The PCE Report, War, & Gold

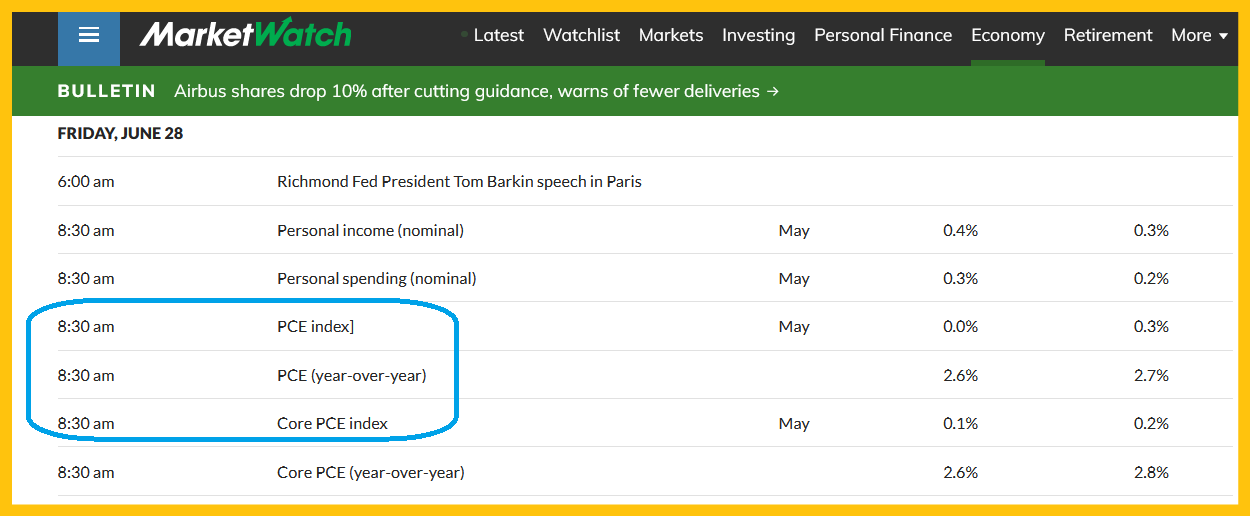

The main global economic theme right now is sticky inflation and fading growth.

(Click on image to enlarge)

The Dow has been drifting sideways since March For gold, the drift began on April 12.

Friday’s PCE inflation report could be the catalyst that pushes both gold and the Dow out of these range trades.

If the break is to the downside, gold is likely to reach the outskirts of a very tantalizing buy zone, at $2150.

If the break is to the upside, a surge to $2600 would be a near-certain event.

