Silver Update: Scarcity Gets More Extreme

Image Source: Pixabay

Since our last silver article, the price of silver has dropped. With due respect to Frederic Bastiat, the price is the seen. The basis mostly goes unseen. We will take a look at the market data, revised for a few more days of trading.

Warren Buffet, 2008, and the Cobasis

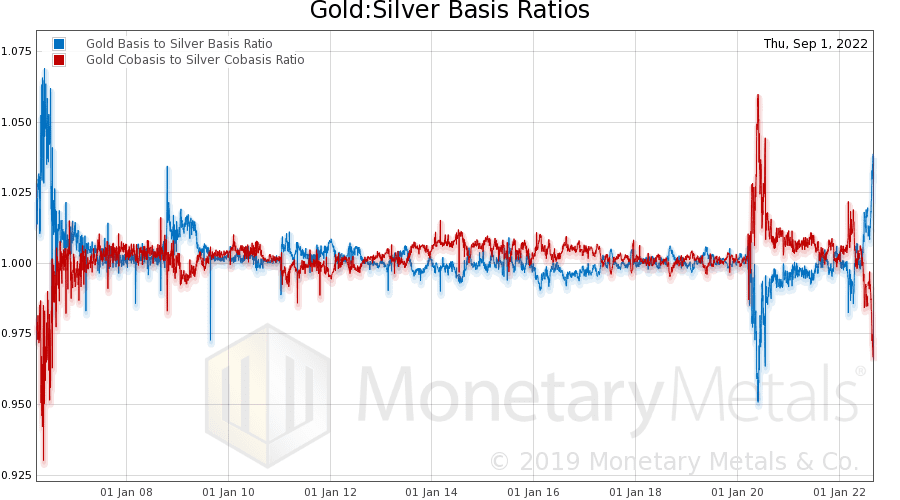

But first, let’s look at a chart we have discussed a few times over the years. It shows two ratios: gold basis to silver basis, and gold cobasis to silver cobasis. It shows a measure of gold’s abundance to silver’s abundance and gold’s scarcity to silver’s scarcity. When the blue line is above 1, it means the gold basis is higher, which means gold is more abundant. When the red line is below, it means gold is less scarce.

(Click on image to enlarge)

The blue line is not merely above 1. It is now above the spike in Oct 2008. To find a level this high, we have to look as far back as 2006. In other words, 16 years. Before that, 2001. And before that, 1998, when Warren Buffet’s Berkshire Hathaway was buying mass quantities of silver—after he drove the price up 73% from about $4.25.

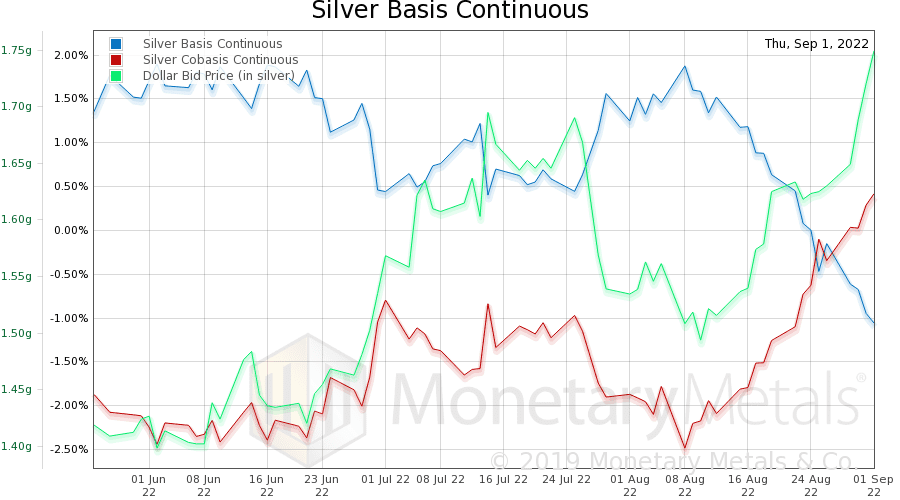

Now here’s our old standby, the silver basis overlaid with the dollar price measured in silver.

(Click on image to enlarge)

The cobasis—our measure of scarcity—has been almost a straight line up from August 8. So has the dollar, which rose from 1.49 grams of silver on Aug 10, to 1.75g (that’s silver dropping from $20.80 to $17.76, just about $3, in dollar-speak).

These are Not Normal Times

Normally, the basis should be around the cost of storage + the cost of interest + marginal profit margin. The higher the interest rate, the higher the basis should be.

Times have not been normal since 2008. And doubly not normal since the Covid lockdown.

