Stocks Kick Off December With Gains After Shaky Start

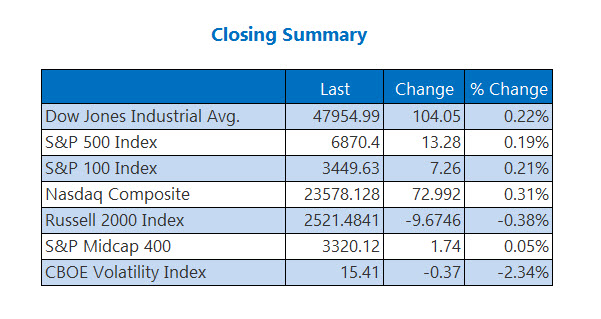

After Bitcoin (BTC)-induced volatility at the start of the week, all three major indexes managed to secure daily and weekly wins, with the S&P 500 trading within a chip-shot of record highs and logging a fourth consecutive daily gain alongside the Nasdaq Composite (IXIC). Soft September core PCE data has taken a front seat ahead of the Fed's final rate cut decision of 2025, due out on Wednesday, Dec. 10, while investors also unpacked a higher-than-anticipated consumer sentiment reading today.

COMMODITIES STEADY AFTER VOLATILE WEEK

Following a week of uncertainty surrounding Ukraine peace talks, crude steadied to close out Friday. January-dated West Texas Intermediate (WTI) crude rose 41 cents, or 0.7%, to close at $60.08 per barrel for the day and added 2.7% on the week.

Jitters surrounding next week's rate-cut meeting was mostly pushed aside for gold traders, though silver futures surged to another record. February-dated gold closed flat at $4,243 per ounce on the day and dropped 0.5% for the week.

More By This Author:

Investors Cheer Upbeat Inflation, Consumer Sentiment DataMarkets Close Lackluster Session On Either Side Of The Aisle

Stocks Mixed As Market-Moving Catalysts Dry Up