The Bullish Case For Palladium

Image Source: Pixabay

Palladium, like platinum, is undervalued and is well-positioned to launch into a bull market of its own as it follows the powerful and still-developing precious metals bull market.

While gold and silver have rightfully been in the spotlight lately, I want to briefly shift gears and highlight the opportunity in another underappreciated precious metal: palladium.

Both platinum and palladium are part of a group known as the platinum group metals (PGMs), which share similar chemical properties, industrial applications, rarity, and historically high prices. Recently, both metals have seen sharp price increases as they join the broader bull market in precious metals that began in early 2024.

Palladium is a lustrous silvery-white metal that was discovered in 1802 by English chemist William Hyde Wollaston. It closely resembles platinum but is the least dense and has the lowest melting point of all the platinum group metals. Palladium does not react with oxygen at standard temperatures, which means it does not tarnish in air.

Like platinum, palladium is extremely rare. In fact, it is about 15 times more rare. To put that into perspective, if all the gold ever mined would fit into 3¼ Olympic-sized swimming pools, all the platinum in the world would fit inside a typical house, and all the palladium ever mined would fit comfortably inside a single living room!

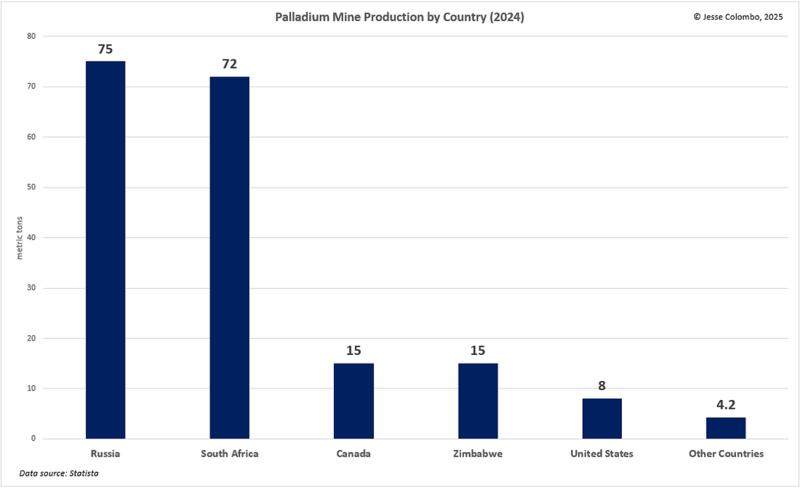

Due to the rarity of palladium ore deposits worldwide, Russia and South Africa together account for 78% of the global palladium supply.

A palladium bullion bar minted by PAMP.

Like platinum, palladium is prized for its unique physical and chemical properties, making it essential in a wide range of automotive and industrial applications. It plays a critical role in catalytic converters, chemical manufacturing, electronics manufacturing, dental and biomedical technologies, and pollution control. Palladium is also used on a smaller scale for investment purposes and in jewelry.

