The Fed Worries About Inflation. Should We Worry About Gold?

Oops!... Gold did it again and declined below $1,800 last week. What’s happening in the gold market?

Image Source: Pixabay

Did you enjoy your roast turkey? I hope so, and I hope that its taste – and Thanksgiving in general – sweetened the recent declines in gold prices. As the chart below shows, the price of the yellow metal (London P.M. Fix) plunged from above $1,860 two weeks ago to above $1,780 last week. It has slightly rebounded since then, but, well, only slightly.

What exactly happened? Funny thing, but actually nothing revolutionary. After all, the reappointment of the same man as the Fed Chair and the publication of the FOMC minutes from the meeting that had already took place earlier in November, were the highlights before Thanksgiving.

Well, sometimes lack of changes is a change itself and information about the past can shed some light on the future. Let’s start from Powell’s renomination for the second term as the Federal Reserve chair. In response, the market bets that the Fed will hike interest rates more aggressively in 2022 have increased. At first glance, the strong investors’ reaction seems strange, given that the monetary policy shouldn’t radically change with Powell still at the helm.

However, the continuation of Powell’s leadership implies that Lael Brainard, regarded as more dovish than Powell, won’t become the new Fed Chair – what was expected by some market participants. Hence, the dovish scenario won’t materialize, which is hawkish for gold.

Just two days later, the FOMC revealed the minutes from its November meeting. The main message – the Fed decided to taper its quantitative easing – was, of course, included in the post-meeting statement. The minutes revealed, however, that the Fed officials had become more worried about inflation and had expressed a more hawkish stance than the statement suggested.

First of all, we learned from the minutes that some central bankers opted for more aggressive tapering and a more flexible approach that would allow for adjustments in the face of high and persistent inflation:

Some participants preferred a somewhat faster pace of reductions that would result in an earlier conclusion to net purchases (…). Some participants suggested that reducing the pace of net asset purchases by more than $15 billion each month could be warranted so that the Committee would be in a better position to make adjustments to the target range for the federal funds rate, particularly in light of inflation pressures. Various participants noted that the Committee should be prepared to adjust the pace of asset purchases and raise the target range for the federal funds rate sooner than participants currently anticipated if inflation continued to run higher than levels consistent with the Committee's objectives (…) participants noted that the Committee would not hesitate to take appropriate actions to address inflation pressures that posed risks to its longer-run price stability and employment objectives.

This is because the FOMC members’ concerns about inflation strengthened. As we can read in the minutes,

They indicated that their uncertainty regarding this assessment had increased. Many participants pointed to considerations that might suggest that elevated inflation could prove more persistent. These participants noted that average inflation already exceeded 2 percent when measured on a multiyear basis and cited a number of factors—such as businesses' enhanced scope to pass on higher costs to their customers, the possibility that nominal wage growth had become more sensitive to labor market pressures, or accommodative financial conditions—that might result in inflation continuing at elevated levels.

Last but not least, the Fed officials also made other hawkish comments. Some participants argued that labor force participation would be lower than before the pandemic because of structural reasons. It implies that we are closer to reaching the “full employment”, so monetary policy could be less accommodative. What’s more, “some participants highlighted the fact that price increases had become more widespread”, while a couple of them noted possible signs that inflation expectations had become less anchored. So, the Fed officials’ worries about inflation strengthened.

Implications For Gold

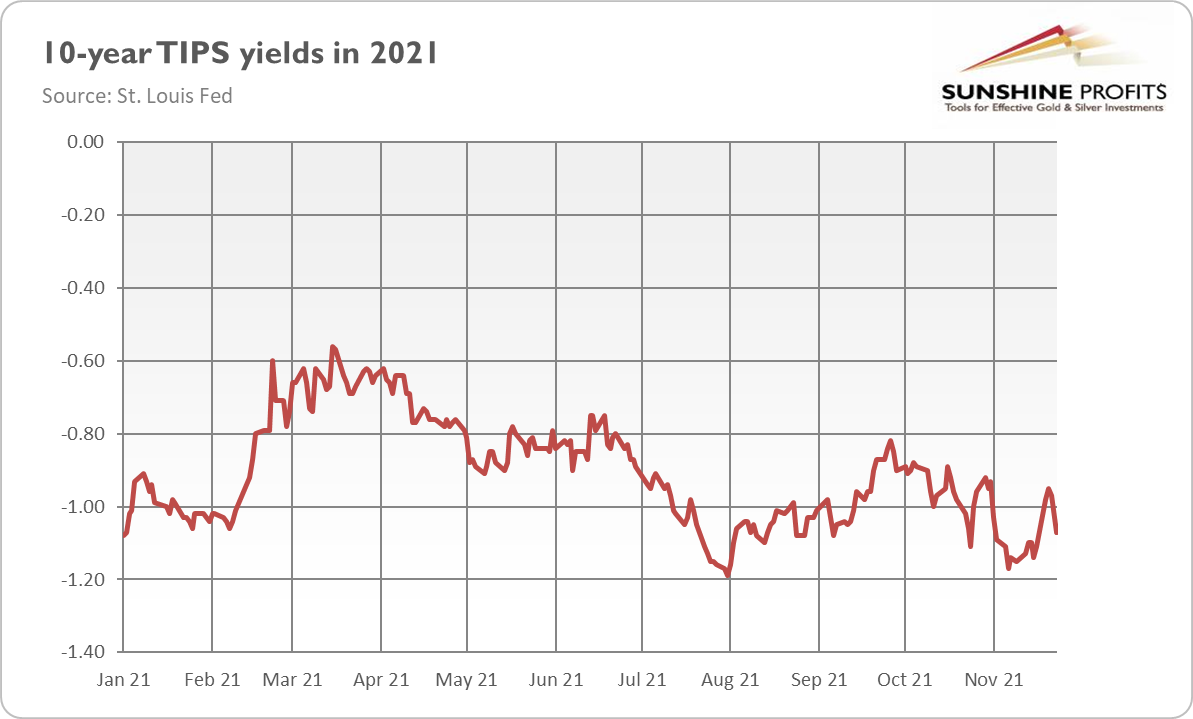

What does it all imply for the gold market? Well, both the reappointment of Powell as the Fed Chair and the latest FOMC minutes were interpreted as hawkish, which pushed gold prices down. The more upbeat prospects for monetary tightening are clearly negative for the yellow metal, as they boosted the bond yields (see the chart below).

This is something I warned investors against earlier this month. I wrote in the Fundamental Gold Report on November 16 that “when something reaches the bottom, it should rebound later. And if real interest rates start to rally, then gold could struggle again.” This is exactly what happened. Later, in the article on November 18, I added that “I will feel more confident about the strength of the recent rally when gold rises above $1,900”.

Well, gold failed to do this, so I’m not particularly bullish on gold right now. We could say that gold did it again: it played with the hearts of gold bulls but got lost in the game, as it didn’t resist the pressure.

Yes, the new Omicron variant of coronavirus has been noted, and uncertainty about this strain could provide short-term support for the yellow metal. However, it seems that the prospects of monetary tightening and higher real interest rates will continue to put downward pressure on gold prices. I agree, the rally looked refreshing after months of disappointment. However, it seems that we have to wait longer, possibly for the start of the Fed’s increasing the interest rates, to see gold truly shining.

Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) ...

more

Good read, thanks.