The Gold Market In 2020 And Beyond

Was the past year good for the yellow metal? What happened in 2020 and what will 2021 be like for the gold market?

Nobody expected the Spanish Inquisition! And nobody expected a pandemic in 2020! Oh boy, what a year… How good that 2020 has already passed! It was an extraordinary year, unlike any other in many decades. Unfortunately, 2020 was a disastrous time for many people all over the world who suffered from COVID-19 or whose relatives and friends died because of the coronavirus or the collapse of the healthcare system… Our thoughts are with them. Many others lost their jobs or income, and all of us suffered from loneliness and limited freedom during the Great Lockdown. Indeed, it’s good that 2020 is over – and we hope that 2021 will be much better!

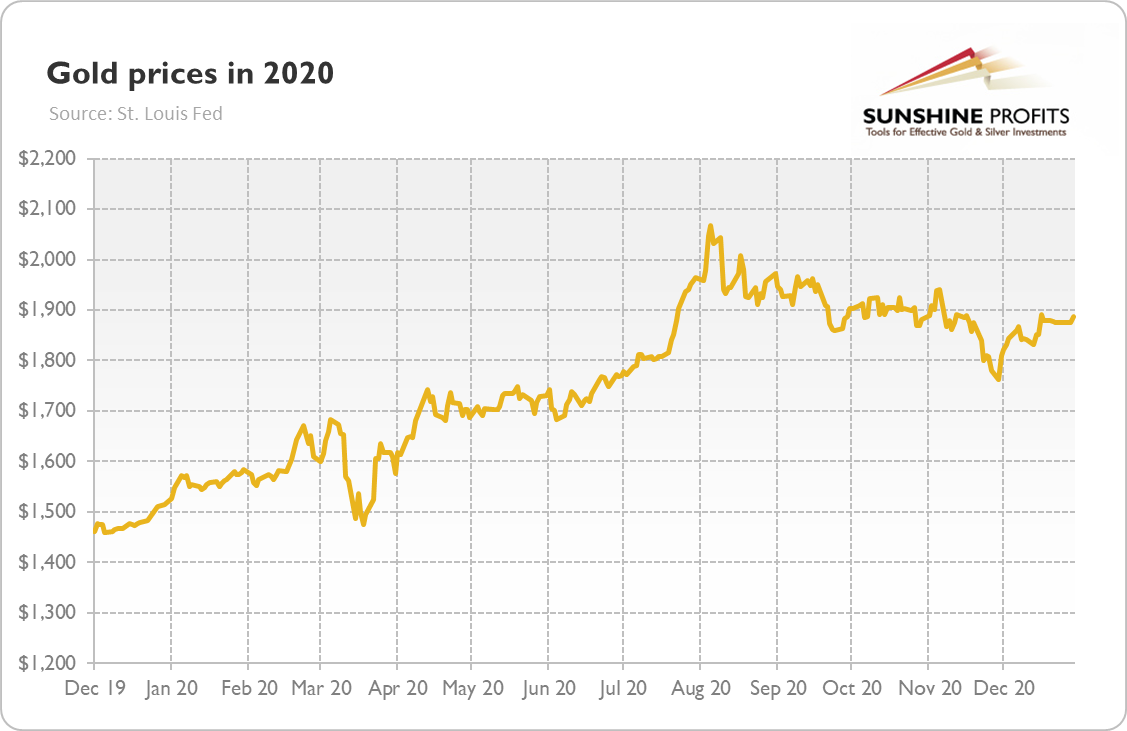

And what did 2020 mean for gold? Well, it turned out that last year was gracious to the yellow metal. As the chart below shows, gold entered 2020 with a price of $1,515 per ounce and finished the year at $1,888 (London P.M. Fix as of December 30). It means that the shiny metal rose over 24 percent – that’s not bad considering other assets were hit really hard during the economic crisis!

