The Global Silver Market Is Breaking Down

Image Source: Unsplash

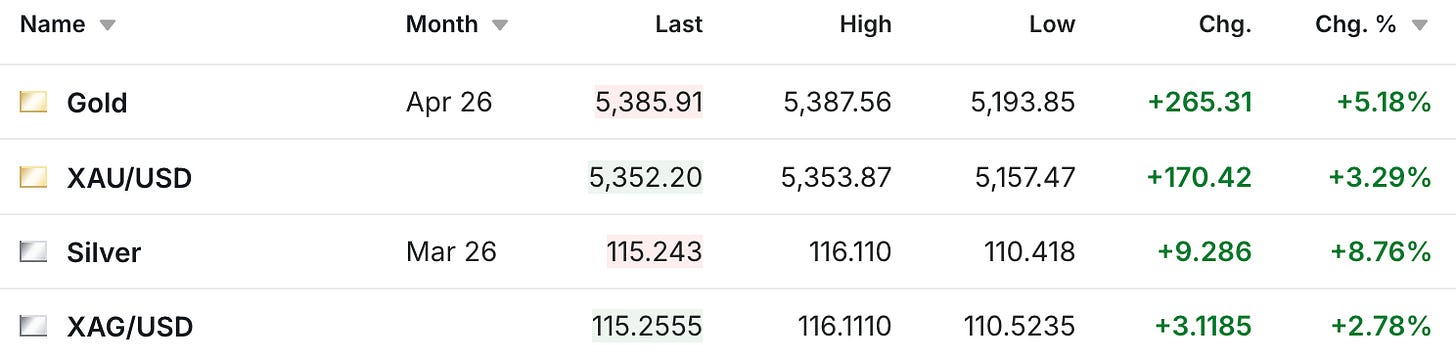

We’re witnessing another stunning day in the gold and silver markets, as the gold futures are currently up over $265 on the session, while both the silver futures and spot price are back above $115.

It was just last week when the market started to wonder if gold would break through the $5,000 level, and now here we are nearing $5,400. Meanwhile, silver has rebounded from its $15 midday sell-off on Monday, while the prices in China ($130) and India ($131) continue to trade at even greater premiums.

Before the markets opened in the East on Sunday, I was talking to people at the Vancouver Resource Investment Conference and suggesting that at some point we were going to wake up and see silver down by an amount greater than we’ve yet seen, perhaps in the $10-$15 range…enough that people would feel it. And then on Monday we basically saw that, which I think in some ways was really a good thing.

Of course it’s exciting to see silver rallying the way it is, although there’s a tendency when that’s happening to start thinking that we might never see another sell-off. Yet with the way things unfolded on Sunday and into Monday, with the price surging in Asia and then continuing to $117 in New York, we did see a $15 sell-off, although because of the timing, the silver price still ended up in positive territory on the day. And of course, to see it rally back since then continues to show that this is atypical of anything we’ve seen to date in the silver market, and reinforces my view that this is being driven by physical supply issues in the East that are not easily resolved.

Now with gold also soaring too, we can see that this is not ONLY a supply issue specific to silver that’s moving the precious metals markets. Something is happening, and as I was thinking about what’s driving this latest surge, I came to the conclusion that it’s all of these things that we’ve been talking about day after day.

Sometimes it’s easy to lose track when we’re in the middle of it, but I think the continued upward trajectory in both gold and silver is the result of all of these things that the world’s been becoming increasingly concerned about.

Central banks like Poland continuing to buy gold.

The fact that Wall Street has made it normal to talk about “the debasement trade.”

That the Trump administration has threatened legal action against Jerome Powell and the Fed, which has left great portions of the investing world quite concerned.

