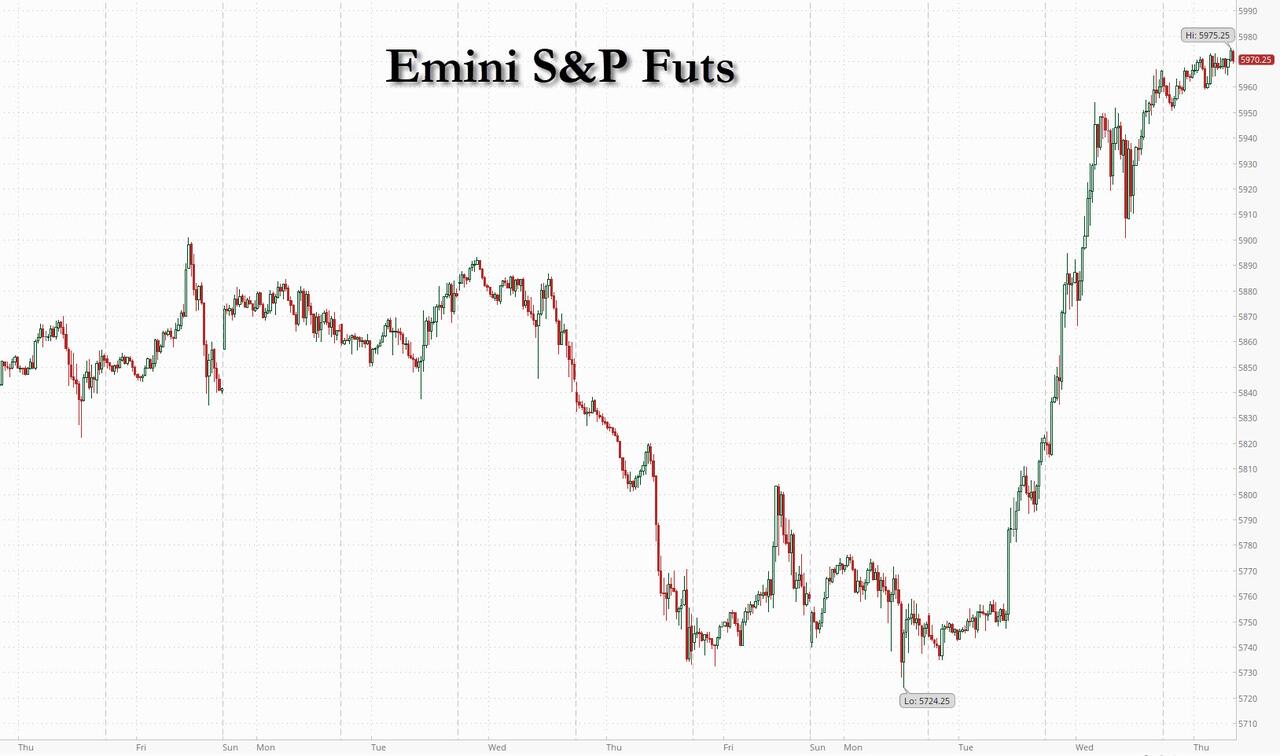

S&P Futures Extend Gains As Trump Trades Cool

US equity futures extended their post-election gains, as S&P futures traded near session high with both Tech and small caps outperforming as the dollar eased and yields were flat, as traders continued to map out Trump’s return to the White House and what it holds for the Fed’s interest-rate path. As of 8:00am ET, S&P 500 futs traded 0.2% higher after surging in the previous session on bets that the newly elected President will boost corporates through pro-growth policies; Nasdaq futures rose 0.4% after hitting a new all time high on Wednesday; Mag7 names were mixed premarket with semis bid despite NVDA dipping -21bps. An index of the dollar retreated 0.3% following its best day since Sept 2022. Moves in US Treasury yields were muted after Wednesday’s seismic selloff; bond yields are 1-2bps lower as the curve steepens. The commodity complex is mixed with Ags higher, Energy lower, and Base metals outperforming Precious. Today’s macro data focus is on the Fed’s decision (2pm ET) and the BOE (7am ET); both CBs are expected to cut by 25bps.