Actually, 2020 was definitely better for gold prices than 2019, when the yellow metal gained “only” over 18 percent. As I didn’t predict the global pandemic (who did?), I didn’t forecast such strong gains in my base scenario. However, given the inversion of the yield curve in 2019, I expected a kind of economic downturn that would positively impact gold prices. One year ago, in a January 2020 edition of the Gold Market Overview, I wrote:

unless anything ugly happens, the macroeconomic environment could be less supportive for gold than in 2019. However, bad things do happen, and, according to Murphy’s law, anything that can go wrong will go wrong. Hence, the gold fundamentals may turn out to be more positive for gold over the year. After all, the yield curve has inverted last year and we are already observing some recessionary trends, especially in the manufacturing sector and among the small-sized companies (…) given the amount of black swans flying just above the market surface, gold might provide us with some bullish surprises as well.

And indeed, the black swan (or perhaps a white or gray swan) landed in 2020, pleasing the gold bulls. However, despite gold’s impressive performance, some people complain that gold didn’t rally more during the coronavirus turmoil. I completely understand this disappointment – after all, the world suffered its deepest economic downturn since the Great Depression, larger even than the Great Recession, and gold gained only 24.6 percent?

However, the crisis was deep but very short, as we quickly learned how to live with the virus, while our brilliant scientists swiftly developed vaccines. Moreover, this time banks were resilient and there was no financial crisis. Another factor is that gold actually rallied more than 36 percent until its peak in August (or more than 40 percent counting from the bottom), but it later corrected somewhat.

Indeed, we can distinguish a few phases in the gold market in 2020:

- A pre-pandemic bullish phase caused by easy monetary policy and worries about the coronavirus, that lasted until mid-February, with the price of gold increasing from $1,515 to $1,604 (5.9 percent) on February 19, just before the stock market crash.

- The bullish period (with a short bearish correction) more closely related to the unfolding pandemic, the stock market crash, and central banks’ panic and bold responses. It started on February 20 and ended on March 6, when the price of gold reached $1,684 (gaining 5 percent).

- The bearish phase caused by investors’ panic selloff of all assets in order to raise cash. It lasted until March 19, when the price of gold reached its 2020 bottom of $1,474 (a decline of 12.5 percent).

- A super bullish phase that lasted until August 6, when the price of gold reached its all-time peak of $2,067, soaring 40.2 percent in just four and a half months. This period can be split into: the bullish phase, caused by the coronavirus shock, that lasted until mid-April; the consolidation period, that came when the financial markets calmed down as the initial doomsday scenarios didn’t materialize, and lasted from mid-April to mid-June; and another bullish phase, caused by disastrous economic data for the first half of 2020, and massive stimulus programs delivered by the central banks and governments.

- The bearish period, during which the yellow metal declined to $1,763 on the last day of November, or 14.7 percent, due to positive vaccine-related news and reduced geopolitical uncertainty after the U.S. presidential elections.

- The bullish remainder of the year, during which gold rose to $1,888, or 7 percent, caused by the dark COVID-19 winter, poor economic data, strengthened prospects of another government financial stimulus, and related worries about the rising U.S. debt.

So, it’s pretty obvious that the course of the pandemic was one of the most important tailwinds for gold prices in 2020. Thus, the correction caused by the vaccine breakthroughs is not surprising, given the scale of the previous rally. However, please note that gold reacted not to the pandemic itself, but rather to the investors, governments, and central banks’ reaction to it. The yellow metal gained the most when investors were fearful, and when the Fed and Treasury injected liquidity into the markets.

This all bodes well for gold in 2021. After all, the U.S. central bank won’t cease conducting its very easy monetary policy, while a Biden-Yellen duo will continue the dovish fiscal policy inherited from the Trump administration. Such a policy mix should support gold prices. Of course, the scale of accommodation would be lower than in 2020, so gold’s performance in 2021 could be worse than last year. But unless we see a normalization in the monetary policy and an increase in the real interest rates, the bull market in gold shouldn’t end.