The Future Of Copper And A Look Back – Trading Review

Image Source: Pixabay

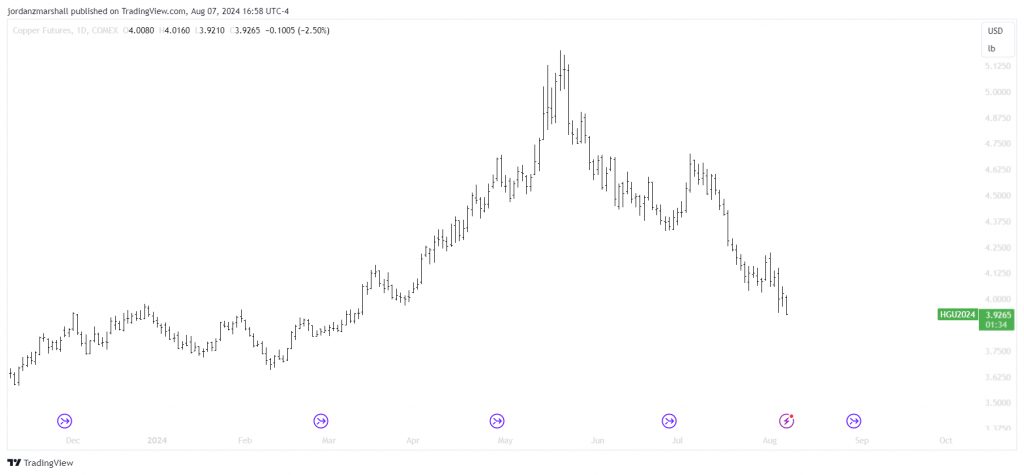

Copper has been a hot commodity, only to fall rapidly. If we look at Copper‘s price action history on the daily chart, there is a giant spike from the 3.57 to 5.19 area in just a few months. After that, HG (Copper Futures) has crashed back down to just 3.95 today shown here. What can we learn from the past and use that to make better trading decisions moving forward?

Copper price history since 2023

Could any trader have predicted the rise and fall of HG in just 1 year? Let’s review some signs the top of the market gave us at the peak and trough to help us see how the pattern emerges.

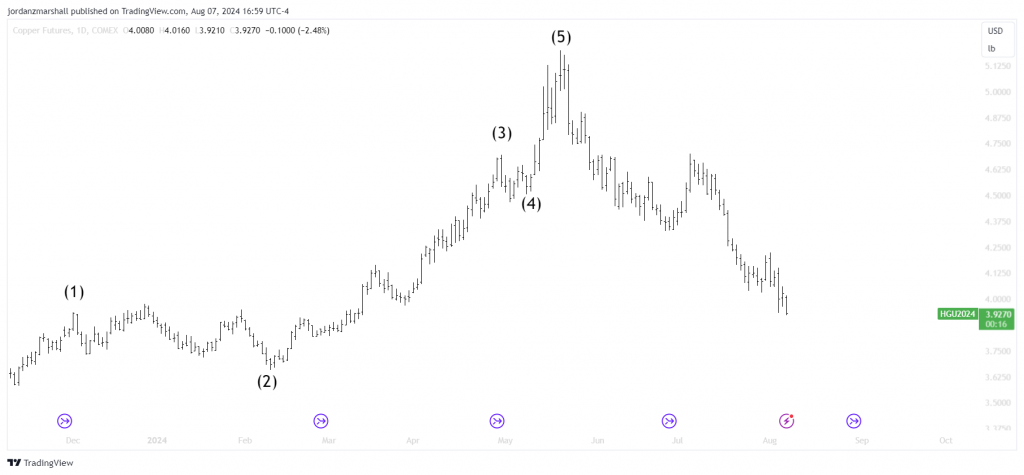

Counting Waves

Copper chart with 5-waves

To start off with the initial breakout in mid-March 2024 made new highs with strength. This is a tell-tale sign of an impulse wave getting underway, new highs out of the previous sideways zone. From the bottom here we can actually count a total of 5-waves up as pictured here:

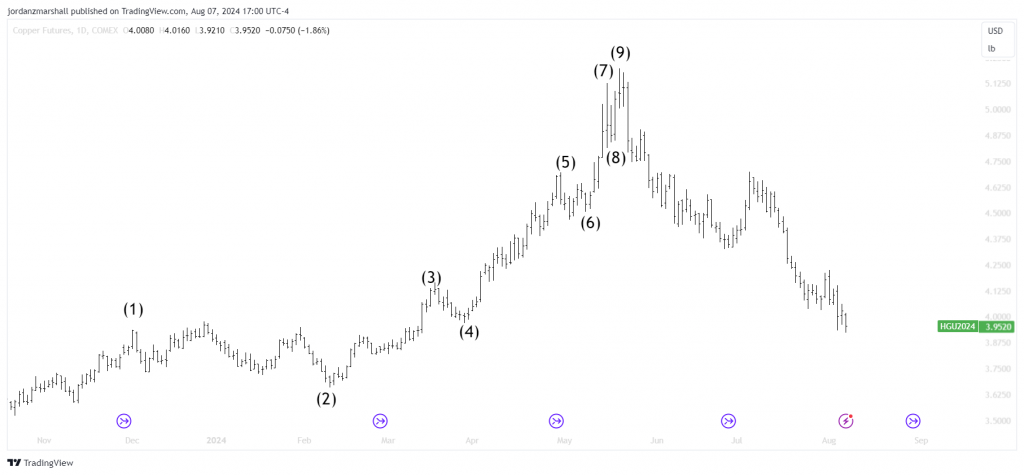

This is what we look for in an impulse wave, because they always subdivide into 5-9-13 waves, and then keep adding 4 from there. Another way to count this is 9-waves pictured below:

Copper chart with a 9-wave count.

Trend Lines

After the impulse wave ends, we then look for a correction. These occur in 3-7-11 waves instead of 5-9-13. A trend line usually aids in telling when an impulse wave ends. Pictured here is the same chart with trend lines attached. This shows support from 27 March 2024 to 08 May 2024. Price broke through that level and fell rapidly:

Copper chart with trend lines and wave-counts.

I’ve also added a new-trend line showing the trend line I see from the top. This pivots off of the top of 20 May 2024 and 10 July 2024, This is the current trend we are in. We have 3-waves down now but are still within the same downward trend-line. After we break this upward with 3-7 or 11 waves, we could be in the next bull-market.

Trend lines when combined with Elliott Wave, and correlations can be very effective. In this situation the best-fitting trend line is drawn from the pivots of June 2024, and August 2024. Price closing below this line helped to identify a downturn in HG. Trend lines are rough estimates though and are best combined with other techniques to identify tops and bottoms.

Utilizing a set of tools to predict markets can drastically improve your cohesion and profits when interacting with it. These 2 tools, trend lines, and wave counting are really good to use in the market. They are also simple to use. Next time you’re wondering when a trend will reverse, try these two tools out and make better informed decisions.

More By This Author:

QQQ Completed A Cycle Expecting To Resume The RallyDeckers Outdoor Favors Sideways Correction Before Rally Again

Oil Should Continue Lower To Build An Impulsive Structure

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more