a rock last year.

Investors turned to equities, real estate, and even cryptocurrencies to preserve and grow their investments, rather than the traditionally favorable gold (-3.64%) and silver (-11.72%). Platinum and palladium also lagged behind other commodities, only returning -9.64% and -22.21% respectively.

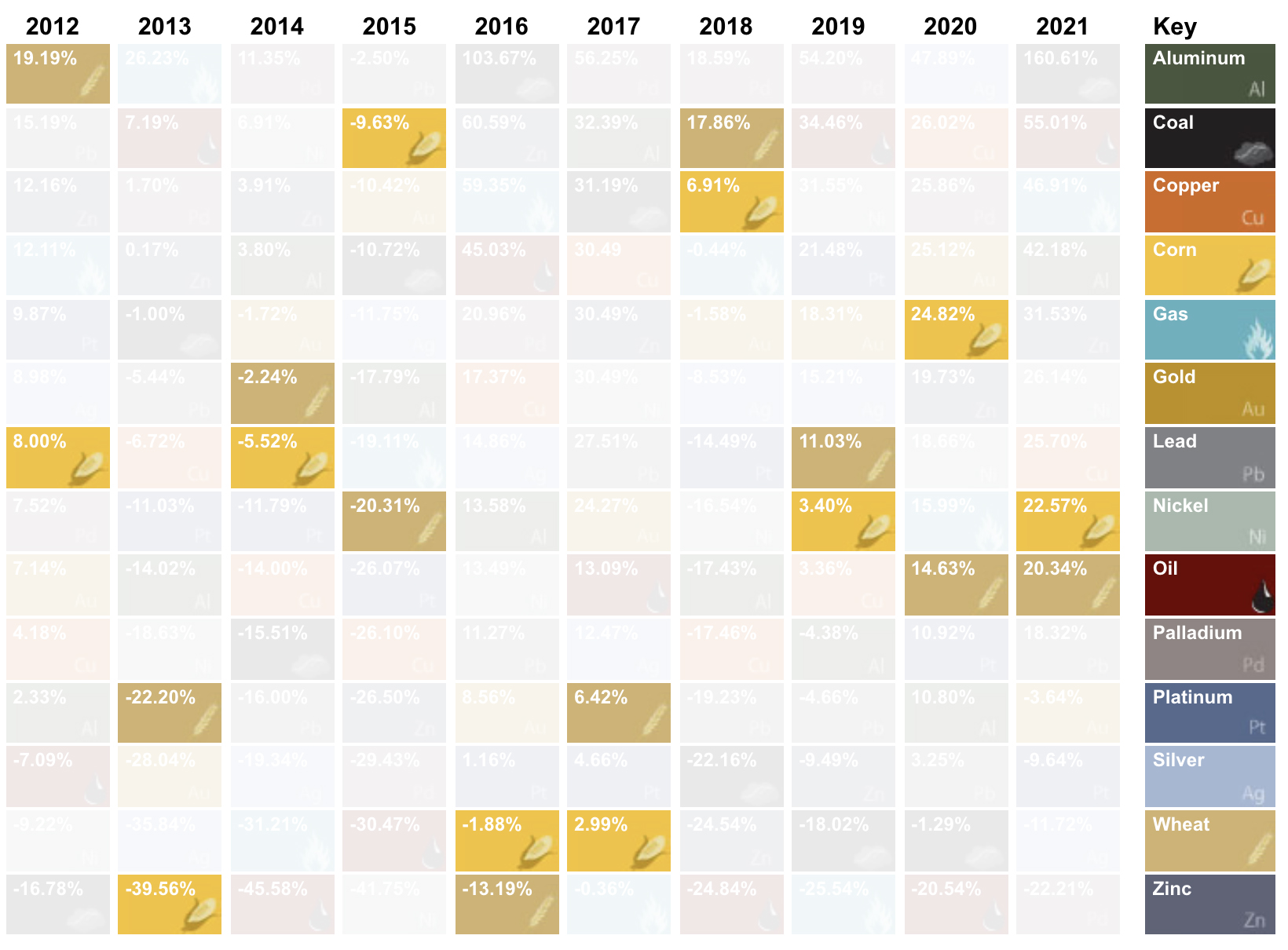

Grains Bring Steady Gains

In a year of over and underperformers, grains kept up their steady track record and notched their fifth year in a row of positive returns.

Both corn and wheat provided double-digit returns, with corn reaching eight-year highs and wheat reaching prices not seen in over nine years. Overall, these two grains followed 2021’s trend of increasing food prices, as the UN Food and Agriculture Organization’s food price index reached a 10-year high, rising by 17.8% over the course of the year.

(Click on image to enlarge)

As inflation across commodities, assets, and consumer goods surged in 2021, investors will now be keeping a sharp eye for a pullback in 2022. We’ll have to wait and see whether or not the Fed’s plans to increase rates and taper asset purchases will manage to provide price stability in commodities.

Disclosure: None.