The Bullish Case For Platinum

After fifteen years of stagnation, platinum has woken up in a big way with an impressive 50% surge over the past four months. Even more exciting, this bull market may just be beginning.

Platinum is a dense, malleable, ductile, and highly unreactive precious metal with a silver-white sheen. It’s also one of the rarest elements in Earth’s crust—roughly 30 times rarer than gold.

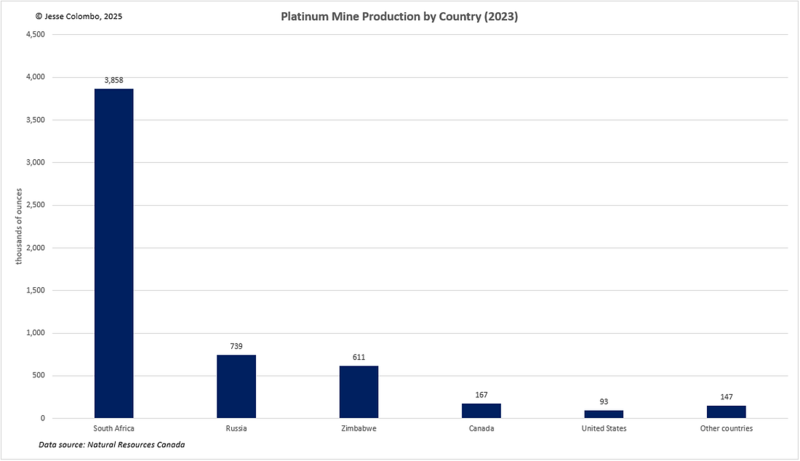

About 90% of global production comes from a handful of regions, including Russia’s Ural Mountains, Colombia, Canada’s Sudbury Basin, and especially South Africa, which holds the largest reserves. Due to its scarcity, only a few hundred metric tonnes are produced annually.

This limited supply, combined with its critical industrial and investment applications, makes platinum both highly valuable and a key precious metal commodity.

Thanks to its unique physical and chemical properties, platinum is heavily used in industrial and automotive applications. It plays a vital role in catalytic converters, laboratory equipment, electrical contacts and electrodes, platinum resistance thermometers, dental instruments, and the glass industry. Platinum is also popular in jewelry, especially when gold prices are high, as they are now.

With gold trading at $3,766 an ounce and platinum at just $1,480, many consumers—particularly in China—are turning to platinum as a more affordable yet elegant alternative.

Unlike gold and silver, which have long histories as monetary metals used in coinage, currency backing, and investment, platinum was only discovered and understood relatively recently in the 18th century.

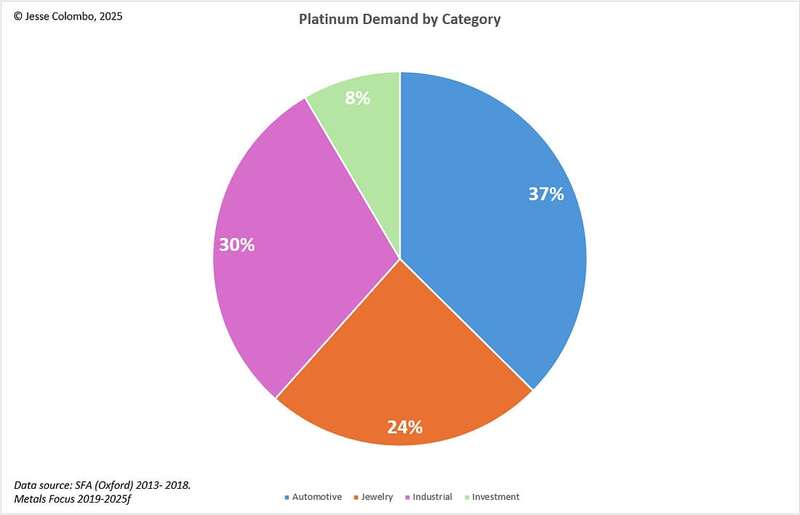

It has seen virtually no use as money, and only about 8% of its demand comes from investment. The remaining 92% is driven by other applications: automotive catalytic converters (37%), industrial uses (30%), and jewelry (24%), as illustrated in the pie chart below.

