The Drifters

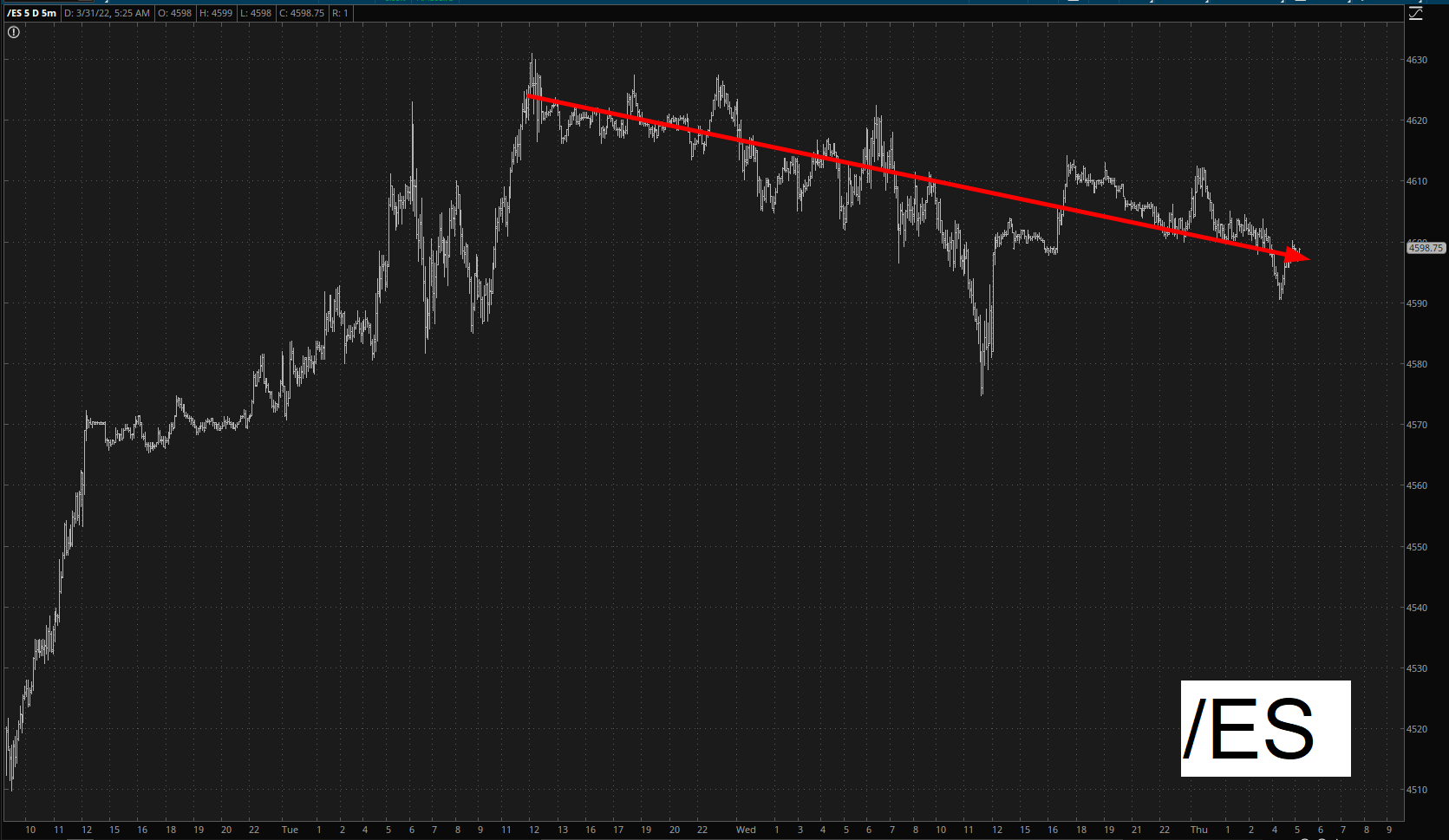

Good morning, everyone. Well, this quarter is ending not with a bang but a whimper. The S&P futures are up a few hundreds of a single percentage point, and the Russell small cap futures are down by the same amount. A whole lot of nothing. The /ES has been in a very slow drift lower since yesterday’s peak.