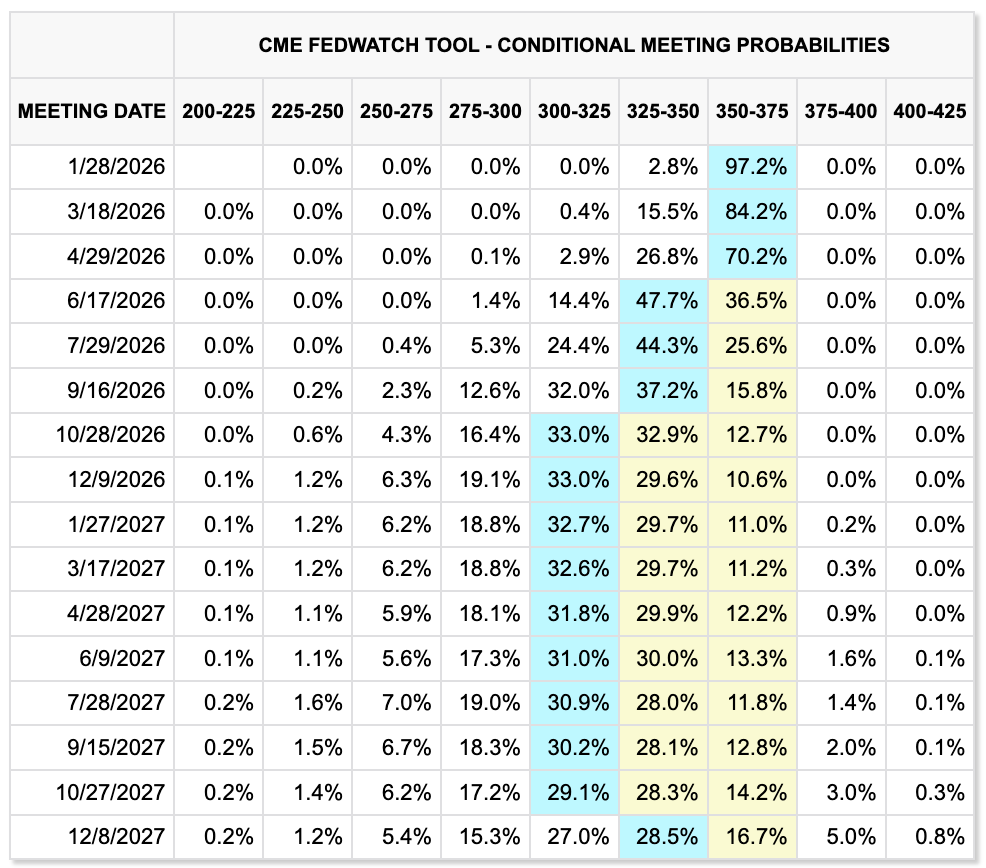

And of course, that Trump is getting closer to picking his next Fed chairman, who’s incredibly likely to be aligned with Trump’s belief that interest rates should be 1% or lower (even if there’s at least some increased probability that there might be issues in that process).

Trump added that he will soon announce his pick to serve as head of the U.S. central bank, and predicted interest rates would decline once the new chair takes over.

So if gold’s at $5,300 now, yet the Fed Funds futures are only pricing in two 25 basis point rate cuts over the next year and a half down to the 300-325 bp range, but Trump’s getting ready to put in someone who might take rates 250 points lower, what’s going to happen to the gold price if that occurs?