Owing to its substantial demand from industrial sectors, automotive applications, and jewelry, platinum exhibits high sensitivity to economic cycles, significantly more so than gold or silver.

This sensitivity is one reason I’ve been less enthusiastic about platinum, especially as I actively anticipate and prepare for a major economic crisis. Consequently, I’ve favored gold and silver more heavily.

That said, I remain optimistic about platinum’s future and consider it an excellent portfolio diversifier for larger portfolios with a strong foundation of gold bullion for stability, complemented by some silver.

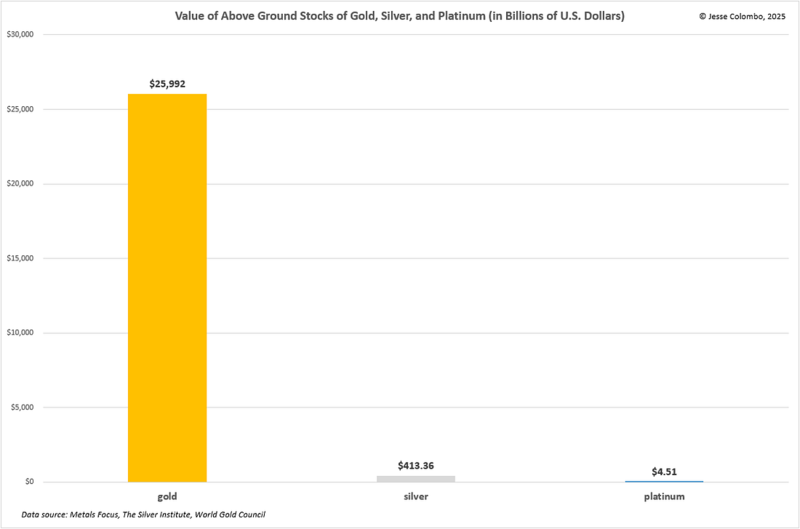

I want to highlight the remarkably small size of the global platinum market compared to gold and silver, a factor that contributes to its greater volatility and choppiness, while also presenting significant upside potential when conditions align favorably.

The total value of above-ground gold stock stands at an impressive $26 trillion, silver at $413.36 billion, and platinum at a mere $4.51 billion, as shown in the chart below. This small scale is one of the reasons why central banks and major institutional investors largely overlook platinum, favoring gold as their preferred asset.

The platinum market's volatility is further amplified by its heavy reliance on mine production concentrated in a few countries.

South Africa leads with 3.86 million troy ounces mined in 2023, followed distantly by Russia with 739,000 troy ounces and Zimbabwe with 611,000 troy ounces, while the U.S. contributed a modest 93,000 troy ounces.

This dependence on nations susceptible to labor strikes and geopolitical instability introduces significant uncertainty and price volatility to the platinum market.

