The Gold & Silver Correction Finally Arrives

.webp)

Photo by Zlaťáky.cz on Unsplash

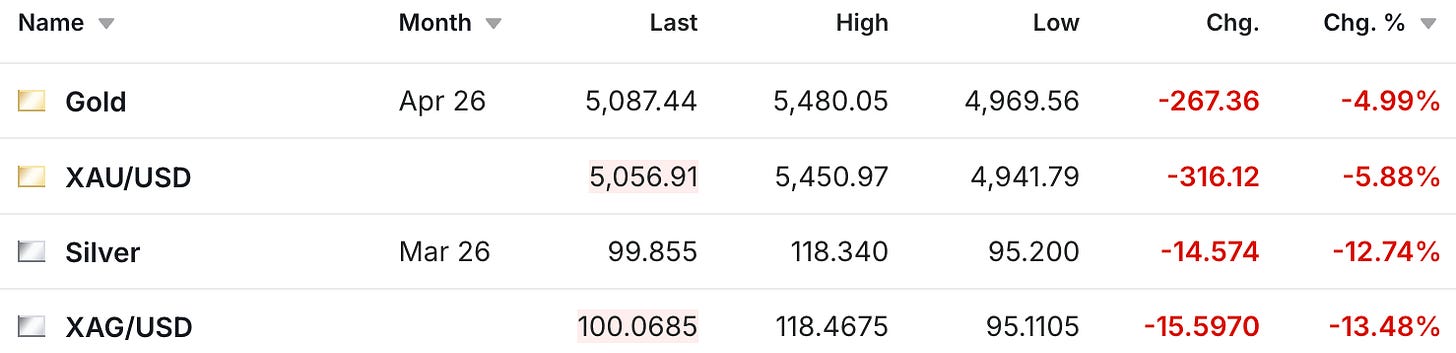

The gold and silver prices are in the midst of one of their largest (at least by dollar amount) moves downward this morning, which the Wall Street media is attributing to the nomination of Trump’s new Fed chair candidate.

(Click on image to enlarge)

The narrative being presented is that Kevin Warsh is a more hawkish choice, and less likely to be in favor of the lower interest rate policy that Trump has made clear he wants over the past year.

Stocks fell and Treasury yields pushed higher on bets Warsh will be nominated, while the dollar rose. The trades reflected speculation Warsh may be less enthusiastic to cut rates than other candidates given his past warnings of inflation risks and more recent calls for the Fed to reduce its balance sheet. He has more recently echoed Trump’s criticism of the Fed for being too slow to ease.