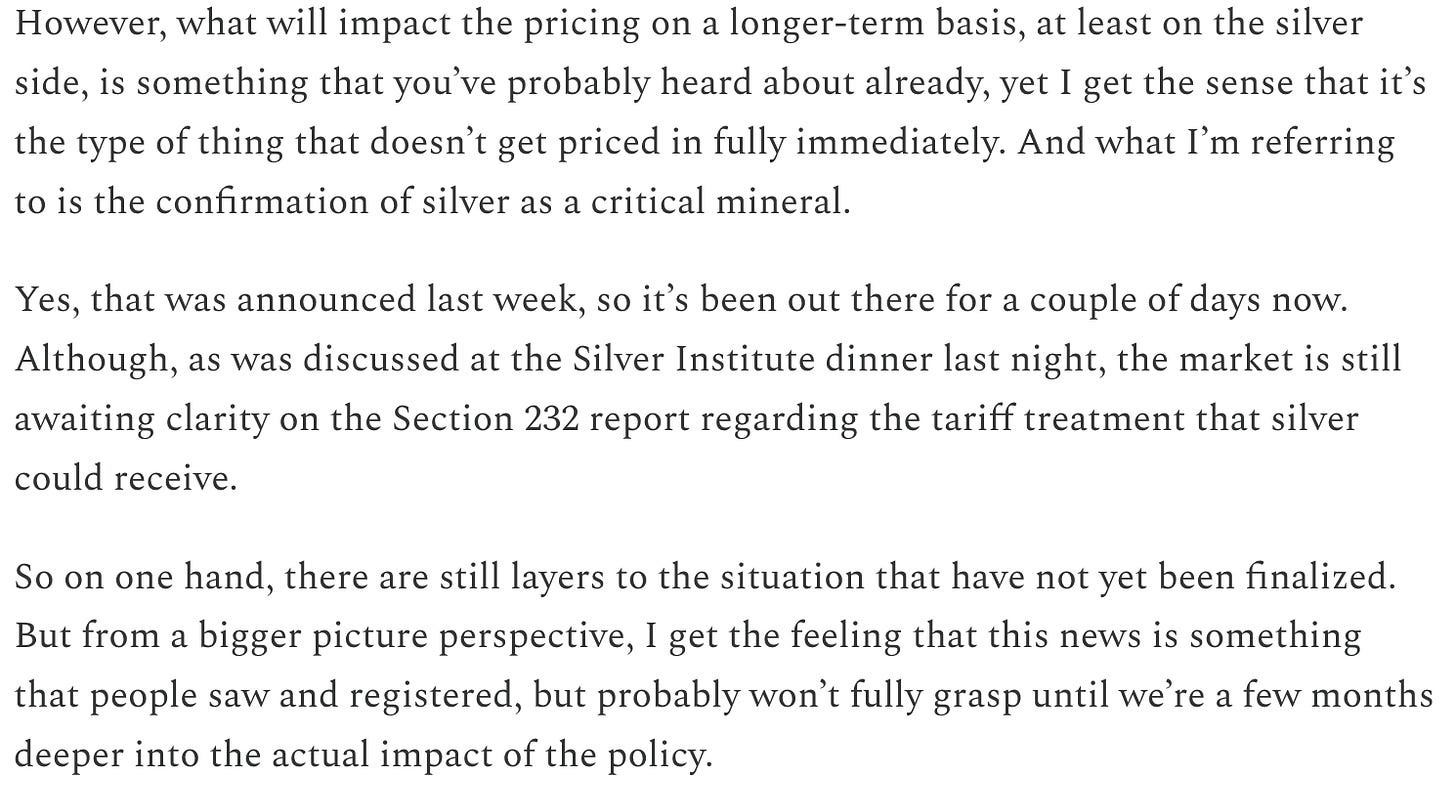

I was also thinking about how back in November when silver was finally officially added to the US Critical Minerals List, I heard from people who were disappointed or confused why the price was down a little bit that day, although here’s what I wrote back then:

That was back on November 14th, and the silver price has more than doubled since then, while we’re now seeing things like the US government introducing a bill to create a critical minerals stockpile.