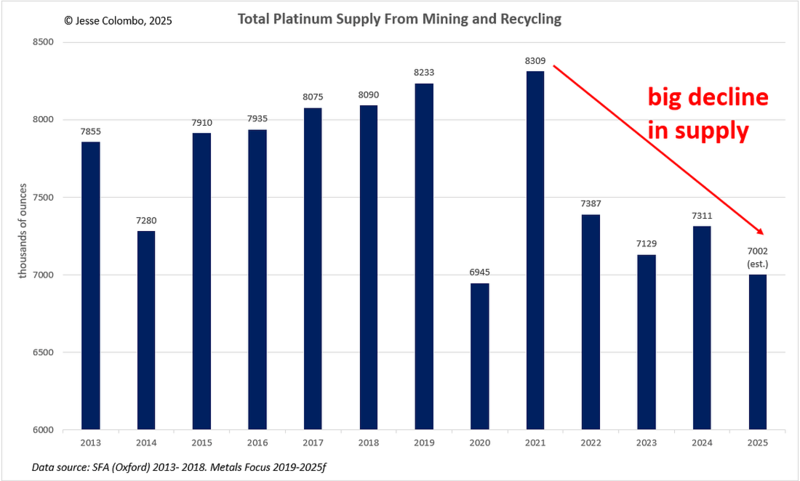

One key driver behind the recent surge in platinum prices (which I’ll explore in greater detail shortly) and a cornerstone of the bullish case for platinum is the significant decline in supply from both mining and recycling. This supply has dropped by approximately 1.3 million troy ounces, or roughly 16%, since its 2021 peak, influenced by multiple factors.

In South Africa, the leading producer, persistent electricity shortages, labor strikes, escalating operational costs, and insufficient investment in new capacity have caused major supply disruptions. Similarly, Russia, the second-largest producer, has faced challenges due to international sanctions stemming from the Ukraine conflict.

Another contributing factor is the global decline in average ore quality, as high-grade deposits are exhausted, requiring increased effort and higher costs to extract the same quantity of platinum, which gradually erodes supply over time.

Additionally, the low platinum prices in recent years (as I’ll show shortly) have rendered mining less profitable, further suppressing mine supply.

While the global supply of platinum has declined over the past five years, demand has remained robust, even amidst concerns about reduced need for platinum in automotive catalytic converters due to the rising popularity of electric vehicles.

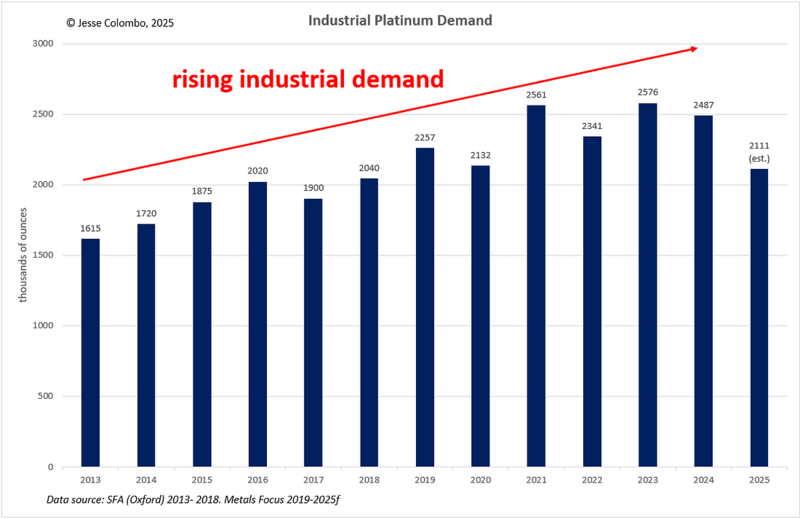

A key growth area for platinum demand over the past decade has been the industrial sector, which constitutes approximately 30% of total demand, as highlighted earlier.

This increase is driven by global economic growth, surging demand in glass manufacturing, the medical sector, and platinum’s expanding role in hydrogen fuel cell electric vehicles (FCEVs), a component of the green energy transition.

