The Oil Heat Wave That Could Ice The Market

The latest tensions between Israel and Iran are casting long shadows—not only over the region, but directly onto global financial markets. The Oil market may be the focal point, but the implications extend far beyond that, as we will see.

Despite decades of sanctions, Iran remains one of the most important players in the global Oil trade. Around 80% of its exports go to China – a fact that makes any idea of turning off the Iranian Oil tap politically sensitive. After all, anyone who wants to cut off China's Oil supply is playing with fire.

But there is more at stake than exports. Iran controls access to one of the most vulnerable points in the global energy supply: the Strait of Hormuz. Around 20% of global Oil trade passes through there every day – including large quantities of liquefied natural gas (LNG). And it is not only Iranian Oil that flows through this bottleneck, but also Oil from Saudi Arabia, the UAE, Qatar, Kuwait, and Iraq.

The Strait of Hormuz:

Source: Google Maps

If Tehran seriously considers blocking the strait, as it has hinted at several times in recent days, the global Oil market will face a sudden supply shortage. This would result in a further significant increase in Oil prices.

Until the escalation between Israel and Iran, the Oil market was in almost perfect balance: if the market price fell, US fracking companies cut back their supply. If prices rose, US fracking companies and OPEC would have turned up the tap further, thereby increasing supply. This balance of power ensured stability – at least on paper. But with the new escalation in the Middle East conflict, this zero-sum game has been thrown off balance. Many Arab states are likely to welcome rising prices: they need at least USD 90 per barrel to balance their national budgets.

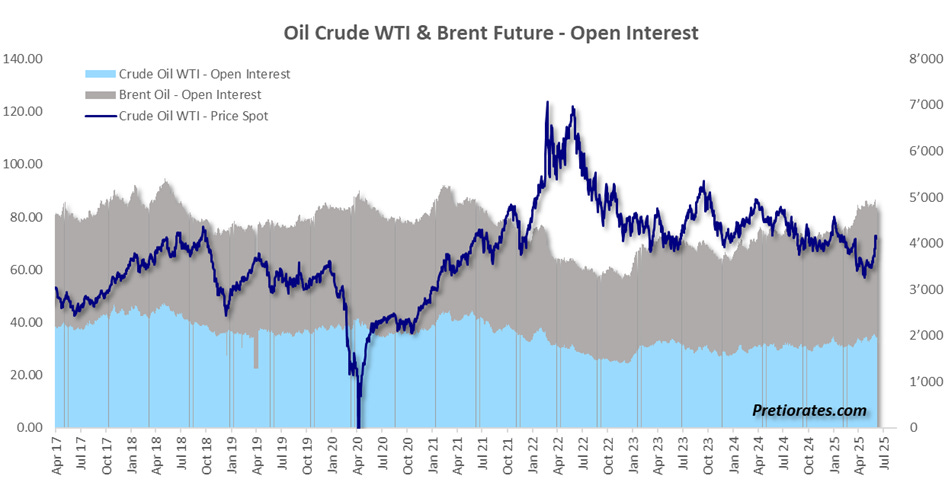

Oil prices have risen significantly. But how are the professionals reacting? A look at the open interest in the futures market provides some clues. The more open contracts there are, the stronger the interest – and often the price fantasies of investors. This volume has been rising noticeably since April 2025. On the buyer side: institutional investors and traders. On the seller side: production companies looking to hedge their production.

(Click on image to enlarge)

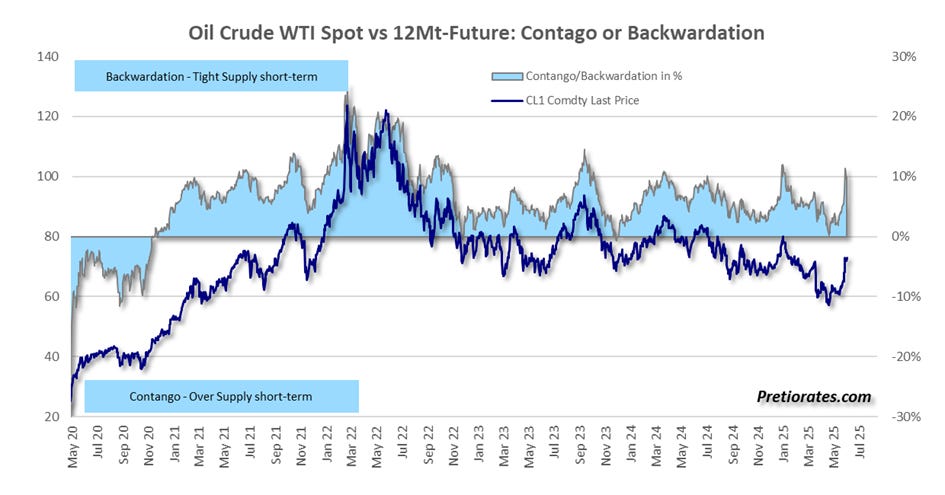

Currently, the market is paying more for immediate delivery (spot) than for later delivery – a situation known as backwardation. The signal: there is currently a shortage of supply. And as long as it lasts, it is positive for prices.

