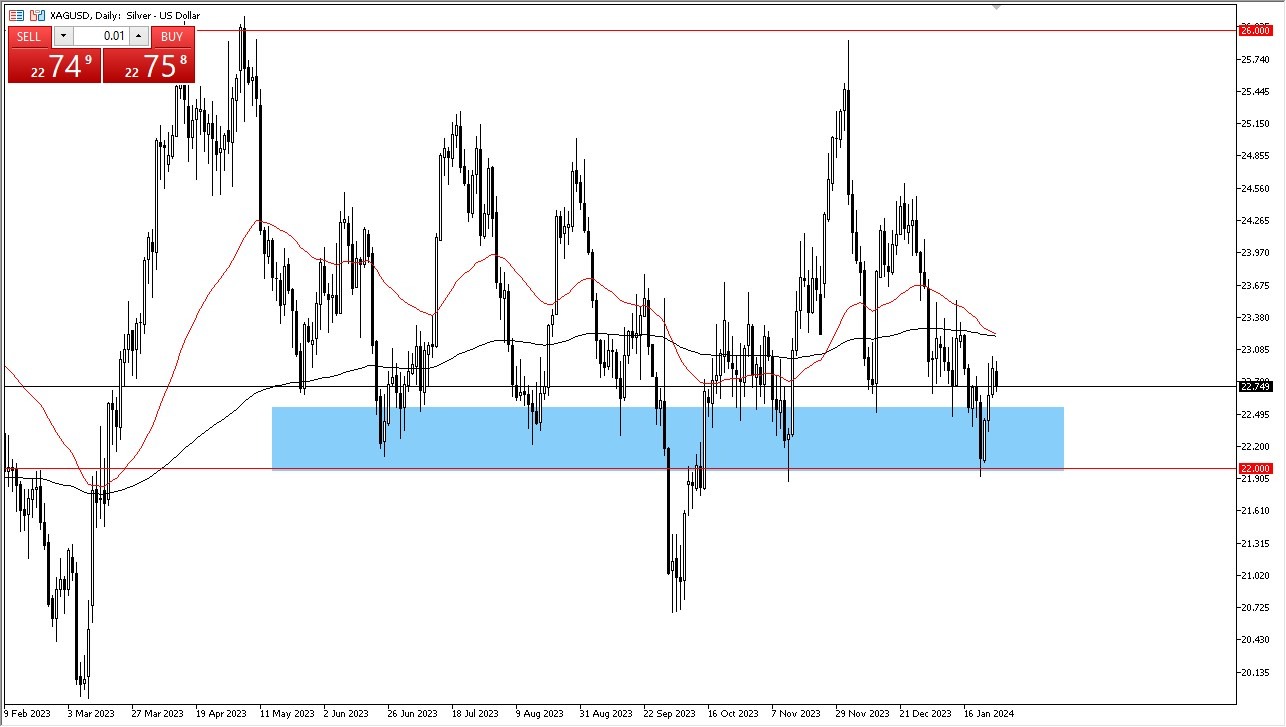

Silver Signal: Silver Continues To See Volatility

I would start to scale and right around the $22.50 level, with a stop loss at the $21.90 level. I would be targeting $23.50 initially, followed by the $24.50 level.

- Silver pulled back slightly during the trading session on Friday, as we continue to see a lot of noisy behavior.

- Quite frankly, this is typical for silver, as it is one of the more volatile commodities out there to trade.

- Furthermore, you would have to think that a lot of the traders that have picked up so much in the way of profits this week would be willing to take them home on Friday in order to avoid any potential trouble early on Monday.

(Click on image to enlarge)

Looking forward, I do think that there are plenty of buyers underneath it will get involved and therefore I am paying attention to the $22 level as a major support level. After all, it has been a major support level on longer-term charts, and the bottom of the range that the market has been “comfortable in” for the last several years. I think this sets up a nice trading opportunity that you can take advantage of, and that’s exactly what I will be paying close attention to.

Bottom of the Range?

The $22 level could be at the bottom of the overall range, and I think this is an area that a lot of traders will be paying close attention to. The closer we get to that area, the more likely I am to jump in and take advantage of “cheap silver.” I recognize that this market will remain extraordinarily volatile, but that again, is nothing new for this market. If we were to break higher and clear the 200-Day EMA, I think it rushes in a flood of FOMO trading going forward, perhaps allowing silver to go looking toward the $24.50 level above, and then eventually the $26 level after that. The $26 level has been the top of the range that traders have been paying such close attention to over the last several years.

I do believe that silver continues to see a lot of buyers jumping into the market and taking advantage of this well-defined range. You will have to pay close attention to the 10 year yield, but if it starts to drop, that will help silver. A pullback at this point in time offers a buying opportunity that I am willing to take advantage of. I would start to scale and right around the $22.50 level, with a stop loss at the $21.90 level. I would be targeting $23.50 initially, followed by the $24.50 level.

More By This Author:

Gold Forecast: Gold Continues To Consolidate Near Bottom Of The Overall RangePairs In Focus - Sunday, Jan. 28

Nasdaq 100 Forecast: Nasdaq 100 Continues To Rocket Higher

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more