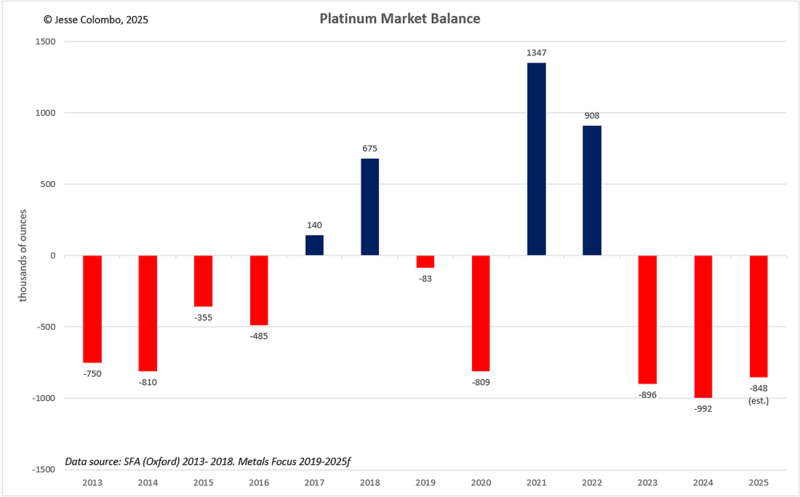

The shrinking supply of platinum, coupled with sustained demand, has driven the platinum market into a deficit of nearly 1 million ounces over the past two years, with a similar shortfall anticipated for the current year.

This deficit, and the growing recognition that it is unlikely to improve soon, has been an important catalyst for platinum’s remarkable surge over the past four months, with prices rising approximately 48% to $1,480 per ounce. I will explore this trend in greater detail in the upcoming technical analysis section of this report.

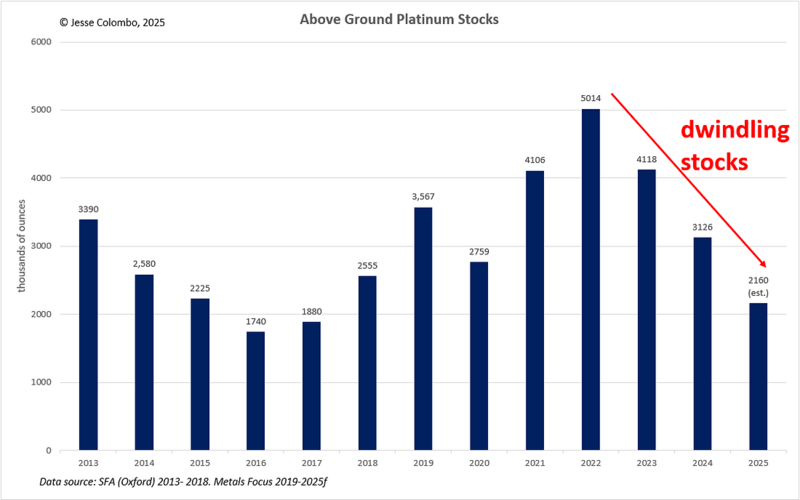

Not surprisingly, the platinum deficits of recent years have led to a substantial decline in above-ground stocks, dropping from a peak of approximately 5 million ounces in 2022 to an estimated 2.16 million ounces this year—a striking 57% reduction in just a few years. This development exacerbates the already tight platinum market, which is inherently small, with above-ground stocks valued at just $4.51 billion, as noted earlier.

This limited supply means that even relatively modest investment capital could acquire a significant portion of the available stock, driving prices sharply higher. For large institutions and investors, this would be akin to an elephant leaping into a kiddie pool, causing water to splash dramatically in all directions.

Now let’s transition to the technical analysis section of this report. Platinum has surged nearly 50% since its rally began on June 20th. After that sharp move, it paused over the summer and formed a triangle pattern, which it broke out of today. This is a bullish signal.

The final confirmation I am watching for is a breakout above the $1,480 resistance level, shown in light blue, which was established at the highs on July 18th and 21st. Clearing that level is important because breakouts from horizontal resistance carry more significance than those from diagonal levels such as the top of the triangle.

Several catalysts have fueled platinum’s recent breakout after 15 years of stagnation. Chief among them is the powerful bull market in gold and now silver, both of which have reignited investor enthusiasm for the precious metals sector.

Additionally, as discussed earlier, the increasing recognition that platinum market deficits are likely to persist in the foreseeable future has played a pivotal role.