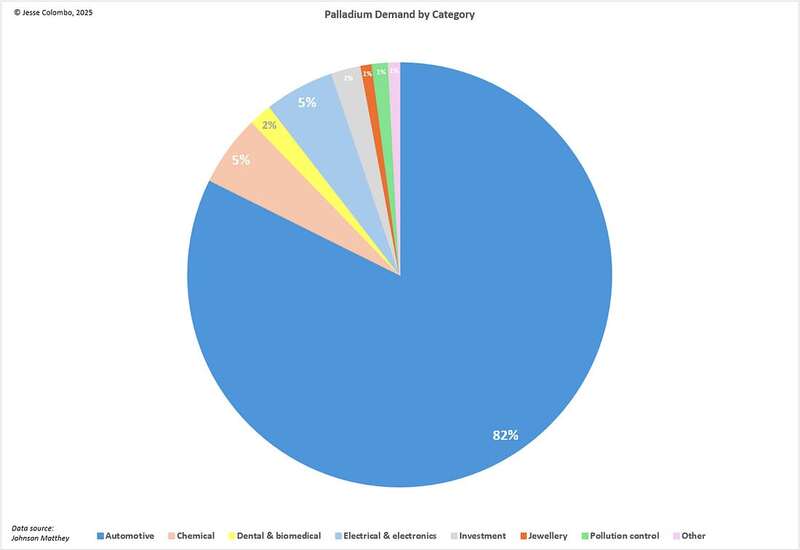

Unlike gold and silver, which have long histories as monetary metals used in coinage, currency systems, and investment, palladium was only discovered in the 19th century and has seen virtually no use as money. Today, only about 2% of its demand comes from investment.

The vast majority, approximately 82%, is driven by the automotive sector through its use in catalytic converters. Another 5% comes from chemical manufacturing, 5% from electronics, and just 1% from jewelry.

Because the overwhelming share of palladium’s demand comes from the automotive and industrial sectors, it is highly sensitive to economic cycles, much more so than gold or silver.

This cyclical sensitivity is one reason I’ve been less enthusiastic about palladium, especially as I actively anticipate and prepare for a major economic crisis. As a result, I’ve leaned more heavily toward gold and silver.

That said, I am optimistic about palladium’s future and can see the value of having a small portion of it (around 5% or less) for the sake of portfolio diversification for large portfolios that already have a strong foundation of gold bullion for stability, complemented by some silver for additional upside exposure.

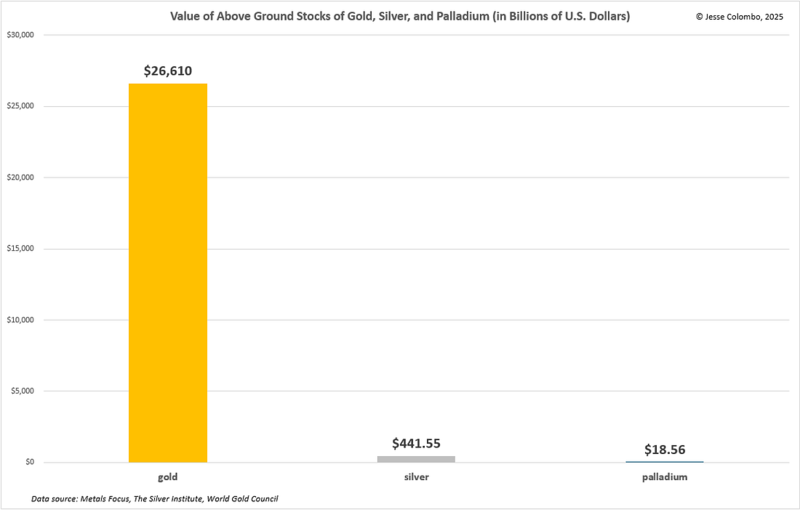

I want to highlight the remarkably small size of the global palladium market compared to gold and silver, a factor that contributes to its greater volatility and choppiness, while also presenting significant upside potential when conditions align favorably.

The total value of above-ground gold stock stands at an impressive $26.6 trillion, silver at $442 billion, and palladium at a mere $18.56 billion, as shown in the chart below. This small scale is one of the reasons why central banks and major institutional investors largely overlook palladium, favoring gold as their preferred asset.

This limited supply means that even relatively modest investment capital could acquire a significant portion of the available stock, driving prices sharply higher. For large institutions and investors, this would be akin to an elephant leaping into a kiddie pool, causing water to splash dramatically in all directions.

The palladium market’s volatility is further amplified by its heavy reliance on mine production concentrated in just a few countries. Russia led in 2024 with 75 metric tonnes, followed by South Africa with 72 metric tonnes. Canada and Zimbabwe each produced 15 metric tonnes, while the United States contributed only 8.

As mentioned earlier, Russia and South Africa together account for 78% of the global palladium supply. This dependence on countries vulnerable to geopolitical instability and labor strikes adds significant uncertainty and price volatility to the palladium market.

