The Dollar Breakdown Is Underway

Image Source: Pixabay

The dollar is weakening and on the cusp of breaking down from the channel pattern it has traded in since 2008, signaling the start of a new secular bear market.

The U.S. Dollar Index fell 0.73% yesterday and is starting to break down, as I had been expecting and writing about. I’m publishing this quick update to show you where things currently stand.

As of yesterday, that move may finally be starting to unfold. This has big implications for precious metals because the dollar is a major influence on them and trades inversely with them.

Back in April, the U.S. Dollar Index broke below the critical 100 level, which had served as a key technical support going back to 2023. That breakdown signaled that further weakness was likely ahead.

Since then, the Dollar Index has been consolidating as it awaits clarity on two major factors: the pace and extent of upcoming Fed Funds Rate cuts, and who President Trump will nominate to replace Jerome Powell as the next Fed chair.

But over the past few days, and especially after yesterday's sharp slump, which was driven by growing speculation of additional rate cuts in the near future, the Dollar Index has started to break down from the seven-month consolidation pattern.

The next key confirmation would be a decisive close below the 96 support level that formed at the July 1st low. That is important because horizontal support levels generally carry more weight than diagonal ones. If that breakdown occurs, it would signal the start of the next major leg down, accompanied by a significant increase in volatility.

(Click on image to enlarge)

Yesterday's decline puts the U.S. Dollar Index on the cusp of breaking down from the long-term rising channel it has traded within since 2008. That would be a key signal that the dollar is entering a new bear market, similar to the one that occurred in the early 2000s. That would be extremely bullish for precious metals and commodities.

Assuming such a breakdown occurs, the next immediate level to watch is the support at 90. This level was formed by multiple peaks and lows dating back to 2008, making it a critical and long-established level that is likely to draw the index toward it like a magnet.

(Click on image to enlarge)

Another factor that is likely to pull the dollar lower, and that also serves as a useful indicator of which direction the dollar may break, is U.S. Treasury yields. These yields are positively correlated with the U.S. Dollar Index.

When U.S. yields decline relative to bond yields in other countries, the dollar tends to weaken because it is less attractive to move capital into the United States in search of yield. Conversely, when U.S. yields rise relative to global yields, the dollar typically strengthens as it becomes more appealing for investors to direct capital into the United States.

The chart below shows the U.S. 2-Year Treasury Note yield, which has formed a descending triangle pattern. This is typically a bearish setup and is occurring at the same time as a volatility squeeze, both of which indicate that a significant move in interest rates is likely.

Since Treasury yields are closely tied to the U.S. dollar, any major move in rates should affect the dollar as well.

If the chart breaks down convincingly below the 3.5% support level, it would be a strong signal that both yields and the dollar are heading lower. It would also be a strong indication that a recession is approaching.

(Click on image to enlarge)

Further confirmation that the U.S. dollar may be on the verge of a new secular bear market can be seen in the monthly chart of the euro.

The euro recently broke out of a long-term falling channel that stretches back to 2008, a strong signal that a new bull market in the currency has begun.

(Click on image to enlarge)

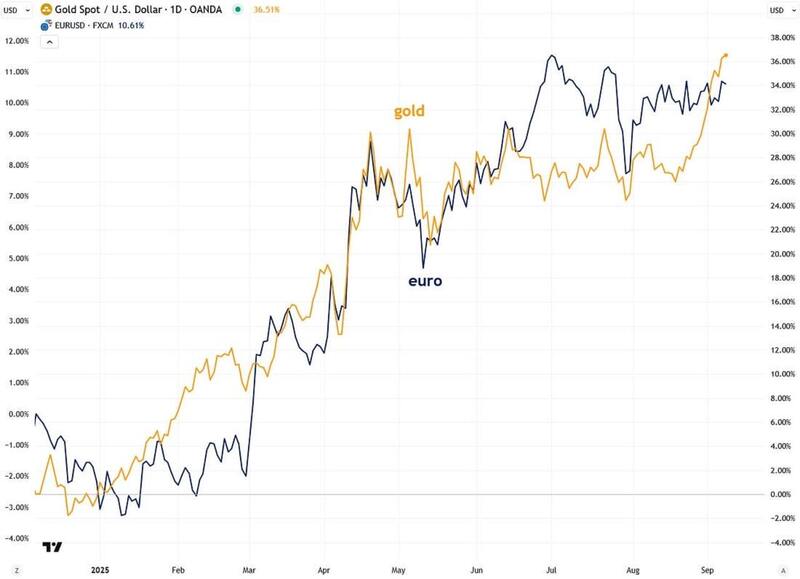

As the chart below shows, the euro and gold often move in lockstep, which means that insights into the euro’s direction can also provide valuable clues about where gold may be headed.

(Click on image to enlarge)

To wrap things up, the U.S. dollar and euro are starting to move as I’ve been expecting, and the start of a new bear market in the dollar, once fully confirmed by a solid close below the 96 support level, would have major bullish implications for precious metals and commodities in general.

What the dollar does next will largely depend on Wednesday’s Fed meeting and whether the Fed cuts rates by 25 or 50 basis points, as well as the comments made by Fed Chair Jerome Powell.

After that, the market will shift its focus to incoming economic data to determine whether additional rate cuts are likely at the October Fed meeting and to what extent. I will be watching this situation closely and keeping you updated.

More By This Author:

Gold & Silver Officially Confirm Their BreakoutsWhy Silver May Hit $50+ In September

A Major Move Is Ahead For Interest Rates

For the author's full disclosure policy, click here.