Stocks Show Little Reaction To Highly-Anticipated Rate Cut

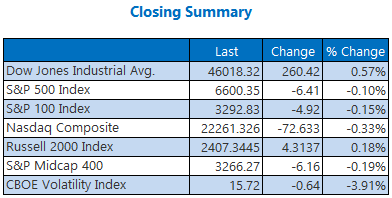

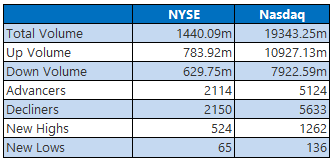

The Federal Reserve delivered its widely-expected rate cut, lowering interest rates by 25 basis points to a range between 4%-4.25%. Fed Chair Jerome Powell described the move as a "risk management" play, while the central bank signaled it expects two more rate cuts in 2025. Stocks were little changed after the decision, with the Dow adding 260 points, while the S&P 500 and Nasdaq finished marginally in the red.

Tech stocks in particular were subdued today, with the Fed decision and subsequent rhetoric from Powell largely priced in to growth names. Elsewhere, Wall Street's "fear gauge," the Cboe Volatility Index (VIX), snapped a three-day win streak, while the small cap Russell 2000 (RUT) nabbed an intraday record high.

OIL, GOLD SLIP AFTER RATE CUT

Oil prices slipped today as U.S. demand concerns overshadowed geopolitical tensions. October-dated West Texas Intermediate (WTI) crude fell lost 47 cents, or 0.73%, to $64.05 per barrel.

U.S. gold futures for December delivery settled 0.2% lower at $3,717.80 per ounce, remaining above $3,700. Notably, Deutsche Bank raised its 2026 forecast on gold prices today to an average of $4,000 an ounce.

More By This Author:

Stocks Notch Weekly Wins, Nasdaq's 5th-Straight Record CloseNasdaq Nabs New Record; Major Weekly Wins Remain In Sight

Stocks Mark Record Closes With Dow Up 616 Points