Silver Surges Again After CPI Posts Biggest Gain Since January

Image Source: Pixabay

There was more divergence in the gold and silver markets on Thursday, a trend we’ve seen several times throughout this year. This time the divergence left the gold futures slightly down on the day, while the silver price took another leap forward.

The gold futures are currently down $6 to $3,675.

Yet it was quite a different story in the silver market, where the futures are up 65 cents to $42.25.

The big event on Thursday was the release of the latest CPI data, which came in higher than last month, and logged the largest inflation figure (at least according to the government’s math) since January.

It also seems worth noting that after the markets have closed today, the front of CNBC is still talking about how the tariffs are now filtering through to higher consumer prices.

We talked about that plenty earlier this year, and despite how President Trump and Treasury Secretary Bessent continued to claim that there was no inflation, even while all of the government numbers remained well in excess of the Fed's 2% mandate, now even the mainstream financial channels are unable to ignore it.

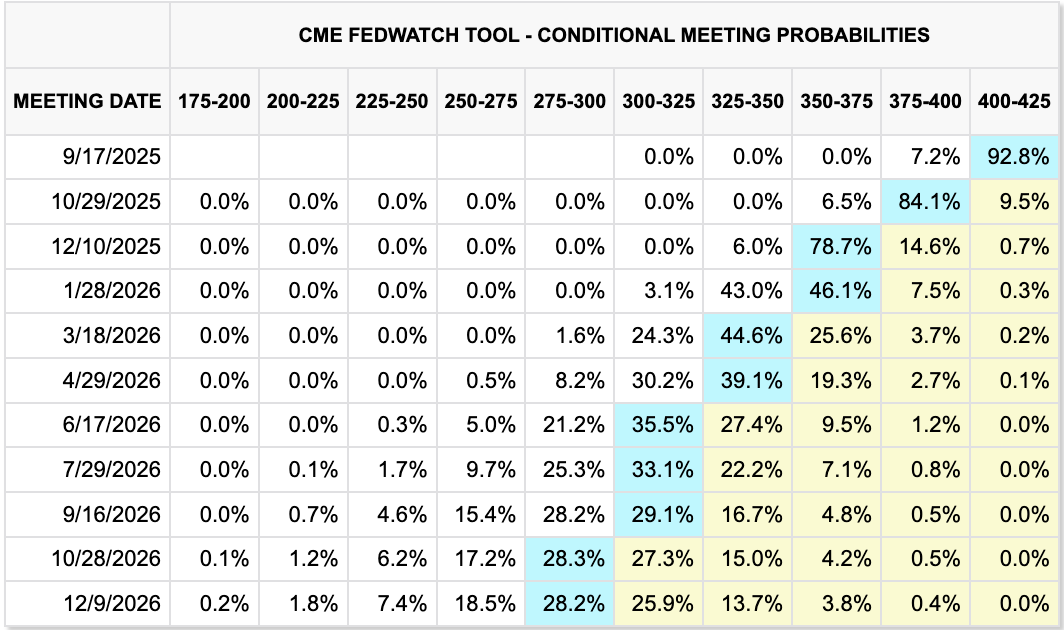

The markets are currently pricing in a 93% chance of a 25 basis point rate cut next week, although there does continue to be talk about the possibility of a 50 point cut.

In case you were wondering how the Treasury is feeling today about the Federal Reserve and its interest rate plans, here's the latest from Scott Bessent.

Of course, the Trump administration is also being guided by a Chairman of the Council of Economic Advisors who once wrote that ‘the root of the economic imbalances lies in persistent dollar overvaluation that prevents the balancing of international trade.’ So I think you can get an idea of where this is headed.

All of which has a lot to do with the current gold and silver pricing, and will likely continue to be a driver in the months and years ahead. Although with silver already up almost two dollars just this week alone, please do remember that there will be more sell-offs along the way, and it shouldn't be a surprise to see another one in our near future.

Lastly, before wrapping up today, I just wanted to send kind thoughts and prayers to all of you on this September 11th. Obviously it's an incredibly important day in our country's history, and especially having personally been so close to the Trade Centers on the day they came down, it's one that's seemingly taken on an even greater significance as the years have gone by.

So hopefully you'll have a moment to feel whatever thoughts are appropriate for you to feel about what happened on September 11, 2001, especially in light of the tragic shooting of Charlie Kirk yesterday. It sure feels like a really intense period of time on the planet right now, and I just genuinely hope that you are safe and able to find peace tonight.

More By This Author:

Gold & Silver Sell Off After This Week's Furious RallyOne Day After Silver Futures Break $41, Then They Break $42 On More Tariff Confusion

Gold Futures Rallied To Over $3,600 Even In The Face Of Dollar Rally