(Click on image to enlarge)

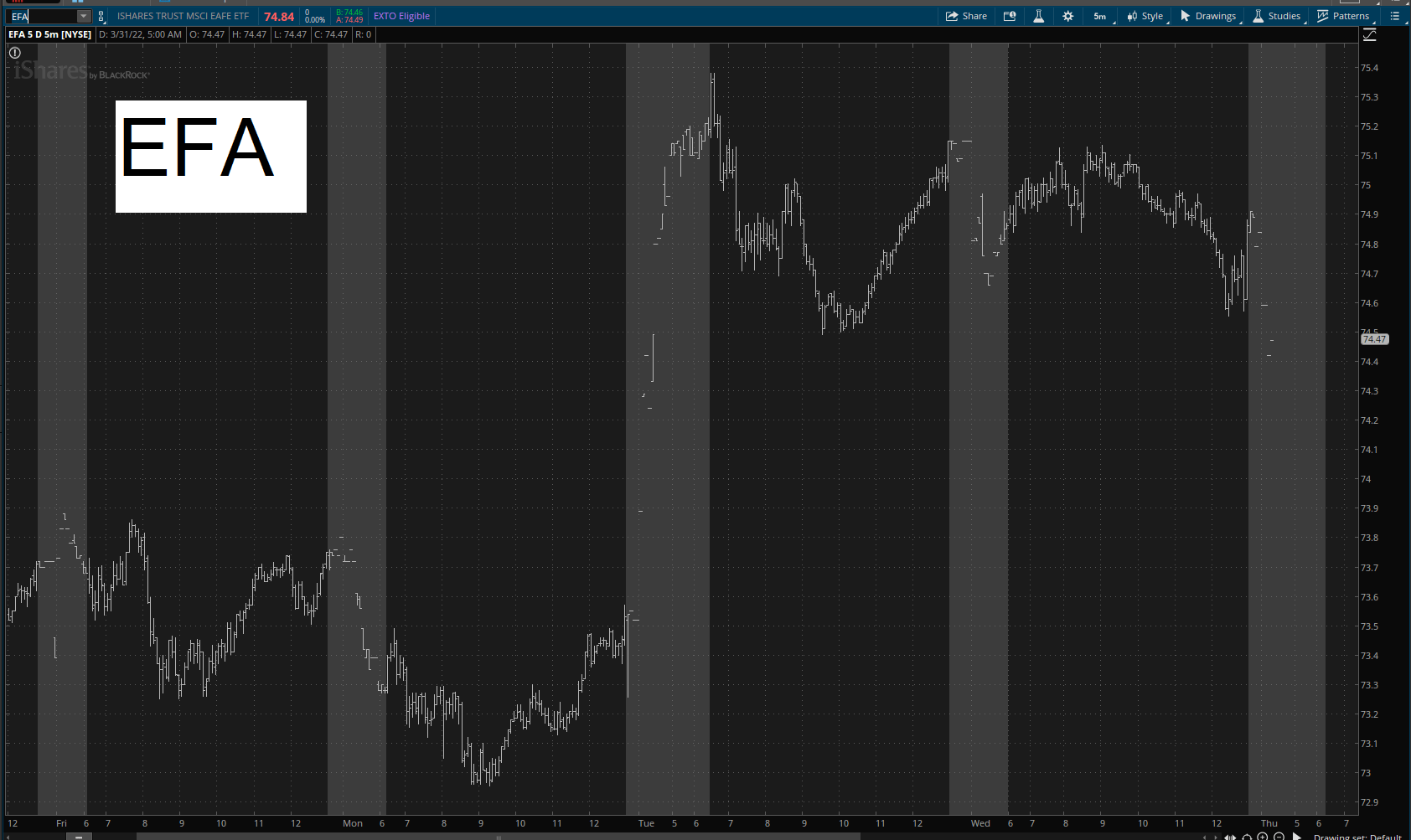

My fixation on the not-the-U.S. markets continues, with EFA continuing as my all-time favorite. This is looking at a weak opening bell.