In premarket trading, Lyft soared 22% after the ride-hailing company topped fourth-quarter forecast, with analysts positive about the company’s profitability path. Tinder parent Match Group tumbled 13% after the dating-app company’s fourth-quarter revenue forecast missed estimates. SolarEdge shares slumped 16% after the renewable-energy-equipment provider took a $1-billion writedown and issued underwhelming guidance for the fourth quarter. Here are some other premarket movers:

- AppLovin (APP) rises 30% after 3Q results from the mobile-gaming software company beat expectations.

- Arm Holdings (ARM) falls 6% after the chip designer issued a disappointing forecast for third-quarter revenue.

- Bumble (BMBL) drops 6% after the dating-app company posted in-line results, and analysts flagged concerns about limited visibility on the turnaround strategy.

- Corteva (CTVA) declines 7% after the company cut its net sales guidance for the year, as a reduced corn-planted area in Argentina hurt the company’s seed business in the 3Q.

- Digital Turbine (APPS) sinks 38% after the application software company cut its full-year revenue forecast.

- Dutch Bros (BROS) jumps 17% after the drive-thru coffee chain boosted its full-year total revenue forecast.

- Elf Beauty (ELF) climbs 10% after the cosmetics company boosted its full-year guidance.

- Qualcomm (QCOM) rises 6% after the world’s biggest seller of smartphone processors gave a bullish sales forecast for the current period.

- Tapestry shares (TPR) climbs 5% after the accessories company raised its annual guidance.

- Wolfspeed (WOLF) sinks 25% after the semiconductor device company gave weak second-quarter guidance below consensus.

The furious post-election rally eased on Thursday after grappling with the far-reaching consequences of a Trump presidency. His win has forced investors to come to terms with economic policies that could lead to fewer Fed rate cuts, along with a possible Republican sweep of Congress that could help fuel fiscal expansion.

"What we saw yesterday was the playbook of the Trump trade in action but it’s soon going to evolve," said Arnaud Girod, head of economics and cross-asset strategy at Kepler Cheuvreux in Paris. “US yields can’t continue to go up with US equities on the rise, my conviction is that yields will calm down.”

Ahead of the Fed's rate cut at 2pm (full preview here), the Bank of England lowered borrowing costs earlier on Thursday by 25 basis points to 4.75%. Governor Andrew Bailey said that rates are likely to fall “gradually from here” and that last week’s UK budget will lift inflation by just under half a percentage point at its peak.

In Europe, stock also gained for a second day, with the Stoxx 600 rising 0.6% led by gains in basic resources after Chinese stocks closed near a one-month high as traders digested the possibility of fresh elections in Germany and whether it could help to revive growth in Europe’s biggest economy. Here are the biggest movers Thursday:

- Banco Bpm shares rise as much as 11% to the highest in almost nine years, after the Italian lender launched an all-cash takeover offer for asset manager Anima Holding SpA

- Swiss Re surges as much as 7.1%, the most in four years, after the reinsurer raised its US liability reserves by $2.4b in Property & Casualty Reinsurance in 3Q, following a comprehensive review

- Heidelberg Materials rises as much as 7.7% to their highest intraday value on record after results Jefferies called a pleasant surprise. Analysts highlighted its guidance upgrade as a positive

- ArcelorMittal shares climb as much as 5.4% after Netherlands-based mining company reported 3Q Ebitda beat that analysts attributed mainly to Brazil, Europe and mining

- PKO shares jump as much as 3% while Pekao surges as much as 6.5% following strong 3Q results by Poland’s two biggest lenders, which showed more tailwinds from the country’s high interest-rate environment

- Delivery Hero shares climb as much as 4.1% after the German delivery company narrowed its 2024 growth guidance to the upper end of the range. Analysts say the valuation is compelling

- Adyen shares fall as much as 13% after the payments firm reported net sales that missed estimates, driven by lower processing volumes, wholly driven by a single large customer

- ITV drops as much as 10% after the broadcaster gave an underwhelming forecast for a decline in total advertising revenue in 4Q, with ad bookings taking a hit from uncertainty ahead of the UK budget

- Novo Nordisk shares drop as much as 5.3% to the lowest since January as analysts weighed the drugmaker’s comments about next year’s revenue growth rate, which was slightly below market expectations

