Silver's Now Up Almost 100% In Just The Past 2 Months, & That's After It Broke The $50 Level

.webp)

Photo by Zlaťáky.cz on Unsplash

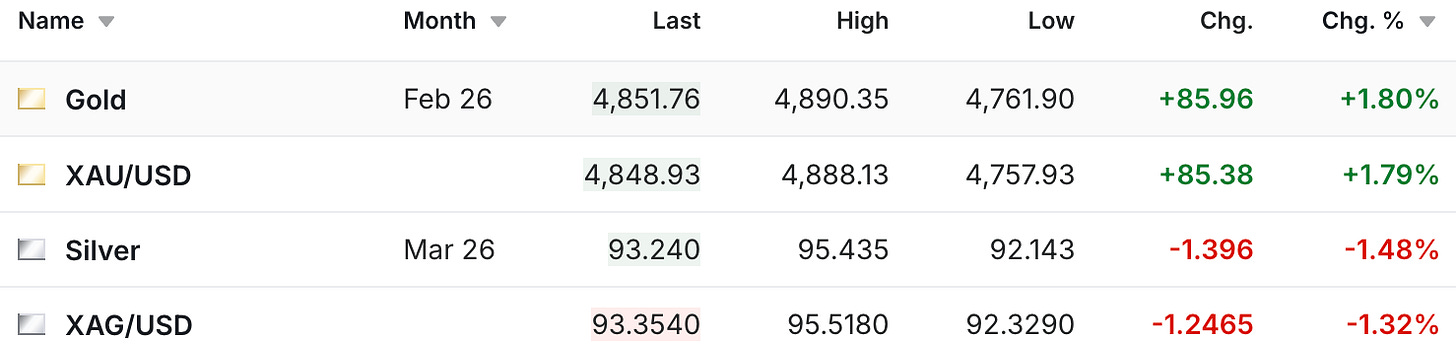

We’re seeing more movement in the gold and silver pricing on Wednesday, this time with some divergence, as the gold futures are currently up $86, while the silver futures are down $1.40.

Both prices have been moving around quite a bit over the past 24 hours, and you may also notice that silver is still in slight backwardation.

Given what’s happening in the world, it’s not entirely surprising to see more volatility, and this is also the type of environment where seeing somewhat unusual divergence like this should be expected. We’ll dig into some of those events that are going on to cause that volatility, although first, it’s truly stunning to realize that the silver price is currently up just under 100% in the past two months!

The silver futures were down to $48.60 on November 20th, and last night on January 20th, they set another new all-time record high of $95.77.

So just in case finally breaking the $50 level after a 45-year wait wasn’t exciting enough, then, AFTER that happened, the price has basically doubled in the following two months.

Then add on that silver is currently trading at $103.58 in Shanghai, which indicates that the pressure there (where they were already known to be tight on their silver supply prior to the premium over New York breaking out) remains, and you could even make a reasonable argument that it’s been increasing.