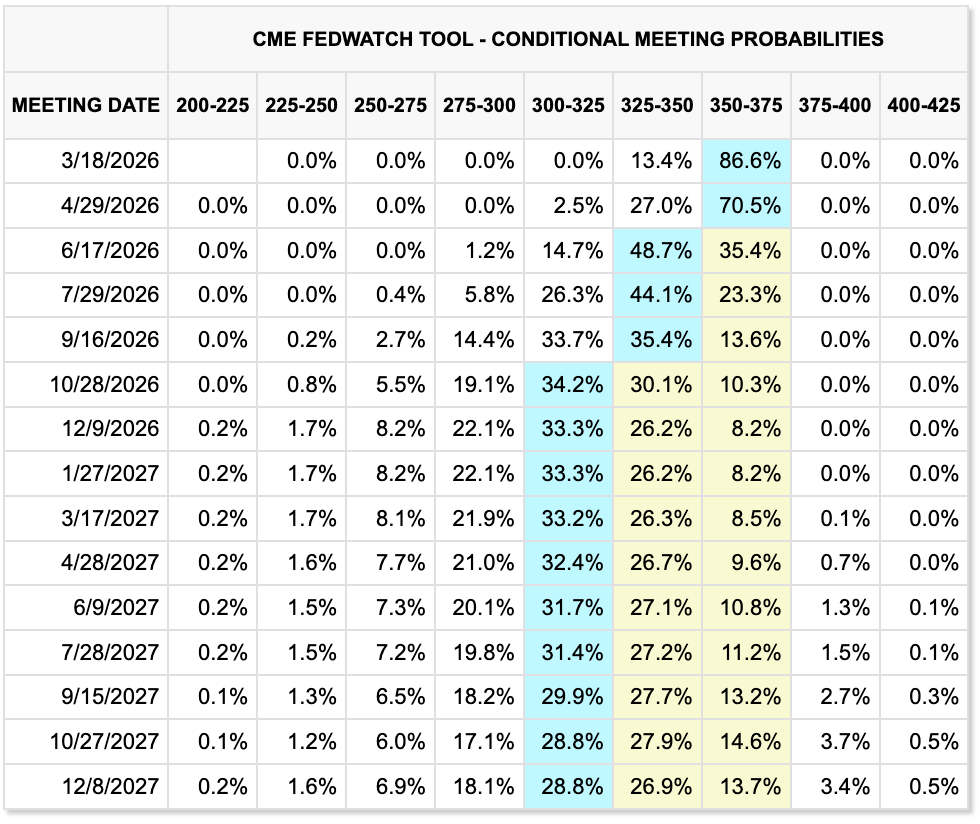

I’m not sure I’m ready to buy the idea that Warsh is going to come in and start jacking rates like Volcker, and the last sentence in the quote above about Warsh joining Trump in saying the Fed’s been too slow to ease seems a lot easier to believe.

I suppose if we’re sitting here a year from now and Warsh has rates higher than today, I’ll have to say I was wrong. But I still see rates going far lower than the current Fed futures curve is pricing in, where they still only see two 25 basis point rate cuts over the next two years.