- Air France-KLM shares tumble as much as 12%, the steepest drop in two years, after reporting a third-quarter earnings before interest and tax that missed expectations

- Legrand drops as much as 6.9%, the most in a year, after the French electrical-device manufacturer released what analysts see as a “soft set” of numbers, with narrowed guidance

- Rolls-Royce shares drop as much as 4.9%, retreating from Wednesday’s record high, after the aerospace and defense firm’s engine flying hours came in toward the low-end of its guidance

Earlier in the session, Asian stocks rose, supported by a rally in China, as expectations grow that Beijing will unveil more stimulus at this week’s key policy meeting to counter potential risks from Trump’s second presidency. The MSCI Asia Pacific Index rose as much as 1%, on track to hit the highest level in more than two weeks. Toyota, TSMC and DBS were among the biggest contributors. Most major markets in the region advanced Thursday, led by mainland China, Hong Kong and Singapore. Japan’s Topix also rose, while Philippine and Indonesian stocks extended losses to a second day. Chinese shares rebounded strongly from Wednesday’s losses as robust exports data lifted sentiment. Traders are monitoring the Standing Committee meeting of the National People’s Congress, which concludes Friday, for possibly more measures to boost the economy and markets.

“The market is speculating the policymaker would announce a relatively large scale of fiscal package to stimulate domestic demand after the NPC meeting, in order to offset the potential tariff hike risk from Trump,” said Jason Chan, senior investment strategist of Bank of East Asia. “So sectors like consumer, property, Internet and SOEs are the major contributors.”

In FX, the Bloomberg Dollar Spot Index falls 0.3%. The Norwegian krone is the best performer among the G-10 currencies, rising 1.1% against the greenback after the Norges Bank repeated no imminent plans for easing. The Swedish krona adds 0.5% after the Riksbank cut interest rates by 50 bps. The pound surged 0.6% after the hawkish Bank of England rate 25bps cut with traders seeing no more rate cuts until next year.

In rates, treasuries traded higher, with US 10-year yields falling less than a basis point to 4.43%. German bonds underperform their US peers, with the long end under pressure as traders brace for the possibility of more debt sales after the nation’s ruling coalition collapsed. German 10-year yields rise 8 bps and are above the equivalent swap rate for the first time as traders braced for the possibility of an administration that could be more tolerant of increasing debt.

In commodities, oil prices decline, with WTI falling 0.8% to $71.10 a barrel. Spot gold rises $8 to $2,667/oz.

Looking at the US economic data calendar, the main highlight will be the Federal Reserve’s latest policy decision at 2pm ET, along with Chair Powell’s subsequent press conference. The slate also includes 3Q productivity and unit labor costs and weekly jobless claims (8:30am), September wholesale inventories (10am) and consumer credit (3pm).

Market Snapshot

- S&P 500 futures up 0.2% to 5,971.00

- STOXX Europe 600 up 0.7% to 510.21

- MXAP up 0.9% to 188.94

- MXAPJ up 0.8% to 601.67

- Nikkei down 0.3% to 39,381.41

- Topix up 1.0% to 2,743.08

- Hang Seng Index up 2.0% to 20,953.34

- Shanghai Composite up 2.6% to 3,470.66

- Sensex down 1.0% to 79,549.06

- Australia S&P/ASX 200 up 0.3% to 8,226.30

- Kospi little changed at 2,564.63

- German 10Y yield +6.5bps at 2.47%

- Euro up 0.3% to $1.0758

- Brent Futures down 0.3% to $74.70/bbl

- Gold spot up 0.2% to $2,663.91

- US Dollar Index down 0.24% to 104.84

Top Overnight News

- China’s exports surged in Oct (+12.7% vs. the Street +5% and up from +2.4% in Sept) as the government’s stimulus measures start to bear fruit, although the number means trade tensions are set to climb between Beijing and other major economies. WSJ

- BHP’s CEO says the company is finally starting to see “green shoots” in China’s economy as government stimulus efforts begin to bear fruit. FT

- Japan’s chief currency official warned of potential action against excessive yen moves. Separately, Trump’s victory may prompt a near-term rate hike if the yen weakens further, former BOJ exec Kazuo Momma said. BBG