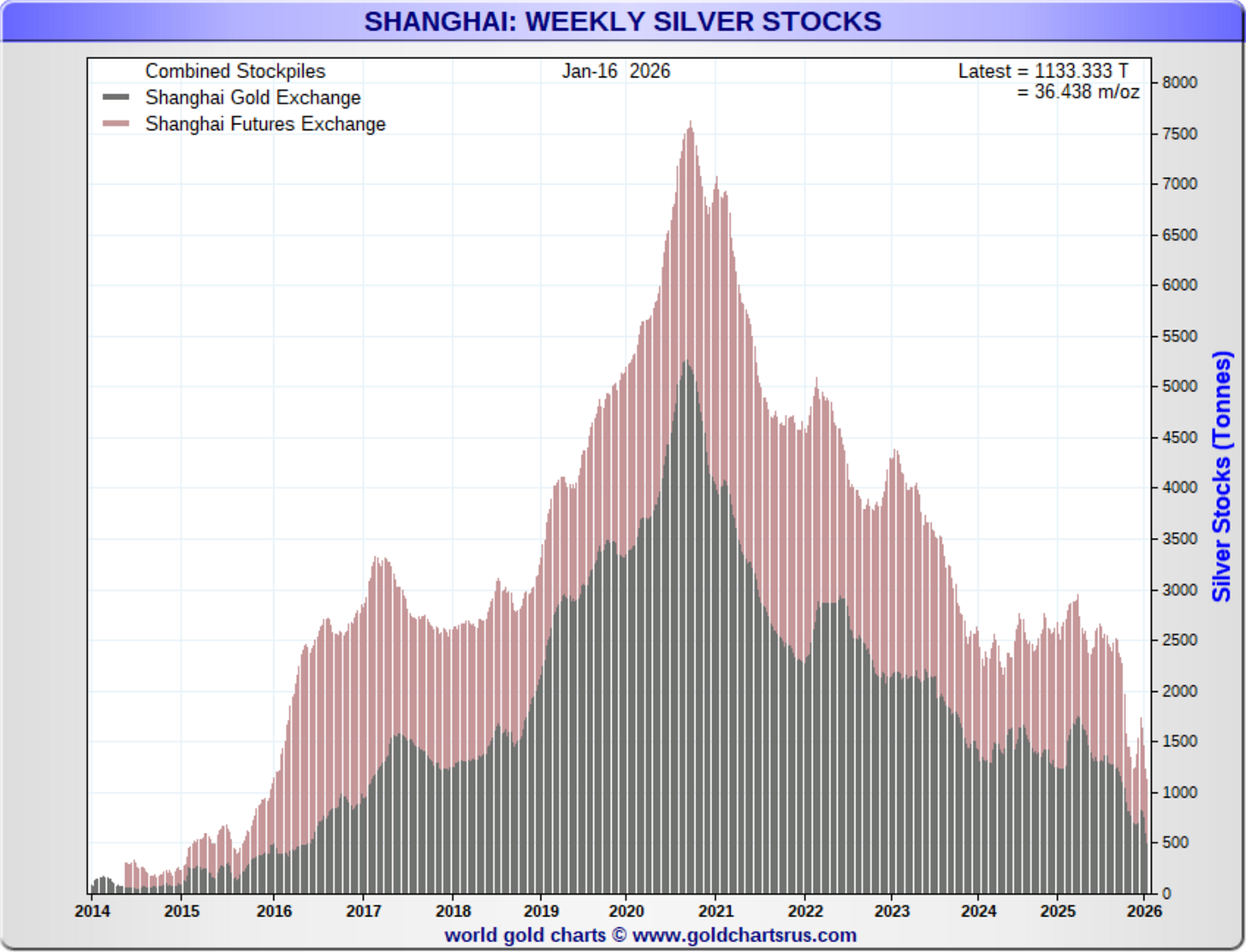

The Current Total Is Down To 1133 Tonnes

Last year the Polish central bank said they wanted to increase the percentage of gold of total reserves to 30%. Although as we just found out, they did that, and then went back for more as they’re now up to 37%.

For more color, my colleague Vince Lanci did talk about that in his morning show today.

