Stocks Secure Weekly Losses With Sharp Friday Selloff

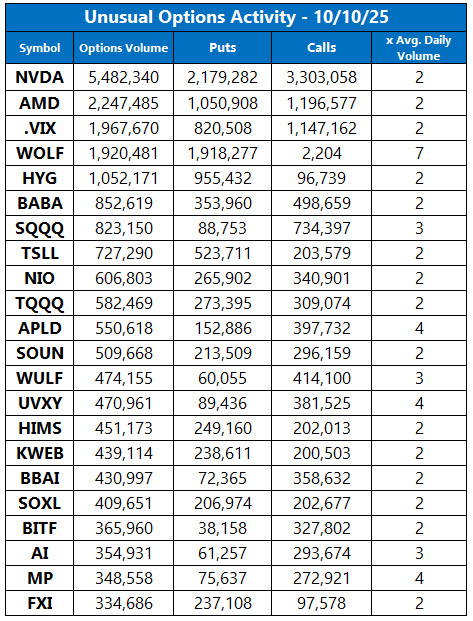

Major indexes suffered steep Friday selloffs, securing weekly losses as U.S.-China trade tensions continued to ramp up. Notably, Trump's canceled meeting with President Xi trailed comments from the former saying China is "becoming very hostile." Budget Chief Russell Vought also noted that government layoffs have commenced, as the shutdown puts a bow on day 10.

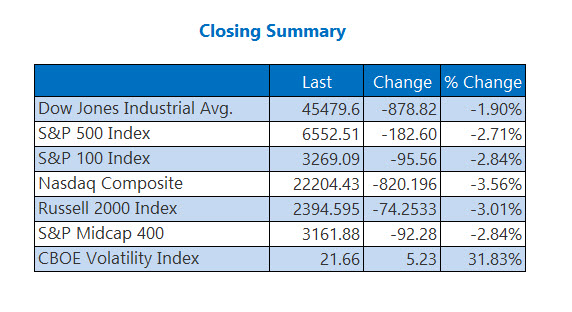

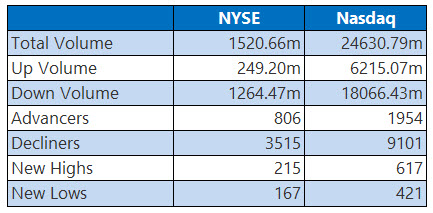

The Dow dropped 878 points, marking its worst daily percentage loss since May, while the Nasdaq and S&P 500 suffered their worst sessions since April. On a weekly basis, all three indexes turned in their worst performance since August 1. Meanwhile, Wall Street's "fear gauge," the Cboe Volatility Index (VIX), surged to its highest level since June.

CRUDE FUTURES PLUNGE 4% ON CHINA TENSIONS

Tensions on rare-earth exports between the U.S. and China pressured crude lower. November-dated West Texas Intermediate (WTI) crude fell $2.53, or 4.1%, to settle at $58.98 per barrel. For the week, oil shed 3.2%

Trump's China threat triggered a surge in gold, the safe haven asset pushing back above the key $4,000/oz mark. December-dated gold futures settled 1.3% higher at $4,024.40 per ounce. On the week, gold rose 2.7%.

More By This Author:

U.S.-China Tensions Send Stocks Reeling MiddayStocks Slide As Government Shutdown Heads To Day 10

Nasdaq Pulls Back After Breaking Above 23,000