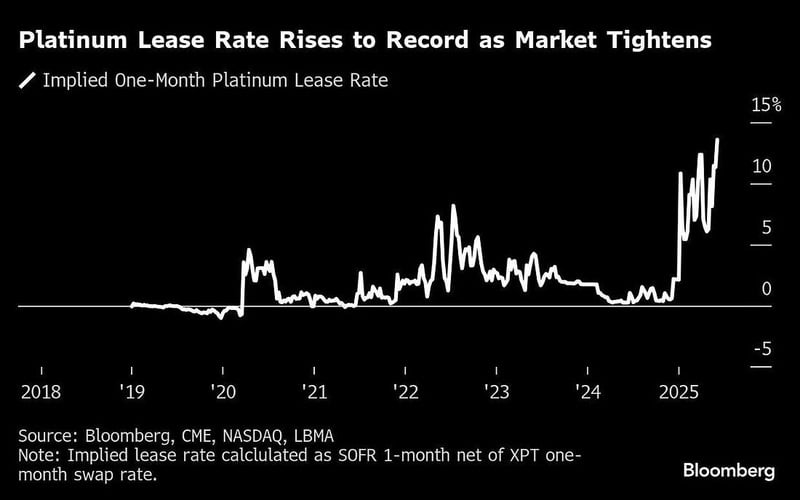

This supply tightness, coupled with the price surge, has driven lease rates in London and Zurich vaults to multi-year highs, signaling a scramble for platinum.

Furthermore, a significant portion of this recent rally is technically driven, a common occurrence when an asset breaches a key resistance level or price pattern, such as platinum’s three-year triangle formation that I will show shortly.

A look at platinum’s weekly chart shows that it broke out of a long-term triangle pattern in May. That pattern had been forming since 2022 and its breakout marked the beginning of a new bull market.

Triangle patterns indicate a volatility squeeze, where the asset is compressed like a coiled spring, poised to release with substantial energy upon breaking out.

Stepping back to examine the longer-term monthly chart reveals that platinum recently broke above the $1,200 to $1,300 resistance zone, which is a clear sign of strength. That zone has now turned into support.

The next major target and challenge lies in the $1,700 to $1,900 resistance zone overhead. A breakout above that level would provide another key bullish confirmation.

So far, I have outlined the bullish fundamental case for platinum, focusing on the persistent deficits, as well as the technical case, and now I aim to demonstrate how undervalued platinum remains across various metrics. The potential for its price to realign with historical norms further bolsters the bullish outlook, even without any changes in the supply and demand dynamics.

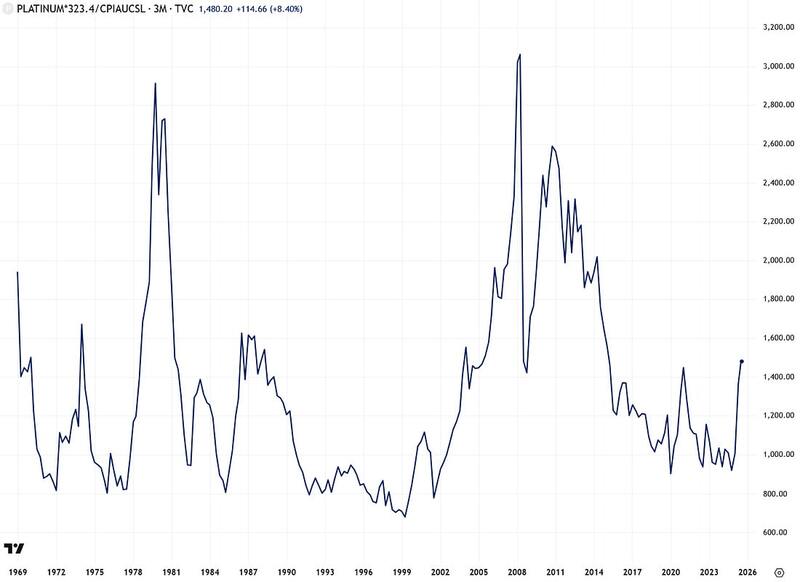

The first metric I will highlight is the real or inflation-adjusted price of platinum, tracing back to the 1960s. As depicted in the chart below, despite the recent surge, platinum remains near the lower end of its historical real price range.