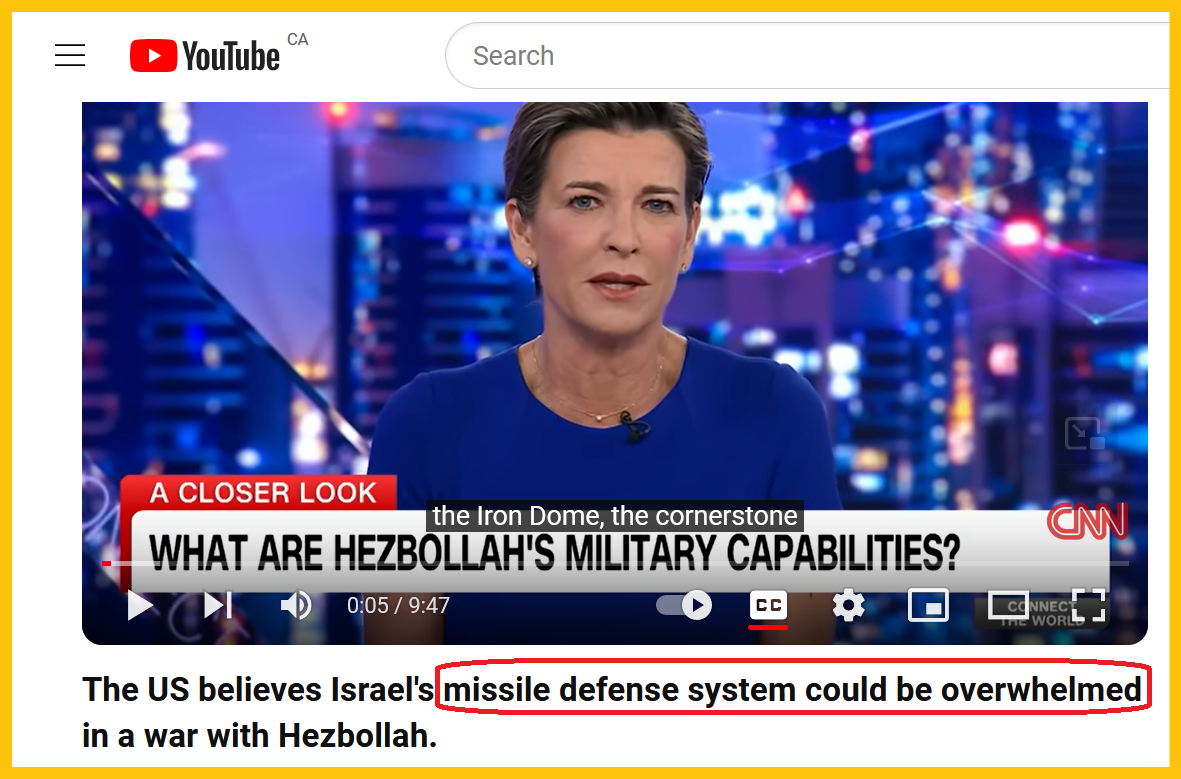

While COMEX futures traders are focused on the PCE report, every gold investor in the world could soon be maniacally focused on… Lebanon.

The Gaza war featured a mini-massacre of Israeli innocents and a modest massacre of Gazan innocents.

This horror was supportive for gold.

Importantly, Hamas didn’t have the firepower that Hezbollah has, and if Hezbollah uses it, the potential exists not only for a giant war, but one that goes out of control.

Ominously, there’s still some time left in the 2021-2025 war cycle. If there’s a big war in Lebanon, it’s possible that the synergy between the Dow and gold comes to an end.

Gold could surge higher while the Dow crashes into a late-stage bull market abyss.

(Click on image to enlarge)

On the weekly gold chart, there’s a flag-like drifting rectangle in play.

Stochastics and RSI are coming down and concerns about gold being overbought are now unnecessary.

One scenario would see a PCE report that’s negative for gold. That could send the price down to the gargantuan buy zone of $2150-$1985.

Funds would short the metal on that dip, while millions of savvy Indians and banks would buy. From there, a Hezbollah-IDF war could create the largest short-covering rally in the history of the gold market, perhaps dwarfing the recent surge from $1810 to $2448.

Gold is the ultimate currency. It’s the ultimate asset. Most investors are focused on getting more fiat, which is good, but that fiat should then be used to get more gold.

The bottom line: There’s no need to top call gold, but there is a great need to get a lot more of it!

(Click on image to enlarge)

Silver also sports a drifting flag-like pattern.

A negative-for-gold PCE report could see silver reach the massive $26 buy zone while gold trades at $2150.

If the report is neutral or positive for gold, the current $29-$30 support likely serves as a springboard for a surge to $35-$40… and Israel-Lebanon war cycle horror could see this mighty metal challenge (and exceed!) its $50 all-time highs.