- The BOE cut rates by 25 bps to 4.75% today. Focus will be on the path for borrowing costs beyond that, after it was thrown into doubt by the fallout from the UK budget and Trump’s victory. BBG

- GS FOMC Preview – Consecutive 25bp Cuts for Now. Fed officials have sounded more relaxed about both sides of their dual mandate than at earlier points this year. This should make a 25bp cut at the November meeting uncontroversial. We expect cuts to remain consecutive at least through December and are penciling in four more consecutive cuts in the first half of 2025 to a terminal rate of 3.25-3.5% but see more uncertainty about both the speed next year and the final destination. GIR

- The outcome of the House battle remains uncertain, with many key races still too close to call, particularly in California where absentee ballots can be counted for up to a week after the election. BBG

- President-elect Donald Trump and his senior advisers are privately assembling shortlists of candidates for top jobs in the incoming administration, from White House chief of staff to Treasury secretary. Potential Trump cabinet candidates include Chief of Staff (Susie Wiles), Treasury (Scott Bessent, John Paulson, Robert Lighthizer, Jay Clayton, Bill Hagerty), State (Marco Rubio), Defense (Mike Pompeo), Justice (Mike Lee, John Ratcliffe, Eric Schmitt, Tom Cotton), Commerce (Linda McMahon). WSJ

- Scott Bessent — a hedge fund manager and top Trump fundraiser — is positioning himself to be Treasury secretary and canvassing candidates to serve as his deputy. FT

- Companies could accelerate imports to the US in an effort to get ahead of potential Trump tariffs, providing a boost to trucking and railroad firms. WSJ

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were somewhat mixed albeit with a mostly positive bias as the dust settled from the US election and the Trump trade began to wane after reverberating across global markets with participants bracing for higher US tariffs, while participants also digested Chinese trade data as the attention turned to the incoming central bank rate decisions including from the FOMC. ASX 200 was indecisive but eventually finished positive as strength in energy, tech, industrials and financials gradually picked up the slack from weakness in real estate and defensives, while weak Australian trade data capped the upside. Nikkei 225 initially surged on the back of a weaker currency but failed to sustain the momentum and gave back its spoils. Hang Seng and Shanghai Comp shrugged off the threat of incoming blanket tariffs from the next US administration as participants continued to await a potential fiscal stimulus announcement and as the latest Chinese trade data was mostly better-than-expected with double-digit export growth. Furthermore, the PBoC held a meeting with international financial institutions and affirmed to continue its accommodative monetary policy, while China told banks to cut interbank deposit rates to boost growth.

Top Asian news

- PBoC held a meeting with international financial institutions including HSBC (5 HK), Standard Chartered (2888 HK) and Citi (C), while it affirmed to continue accommodative monetary policy stance and vowed to strengthen communication with the market. Furthermore, Governor Pan said they are to expand connectivity between domestic and overseas markets.

- China instructed banks to cut interbank deposit rates to boost growth, according to Bloomberg.

- Chinese President Xi congratulated Trump on winning the US presidential election and said he hopes that the two sides will respect each other, coexist peacefully, and achieve win-win cooperation. Furthermore, Xi said both sides should strengthen dialogue and that US-China cooperation is a long-term goal, according to Xinhua.

- Japanese top currency diplomat Mimura said they are closely watching market moves with a high sense of urgency and are ready to take appropriate actions for excess FX moves if needed.

- Nissan (7201 JT) is revising its FY24/25 operating profit forecast to JPY 150bln (prev. guided 500bln), withdraws net forecast; to sell a partial stake in Mitsubishi Motors (8058 JT). To reduce the global headcount by 9k & production capacity by 20%.

European bourses, Stoxx 600 (+0.6%) began the session on a modestly firmer footing and continued to edge higher as the morning progressed. Today’s EZ-specific docket has been relatively light, but focus ahead will lie on policy announcements from the BoE and the Fed thereafter. Region awaiting updates on China's stimulus and also sensitive to ongoing political uncertainty in Germany. European sectors hold a strong positive bias. Basic Resources is by far the clear outperformer, lifted by strength in underlying metals prices after strong Chinese price action overnight. Telecoms is found at the foot of the pile, dragged down by losses in Telefonica (-1.5%) and BT (-5.2%), with the latter also lowering its FY25 guidance.