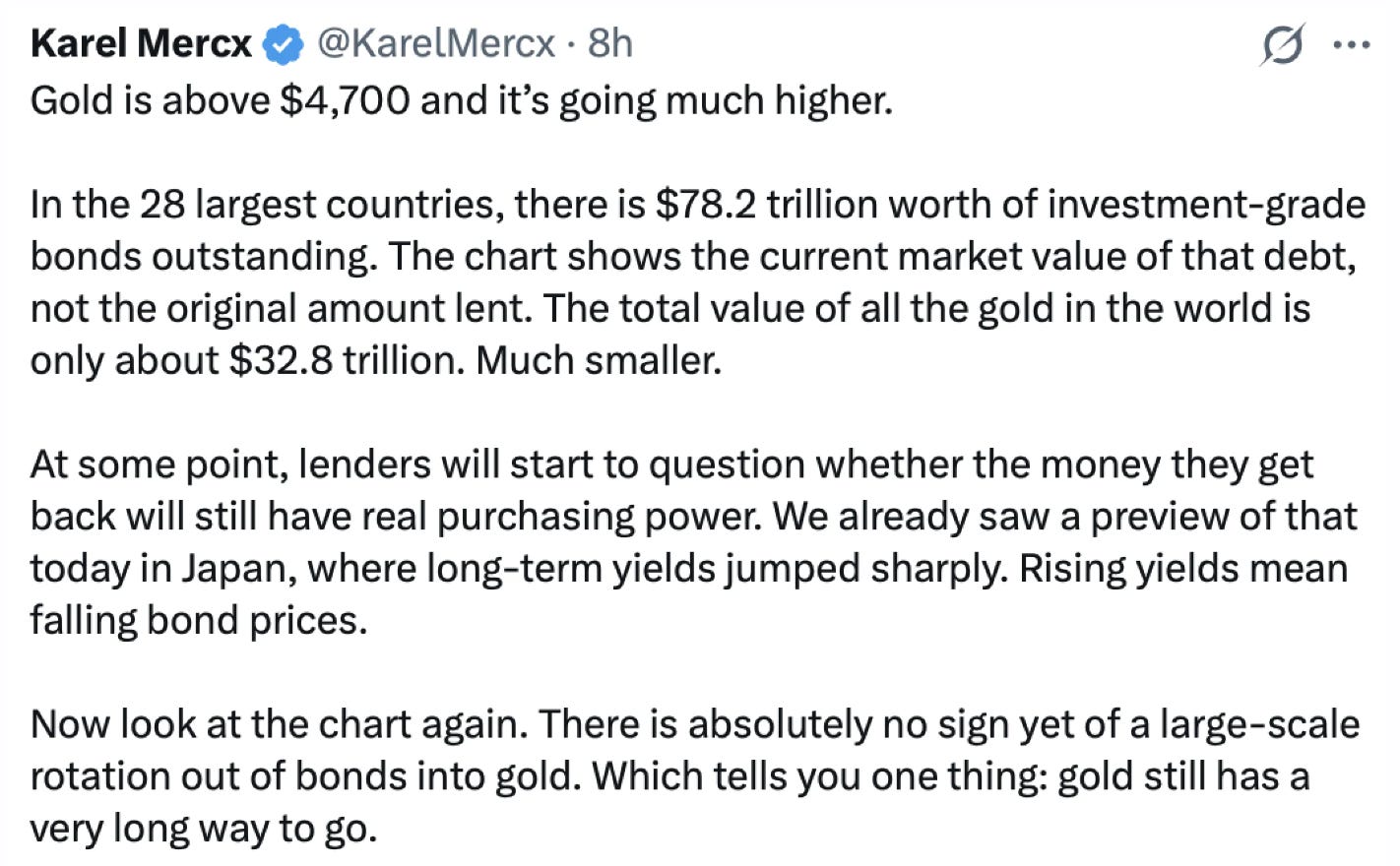

Robert Gottlieb, the former J.P. Morgan Precious Metals managing director, also commented on this in his latest post, and talked about how he expects other central banks to follow Poland’s lead, especially with the geopolitical events playing out before our eyes.

Yesterday I officially changed my view from early last year. While silver significantly outperformed gold in the second half of 2025, the backdrop has shifted. With geopolitical risks escalating and European nations increasingly pushing back against the U.S., gold should maintain a more durable and consistent bid as the world’s preferred reserve asset.

My good friend John Reade (WGC) posted earlier that the National Bank of Poland, one of the largest central bank gold buyers in recent years, has increased its ceiling for gold holdings and can now hold up to 700 tons, roughly 150 tons above recently reported holdings.

My educated guess: other central banks will follow.

Underlying all of that, is that if you had to pick one single reason why there’s an incredibly high chance that 10 years from now the gold price will be even higher than it is today, and perhaps substantially higher, this comment below is it.

As for silver, Gottlieb mentioned the following:

Meanwhile, silver still has $100 in sight and managed to rally back after being down on the day. However, we need to stay focused on the evolving liquidity picture. OTC liquidity in London is loosening, with lease rates near recent lows, even as longer-dated OTC forwards remain in backwardation. 1-month OTC is now flat bid (implying <4% lease), and 2–3 month lending is around -1% (implying <5% lease).

We also need to monitor:

China’s silver export approvals, which have become more restrictive

Global ETF demand, which can tighten conditions quickly

Structurally, the bullish case remains intact: we’re still in multi-year deficits, with supply forecasted to remain largely stagnant while industrial demand is expected to rise modestly over the next four years.