(Click on image to enlarge)

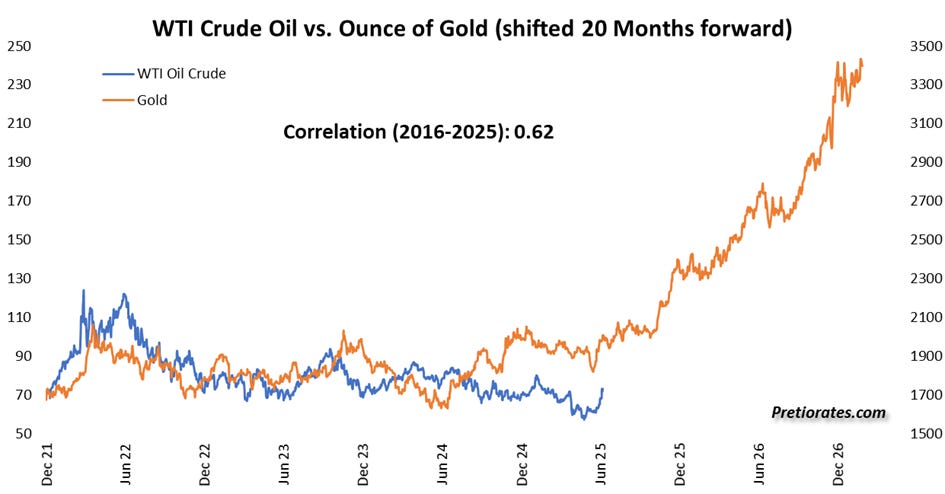

US analyst Tom McClellan pointed out a striking correlation five years ago: the price of Gold as an early indicator of the price of Oil – with a lead time of around 20 months. We have recalculated this model for the present day – with a not entirely surprising result. With the sharp rise in the price of Gold over the last 20 months, something similar could now be in store for the price of Oil from a statistical point of view.

Of course, this is no guarantee – but it is a possible scenario that should be kept in mind. After all, the historical correlation of 0.62 between Gold and Oil since 2016 should not be underestimated.

(Click on image to enlarge)

