The Perfect Environment For The Outperformance Of Commodities

Below are some of the most interesting things I came across this week.

LINK

“Together, lagged tariff pass‑through, tightening labor supply, looser fiscal policy, and accommodative financial conditions create a macro environment in which inflation rising above 4% by the end of 2026 is not only plausible but arguably the most likely scenario,” argue Peter Orszag and Adam Posen.

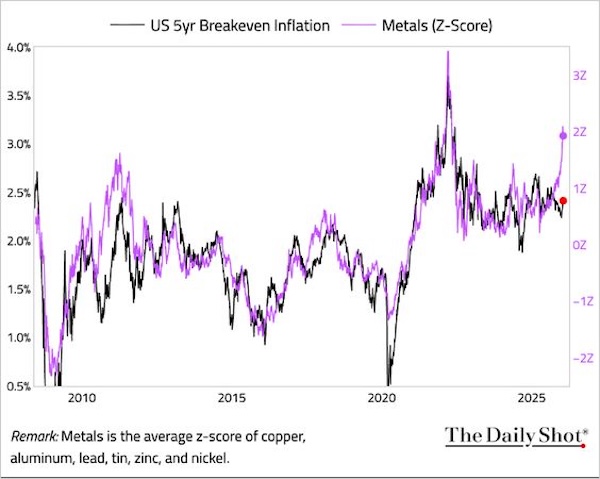

CHART

The return of inflationary pressures is something the metals markets are already warning about. “The gap between breakeven inflation and metal prices persists. Will metal prices fall, or will breakeven inflation rise?” asks The Daily Shot.

LINK

At the same time, the stock market is increasingly vulnerable to a bursting asset bubble. As Cory Doctorow writes, “AI is a bubble and it will burst. Most of the companies will fail. Most of the datacenters will be shuttered or sold for parts… As Stein’s law has it: ‘Anything that can’t go on forever eventually stops.'”

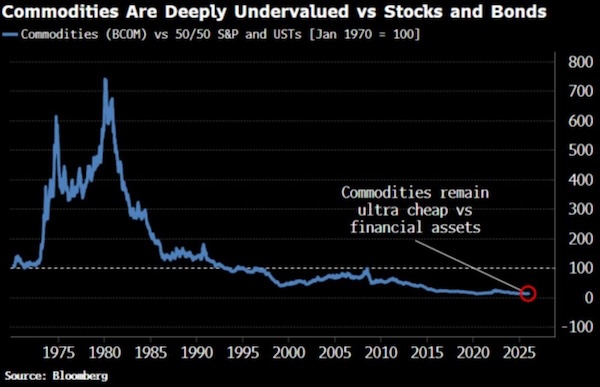

CHART

As such, “It’s the perfect environment for commodities to forge a generational outperformance over financial assets. Hard assets climb in real terms, while stocks and bonds, denominated in increasingly debauched, unbacked currencies, fall further behind,” writes Simon White.

LINK

With metals already discounting these dynamics to some degree, the real opportunity today may be in commodities that have yet to do so. “We may be living in a ‘just in case’ world but most traders still have a ‘just in time’ view on oil, and they seem to assume there is no trouble on the horizon,” writes Rana Foroohar.

More By This Author:

The Most Powerful Lesson Anyone Can Learn In This Business

Where Are The Hated Stocks?

The Secret Of Warren Buffett’s Storied Success