One notable development: China reported LONGi exploring substitution of copper for silver in solar panels, which is understandable given silver’s rising cost share. But copper has its own physical constraints, and any meaningful substitution will take time to scale.

Takeaway: Silver may be the momentum trade, but gold is becoming the structural trade, and in a world of geopolitical fracture and accelerating de-dollarization, central banks are likely to keep the bid under gold for years.

He mentions how conditions have eased in London, which is not surprising after metal was shipped from China and New York to quell their supply crisis. Although as a reminder, when I went to the Silver Institute dinner in November, I actually talked with both Robert and Philip Newman of Metals Focus (that compiles the data for the Silver Institute), and neither of them were willing to go as far as to say that the amount of metal sent over was a definitive long-term resolution rather than a short-term band-aid.

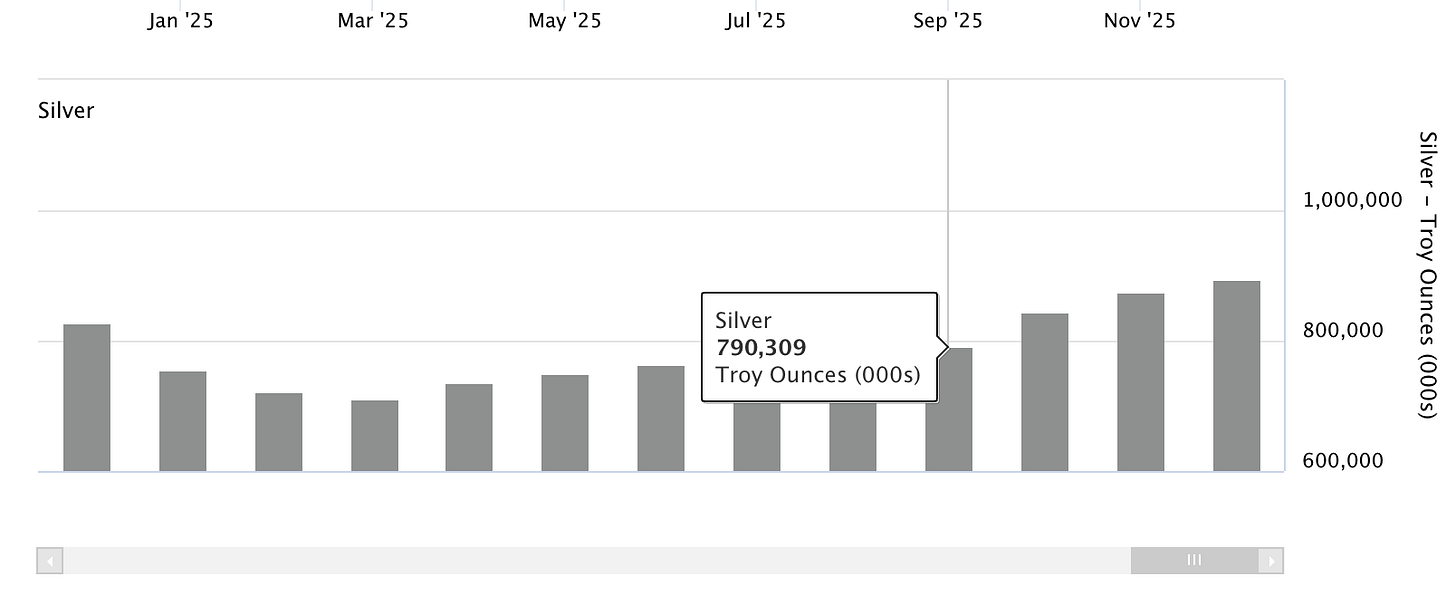

In fact, Robert has given several interviews where he said that he thought London needed 100-150 million ounces of silver for the situation to be normalized.