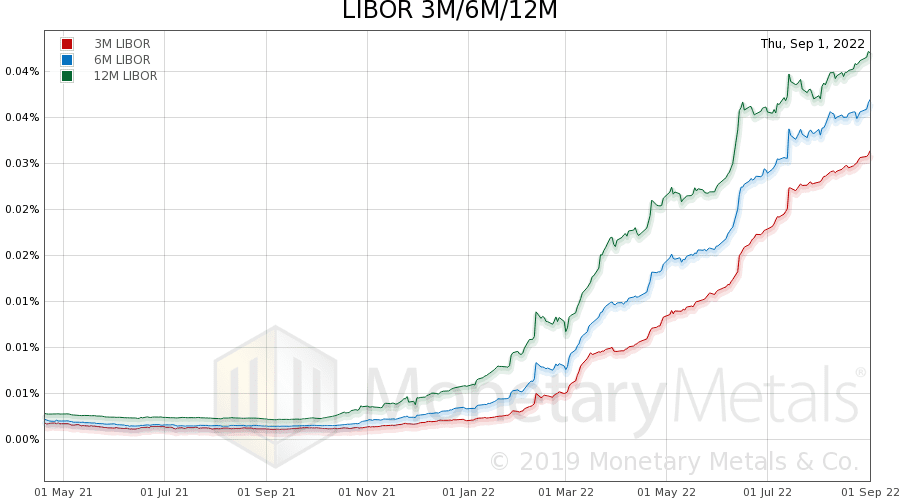

Anyways, the relevant interest rate to the basis (i.e. the short term rate) has been on a tear since Q4 last year and accelerating since the end of January.

(Click on image to enlarge)

At the beginning of August, the 6-month LIBOR was 3.3%. Now it is 3.7%. That’s a gain of 0.4%, which may not sound like a lot until you look at the cobasis which is under 0.5%. The interest rate moved as much in a month as the total magnitude of the cobasis!

Normally—but remember, we’re not in a normal world—the silver basis should go up by this 0.4%. It would be remarkable for going down at all, much less with the interest rate rising this much.

Lease Rates, Mints, and the Solution to Silver Scarcity

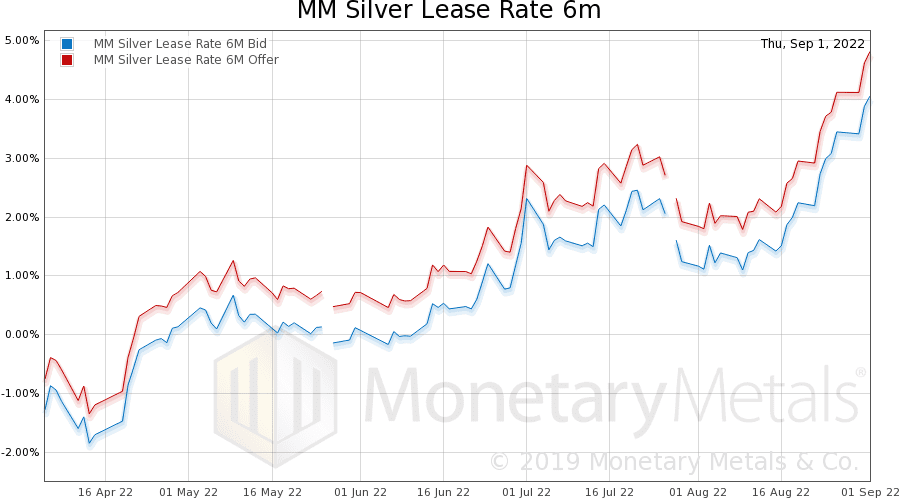

Finally, let’s take a look at the silver lease rate which is LIBOR – silver forward rate (closely related to the silver basis).

(Click on image to enlarge)

It’s up to 4.8%. This is the neutral point for a bank. They borrow at LIBOR, buy silver metal and simultaneously sell it forward (e.g. 6 months in this case). They would have to charge 4.8% just to break even. This does not count their own internal treasury cost—the bank as an institution may be borrowing at 3.7%, but it marks up this cost to each group within the bank. Then the bullion group has its own internal costs. Then it adds a credit spread, based on each particular lessee’s risk profile. And finally, it adds a profit margin.

Intuitively it makes sense that, as something becomes scarcer, the cost to rent it goes up. Suppose you live in a city that has long stopped developers from building new apartment buildings. Then a large number of people move in, perhaps from California. Apartments become scarcer. And rents go up.

This is what backwardation is telling us. Silver has become scarce. Our first point is that this is likely to be resolved by a price move to the upside.

More By This Author:

Buy Gold, Because…

What the Heck Is Happening to Silver?

Rare Gold-Silver Crystal Sighting

Disclaimer: The content in this article is provided as general information and for educational purposes only and should not be taken as investment advice. We do not guarantee the accuracy ...

more