US Equity Futures (ES +0.2%, NQ +0.2%, RTY +0.3%) are modestly firmer across the board, taking a breather following the significant gains seen in the prior session, where the S&P500 soared to record highs after Trump returned to Presidency.

Top European news

- Riksbank cuts its Rate by 50bps as expected to 2.75% (prev. 3.25%); policy rate may also be lowered in December and H1 2025 (in line with what was communicated in September). Click for details.. Riksbank's Theeden says flash CPI data for October do not change the overall picture; Crown is a risk factor "but we don't think it will affect out inflation picture". Says the rate path is more uncertain than usual.

- Norges Bank leaves its Key Policy Rate at 4.50% as expected; "the policy rate will most likely be kept at 4.5 percent to the end of 2024". Click for details.

- Deutsche Bank lowers its terminal ECB rate forecast to 1.5% from 2.25%

- ECB's Schnabel says the balance sheet reduction has not left any significant footprint in many areas, thus far.

- ECB survey on Survey on the Access to Finance of Enterprises: firms report moderate tightening of financing conditions shows cost pressures remain widespread across businesses of all sizes. Firms reported little changes regarding the availability of bank loans. However, firms’ need for bank loans has declined moderately, partly due to high internal funds. Substantially fewer firms reported rising bank interest rates on loans, although many indicated a further tightening of other conditions. Firms’ inflation expectations continued to decline, with their median expectations for annual inflation in one, three and five years all standing at 2.9%.

- Joerg Kukies has been appointed German Finance Minister, replacing Lindner.

- Maersk (MAERSKB DC) says overall freight volumes from Europe continue to report a slight 4% Y/Y increase; freight rates continue to decline. Seeing demand in Europe bounce back a lot stronger this year.

FX

- USD is giving back some ground to major peers after the DXY sky-rocketed from 103.70 to 105.44 on account of the Trump victory. Attention now turns to today's FOMC announcement which is expected to see the Fed step down to a 25bps cadence of rate cuts.

- EUR has been able to make some headway vs. the USD. However, today's peak at 1.0771 is some way off Wednesday's best at 1.0936. As such, it remains to be seen how much legs the attempted recovery has, particularly given the political instability in Germany with the prospect of a general election in March next year.

- GBP is attempting to undo some of the damage seen during yesterday's session with Cable returning to a 1.29 handle after delving as low as 1.2835. Expectations are for a 25bps cut via a 7-2 vote split.

- JPY is attempting to recoup some of the lost ground vs. the USD brought on by Trump's victory. However, progress has been relatively limited with USD/JPY's current low at 153.66 standing in contrast to Wednesday's 151.27 trough.

- Antipodeans are both markedly higher and leading the charge against the USD after what was a particularly bruising session on Wednesday given exposure to China. Accordingly, AUD/USD has almost pared a bulk of yesterday's move that dragged it down from a 0.6644 high to a 0.6511 low.

- SEK is flat following the Riksbank's decision to cut rates by 50bps as expected (despite some outside calls for a 25bps) reduction and reiterate guidance on rates. EUR/NOK has extended on yesterday's downside with an in-line decision from the Norges Bank underscoring the Bank's hawkish credentials relative to most other peers.

- China state-owned banks were seen selling US dollars and buying yuan, according to traders.

- PBoC set USD/CNY mid-point at 7.1659 vs exp. 7.1679 (prev. 7.0993).

- Brazil Central Bank hiked the Selic rate by 50bps to 11.25%, as expected, with the decision unanimous. BCB stated the pace of future interest rate adjustments and total magnitude of the cycle will be determined by the firm commitment to reaching the inflation target. Furthermore, it stated the pace of future interest rate adjustments and total cycle magnitude will depend on inflation dynamics, expectations and projections, the output gap, and the balance of risks, while it added that risks to inflation scenarios are tilted to the upside.

USTs

- USTs are a touch firmer and holding around 109-20, but has been as low as 109-14. Despite the slight bid, the curve remains steeper with the long-end picking up while the short end pulls back slightly as attention turns to the FOMC later tonight, where a 25bps cut is entirely priced in. On the election, the story is much the same as we continue to await a decision on the House race to determine whether markets are contending with a Trump with or without Congress scenario

- Bunds have recently lost the 131.00 mark, down to a 130.74 low which is clear of Wednesday's 130.58 trough. The main update has been the sacking of Germany’s Finance Minister Lindner (a debt brake advocate). An update which broke the already-fractured coalition and has seen Chancellor Scholz pencil in an early-January confidence vote, which he will likely lose, paving the way for snap-elections in Q1.