(the latest total from December is 894 million ounces)

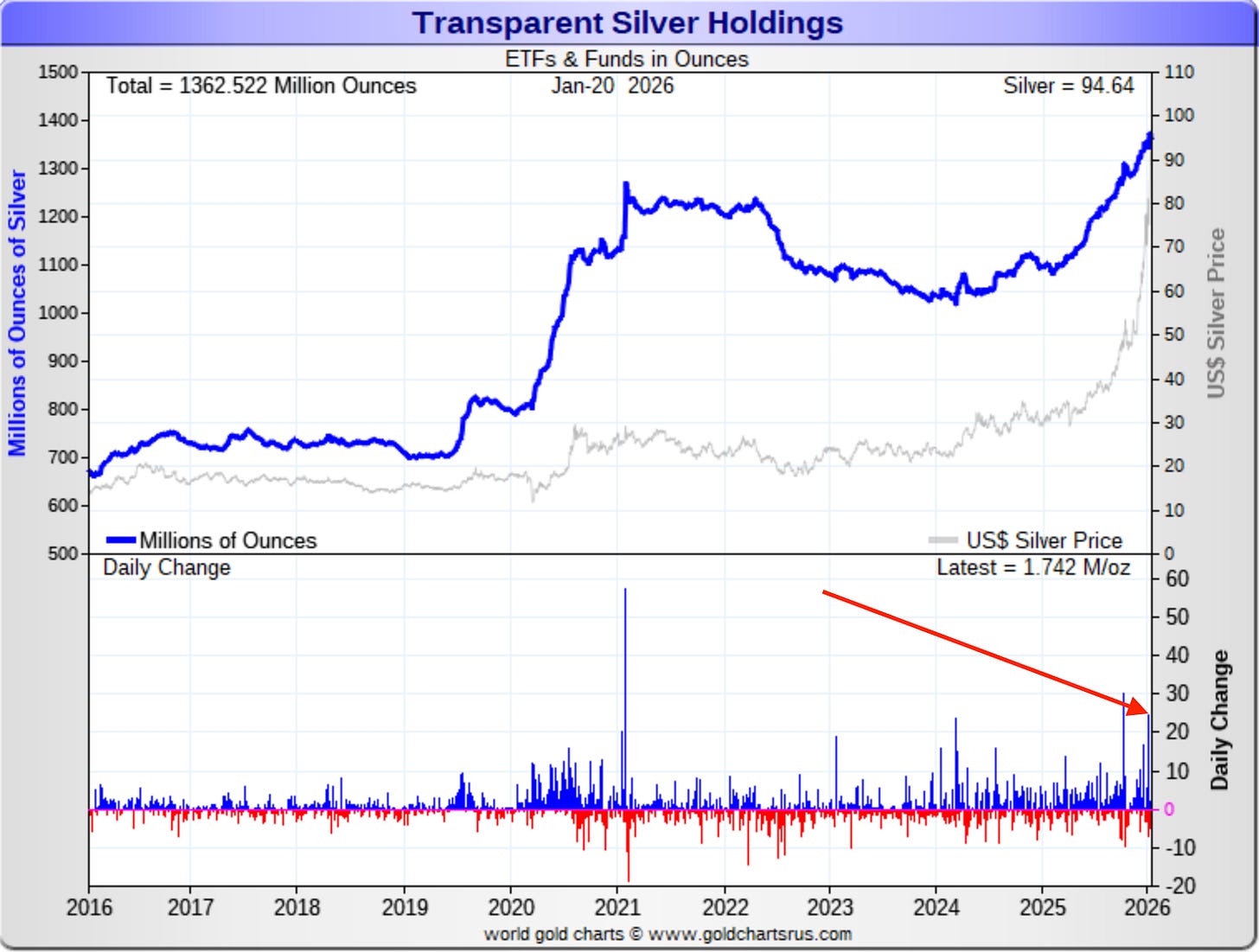

The LBMA has added 104 million ounces since the end of September, and that explains why you’ve seen the lease rates in London come back in. Although with the market continuing to run a deficit, and retail buying picking up significantly over the past month, we also just saw the fourth-largest single-day ETF addition in history, when 23.5 million ounces were added to the Indian silver ETFs on January 11.

