Stocks Reverse Gains, Settle Red As Banks Bottom Out

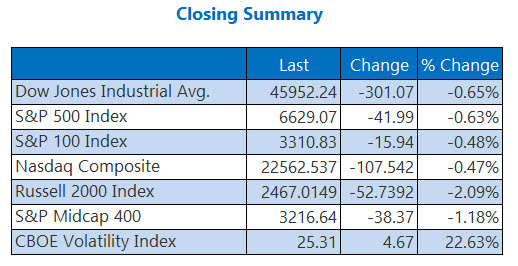

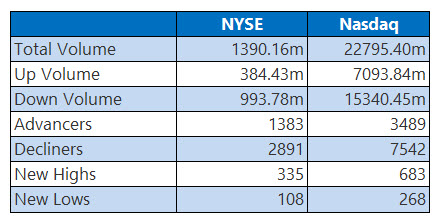

Today's midday gains were cut short, as fears surrounding the government shutdown and big banks weighed. Following an incident of borrower fraud and bad loans, most of the banking sector slid into the red, falling from its recent post-earnings pedestal. The Dow backpedaled 301 points, while the tech-heavy Nasdaq handed over its once triple-digit gain for a 107-point drop. The 10-year Treasury yield moved lower alongside the U.S. dollar, while the market's "fear gauge," or Cboe Volatility Index (VIX), shot to its highest level since May.

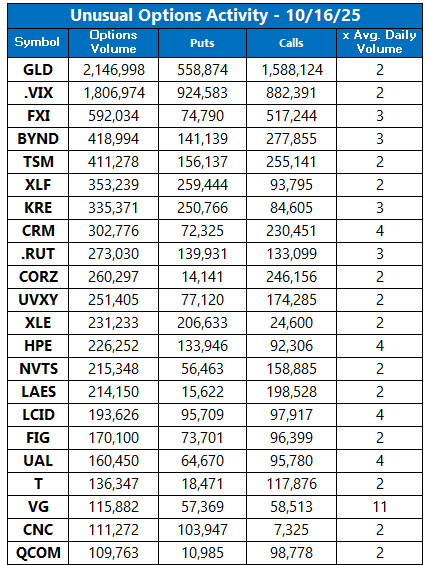

GOLD CONTINUES RECORD-BREAKING WIN STREAK

Oil futures were modestly higher as investors looked to a potential shift in Russian oil imports to India. December-dated West Texas Intermediate (WTI) crude added 0.5%, or 28 cents, to settle at $58.51 per barrel.

Gold continued higher, hitting a fresh record as uncertainty pushed investors to safe havens. December-dated gold futures closed up 2% to settle at $4,288.50 per ounce.

More By This Author:

Tech-Heavy Nasdaq Continues To Climb On AI OptimismDow Erases Triple-Digit Gain To End Volatile Session Lower

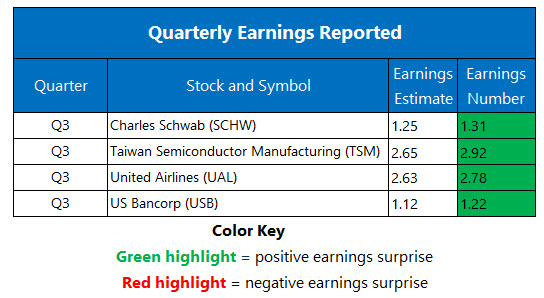

Big Bank Earnings Give Major Indexes A Lift