Silver: Short Sellers, Your Time Has Come To Pay The Piper

Fundamentals

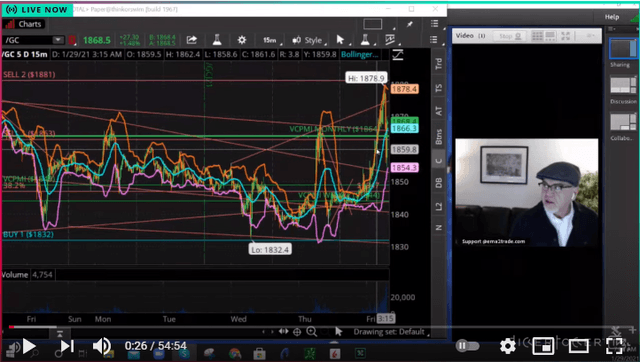

January 29, 20221 at 7 am PST. We have a fast market in gold. It is up about $27 to $1868. Volatility has increased to a point that is unlike anything in living memory.

Photo by Robert Haverly on Unsplash

Since March of last year, we have entered a new paradigm. Gold fell to $1450 and the stock market fell below 2200, which was the bottom of this new trend that marked the transformation from the old physical economy to a virtual economy. It was one of the reasons why gold hit $2086; a $600 move in the blink of an eye. That was just the beginning.

Courtesy: TickerTocker

The high of 2089 that gold hit discounted the economic damages that the pandemic caused. Now we are seeing that volatility spread to Millenials. Recently, Robinhood limited trading in a stock that went up hundreds of percent: Gamestop. The playing field has changed in relation to the application of technology against some of the biggest hedge funds, which had been essentially controlling certain markets. New technology has leveled the playing field. Gamestop is one example. The Variable Changing Price Momentum Indicator (VC PMI) is another example where we can use technology to make the small trader equal to the big institutional investors.

Gold has not reflected the actual economic fundamentals in relation to stimulus, interest rates, fiscal and monetary policies. It is not reflecting the ratio of gold to stocks or gold to debt. Everything is related economically. Gold is a major benefactor of a weakened economic system. Gold is a safe-haven investment, a hedge against an economic downturn, and is real money, which it has been for thousands of years.

Based on the fundamentals, Gold should be at $5,000 or more, but it is not. Therefore, you have to use technical analysis, such as the VC PMI, to guide your trading. We are bullish on gold and silver long-term and we are using the VC PMI to day trade the volatility, while building a long term position in gold and silver. These times are a golden opportunity to traders. It is similar in some ways to the 1970s, when we began to see inflation take off and gold hit $800 in 1981. The stock market, the Dow Jones, was at about 1000. Interest rates were at about 14% or 15%. The playing field has changed, but the only difference is the interest rate picture. Today we have negative interest rates, if you take into account inflation. Europe has negative interest rates. It is impossible for an economy to function with negative interest rates. It cannot last. You pay a bank to hold your money and they use your money to invest in stocks and make a fortune.

The pandemic has collapsed the economy. There is still no light to show us how all of this is going to be resolved. We have tremendous debt. Governments are producing incredible amounts of new money or stimulus. They are not concerned with the long-term effects. They are not facing the reality that the more money you print, the more you devalue each dollar, which leads to inflation and further weakens the US dollar’s role as the world’s reserve currency. The Feds cannot raise interest rates with such levels of debt. We are going to be facing a $30 trillion debt soon and if interest rates rise, it will put immense pressure on the cost of that debt. The Feds are in a hard place. They are in a situation that they can’t control. As they continue to erode the purchasing power of the US dollar, it increases the risks of inflation and even hyperinflation. The US dollar is holding against other currencies, because other currencies are even weaker than the US dollar. But as we print more and more money, all fiat currencies become less and less valued. Currencies are set to go to zero and then we will see a reset. That will bring down the debt in the old currencies. We are likely to see a new virtual currency and no debt based on the old currencies.

In terms of virtual currencies, Bitcoin is the leader. We trade the Grayscale Bitcoin Investment Trust, which is based on Bitcoin. It offers great liquidity. We trade GBTC to make money to then invest in gold long term.

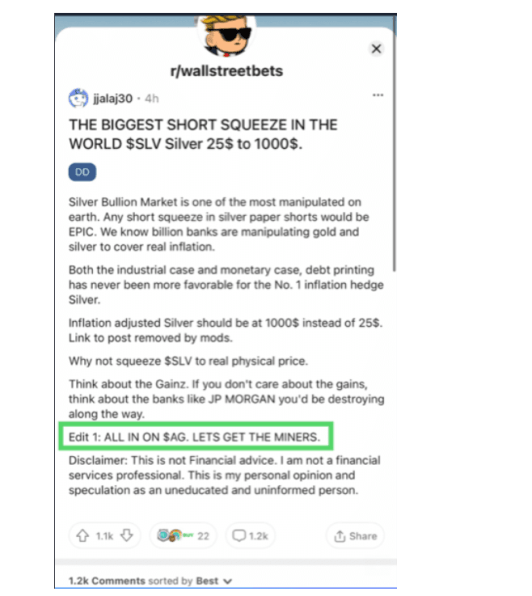

Gamestop has changed the benchmark for volatility. The big hedgers and short sellers have to take into account what has happened. Silver is now in one of the biggest short-squeezes ever seen. Silver is the poor man’s gold. Silver hasn’t even broken the high in the 1970s, which was around $50, or even the high in 2011. Silver production compared to gold is 8 to 1. The current gold and silver ratio is at about 68. It is coming down to what could be 15 to 1, which would explode the price of silver. If we are talking about $8,000 gold, then at a 15 to 1 ratio, then silver will be at about $200. Some people are saying silver is worth $1,000 and ounce. Short hedgers are now under warning that they can be wiped out by private investors banding together, as they did with Gamestop.