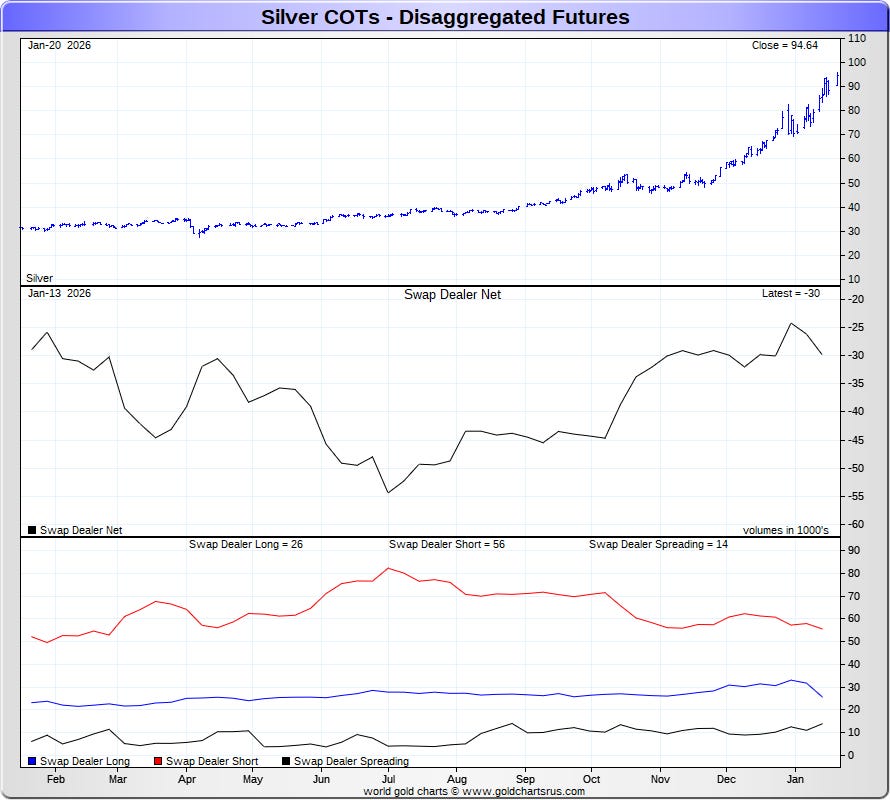

It’s also interesting to see how the silver COT chart has evolved, where you can see on the following chart how the banks (the gray line in the middle section) have been reducing their Comex short position, beginning when silver was still in the $40s back in July of last year, before an acceleration of the reduction of the bank short position in October.

For what it’s worth, I see a lot of commentary on Twitter about which banks are short and how they’re about to get a margin call. I’m often still somewhat surprised to see that, as my understanding was that there is very little information about the banks’ net positions made public, and I did check with someone I know from one of the banks to see if there had been any change to that, and he confirmed that there had not been. So just a warning to be careful of some of the things that you read out there, and that it’s always good to double-check and verify.

The same person also mentioned to me that the way the bank short position is viewed is primarily incorrect, as he said that the bank shorts are added as a hedge against the off-take agreements from the mining companies, and that aside from if someone on a prop desk takes a position, the bullion banks rarely have a directional exposure.

I’ve been thinking about that a lot lately, and continuing to follow up and verify to make sure I have the best understanding possible, and I will continue to do that and report back. However, my belief is that this person was not just making that up, and that there is credence to what he’s saying. Maybe it’s not always 100%, and I do think that there are groups that end up with an unhedged short at times. But my current belief is that when we look at the short position held by the banks on the Comex, that’s not an entirely naked short position, as many (including myself in the past) believed it to be. Also, if the banks were in danger of getting a margin call on a short position that could cause significant damage, you would think we might have seen that by the time silver hit $75, let alone $100.

Yet, with all of that said, over the past decade or so, it still has often been a rather reliable indicator of what’s happening with the price. With extremely net short positions on the Comex by the banks often occurring prior to sell-offs, and the banks typically being closer to flat before the rallies. If there were ever a time when traditional relationships could get thrown out the window, this is it. But hopefully that comment helps to give further color on how to put it all in the proper context.

So we’ll see what’s in store for the gold and silver prices over the next 24 hours, but that’s it for today, and I’ll check back in with you tomorrow.

More By This Author:

As Silver Breaks $94, Here's Why It Might Still Be EarlyThoughts On Rick Rule Selling His Silver

Why Silver Just Rallied Past $91