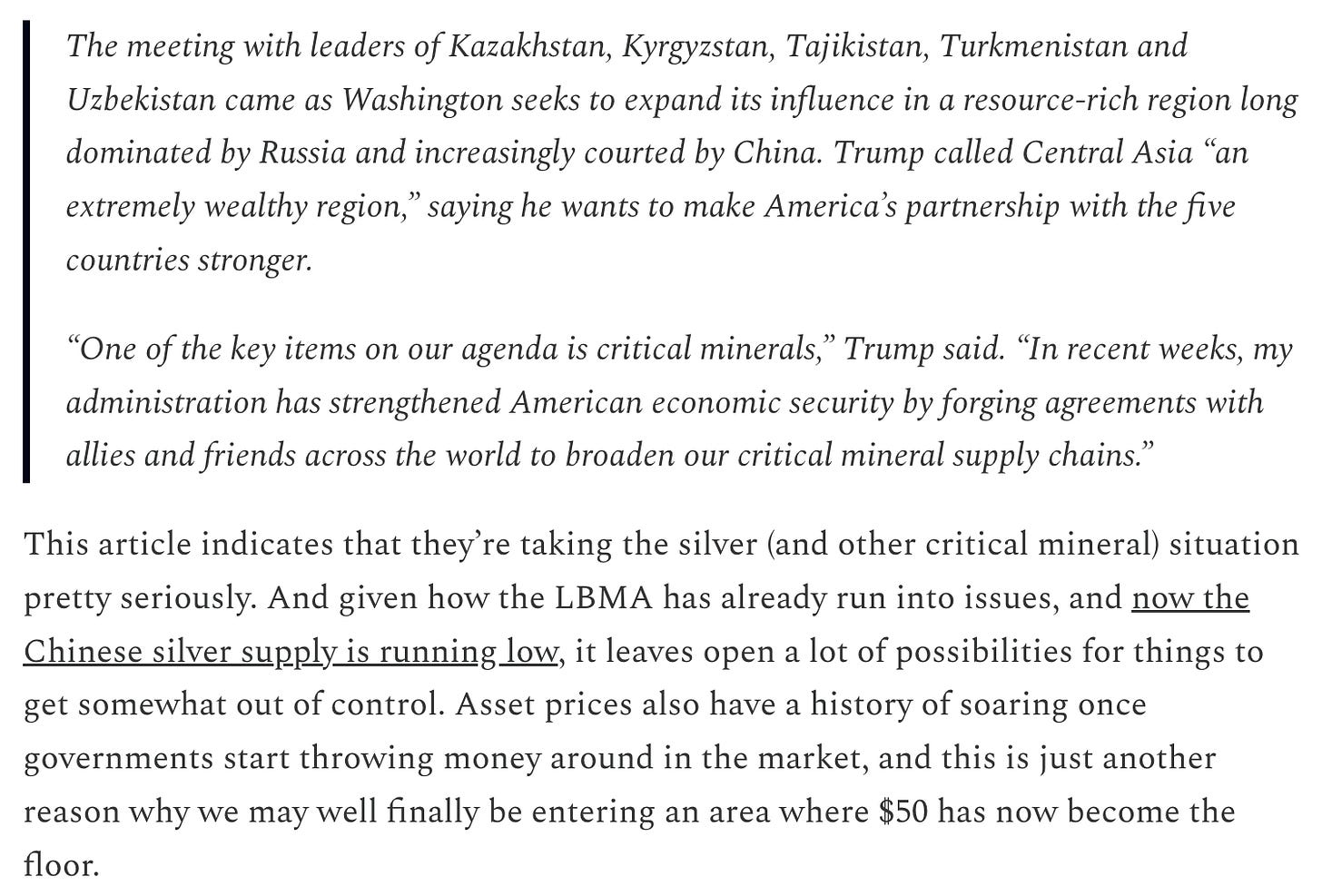

Look at the marketing and imagery now being sent out by Reuters. That’s what’s being emblazoned into people’s subconscious as the U.S. stockpiles critical minerals.

Although of course, that’s just a drop in the bucket relative to what critical minerals czar David Copley said at a recent speech:

He told you they were going to invest hundreds of billions, and now you’re starting to see the impact of that (although I still think we’re still very much in the early stages).

Bloomberg is now also increasingly reporting that the rally in silver is being driven by liquidity issues in China and elsewhere.

This is also consistent with what I’ve been suggesting over the past couple of weeks, and continue to believe is the case. And to better understand why, if you’ve not yet seen the video I recorded from the VRIC conference prior to the Sunday night open, I think you would enjoy this one.

Another Bloomberg article mentioned that:

Silver’s rally is leaving banks and refiners scrambling to meet unprecedented demand from retail investors, with the metal jumping by around a third in a few weeks.

From Chinese aunties queuing in Shenzhen markets to out-of-stock Turkish refineries and a Korea Mint offer that sold out within an hour, silver’s dizzying rally is leaving banks and refiners scrambling to meet unprecedented demand from retail investors.

They also mention how the surging premiums are now spreading beyond China and India.

