Stocks Finish Firmly Higher After Fed Cuts Rates

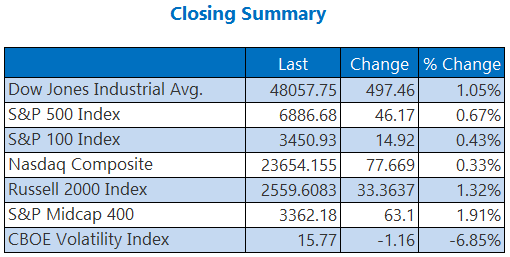

The Dow carried its gains through the close, finishing up 497 points after the Federal Reserve cut interest rates by 25 basis points for the third -- and final -- time this year. The target range is now 3.50% - 3.75%, with Fed Chair Jerome Powell citing a cooling labor market, rising unemployment, and elevated though easing inflation. According to the central bank's dot plot, the Fed projects one rate cut in 2026, though the CME Fedwatch tool is pricing in a 68% chance of two rate cuts next year.

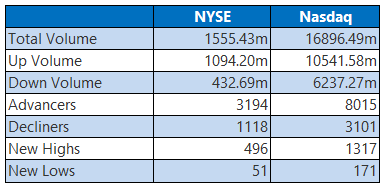

Bank stocks surged in response, with the S&P 500 finishing just shy of an all-time peak, while the Russell 2000 Index (RUT) managed to eke out a record close. The Nasdaq shook off its midday losses to settle in the black as well.

GOLD, CRUDE PUSH HIGHER AMID RATE CUT

The oil rig seize by the U.S. pushed crude higher for the session. January-dated West Texas Intermediate (WTI) crude added 21 cents, or 0.4%, to close at $58.46 per barrel.

Gold futures saw modest gains, while silver continued its surge, now within a chip-shot of record highs. February-dated gold closed up 0.2% at $4,242.50 per ounce.

More By This Author:

Dow Resumes Climb Ahead Of Much-Needed Fed RhetoricJ.P. Morgan Weighs on Dow As Russell 2000 Hits Record High

Stocks Steady As JOLTS, Fed Take Center Stage