With its current price at $1,480 per ounce, it is roughly half the approximately $3,000 it reached during the late 1970s and late 2000s. This indicates that platinum has considerable potential for further price appreciation.

Moreover, the historically low prices over the past decade have been a major factor behind the decline in global mine output. At those levels, mining became far less profitable, especially with the sharp increase in operating costs caused by inflation.

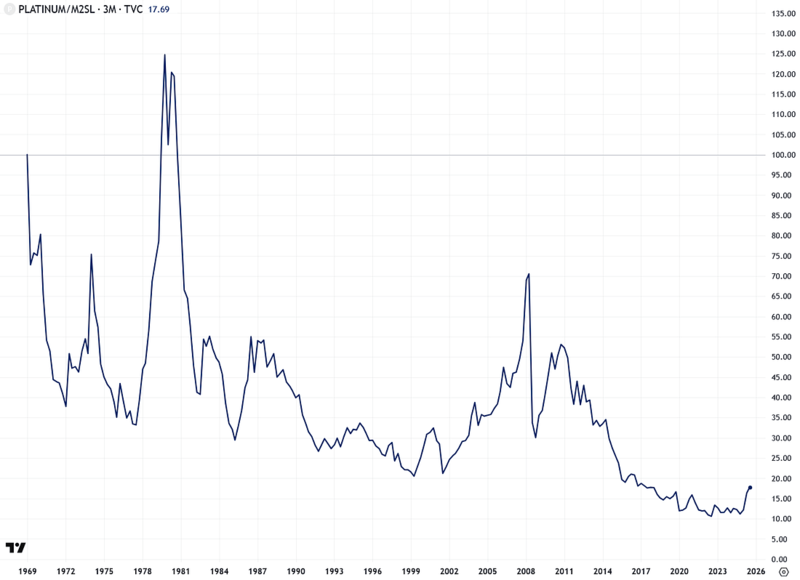

Additional evidence of platinum’s current undervaluation is evident in the platinum-to-U.S. M2 money supply ratio, which is near its lowest levels over the past five decades. I frequently compare asset prices to the M2 money supply to assess whether they are keeping pace with monetary inflation, and in this instance, platinum has clearly lagged.

(In this chart, I indexed the ratio to a base value of 100 in the year 1969 to create a more intuitive and visually meaningful price scale.)

The resurgence of M2 money supply growth in the U.S. and globally since late-2023 has been a significant catalyst for the broader precious metals bull market during this period.

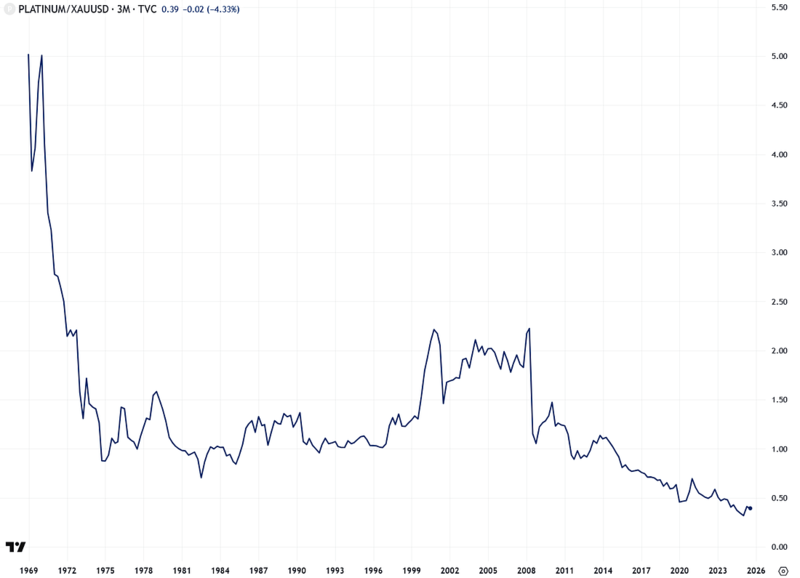

Comparing precious metals such as platinum and silver to the leading precious metal, gold, provides valuable insight into their relative valuation, whether they are historically undervalued, overvalued, or fairly priced.