WALLSTREETBETS PUSHING SILVER TO $1000?

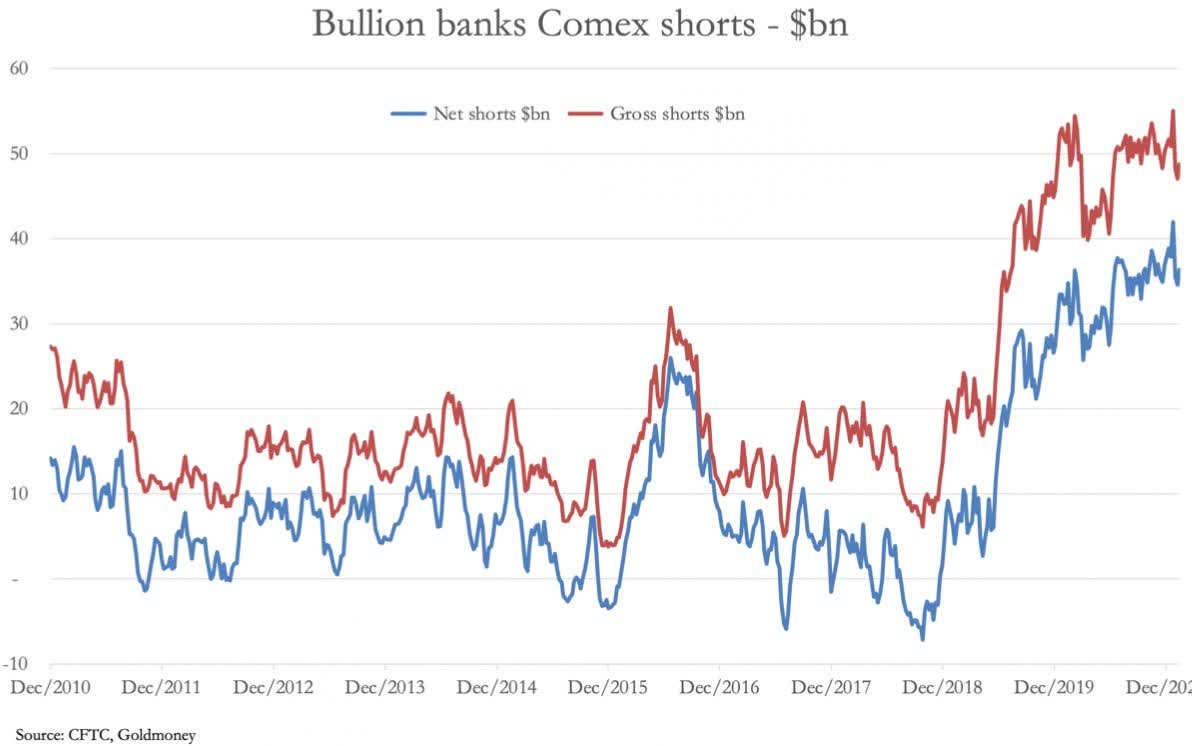

In silver, the commercials and Central Banks are at major risk. According to the COT reports, they have about $35 billion in short positions. As silver rises, the short squeeze pressure on them increases massively. We appear to be heading into more lockdowns and the supply chain is being disrupted again. Gold and silver production may be hindered. We are running out of gold and silver inventory. Premiums are increasing tremendously in the cash market.

(Click on image to enlarge)

$250 Silver

" And you look at the real price of silver inflation-adjusted. Remember the famous Hunt Brothers effort to corner the silver market back in 1980? Silver hit $50 an ounce. Okay, but adjust for inflation since then. The CPI is up about 5-times since 1980, so that $50 is more equivalent to $250, and silver is sitting here at $26. So, is there room for silver to go up? Oh my goodness, yes." Ray Arnott, CEO Research Affiliates.

(Click on image to enlarge)

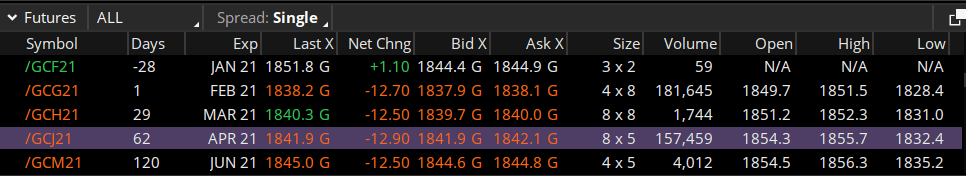

On January 27, the spot month in gold was trading at a premium to the back months. Therefore, it’s an inverted market, which usually means there is a shortage of supply. Everyone wants to take delivery. People are going into the futures market to take delivery, which is putting a squeeze on the COMEX and London Metals Exchange. We are going to find that whatever physical they said they were carrying was highly leveraged. It is the same thing as happened in 2008, where mortgages were highly leveraged. The difference is that the short-side of the market is running scared. They can’t cover their shorts. Every time gold and silver come down, buyers come in at a higher level than before. Now we are looking at $1880 gold and it is not coming down. Every time we come down, we get a reversion rapidly. Supply is taken every time by strong buying. If we break through $1880, we should hit $1900 or $1917 as the weekly targets. Then the monthly and annual targets come into play. If it goes back into that $1870 area, it is pretty strong for gold. Buy corrections and hold your long-term position in gold.

Courtesy: TDAmeritrade

Silver is building an impressive base. Demand is solid. It is entering an area where we can see some supply coming into the market. Now we need to see how the price functions through this supply. If we go up through $28.40, we are off to the races.

Disclosure: I am/we are long SILJ. I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this ...

more