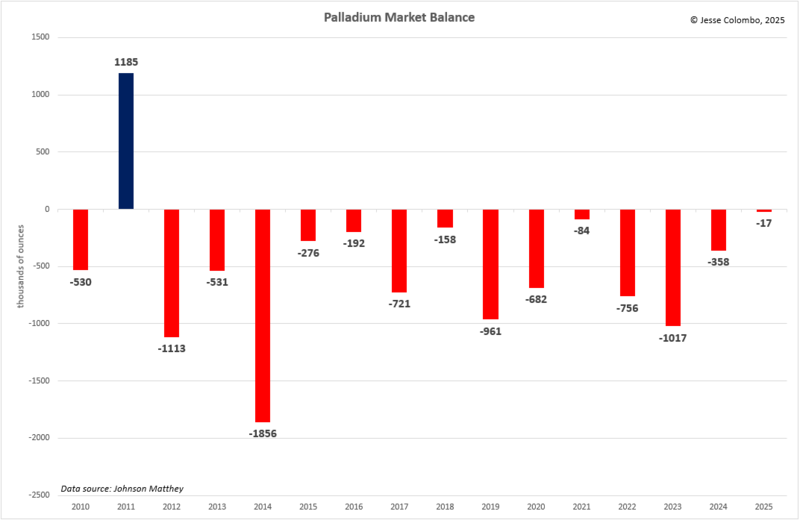

Due to demand consistently exceeding supply, the palladium market has been in deficit every year since 2010 except for the anomalous year of 2011. These deficits have averaged about 500,000 ounces, or 15.55 metric tonnes, annually during that period.

The main drivers of the structural deficit have been tightening global emissions standards, which increased demand for automotive catalytic converters, stagnant mine production that struggled to keep pace with demand, and limited recycling and secondary supply.

This persistent deficit has greatly depleted above-ground inventories, leaving the palladium market vulnerable to extreme price spikes such as those seen in 2019–2021.

Although Johnson Matthey expects the palladium market to move roughly into balance this year, the factors that created the deficit over the past fifteen years have not disappeared, and much of the damage to above-ground inventories has already been done.

Though the growing popularity of electric vehicles poses an obvious threat to demand for automotive catalysts, which are the primary driver of palladium consumption, this risk has been well known for years and is likely already factored into palladium’s relatively low price in recent years.

In addition, with U.S. energy policy shifting under the Trump administration, palladium demand may increase as pro–fossil fuel policies encourage greater use of gasoline-powered vehicles. More traditional cars and other vehicles would boost catalytic converter demand and increase palladium requirements. Furthermore, oil refining also relies on palladium and other platinum group metals.

Now, let’s move on to the technical analysis section of this report, starting with the weekly chart of palladium going back to 2022. This chart clearly shows that, after a steep decline since 2021, palladium has formed a rounding bottom pattern over the past two years. This pattern is often seen ahead of major bullish moves.

Since the beginning of the year, palladium is up roughly 40%, moving in tandem with the broader precious metals bull market, including platinum. There is a key resistance zone overhead between $1,200 and $1,400, and a decisive high-volume close above this zone would confirm the start of a new bull market for palladium.

A look at the long-term monthly chart of palladium reveals several important developments, including an uptrend line that has held since 2008 and a downtrend line that began in 2021.

Palladium recently broke above that downtrend line, signaling that the four-year decline has ended and that a new bull market is likely underway.

One way to evaluate a commodity’s potential for further upside is by assessing how cheap or expensive it is using various valuation measures. The first we’ll examine is the real, or inflation-adjusted, price of palladium. The inflation-adjusted price is currently around $1,300 per ounce.

While this is neither especially cheap nor expensive by historical standards, it is significantly lower than the inflation-adjusted peaks of $1,933 in 2001 and $3,583 reached in 2021.