In this case, platinum is trading near its lowest levels relative to gold since the 1960s, reinforcing the view that it is undervalued and offers substantial potential for future price appreciation.

Since the start of the millennium, gold and silver have dramatically outperformed platinum, contributing to its current undervaluation relative to gold.

Over this period, gold has gained around 1,400%, silver approximately 750%, while platinum has risen by just over 300%. Nevertheless, this condition is likely to reverse as platinum’s bull market gains traction and its valuations return to historical norms.

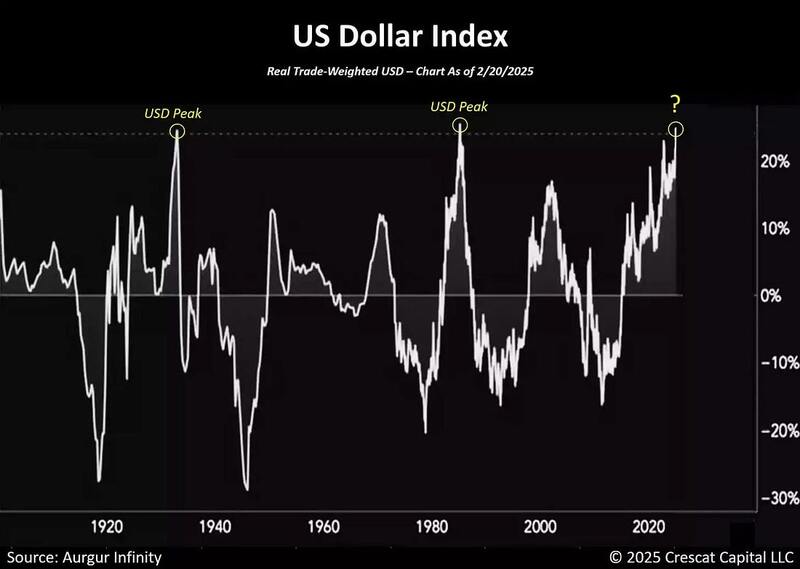

Another significant catalyst poised to drive all precious metals, including platinum, higher is a potential bear market in the U.S. dollar.

The dollar and commodities, including precious metals, typically move inversely, meaning a bearish trend in the dollar is bullish for commodities, and vice versa.

In April, the U.S. Dollar Index broke below the key 100 support level, which has now turned into resistance. With the index trading below this critical threshold, the probability of continued weakness has increased, and the 90 level now stands out as the next likely downside target.

I foresee a substantial bear market for the dollar in the near future, driven by its extreme overvaluation relative to more than a century of historical data. Such pronounced overvaluation has only occurred twice before, in 1933 and 1985, and each time it was followed by substantial dollar declines.

The dollar’s unusual strength in recent years has been a major factor keeping commodity prices, including platinum, much lower than they would ordinarily be. However, an impending correction in the dollar’s value should trigger a powerful bullish surge across the commodities sector, including assets like copper, gold, silver, platinum, and mining stocks.

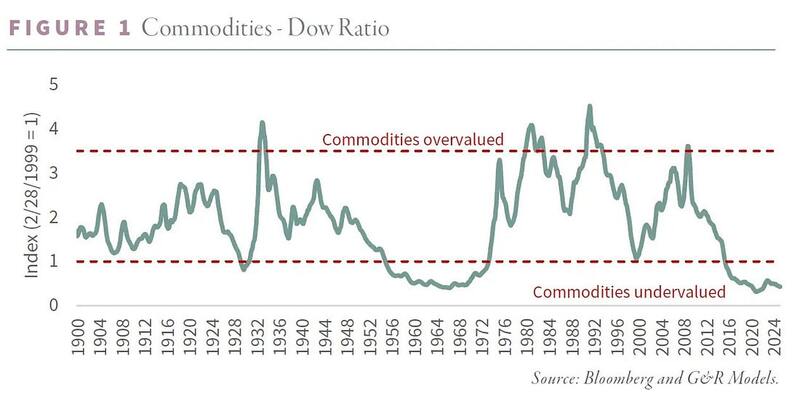

Multiple metrics indicate that commodity prices are currently exceptionally undervalued, aligning platinum’s low prices with this broader trend (as well as silver’s). One key metric is the commodities-to-Dow ratio, which highlights that commodities remain significantly undervalued compared to stocks.