(Click on image to enlarge)

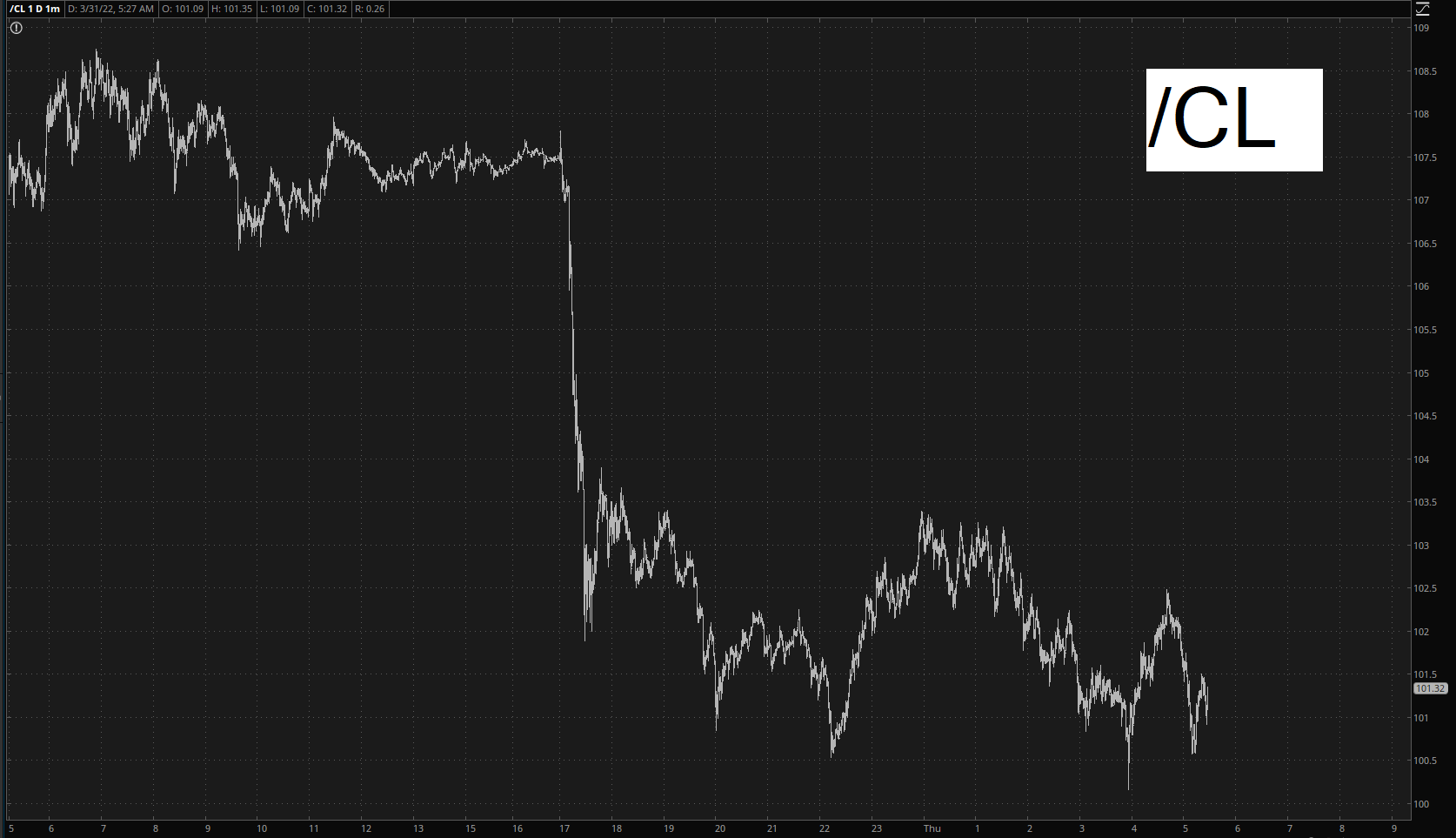

The federal and various state governments continue to grapple with surging energy prices, with the latest shot-in-the-dark being the threat to release large quantities of the nation’s strategic petroleum reserves (which, I dunno, we might want to keep safely in storage in case there’s an actual serious crisis on our own shores one day) and that is zapping crude oil prices hard.