Assuming that palladium continues to participate in the broader precious metals bull market, there is a strong possibility that it will revisit those highs or even surpass them, making those levels valuable reference points moving forward.

Another valuable valuation metric is the palladium-to-U.S. M2 money supply ratio, which is now near its lowest level in a decade. Comparing a commodity to the M2 money supply helps assess whether or not it is keeping pace with monetary inflation. Although it has largely kept pace, its current ratio of just 140 remains far below the 506 level seen in 2001 and the 388 level in 2020.

(In this chart, I indexed the ratio to a base value of 100 in the year 1985 to create a more intuitive and visually meaningful price scale.)

The resurgence of M2 money supply growth in the U.S. and globally since late-2023 has been a significant catalyst for the broader precious metals bull market during this period.

Comparing precious metals like palladium and silver to gold, the benchmark of the sector, can provide valuable insight into their relative valuation and whether they are historically undervalued, overvalued, or fairly priced.

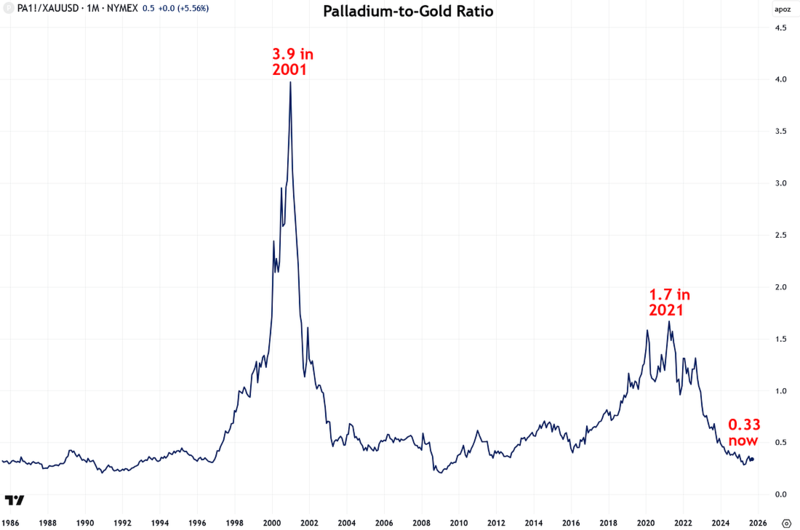

At present, palladium is trading near its lowest level relative to gold since 2008, reinforcing the view that it is undervalued and offers potential for future price appreciation.

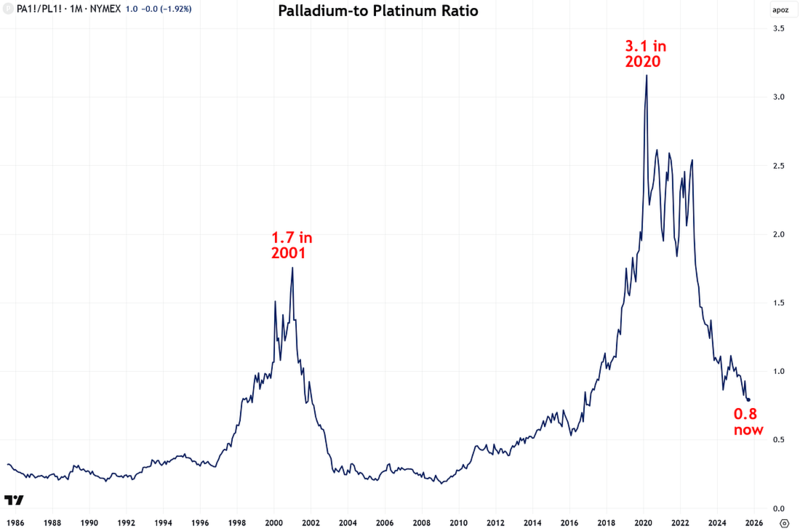

Along those lines, it is also useful to compare other platinum group metals to the leader of the group, which is platinum. By that measure, palladium is trading at very low relative levels and remains far below its peaks in 2001 and 2020.