However, I anticipate this unusual condition will soon normalize through a robust commodities boom or supercycle—reminiscent of the early 2000s—and a notable correction in equity markets.

This aligns with my broader view that we’re in the early stages of a major capital rotation out of overvalued stocks and into still-undervalued precious metals.

In addition to the commodities-to-Dow ratio shown above, I created a long-term logarithmic chart of the platinum-to-Dow ratio, which reveals that the metal is currently at near-record lows relative to stocks.

Notably, it has recently broken above the downtrend line that has been in effect since 2011, marking a bullish development. It’s worth highlighting that the last time the platinum-to-Dow ratio broke above a downtrend line, at the start of the millennium, it led to an impressive nearly 500% price increase over the subsequent seven years.

Having outlined the bullish case for platinum, I now turn to exploring various methods to gain exposure to it. Options range from the most straightforward—physical bullion bars and coins—to exchange-traded funds (ETFs), futures and other derivatives, and mining stocks.

My preference leans toward physical bullion, supplemented with selective exposure to mining stocks for those with a higher risk tolerance, given their volatility. I favor holding bullion in my own possession as the most resilient strategy, especially in light of the challenging and turbulent global economic conditions I foresee ahead.

When it comes to bullion, as an American, I particularly favor the U.S. Mint’s 1 oz American Platinum Eagle coins.

However, other renowned mints, such as the Royal Canadian Mint, the UK’s Royal Mint, and Australia’s Perth Mint, also produce their own high-quality platinum bullion coins. For those seeking to purchase larger quantities at reduced premiums, platinum bullion bars are a viable option.

It’s advantageous to acquire bullion, including platinum, at low premiums, which may require sleuthing around among various bullion dealers. A valuable resource for this purpose is FindBullionPrices.com, which facilitates price comparisons across multiple dealers.

Alternative avenues for investing in platinum include exchange-traded funds (ETFs), with only two available in the U.S.: the more popular abrdn Physical Platinum Shares ETF (PPLT) and the lesser-known GraniteShares Platinum Trust (PLTM).

While ETFs offer convenience, I approach them with caution in the current climate due to their increased complexity and counterparty risk, which undermines many of the inherent benefits of precious metals.

Another option is futures trading; however, I do not recommend this approach, as it caters more to short-term traders than long-term investors, demands a high level of expertise, and carries heightened risk given platinum’s status as one of the most volatile assets, making futures trading particularly perilous.

Another avenue for investment is platinum mining stocks, which I am interested in; however, the limited number available in the U.S. often necessitates purchases through the less transparent over-the-counter (OTC) market or Canadian exchanges, requiring a higher level of investor expertise.

To summarize, there are compelling reasons to adopt a bullish stance on platinum, including the persistent deficits of recent years and those projected for the foreseeable future, the favorable technicals such as the recent breakout, its demonstrated undervaluation relative to inflation, gold, the M2 money supply, and stocks, as well as the strong possibility of an impending U.S. dollar bear market, which could soon trigger another commodities supercycle akin to the early 2000s—a development that would be highly bullish for precious metals, including platinum.

Although platinum exhibits significant volatility and sensitivity to economic cycle fluctuations, I believe it deserves a place in portfolios, provided they are built on a solid foundation of gold bullion and supplemented with some silver, alongside high-quality mining stocks for enhanced upside potential.

More By This Author:

The Dollar Breakdown Is UnderwayGold & Silver Officially Confirm Their Breakouts

Why Silver May Hit $50+ In September

For the author's full disclosure policy, click here.