Tariff-Driven Rally Reverses In Lumber Market

Image Source: Pixabay

There is some good news in the lumber market: contracts have plunged more than 14% in recent weeks, reversing highs last seen during the pandemic shortages. The sharp reversal comes as bets on tariff-driven cost pressures and lower interest rates failed to lift demand. At the same time, disappointing housing data and weak earnings across the housing industry underscored the trouble festering.

Traders ramped up bets that U.S. tariffs on Canadian imports and lower interest rates would lift costs and demand, but housing activity has failed to deliver any demand tailwinds.

There has been weak builder confidence (hitting 13-year lows), disappointing housing permits, and earnings misses at Home Depot, James Hardie Industries, Builders FirstSource, and UFP Industries.

Earlier today...

Why is the housing market completely frozen? A new 30Y mortgage costs 6.80%. The average existing mortgage is almost 3% lower, or 4.11%. https://t.co/hOcBSnWZre pic.twitter.com/ctJozi9CGI

— zerohedge (@zerohedge) August 21, 2025

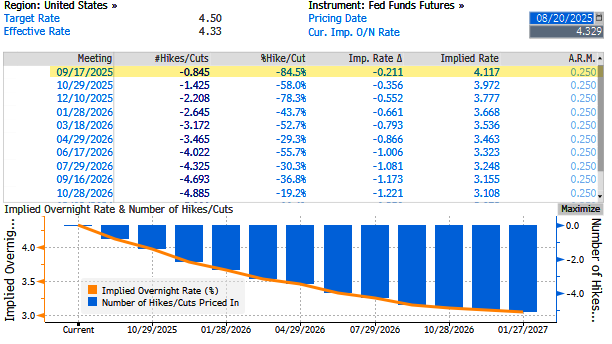

Canadian mills are operating at a loss, which will likely mean lumber supply cuts are just ahead. Even as tariffs doubled this summer, traders remained in "wait-and-see" mode on interest rates. Now the FOMC is preparing for an interest rate decision next month.

On Thursday, lumber futures for September delivery traded around $604 per thousand board feet, down about 14% from the settlement of $695.50 per thousand board feet on Aug. 1.

Greg Kuta, president and CEO of lumber broker Westline Capital Strategies, told MarketWatch that lumber demand is sagging, with possible stabilization next year after Canadian mills dial back production.

Prices "got ahead of themselves with some overbuying on the way up, and a very large and unsustainable futures premium" developed, according to Steve Loebner, vice president of forest products and risk management at Sherwood Lumber, adding that upward pressure in price was driven by tariffs and future supply levels.

More By This Author:

Beijing's Olive Branch: Boeing In Talks On 500-Jet Mega DealFutures Slide For Fifth Day As Jackson Hole Jitters Rise

Meta Freezes Hiring In AI Division

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more