- Gilts are firmer on the session as we count down to the BoE. A meeting which is expected to deliver a 25bps cut with the focus largely on forward guidance. Currently, pivoting the 93.00 mark, picking up slightly from an opening 92.89 base and clear of Wednesday’s 92.53 trough.

- Spain sells EUR 4bln vs exp. EUR 3.5-4.5bln 2.70% 2030, 4.00% 2054 Bono & EUR 0.495bln vs exp. EUR 0.25-0.75bln 0.70% 2033 I/L Bono Auction.

- France sells EUR 12.5bln vs exp. EUR 10.5-12.5bln 3.0% 2034, 4.00% 2035, 0.50% 2044 and 3.25% 2055 OAT Auction.

Commodities

- Crude is modestly weaker and around USD 1.50/bbl off Wednesday’s best but still almost twice that from the troughs. The complex continues to await geopolitical updates out of the Middle East and whether Trump achieves an election sweep.

- Recent attention on a comment from Kann News, which wrote "The preparation for an Iranian attack: the US moved a squadron of F15s to the Middle East - after dozens of fighter jets and 6 B-52 strategic bombers were moved to the region last week" in reference to recent flight radar data.

- Spot gold is a touch firmer, benefitting from the DXY easing below the 105.00 mark. However, magnitudes are relatively slim and XAU remains some way off the virtual double-top from Tuesday & Wednesday at USD 2748-49/oz.

- Base metals are firmer, rebounding after yesterday’s pressure and benefitting from bullish remarks on “green shoots” in China from the BHP CEO and anticipation of Chinese stimulus. Overnight, Chinese exports were particularly strong though desks caution on reading too much into this given looming Trump tariffs (potentially as much as 60% on China).

- NHC updated that the centre of Rafael is moving into the southeastern Gulf of Mexico with a life-threatening storm surge, damaging hurricane-force winds, and flash flooding continuing over portions of western Cuba.

Geopolitics

- Kann News writes "The preparation for an Iranian attack: the US moved a squadron of F15s to the Middle East - after dozens of fighter jets and 6 B-52 strategic bombers were moved to the region last week" in reference to recent flight radar data.

- Israeli warplanes heavily bombard a number of areas in the southern suburbs of Beirut, according to Al Qahera News.

- Ukrainian President Zelensky said he congratulated Trump by phone and they agreed to maintain close dialogue and advance cooperation, according to Reuters.

- Taiwan's Foreign Ministry said it is fully confident the US will continue strong cross-party support for Taiwan going forward and noted that Taiwan-US relations are solid as a rock. It also stated that Taiwan's government looks forward to continuing to deepen ties with the US under the Trump administration and they will continue to strengthen cooperation on combating economic coercion, while they cannot rule out that during the US transition, China will test the bottom line of the new US President by increasing “grey zone” activities which may not only be limited to military drills but could also involve internet attacks.

- South Korean President Yoon said in a phone call with US President-elect Trump that he looks forward to continuing a close relationship on security and economy, while they agreed to meet in the near future and Trump said the American shipbuilding industry needs South Korea's help and cooperation. They also agreed on the need for a strong partnership in the Asia-Pacific and discussed North Korea's ICBM launch, as well as the release of trash balloons into South Korea.

US Event Calendar

- 08:30: 3Q Nonfarm Productivity, est. 2.5%, prior 2.5%

- 3Q Unit Labor Costs, est. 1.0%, prior 0.4%

- 08:30: Initial Jobless Claims, est. 222,000, prior 216,000

- Oct. Continuing Claims, est. 1.87m, prior 1.86m10:00: Sept. Wholesale Trade Sales MoM, est. 0.1%, prior -0.1%

- 10:00: Sept. Wholesale Inventories MoM, est. -0.1%, prior -0.1%

- 14:00: Nov. Fed Interest on Reserve Balanc, est. 4.65%, prior 4.90%

- 15:00: Sept. Consumer Credit, est. $12.2b, prior $8.93b

DB's Jim Reid concludes the overnight wrap

Morning from Oslo where I gave a speech to clients at a large annual dinner last night. I'm not sure how I stayed up as I thought I'd left the days of being awake all night behind me when the twins arrived 7 years ago. I spent most of yesterday walking around like a zombie after being awake most of election night. Hopefully that won't happen again unless I have more kids (would be a biological miracle for my wife and I collectively aged more than 100) or until November 2028!

