Stocks Stumble Out Of September With Steep Losses

The last day of the month and quarter brought more volatility to Wall Street, in typical September fashion. The Dow fell 546 points for its second 500+ drop this week, despite trading up triple digits at its session highs, amid a pullback from energy and financial stocks. The blue-chip index ended September with its worst monthly loss since October 2020 and logged its first quarterly loss of 2021.

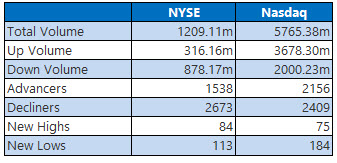

The S&P 500 also fell today, while the Nasdaq failed to hold onto gains despite a muted 10-year U.S. Treasury yield, logging its fifth consecutive loss. The S&P 500 and Nasdaq did not fare much better for September, with the former logging its worst month since March 2020. The S&P 500 still walked away with its sixth-straight quarterly win, while the Nasdaq snapped a win streak of the same length.

The Dow Jones Average (DJI - 33,843.92) fell 546.8 points, or 1.6% for the day, 4.3% for the month, and 1.9% for the quarter. Salesforce.com (CRM) paced the gainers with a 0.3% pop, while Walgreens Boots Alliance (WBA) fell to the bottom, shedding 3.4%.

The S&P 500 Index (SPX - 4,307.54) shed 51.9 points, or 1.2%, for the day, 4.8% for the month, but added 0.2% for the quarter. Meanwhile, the Nasdaq Composite (IXIC - 14,448.58) shaved off 63.9 points, or 0.4% for the day. It lost 5.3% for the month, and 0.4% for the quarter.

Lastly, the Cboe Volatility Index (VIX - 23.14) added 0.6 point, or 2.6% for the day, 40.3% for the month, and 46.1% for the quarter

OIL PRICES SOAR AMID MONTHLY, QUARTERLY WINS

Oil prices were higher on Thursday, shaking off earlier losses following reports that China told energy firms to secure supplies for winter. The country has been struggling with power cuts and electricity shortages of late, amid rising prices for coal and natural gas. In response, November-dated crude rose 20 cents, or 0.3%, to settle at $75.03 a barrel, contributing to the commodity's both quarterly and monthly wins of 9.2% and 2.1%, respectively.

Gold prices settled higher as well, rising from their lowest levels in roughly six months. However, the precious metal still posted both monthly and quarterly losses of 3.4% and 0.8%, respectively. A stronger U.S. dollar and rising Treasury yields are to blame for the dismal results. For the day, December-dated gold rose $34.10, or 2%, to settle at $1,757 an ounce.

Disclaimer: Copyright © 2021 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. Please ...

more