(Click on image to enlarge)

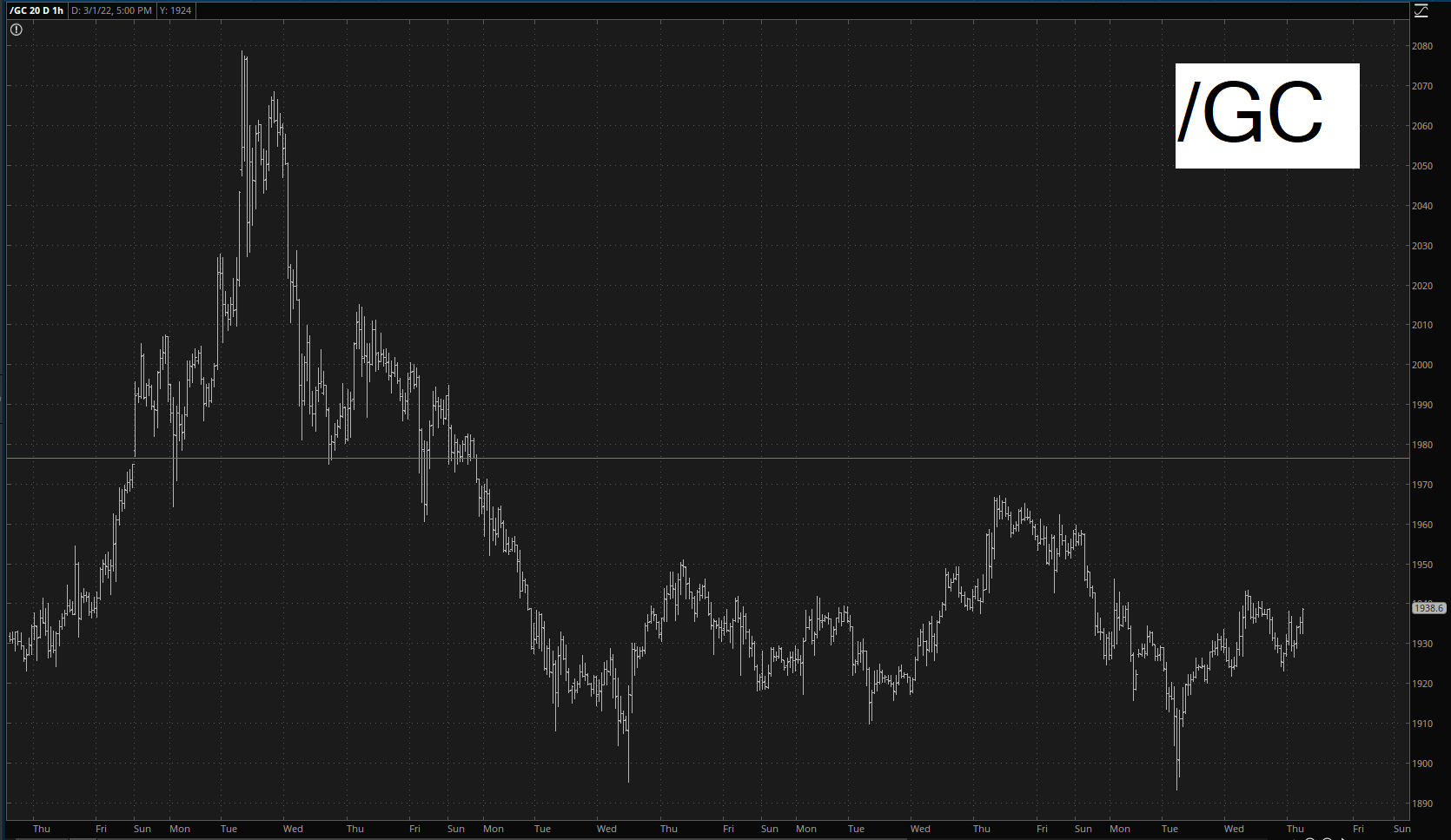

However, I’m pleased to see that gold was able to shake off its weakness last night and has flipped green on us.