As if the US election was not enough, yesterday evening brought major political news out of Germany as Chancellor Scholz called for a confidence vote on January 15 with snap elections likely to follow in March. Our German economists had noted earlier in the day that the US election outcome could add to the tensions in Germany’s three-way coalition and lead to a political circuit-breaker. That materialised last night with SPD’s Scholz dismissing FDP’s Lindner as Finance Minister. The current coalition has been at odds over the budget, and Lindner said he had refused the Chancellor’s request to suspend Germany’s debt brake, while Scholz called for “more financial wiggle room”. With an early election now on the cards, a key question is whether this could lead to a step change in Germany’s fiscal policy. As things stand, Politico’s polling average shows the centre-right CDU in the lead at 32%, followed by the populist AFD on 18% and centre-left SPD on 16%. The greens are at 10%, while the liberal FDP is at 4% (shy of the 5% parliament entry threshold).

Looking now at the market reaction to the US election result. Let’s start with some highlights. The S&P 500 (+2.53%) hit its 48th record high this year posting the best post-election day in its history. The 10yr Treasury yield rose +15.9bps, while the 30yr yield (+17.1bps) posted its biggest jump since March 2020 during the pandemic turmoil. In the meantime, the dollar had its strongest day against the euro since 2016 (+1.89%), whilst Bitcoin (+6.50%) closed at an all-time high of $74,507. So it was a historic day that we’ll no doubt benchmark against for some time when it comes to market movements.

In terms of the politics, we knew in yesterday’s EMR that a Trump victory was incredibly likely, but we got formal confirmation of that by the Associated Press at 10:34 London time, when his victory in the battleground state of Wisconsin was confirmed. We’ll have to wait a bit for the complete final results, but if Trump maintains his lead in the states he’s ahead in, that would put him on 312 electoral college votes, with Kamala Harris on 226. So Trump would slightly beat his 2016 electoral college tally thanks to the addition of Nevada (which he didn’t win on either previous attempt), and this also looks like the first of his three runs where he’s won the nationwide popular vote.

From a market point of view, the other significant development is that it now appears highly likely there’ll be a Republican sweep outcome. The Senate is already confirmed for the Republicans, but the House of Representatives now looks very likely to go their way too, with Polymarket currently placing the chance of a Republican sweep at 94% now.

Of course, the reaction was particularly evident among US Treasuries, which witnessed a sharp selloff right across the curve. That’s because the view is that higher tariffs mean that inflationary pressures will rise, and an extension of the Trump tax cuts under a Republican sweep mean the deficit will go up further in the years ahead. Plus the Fed are less likely to cut rates in this scenario. In fact, higher inflation expectations were clear from how inflation swaps reacted, with the 2yr inflation swap surging by +18.6bps yesterday to 2.62%. And the rate priced in by the Fed’s December 2025 meeting was up +12.0bps on the day to 3.78%.

All those trends led to a significant rise in Treasury yields, sending the 2yr yield (+8.4bps) to a 3-month high of 4.26%, whilst the 10yr yield (+16.0bps) hit a 4-month high of 4.43%. Real yields also rose, with the 10yr real yield (+6.4bps) hitting its own 4-month high of 2.04%. Moreover, as both nominal and real yields moved sharply higher, the dollar index surged by +1.61%, whilst precious metals took a significant hit, with sharp losses for gold (-2.87%) and silver (-4.76%).

Meanwhile for US equities, it was a very strong day, in line in with our strategists’ view that they were likely to rally after the election, irrespective of who won. That helped push the S&P 500 (+2.53%) to an all-time high. The small-cap Russell 2000 (+5.84%) posted its strongest performance since November 2022. In addition, banks outperformed given expectations that Trump would bring deregulation, and the KBW Bank Index (+10.69%) had its best day since November 2020, back when the Pfizer vaccine announcement led global markets to surge. The VIX index of volatility also plummeted, falling -4.22pts on the day to 16.27pts.