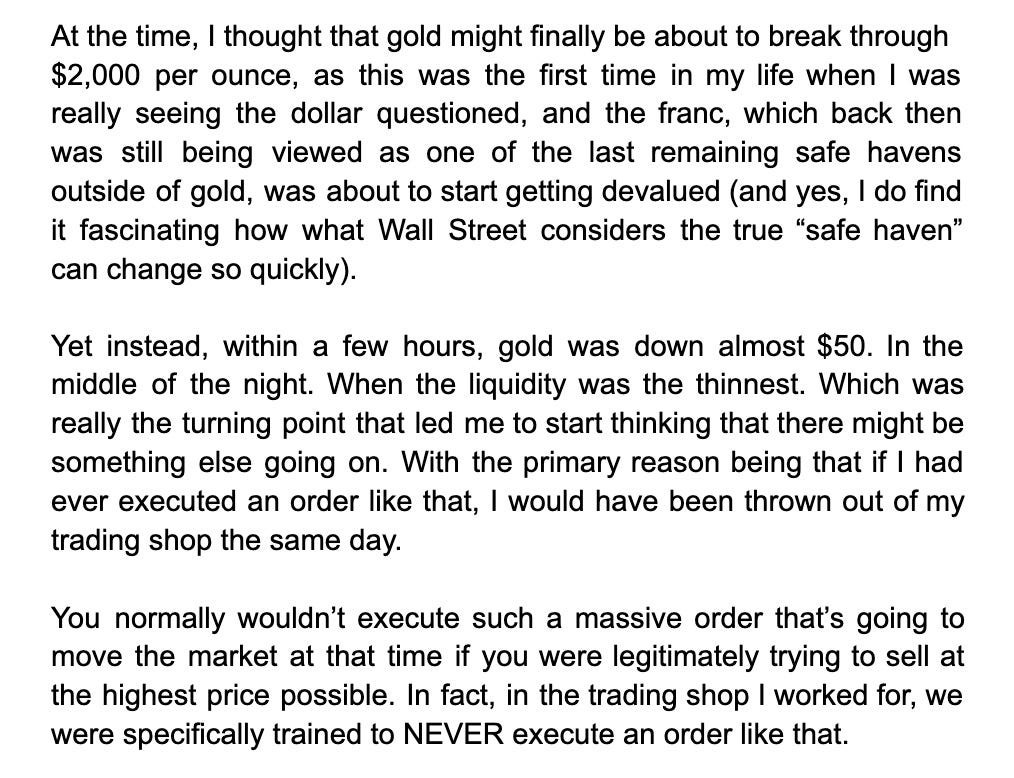

Ultimately, I think today’s move lower in gold and silver is a lot more due to the kind of volatility we’re still in the middle of (with moves both up and down), and that we’ve seen some large block offers dropped on the markets over the past few days.

(Click on image to enlarge)

In terms of some of these instances where we see enormous sell offers dropped on the market that jolt the price lower, here’s what I wrote in the foreword of my book The Big Silver Short.

I also shared this the other day, but in case you still haven’t seen it, it’s a clip from the interview I did in 2019 with former CFTC commissioner Bart Chilton, where he comments on some of these price plunges.

Yet ultimately, regardless of who placed what order, the prices are lower today, although still at historical levels. Especially when you remember that the silver price only finally broke through $100 for the first time ever just a week ago last Friday.

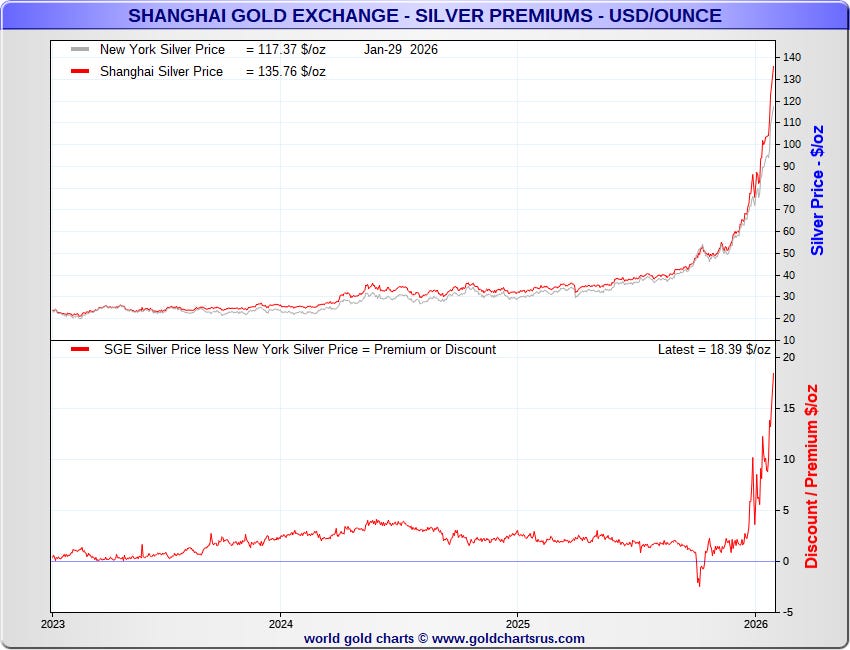

I can’t say for sure that the sell-off is over, but I do continue to expect large swings, especially as these spreads in China and India remain elevated, where as of this morning, silver in China is trading at $118, while the MCX in India is at $116.

