The Holy Trinity, Gold And Silver

The Holy Trinity is a concept in catholic Theology that describes God in three co-eternal persons: the father, the son, and the holy spirit. It shows a distinction, as well as the combination and unity of all three at once. This concept is also present within other religions. In ancient Egypt, their Holy Trinity unified Osiris, Isis, and Horus. In Hinduism, the concept of Trimurti describes the unity of the Gods Shiva, Brahma, and Vishnu. Other religions, most prominently Judaism and Islam, reject this idea completely.

But how did we end up here? This report should have treated the gold and silver prices, shouldn’t it? Don’t worry, we will get there! The concept of the trinity can be found in many other areas as well. We all know the saying: All good things come in threes. Certainly, religious thoughts and customs might have influenced this saying, but this saying this mainly grounded in the fact that in Medieval Europe, a defendant had three chances to appear in front of a court – if he did not, then the sentence was proclaimed in his absence.

Gold and silver fanatics

Now, we have two analogies that we can apply to the developments in the gold and silver market. First, there is the religious aspect. Over the years, we started to understand that for many, investing in these commodities has little to do with rational factors, but is rather based on an almost fanatic belief in them. The Holy Trinity, in this case, is that hardcore gold and silver fanatics believe that these metals are the only safeguard against inflation, deflation, and currency reforms. As is the case with all fanatic beliefs, great damage is just around the corner.

In such a state of mind, one is prone to overlook important factors that need to be included when making investment decisions. Often, this is amplified by people who spur these radical views, in order to profit themselves – it is always the same pattern. Unfortunately, we have come to the conclusion that many investors in the gold and silver market became more radical under the lead of almost all religious leaders, who do not accept any other opinion on the topic of commodities. This does not only take away real chances in other markets but in the very same commodities market as well. Like in any other area of life, the right balance is key.

However, we have to admit that the arguments that are brought forward to convince people to adopt radical stances on gold and silver often make sense. In reality, these arguments were seldom more than grey theory, and the profits were made elsewhere. Not that the gold price did not increase, but it was definitely outgrown by other assets, such as stocks and cryptocurrencies; especially, if the investment was not actively managed. This is our main point of critique. Adding physical metal to a portfolio, as such, can be quite useful – there is little that stands against that. It is also reasonable to hold a few more percentages if you need this safety to sleep better. However, going all-in on the metals and isolate oneself does more harm to oneself than good. Every couple of years, there are corrective movements of more than 50%, but contrary to stocks, gold and silver prices do not recover from such a hit within a year or two. Since 2011, we have waited more than 9 years to reach new highs – and this holds only true for the gold price!

One advantage that comes with this volatility is that it opens up new chances to buy commodities at a cheaper price and use the profits to hold larger positions. But honestly, who does this, if you approach this market so religiously? We have not seen endless queues of people in front of Pro Aurum where people wanted to sell their metals. The exact opposite was the case, as many went on to buy gold since it was believed that nothing would be left and the prices would rise above $3000.

This did not happen and for months now we are experiencing a very complex and wearing correction, which holds true for gold and silver. For us, these markets are very interesting; otherwise, we would not spend so much time analyzing them and make so many enemies when we have to crush hopes that the prices will rise endlessly. We are doing this, in order to help people who have lost their focus on the really important matters.

The trinity of events

This leads us back to the Holy Trinity, or here, the trinity of events. Over the past 40 years, the gold price reached its most significant peaks. In 1980, 2011, and most recently in 2020. As is always the case, nobody wants to believe that it’s over after such a peak. In this current phase, many still believe in new highs than in a more comprehensive correction or even new low points. There are some good indicators that come with the aforementioned peaks. One relatively reliable indicator has signaled us to sell at each of those peaks. After that, there have not been new all-time highs. The question now is whether this is going to be the case for a third time now, or will things take a turn?