But even as many sectors were rallying, it wasn’t all plain sailing. Rates sensitive sectors including consumer staples (-1.57%) and utilities (-0.94%) underperformed within the S&P 500. One significant loser were solar energy firms given the view that Republicans would be less favourable than Democrats towards renewables, and the MAC Global Solar Energy Index (-10.07%) posted its biggest loss since the pandemic turmoil of March 2020. European automakers also slumped given the tariff risk, and the STOXX 600 Automobiles & Parts Index was down -2.29%. That echoed a broader decline across European equities which saw the STOXX 600 (-0.54%) lose ground after the initial rally was tempered by the obvious prospect of tariffs and US exceptionalism over a US tide lifting all boats.

Whilst the US election has been dominating attention, the focus will turn back to the Federal Reserve today, who are announcing their latest policy decision. At their last meeting, they opened a cycle of rate cuts with a larger 50bp move, but for today it’s widely expected that they’ll dial that back to 25bps. That’s the baseline from our US economists as well, who expect the Fed to continue the process of “recalibrating” monetary policy. However, they think Chair Powell is unlikely to provide forward guidance about the policy path ahead. Future reductions are data dependent and they see heightened risks that the Fed skips a rate cut at the December meeting.

Alongside the Fed, the Bank of England will also announce their latest policy decision today, which is their first since the UK government unveiled their Budget last week. As with the Fed, our UK economist expects a 25bp rate cut, which would take Bank Rate down to 4.75%. But in the meantime, UK gilts have continued to sell off, with the spread of 10yr gilt yields over bunds widening by +5.4bps yesterday to 215bps. That’s its widest closing level since September 2022, in the week immediately after the “mini-budget” that triggered market turmoil when Liz Truss was Prime Minister. And in absolute terms, the 10yr gilt yield ticked up another +3.3bps to a one-year high of 4.56%. Bunds (-2.1bps) outperformed, but a more cautious risk tone in Europe saw yields on 10yr OATs (+1.7bps) and BTPs (+6.1bps) move higher.

Asian equity markets are digesting the implications of the Trump win with the Nikkei reversing its initial gains, now trading -0.45% lower. The Hang Seng initially dropped but has since rebounded, climbing +1.16%. The CSI (up +0.70%) and the Shanghai Composite (up +0.88%) are also higher, driven by China’s October export figures significantly surpassing expectations. We also wait news of the latest fiscal stimulus news possibly coming tomorrow. Elsewhere, the KOSPI is up +0.38%, while the S&P/ASX 200 is relatively flat. US equity futures are up around a tenth of a percent and with Treasuries fairly flat.

Focusing back on China, exports grew by +12.7% year-on-year in October, far exceeding the expected +5.0% and marking the fastest growth in over two years, compared to a +2.4% increase the previous month. It's possible some of it may have been a rebound to typhoon distribution in September. The report also indicated that imports fell by -2.3% year-on-year in October, against an expected -2.0% decline and a +0.3% increase in September. Consequently, the trade surplus unexpectedly expanded to $95.7 billion in October, up from $81.7 billion in September.

Finally, there wasn’t too much data yesterday, although the final services and composite PMIs for October in the Euro Area saw some upgrades from the earlier flash prints. In particular, the Euro Area composite PMI came in at 50.0 (vs. flash 49.7), and the Euro Area services PMI came in at 51.6 (vs. flash 51.2).

To the day ahead now, and the main highlight will be the Federal Reserve’s latest policy decision, along with Chair Powell’s subsequent press conference. There’s also a policy decision from the Bank of England, and a press conference from Governor Bailey. Otherwise, ECB speakers include Stournaras, Schnabel, Elderson, Escriva, Knot and Lane. Data releases include German industrial production and Euro Area retail sales for September, the German construction PMI for October, and the US weekly initial jobless claims.

More By This Author:

How American Households Have Changed Over The Last 65 YearsGerman Government Collapses As Mass Strikes Grind Economy To A Halt

OPEC+ Delays Production Hike (Again)

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more