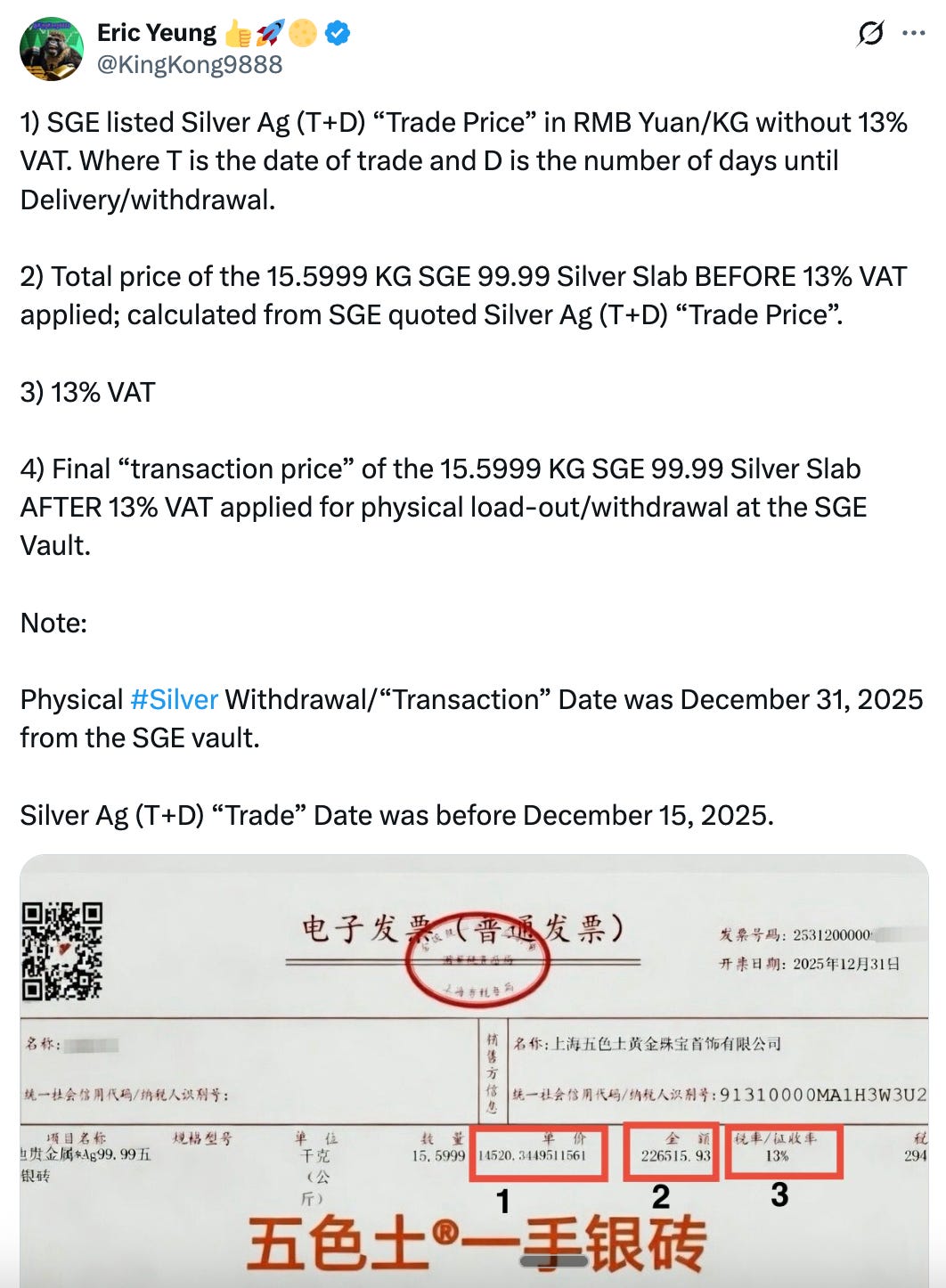

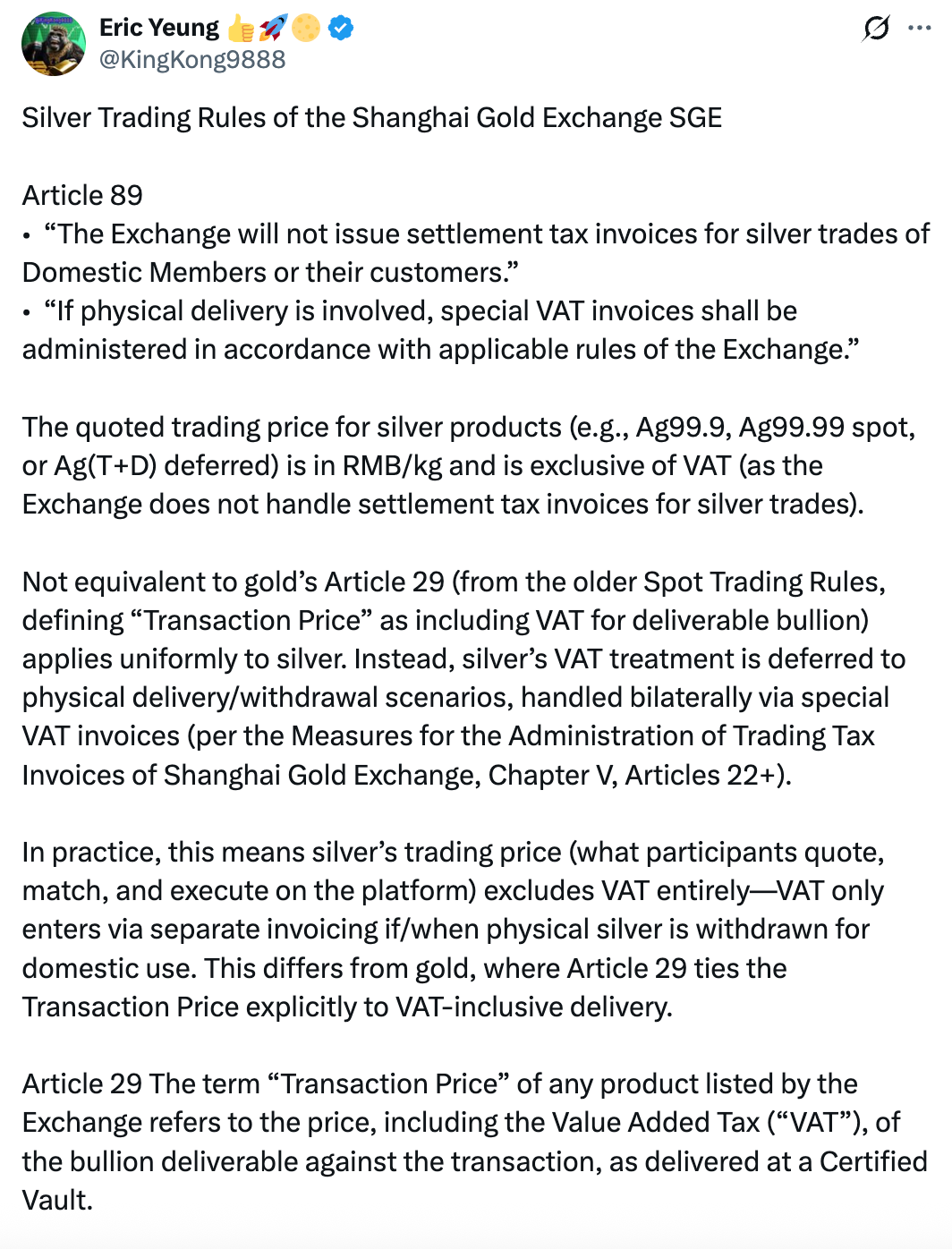

Additionally, in terms of the Shanghai price, I’ve seen that there is debate as to whether the VAT tax is included in the quoted Chinese price. My understanding had been that the VAT was added in certain situations on top of the exchange price, and after checking with several colleagues, I continue to believe that’s the case, and you can click on either of these tweets below for a more detailed explanation.

I’ll continue to verify that this is indeed correct, although perhaps ultimately more significant than the placement of the VAT tax, is that we can see that the spread has been widening, indicating that there is legitimate pressure in the physical industrial market in China.

I’ve also mentioned over the past week how the premium in India has surged again recently, while Bloomberg has reported that demand in India is already well above October levels, when they actually hit an overt shortage.

