S&P 500 Marks 3rd-Straight Loss, Turns Negative For 2026

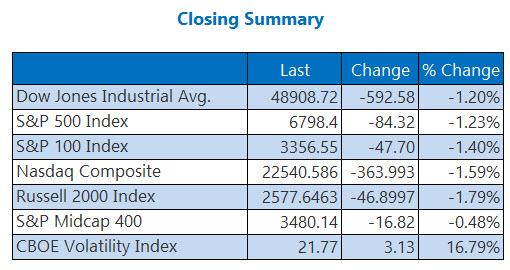

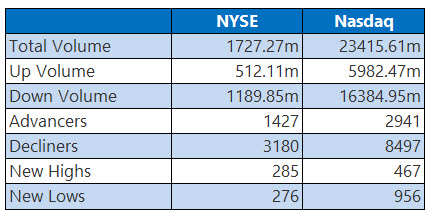

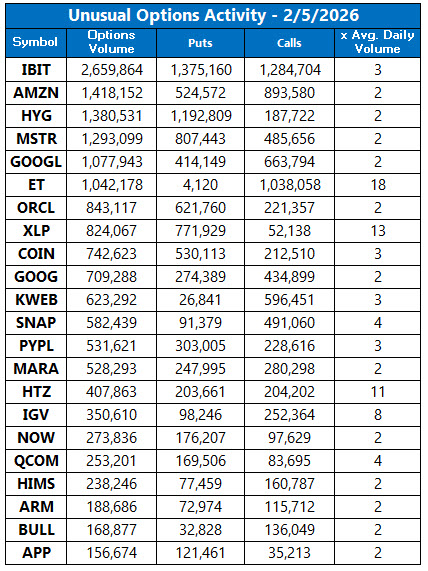

The Dow lost nearly 600 points on Thursday, while the Nasdaq suffered a triple-digit drop as well, marking its third-straight loss alongside the S&P 500 as investors continued to rotate out of tech. The S&P 500 also joined the Nasdaq in negative territory for 2026 as Bitcoin (BTC) -- which fell below key support at $67,000 -- dragged crypto-adjacent stocks lower. Concerns around increased AI spending and a global memory shortage weighed, while the latest jobs data pointed to labor market weakness. Amid today's steep losses, the Cboe Volatility Index (VIX) hit its highest level since November.

OIL PRICES SLIDE AHEAD OF U.S.-IRAN TALKS

Oil prices fell on Thursday, after U.S. and Iran officials agreed to talk in Oman tomorrow, easing concern around a potential conflict. March-dated West Texas Intermediate (WTI) crude fell $1.63, or 2.5%, to at $63.51 a barrel.

Gold priced also settled lower, with silver tumbling as well amid heightened volatility. February-dated gold futures dropped 2.1% to settle at roughly $4,845.50 per ounce.

More By This Author:

Tech And Crypto Selloff Keeps Pressure On StocksNasdaq, S&P 500 Settle Lower On Extended Tech Rotation

S&P 500 Slips, Nasdaq Drops As Traders Dump Chips