“It’s the highest demand I’ve ever seen,” said Firat Sekerci, the general manager of Public Gold DMCC, a bullion dealer based in Dubai. “Most refineries in Turkey have been out of stock for the smaller bars — 10 ounces, 100 ounces — for the past 10 days.”

Retail investors in Turkey are now prepared to pay as much as $9 an ounce above global benchmark prices in London to get their hands on silver, while premiums are elevated across the Middle East, Sekerci said.

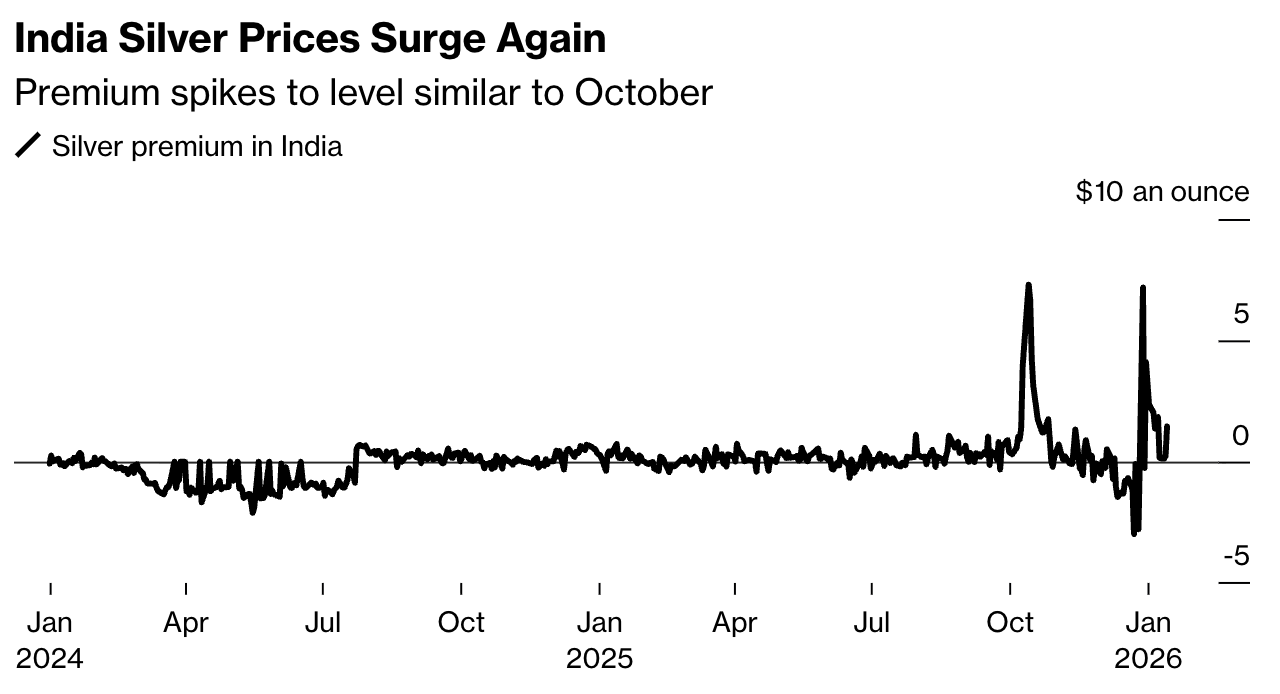

Remember, India actually went into an overt shortage last October, which was also the spark that sent the London market into its own crisis. But look at what’s happening in India now.

That’s prompting global banks to prioritize shipments to the country and region, resulting in less metal reaching India and leaving demand there unmet, according to two dealers familiar with the matter, who asked not to be named as they are not permitted to speak publicly.

A short squeeze last October showed how local supply constraints can quickly go global, especially for a less-liquid metal like silver. At the time, Indians loading up ahead of the Diwali festival, along with tariff fears that kept supplies locked up in the US, drained liquidity in London and pushed benchmark silver prices to the highest since the 1970s.

Investor demand for silver is now even higher in India than it was in October, with smaller bars and coins in vogue, according to Samit Guha, the CEO and Managing Director of MMTC-PAMP India Pvt., the country’s largest precious metals refiner.