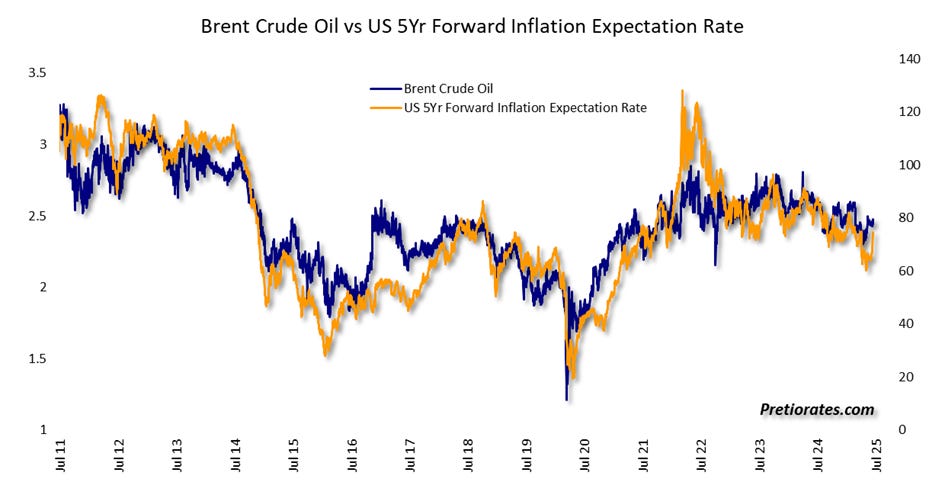

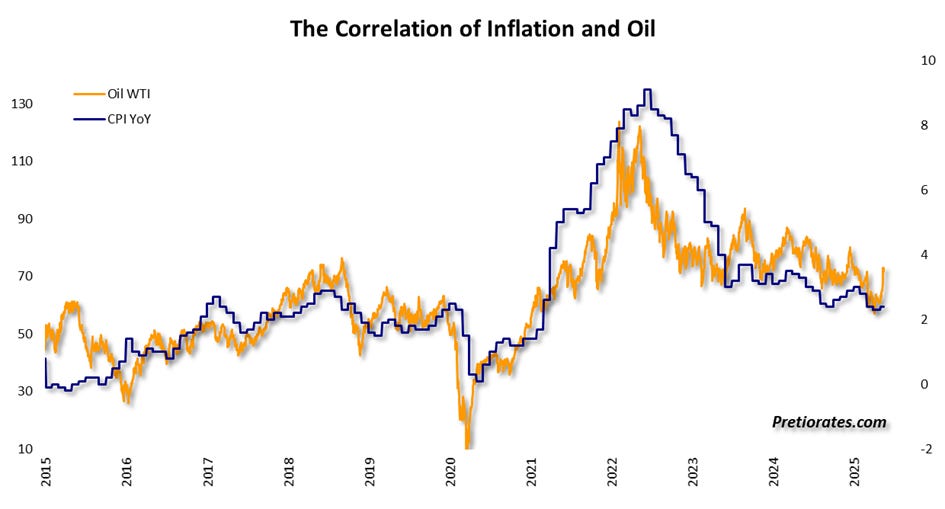

Even if the Gold/Oil model proves to be mere theory, one thing is certain: rising Oil prices fuel inflation. This effect is not yet factored into inflation forecasts. But that could change quickly.

(Click on image to enlarge)

The Oil price is already showing where things are headed – and the consumer price index (CPI) could follow suit. This puts pressure on another source of hope: falling interest rates. If inflation picks up again, this wish could go up in smoke.

(Click on image to enlarge)

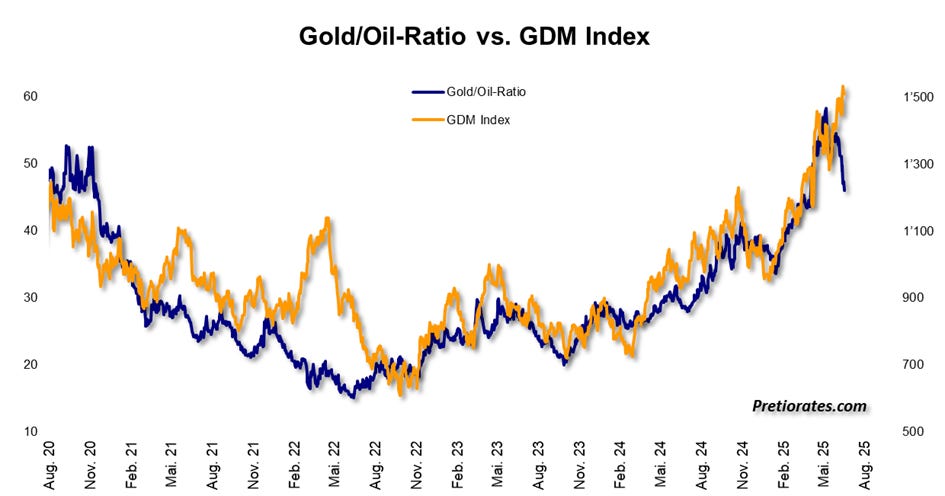

While Gold remains bullish, Gold miners are caught in a bind. Rising Oil prices also mean higher energy costs, which in turn reduce margins. The effect is measurable: the close correlation between the Gold/Oil ratio and the GDM mining index already signals that headwinds are coming. This is likely to usher in another phase in which Gold mining stocks could disappoint...

(Click on image to enlarge)

Bottom line: The conditions for a sustained rise in Oil prices are in place – and with it, inflationary pressure. This increases the risks for the Bond market and causes expectations of interest rate cuts to falter. This development could be positive for the Gold price, but Gold mining stocks could once again feel the brakes being applied. This would be the scenario in the event of further escalation.

The conflict between Israel and Iran is not a regional problem. The financial markets therefore assume that global politicians will do everything in their power to prevent further escalation. That is why Wall Street and almost all other financial markets are behaving so surprisingly calmly. However, should this assumption change – even if only verbally through a statement by a not particularly astute politician – the calm on the markets could very quickly come to an end and the above scenarios could become reality.

More By This Author:

The Little Brother Finally Becomes The Big WinnerParty Too Long, Face The Hangover

A Big Beautiful Bill For The Bond Market

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more