The Gold Breakout Signals Start Of A New Commodity Bull Market, And Silver Prices Are Going To Explode

Image Source: Unsplash

You have likely seen the price of gold rally to new all-time highs this month. It did that after breaking out of a resistance level that has held it down, as it was trading in a narrow range between 2100 and 1980 since October, but really it represents the completion of a cup-and-handle pattern, as noted by Jordan Roy-Byrne, going back for four years.

You may know about it, but many have no idea what is going on because they are not paying any attention to what gold is doing, so captivated they are by the price movements in Bitcoin.

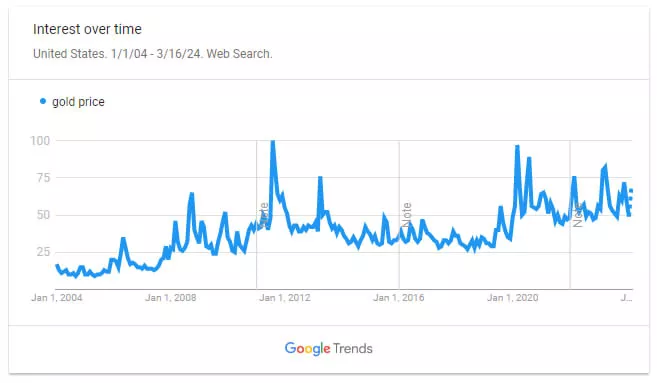

Take a look at the Google Trends search date for “gold price,” and you can see that the number of people searching for information on the price of gold has not gone up at all this month, and is actually below where it was last November and a year ago.

In fact, there have been outflows from the GLD and SLV ETFs during this rise in price.

It seems that many are totally asleep on the implications of the gold breakout. Typically, when gold breaks out like this, other metals such as silver, copper, palladium, zinc, and so forth follow. And they are starting to do just that.

You may have seen copper soar last week. Additionally, as those metals go up, other commodities tend to break out of bases as well to begin new bull markets.

Many may have no idea that the price of cocoa has totally exploded, going up faster than even Bitcoin.

I've previously said on a social media post, "when the price of Bitcoin goes up, it has no impact on the real world. But when cocoa prices do, it does. They say inflation is going away, but I wish they were right."

To reiterate, when cryptocurrencies go up, it has no impact on the real world, as they are simply virtual gambling speculation instruments whose price movements have zero impact on the real world.

Meanwhile, when cocoa prices go up, the cost of chocolate bar production rises. And now in a few months, you can expect to see the cost of chocolate in the grocery stores simply explode.

Here is the CRB Index, which is the main broad based commodity index, including metals, energy, soft commodities, and all the commodity futures contracts.

As you can see, this index has been going sideways in a very narrow 25 point (<15%) range for a year, and it is in a position to follow the price of gold and break out. See how narrow the 200-day Bollinger Bands are for it, with its 200-day width indicator flat-lined. This looks like it is about to breakout, and no one is talking about it all.

Right now, perhaps the easiest way to play this is simply to buy silver, as it is in a position to break out of $26 resistance, a level similar to what $2100 was for gold a few weeks ago.

I can’t predict whether the breakout will happen tomorrow, later this week, or two months from now, but it looks like it’s simply a matter of time, as it should be coming soon. So, are you silver stacking?

More By This Author:

Bitcoin Will Crash One Day, So Silver Is The Way To GoGold Is Close To Breaking Out, Look For Mining Stocks To Play Catch Up

Bill Gates Dumps Stocks In $42 Billion Portfolio, Nvidia Soars Again, And Newmont Corporation Crashes