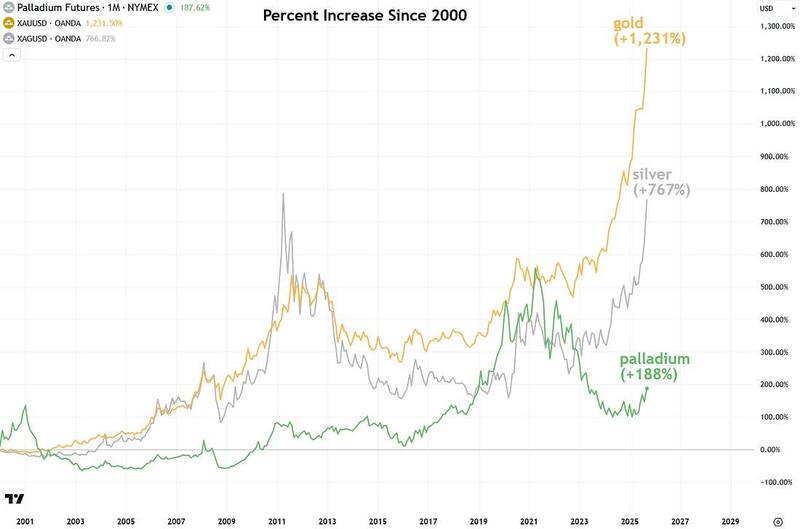

Since the start of the millennium, gold and silver have dramatically outperformed palladium, contributing to palladium’s historically low price relative to gold.

During this period, gold has gained 1,231%, silver 767%, while palladium has risen by only 188%. However, as palladium’s bull market gains momentum, this performance gap is likely to narrow.

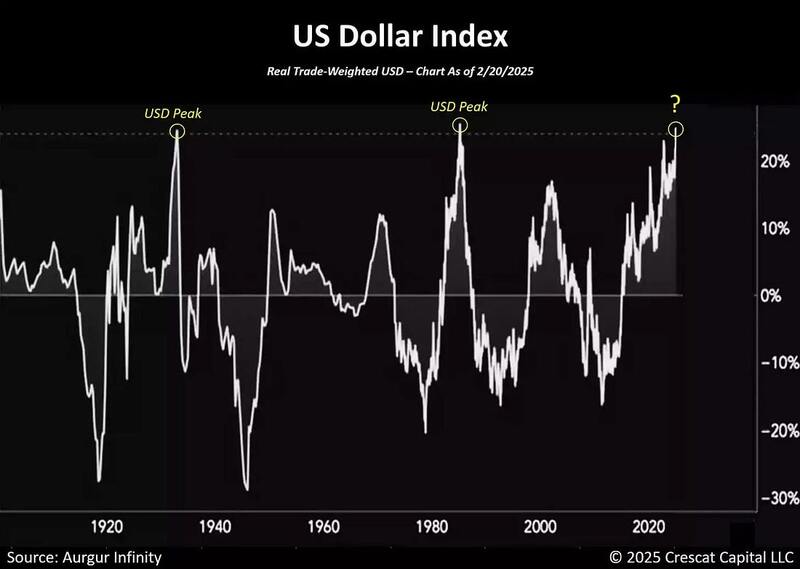

Another significant catalyst poised to drive all precious metals, including palladium, higher is a potential bear market in the U.S. dollar. The dollar and commodities, including precious metals, typically move inversely, meaning a bearish trend in the dollar is bullish for commodities, and vice versa.

In April, the U.S. Dollar Index broke below the key 100 support level, which has now turned into resistance. With the index trading below this critical threshold, the probability of continued weakness has increased, and the 90 level now stands out as the next likely downside target.

I foresee a substantial bear market for the dollar in the near future, driven by its extreme overvaluation relative to more than a century of historical data. Such pronounced overvaluation has only occurred twice before, in 1933 and 1985, and each time it was followed by substantial dollar declines.