But just wait, there’s more …

The company’s silver dore imports have more than doubled between October and December from last year, but it’s struggling to keep up with domestic demand and is also getting unusual requests to refine metal for customers in South Korea, the United Arab Emirates, Vietnam, and Malaysia, he said. “Whatever we manufacture, we sell. We could supply 25% more coins and bars and the market would absorb it.”

This has also led to continued breakdowns in the silver refinery supply chain.

“It doesn’t make sense for refiners to ramp up production and invest in new lines” to raise kilobar supplies, because they have little visibility on where demand will head next, said Sunil Kashyap, managing director of bullion trader FinMet Pte Ltd., which supplies silver feedstock to refineries.

It’s also leading to a lot of issues now in the U.S. retail silver supply chain, which I discussed with Brian Kusmar of Commercial Rare Coins, a local coin shop in South Florida.

I’ve been reporting over the past month how we knew even before the Shanghai premium surged that the Chinese inventory had been running low, and now the conditions there are intensifying.

The squeeze in October has also depleted inventories in some locations, leaving the market without much of a buffer. Stockpiles linked to the Shanghai Futures Exchange made a partial recovery in early December, but have now fallen again to where they were after the crunch in October. The surge in demand has led to old bars with varying purities being released back into circulation, according to a manager at a major refinery.

Yet even at the elevated prices and premiums, it was interesting to hear this comment about how the demand is responding.

“Most retail silver purchases are made fully in cash rather than on margin, so even if prices pull back, many will simply hold on or even use dips to add to positions,” said Zijie Wu, an analyst from Jinrui Futures Co. “So the demand is actually quite resilient on the downside.”

Beyond the big bullion consumers, the insatiable appetite for silver is also spreading. Buyers in South Korea last week snatched up all the 1-kilogram bars in an offer by Korea Mint in less than an hour, while Singaporeans have been queueing for up for 90 minutes to get their hands on the metal.

There was also a comment from Metals Focus (who compiles the data for the Silver Institute) about how the big shift in the retail level, where there had been a lot of selling for the past few years, is now adding even more pressure to the silver market.

“Retail physical demand is keeping prices high,” said Nikos Kavalis, managing director at consultancy Metals Focus. “There’s room for further increase in retail sales, and whether this number keeps up will be key to silver’s rally.”

Then, as I mentioned earlier, all of the other geopolitical events we’ve been discussing in this column over the past few months are factoring in as well.

After surging almost 150% last year, the white metal has taken it up a notch in 2026, jumping by around a third in a few weeks as the Trump administration ushers in a new age of imperialism, while renewing attacks on the Federal Reserve. China was an early epicenter of the consumer frenzy for silver coins and bars, but with prices setting records, the craze is spreading.

Whether retail buying will eventually cool off if prices keep rising is the big question. With US President Donald Trump tearing up the rules-based international order, and a range of other economic and political risks on the horizon, precious metals offer one of the few relatively safe havens for consumers right now.

Public Gold’s Sekerci doesn’t see any let up in demand. “What else can they invest in?” he said. “The American president is causing problems, the dollar isn’t holding up. Metals are better.”

That we’re also seeing gold surge again at this particular time lends credence to the view that the dynamics mentioned earlier between the Trump administration are adding fuel to this fire on a global level.

We’ll start wrapping up there for today, but I’ll leave you with this note regarding another Bloomberg report - about how the U.S. is now considering yield curve control, which probably doesn’t come as a surprise to you, but may be getting closer to becoming reality.

I’ll also have some comments later this week on the volatility in the yen, which is adding to the scramble for precious metals. Although just as a preview, take a look at this one-month chart.

Remember how when there was a big move in the carry trade two years ago, the demand for precious metals surged after the Nikkei was down 12% in a day, and you’ll want to keep an eye on that.

Hopefully you’re enjoying these historic events, and I’m already excited to check back in with you tomorrow!

More By This Author:

Silver Surges To Over $133 In China As 'They're Front Running Each Other'It Looks Like They're Front-Running The Silver Market

Silver Breaks $100 In New York As The Market Starts To Unravel Globally