Tech Selloff, Fed Fears Send Stocks Sharply Lower

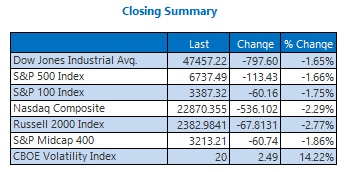

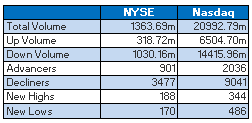

Stocks cooled off in dramatic fashion today, closing out Thursday at session lows. The Dow shed 797 points, pulling back from record high levels and snapping a four-day win streak. The S&P 500 and Nasdaq both dropped triple digits as well, the latter by 536 points as the tech sector rotation worsened, with all three major benchmarks logging their largest daily percentage drops since Oct. 10.

With economic data at a premium right now, CME's FedWatch tool is now pricing in a 49% chance the Federal Reserve cuts interest rates at next month's meeting, down from a 62% chance clocked a day ago. This pivot has investors on edge, reflective of Wall Street's "fear gauge," the Cboe Volatility Index (VIX) reclaiming 20.

OIL, GOLD PRICES STAY STEADY

Oil prices were resilient in the face of a U.S. inventory report showing an upbeat build in U.S. crude stocks and smaller-than-expected draws in products. December-dated West Texas Intermediate (WTI) crude added 20 cents 0.3%, to settle at $58.69 per barrel.

Gold prices finished flat, even as anxiety over upcoming economic data set in. December-dated gold futures gave back 0.1% to settle at $4,211.50 per ounce.

More By This Author:

Dow Cools From Record; Nasdaq Swimming In Red InkDow Adds 326 Points, Rattles Off Another Record Close

Dow Up Nearly 350 Points; Nasdaq Pivots Lower