The Dollar And Oil

“Davidson” submits:

These are interesting times. The past few days have added to the positives of extending the business cycle. Something to watch carefully to see how it all develops.

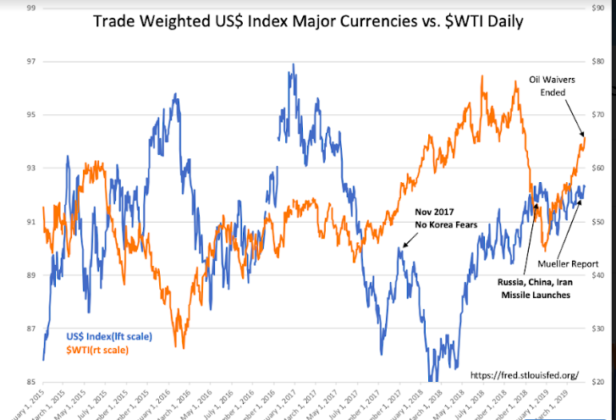

On the Mueller Report, the US$ has risen a little, but the real story is today’s news that oil waivers to give time to global users to establish non-Iranian oil suppliers are ending May 2nd. The Mueller Report added some strength to the US$ which indicated in my opinion that the current administration’s political position had been strengthened in regards to global capital shifts. The sharp reaction to ending waivers to buy Iranian oil resulted in sharply higher $WTI. This is an indication that the world has increased its belief that current administration’s policies are meaningful.

(Click on image to enlarge)

The US has gained in its global negotiating position against autocratic governments and support for pro-Democratic principles in my opinion. The US tariff reduction effort has gained support by these actions.

These recent events are positive for US companies long-term and likely to extend the current economic cycle. This is especially if the policy to reduce global tariffs is successful.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more