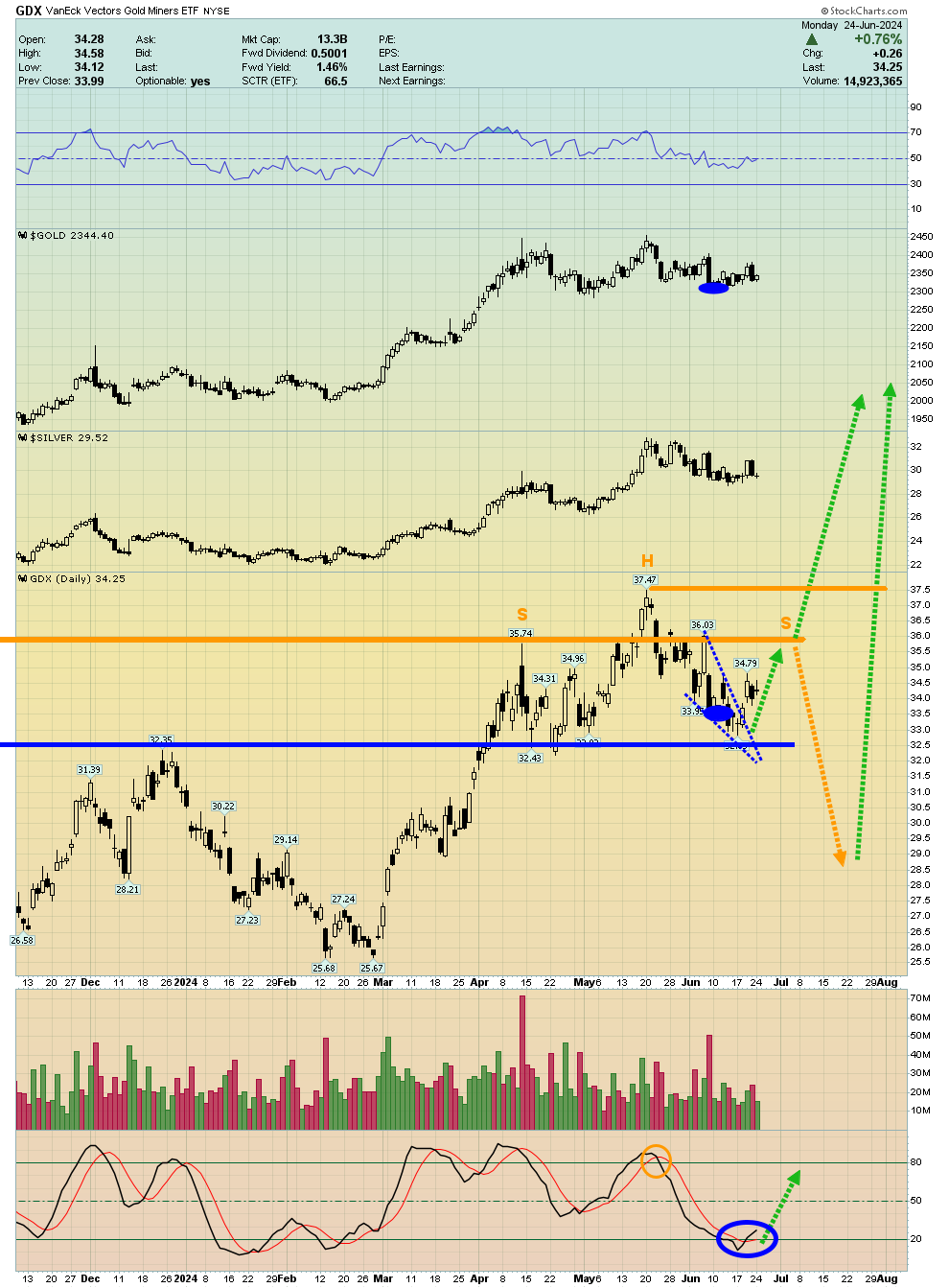

What about the miners?

(Click on image to enlarge)

exciting GDX daily chart.

There’s a bull wedge versus H&S top battle taking place, and “PCE Day” (Friday) likely reveals the victor.

On June 7, I urged investors to buy gold at $2300 and gamblers to buy gold, miners, and silver. I’m 1000% comfortable with these buys. Here’s why: It’s gold, the ultimate asset, and a war cycle crescendo could be dead ahead. A major war involving Hezbollah is likely to bring huge street protests in America… and do it just as the nation gears up for the election. The bottom line:

Tensions are hot and what matters most… is the amount of gold investors have got!

More By This Author:

Dedollarization And Deglobalization - Got Gold?Gold Tactics For CPI And FOMC Surprise

$2300-$2265 Gold The Buy Zone Of Champions