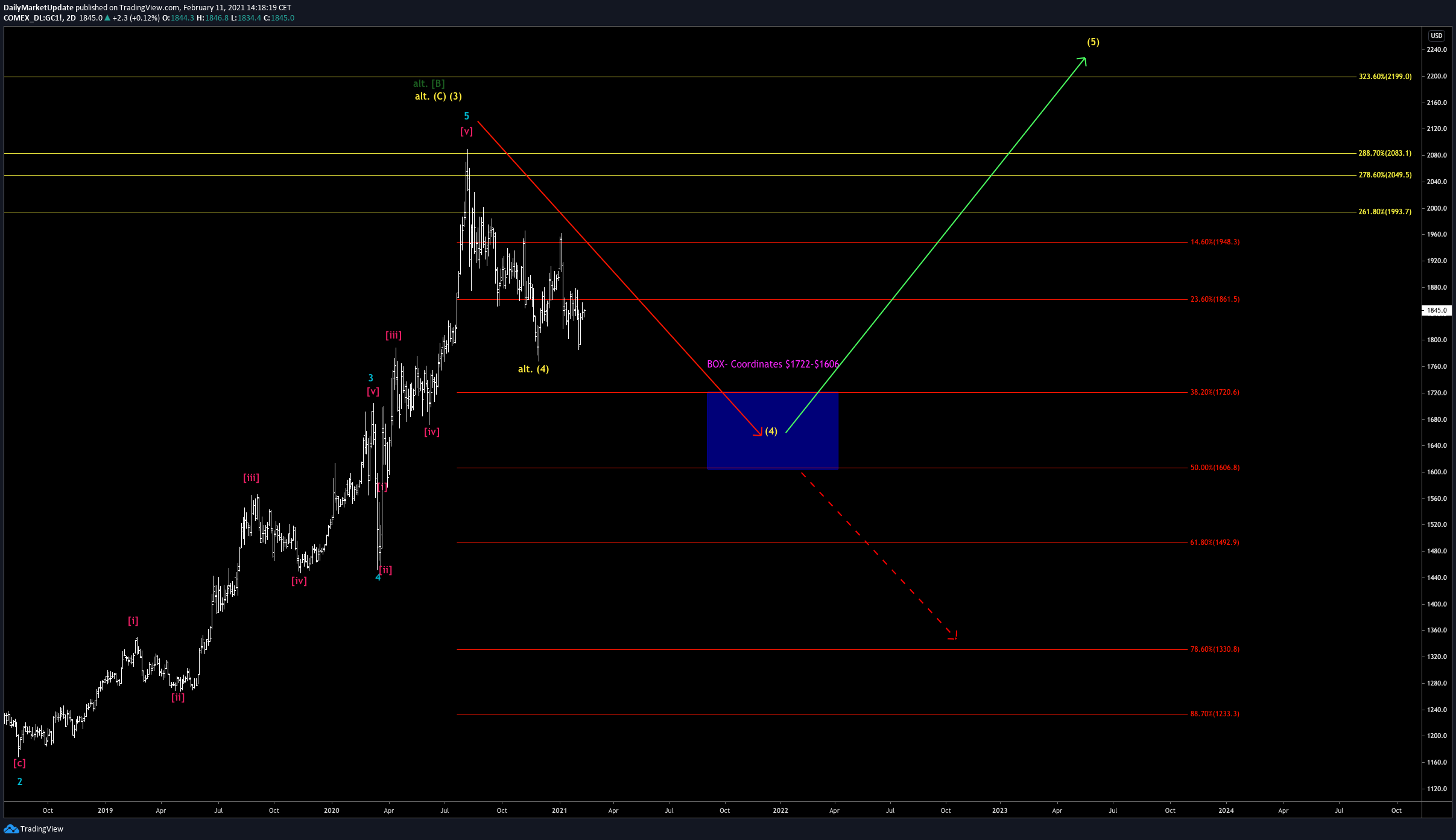

For months now, we are aiming at a target area of $1722 - $1606. This was often interrupted by charades, which pulled the price back up, but was countered by bearish offensives. Currently, we are still within this corrective movement and since last week, we are well-positioned to bring this movement to an end. We can expect that the gold price is going to fall below $1767 and further decline until we reach the target area. From there we can expect a more comprehensive increase and potential highs. In any case, within that target range of $1722 - $1606 upward trends are to be expected. However, it remains to be seen whether the bears can tackle the price at that point and establish an even more comprehensive downward move. If not, we may see new highs above $2000. In both the gold and the silver market, we will have great chances, but these need to be taken as well. If we are to face a correction similar to the one from 2011 and 2015, holding gold passively is not the best approach. In order to really derive value from gold, it needs to be managed actively. In the end, it is not a stock and neither does it pay dividends.