(Click on image to enlarge)

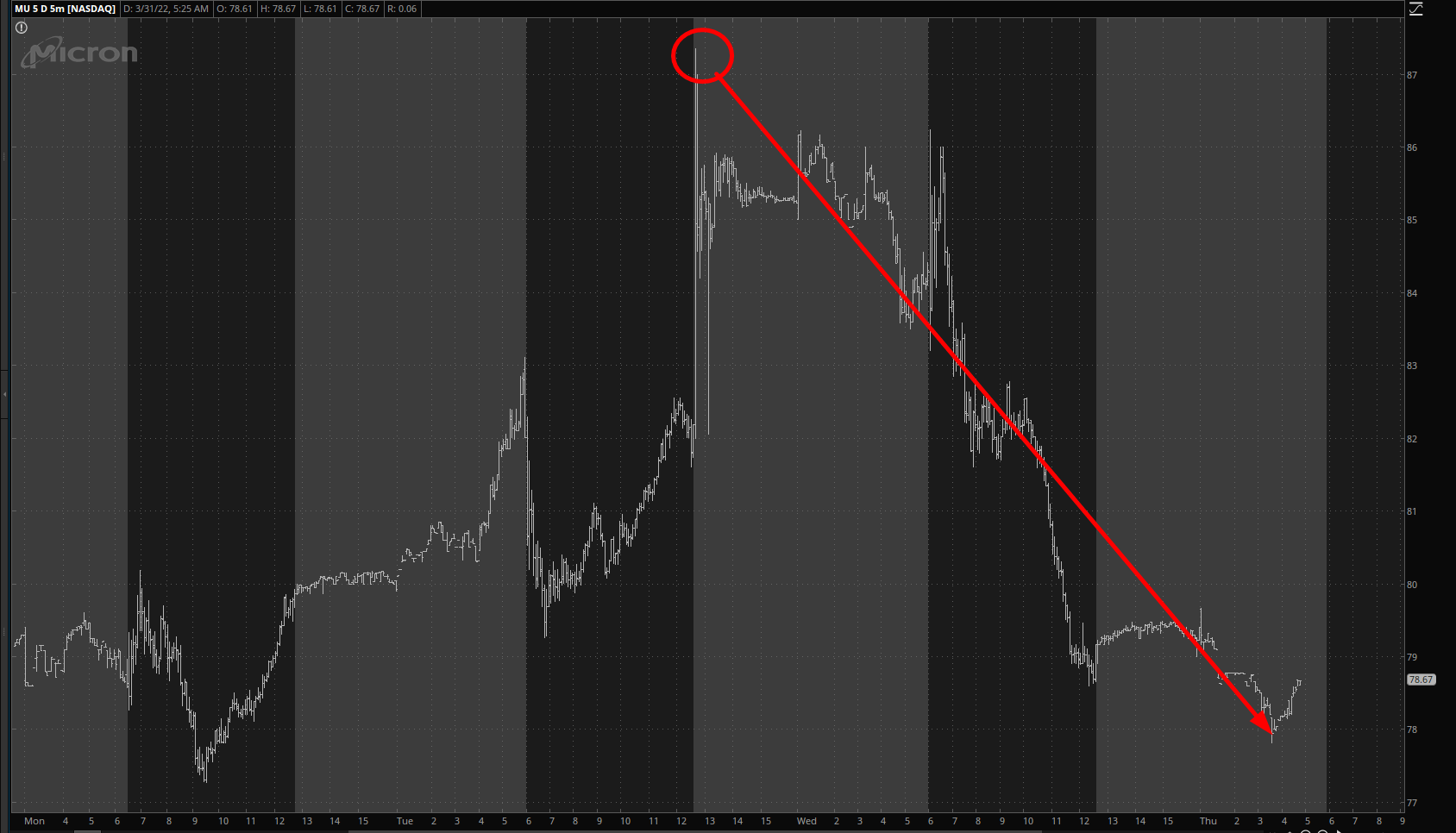

I’ll be glad to see this quarter-end and turn our eyes in a few weeks to earnings season, which I infinitely prefer to the random-war-news driving prices. I have a strong hunch that we’re going to witness what happened with Micron this week hundreds of times in April – – that is, earnings that are initially embraced with huge amounts of buying, only to be countered with a dawning realization that, gee, maybe things aren’t so peachy.

(Click on image to enlarge)

Good luck today, and we finally put Q1 2022 to bed.