“It’s the highest demand I’ve ever seen,” said Firat Sekerci, the general manager of Public Gold DMCC, a bullion dealer based in Dubai. “Most refineries in Turkey have been out of stock for the smaller bars — 10 ounces, 100 ounces — for the past 10 days.”

Retail investors in Turkey are now prepared to pay as much as $9 an ounce above global benchmark prices in London to get their hands on silver, while premiums are elevated across the Middle East, Sekerci said.

That’s prompting global banks to prioritize shipments to the country and region, resulting in less metal reaching India and leaving demand there unmet, according to two dealers familiar with the matter, who asked not to be named as they are not permitted to speak publicly.

A short squeeze last October showed how local supply constraints can quickly go global, especially for a less-liquid metal like silver. At the time, Indians loading up ahead of the Diwali festival, along with tariff fears that kept supplies locked up in the US, drained liquidity in London and pushed benchmark silver prices to the highest since the 1970s.

Investor demand for silver is now even higher in India than it was in October, with smaller bars and coins in vogue, according to Samit Guha, the CEO and Managing Director of MMTC-PAMP India Pvt., the country’s largest precious metals refiner.

The company’s silver dore imports have more than doubled between October and December from last year, but it’s struggling to keep up with domestic demand and is also getting unusual requests to refine metal for customers in South Korea, the United Arab Emirates, Vietnam, and Malaysia, he said. “Whatever we manufacture, we sell. We could supply 25% more coins and bars and the market would absorb it.”

Silver’s rally is leaving banks and refiners scrambling to meet unprecedented demand from retail investors, with the metal jumping by around a third in a few weeks.

From Chinese aunties queuing in Shenzhen markets to out-of-stock Turkish refineries and a Korea Mint offer that sold out within an hour, silver’s dizzying rally is leaving banks and refiners scrambling to meet unprecedented demand from retail investors.

“It’s the highest demand I’ve ever seen,” said Firat Sekerci, the general manager of Public Gold DMCC, a bullion dealer based in Dubai. “Most refineries in Turkey have been out of stock for the smaller bars — 10 ounces, 100 ounces — for the past 10 days.”

In case you’re looking for something to help reassure you of why you’re invested in silver, or other metals that the world doesn’t seem to have enough of right now, you might enjoy this presentation by well-known mining executive Robert Friedland.

He really puts into perspective how behind we are in terms of having even close to the required amount of some of these metals to build the green AI future that’s being promised, and it’s a great overview of where things stand.

This interview with Craig Tindale is another good overview of the critical minerals situation, and how governments in the West are likely to respond.

I also had a gold and silver dealer on our YouTube channel earlier this week, who talked about how things are really breaking down in the retail silver industry, and now a day later we see that one of the larger refiners is no longer taking scrap metal, much as the dealer described in the interview.

Metalor Technologies SA, one of the world’s top gold refiners, paused accepting new shipments of metal due to an inventory backlog caused by severe US weather and an influx of scrap materials driven by record-breaking prices.

The Swiss company has also paused advance payments to clients as it struggles to deal with the surge in business, according to a Jan. 27 letter seen by Bloomberg News. “To navigate this environment responsibly, Metalor is implementing an immediate pause on outgoing advances,” according to the letter, which was sent by the company’s Americas refining business group to clients.

The bolded part about pausing advance payments is a pretty big deal for your local gold and silver dealer, which Brian described in detail in that interview referenced above.

So on a day where the gold and silver prices are down, perhaps it’s a great time to take a step back and think about the things that are going on in the world, and where you think the prices of the metals will have to be in five or ten years from now.

I imagine the path to get there will be a volatile one, but isn’t it exciting to be right in the middle of it?!

More By This Author:

The Global Silver Market Is Breaking DownSilver Surges To Over $133 In China As 'They're Front Running Each Other'

It Looks Like They're Front-Running The Silver Market