The dollar’s unusual strength in recent years has been a major factor keeping commodity prices, including palladium, much lower than they would ordinarily be.

However, an impending correction in the dollar’s value should trigger a powerful bullish surge across the commodities sector, including assets like copper, gold, silver, platinum, palladium, and mining stocks.

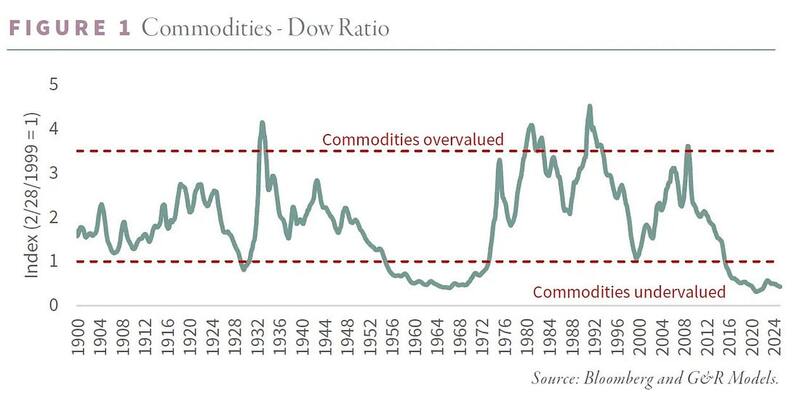

Multiple metrics indicate that commodity prices are currently exceptionally undervalued, aligning palladium’s low prices with this broader trend. One key metric is the commodities-to-Dow ratio, which highlights that commodities remain significantly undervalued compared to stocks.

However, I anticipate this unusual condition will soon normalize through a robust commodities boom or supercycle—reminiscent of the early 2000s—and a notable correction in equity markets.

This aligns with my broader view that we’re in the early stages of a major capital rotation out of overvalued stocks and into still-undervalued precious metals.

In addition to the commodities-to-Dow ratio shown above, I created a long-term chart of the palladium-to-Dow ratio (normalized with 1985 = 100), which shows that palladium is currently near record lows relative to stocks.

This ratio is likely to revert to historical norms once the stock market bubble bursts, triggering a flow of trillions of dollars out of equities and into commodities and the broader natural resources sector.

Now that I’ve outlined the bullish case for palladium, let’s explore the different ways to gain exposure to it. Options range from the most straightforward forms, such as physical bullion bars and coins, to exchange-traded funds (ETFs), futures and other derivatives, and mining stocks.

For those who still prefer to acquire physical palladium bullion instead of ETFs, which is completely understandable, popular palladium coins include the American Palladium Eagle, the Canadian Palladium Maple Leaf, and the Chinese Panda.

Another avenue for investment is platinum group metal mining stocks, which I am interested in; however, the limited number available in the U.S. often necessitates purchases through the less transparent over-the-counter (OTC) market or Canadian exchanges, requiring a higher level of investor expertise.

In conclusion, I am optimistic about palladium’s outlook for several key reasons. These include its small and shrinking above-ground supply, the likelihood of a bullish breakout from the two-year rounding bottom pattern, and its low valuation relative to inflation, gold, the M2 money supply, and equities.

There is also the broader prospect of another commodities supercycle and the strong potential for platinum group metals to participate in the ongoing precious metals bull market, which is less than two years old and should last 10 to 15 years based on historical cycles.

Although platinum group metals are highly volatile and sensitive to economic cycles, I see the value in holding a small allocation to them within larger portfolios for diversification purposes.

This makes the most sense when the portfolio is first built on a solid foundation of gold bullion, supplemented with some silver, and complemented by high-quality mining stocks to enhance upside potential.

More By This Author:

Gold Isn't Going Up, Your Money's Just Losing ValueThe Bullish Case For Platinum

The Dollar Breakdown Is Underway

For the author's full disclosure policy, click here.