Stocks Move Lower, S&P 500 Snaps Win Streak

The Dow fell from last session's record high to finish the day 55 points lower. The S&P 500 and Nasdaq also closed in the red, with the former just barely snapping a three-day win streak despite nabbing a record intraday high. Investors await the start of a new earnings season and tomorrow's inflation data -- a key factor in the Fed's decision-making process regarding interest rates, though Fed Reserve Chairman Jerome Powell has made it clear that the Fed will likely keep its policy in place for a time despite economic recovery. Meanwhile, U.S. President Joe Biden is meeting with executives to discuss the semiconductor chip shortage, as well as lawmakers concerning his infrastructure plan.

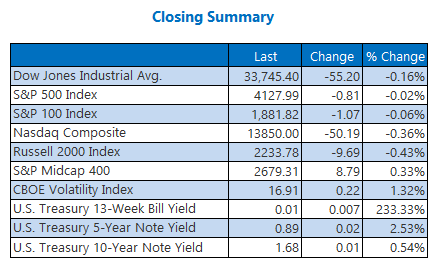

The Dow Jones Industrial Average (DJI - 33,745.40) fell 55.2 points today, or 0.2% for the day. Dow Inc (DOW) topped the list of blue chips with a 1% pop, while Intel (INTC) sunk to the bottom after shedding 4.2%.

Meanwhile, the S&P 500 Index (SPX - 4,127.99) lost 0.8 points, or 0.02%, for the day, and the Nasdaq Composite (IXIC - 13,850.00) dropped 50.2 points, or 0.4%.

Lastly, the Cboe Volatility Index (VIX - 16.91) gained 0.2 points, or 1.3%, for the day.

GOLD FUTURES FALL FOR SECOND SESSION

Oil prices closed higher today, though gains were pared by tensions in the Middle East, as well as ongoing global supply/demand concerns. May-dated crude rose 38 cents, or 0.6%, to settle at $59.70 a barrel.

Gold futures fell for the second-straight session, as strength in bond yields and inflation concerns weighed. June-dated gold dropped $12.10, or 0.7%, to settle at $1,732.70 an ounce -- their lowest finish in a week.

Disclaimer: Schaeffer's Investment Research ("SIR" or "we" or "us") is not registered as an investment adviser. SIR relies upon the "publishers' ...

more