Gold 144m chart

Gold 2D chart

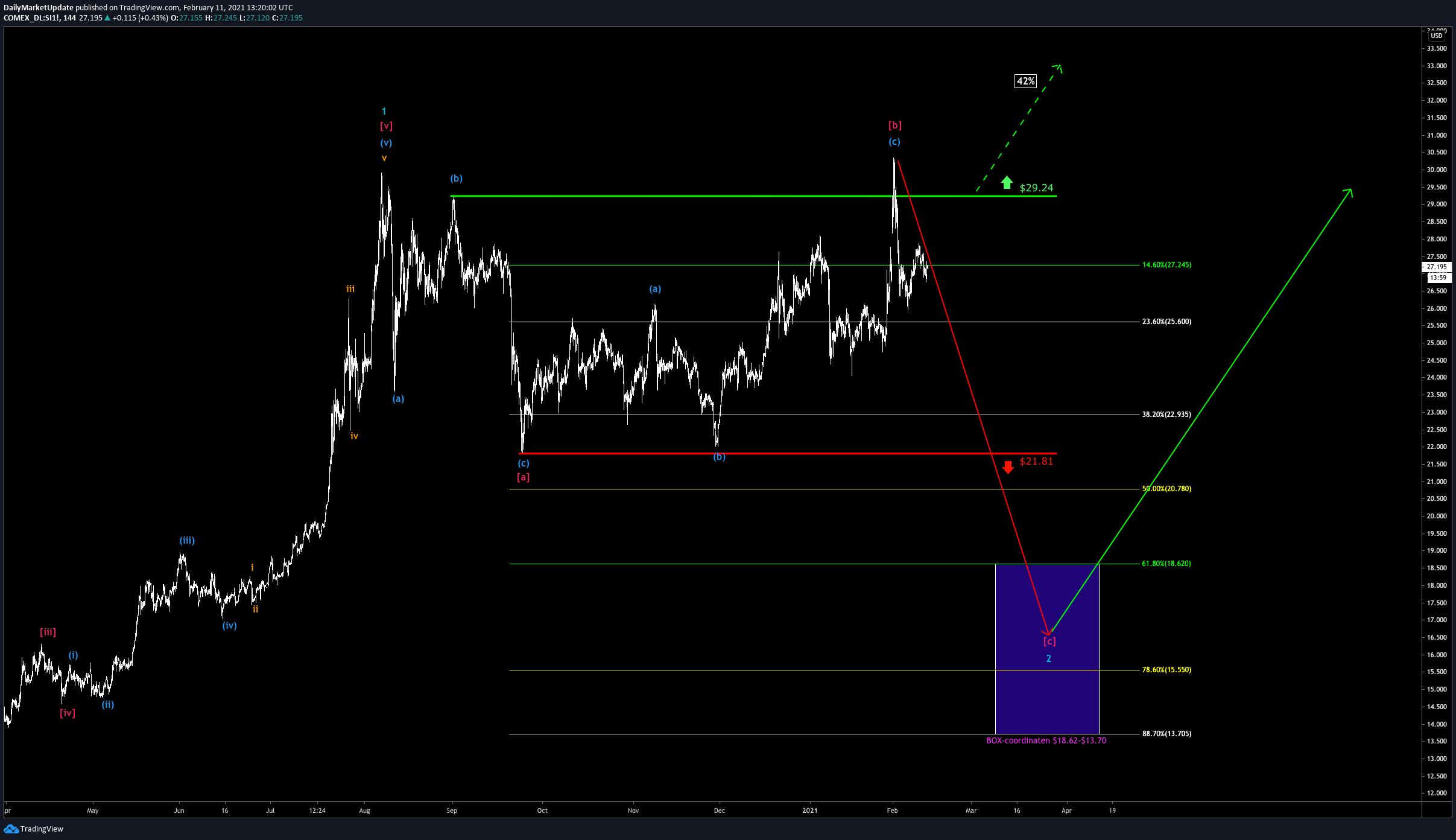

Turning to silver, the situation is not so much different. Here, too, we are within a correction from the peaks in August 2020. August? Exactly, because for the time being, we cannot safely say that the peak from last Monday can be considered a real high. There is an important difference between a high price and an upward trend. In this case, we believe that this was a so-called “B-wave”. An illusion, a fata morgana. Or as we are used to say after watching “The Wolf of Wallstreet”: Fuguisi, Fugazi. B-waves are uncomfortable creatures, as they deceit the lonely investor and trader into believing that the trend will continue from here. Eventually, they only lure them into a bear cave. For the b-wave to be considered a true movement, it needed to at least reach $33.90, which it did not. Accordingly, we hold on to our expectation that the corrective movement continues.

In the course of this movement, silver should approach a low point below $21.81. In detail, the price is expected to fall under $20 and reach a target area between $18.62 and $13.70. The bottom border at $13.70 would, however, be an absolute extreme case. Within the target area, the bulls will have a tough time, though there is still time until we get there. In order to stick to this scenario, the silver price should not move beyond $30.35 and move rather quickly below $24.04. As a next step, it should fall under $21.81. Of course, all this won’t happen without counter-movements, as this is no one-way road. We can expect those to set in somewhere around $22.

Silver 144m chart

Now, we need to understand that this correction is an extremely positive development because if we see the price slope upwards beginning from that target area, we need to brace for a massive run. This does not exclude the possibility that this run sets in before the target area and there is still the chance that we hit a high beyond $30.35 before that. But ultimately, we are still working to correct the lows from March 2020 within one great corrective pattern. Currently, we believe that we are right within this correction and that this will be finalized within the next months.

Summarizing all of the above, we believe that both metals are experiencing ongoing corrective patterns, which are not finished yet. Depending on where they land, we can make assumptions on how the prices will develop. After the corrections, we think that more comprehensive increases in prices are possible. For the gold price, this may mean quotations above $2300 and new highs for silver. It is important, however, to keep an eye on the potential risks, too. What we can just sincerely advise you to do is not to adopt a radical stance and try to build a balanced portfolio. Gold and silver remain very exciting markets after all, but mainly because we are not approaching this market with a dogmatic approach.

Very interesting, thanks for the read.

My pleasure!